By Julie Steinberg

The U.S. Securities and Exchange Commission is asking blue-chip

companies about a popular financing arrangement that frees up cash

but potentially hides risks from investors.

The agency sent letters in June to Coca-Cola Co. and Boeing Co.

requesting more information about how they use supply-chain

finance, essentially a form of short-term borrowing to pay for

goods and services, according to securities filings.

The funding, often provided by banks, pays a company's suppliers

earlier than they would normally be paid, at a slight discount. It

then collects the balance from the company down the road, generally

later than the company would have paid their supplier directly.

While similar to loans, supply-chain financing is often not

clearly called out on a company's financial statements. Companies

typically record the transactions as accounts payable, leading some

to say they portray overly optimistic financial health, especially

if banks pulled the financing suddenly.

An SEC spokesperson declined to comment. The agency has

increased scrutiny of the practice over the past year and a half.

In June, the agency gave guidance on supply-chain and other types

of short-term financing in light of coronavirus disruptions. It

said companies should "provide robust and transparent

disclosures."

"There is almost no information about it" in financial

statements, said Ben Lourie, an assistant professor at University

of California, Irvine's Paul Merage School of Business. He worries

that people don't have the right information when building

valuation and risk models about companies.

In March, the SEC sent a letter to Atlanta-based paper-container

maker Graphic Packaging Holding Co. Last year, it sent similar

letters to Keurig Dr Pepper Inc., Procter & Gamble Co. and

home-improvement company Masco Corp. The companies' spokespeople

declined to comment.

The SEC sent its June letter to Coca-Cola after the agency

noticed the drinks maker's accounts payable increased around $1.1

billion in 2019. A bump in accounts payable can indicate increased

use of supply-chain financing to extend payment terms. The agency

had learned that Coca-Cola was a user of a supply-chain finance

program.

It asked Coca-Cola to provide the SEC with more details about

the supply-chain finance deals and uncertainties related to the

extension of payment terms. The agency also asked the company to

consider publishing changes in its account payable days

outstanding, a metric of how long it takes to pay its

suppliers.

The company said it hadn't previously disclosed the supply-chain

finance program, begun in 2014, because it hadn't materially

affected liquidity and wasn't likely to in the future. Coca-Cola in

a later response to the SEC said it would make disclosures about

the program in future filings. A Coca-Cola spokesperson declined to

comment further.

In Boeing's case, the SEC's letter was prompted by the company's

greater disclosure of its supply-chain financing in March. The

aerospace giant, which was later laid low by the coronavirus

shutdown of the travel sector, said trade payables included $4.5

billion payable to suppliers that were part of its supply-chain

financing programs, down from $5.2 billion at Dec. 31, 2019. It

said access to such financing could be curtailed if the company's

credit ratings were further downgraded.

The SEC letter to Boeing asked it to provide the impact of

supply-chain financing on its cash flows, how accounts payable

balances had changed owing to the programs, benefits and risks of

the arrangements and plans to extend terms to suppliers, among

other things.

Boeing responded that it didn't consider supply-chain financing

to be material to its overall liquidity, and that the decline was

due to fewer purchases from suppliers and not due to changes in the

availability of financing. It pledged to disclose in future filings

the amounts included in accounts payable as a result of the

supply-chain-finance programs and the impact on operating cash

flows each period.

In its latest quarter ending in June, Boeing said trade payables

were little changed from March.

A Boeing spokesperson declined to comment.

Supply-chain finance programs have multiplied in the years since

the financial crisis. Big players include Citigroup Inc. and HSBC

Holdings PLC, as well as nonbank firms such as SoftBank Group

Corp.-backed Greensill Capital.

The techniques have gained ground even as other forms of

short-term financing faltered during the coronavirus pandemic.

Banks generated $12.7 billion in the first half of the year from

supply-chain finance, up 3.6% from a year earlier even as revenue

fell 29% for commodities trade finance, according to research firm

Coalition.

Because the deals are private and there is little disclosure,

the size of the business is hard to pin down. Research firm Aite

Group says there may be more than $350 billion of invoices involved

in the supply-chain finance technique known as reverse

factoring.

Reverse factoring deals are seen as beneficial for both

companies and their suppliers, because the former can extend the

number of days they have to pay and suppliers can get paid

early.

Companies generally don't need to disclose supply-chain

financing arrangements. Moody's Investors Service in October said

fewer than 5% of the nonfinancial companies that it rates globally

disclose supply-chain financing in their financial statements.

The Financial Accounting Standards Board, the private

organization that sets accounting standards, has been soliciting

input from industry participants, a spokesperson said. The Big Four

accounting firms sent a joint letter in October to FASB asking for

guidance on how companies should account for supply-chain finance

transactions.

Mr. Lourie, the accounting professor, met virtually with FASB at

the end of July and recommended adding an extra line on the balance

sheet to report money that is owed to such deals. The line item

would have a note attached where companies would describe the terms

of the financing as well as how many days they had extended

payment.

Supply-chain financing has been at the heart of one recent

corporate blowup. It was a key contributor to the 2018 collapse of

U.K. firm Carillion PLC, according to Fitch Ratings, which had

reported supply-chain finance obligations as "other payables."

Write to Julie Steinberg at julie.steinberg@wsj.com

(END) Dow Jones Newswires

August 27, 2020 07:25 ET (11:25 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

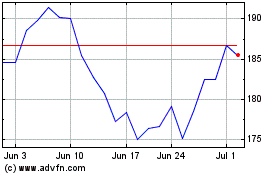

Boeing (NYSE:BA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Boeing (NYSE:BA)

Historical Stock Chart

From Apr 2023 to Apr 2024