Bank Stocks Climb on Mexico Tariff Delay

June 10 2019 - 3:54PM

Dow Jones News

By Michael Wursthorn

Bank stocks rose Monday after the U.S.'s decision to hold off

implementing trade tariffs on Mexican imports brightened investors'

economic outlook.

The KBW Nasdaq Bank Index of large commercial lenders rose 1.1%

Monday to help lead the stock market higher, as yields on the

benchmark 10-year U.S. Treasury notched their biggest one-day gain

since April 1. The moves followed the Trump administration's opting

not to impose tariffs on billions of dollars of goods from Mexico,

removing a threat that had hampered bank stocks and the broader

market.

Shares of Bank of America Corp. rose 2%, while Wells Fargo &

Co. and JPMorgan Chase & Co. added at least 1.1% each.

Citigroup Inc., which gets about 7% of its global revenue from its

Mexican unit, climbed 2.2%.

Rises in yields are often good for banks since higher long-term

rates usually create a steeper yield curve, widening lenders'

profit margins as the spread between what they pay for funds and

what they charge borrowers expands.

The U.S.'s deal with Mexico to avoid trade tariffs removed a

potential economic hurdle that had caused investors to sour on

lenders. Before Monday, bond prices had been falling for five weeks

straight, causing yields on some short-term Treasury bills to

exceed those of longer-term bonds, an event also known as an

inverted yield curve -- which tends to presage a recession. At the

same time, the KBW bank index fell 10% in May.

Resurgent trade tensions with China last month started to upset

investors' economic outlooks. Traders worried the new levies would

further pressure a global economy already showing signs of slowing

down. The threat of additional tariffs against Mexico exacerbated

those concerns, analysts said, helping to send Treasury yields on

their biggest five-week slide in more than three years.

But those stocks appeared to be steadying even before Monday's

move in bond yields. Last week, Federal Reserve Chairman Jerome

Powell suggested the central bank could cut interest rates to keep

the economy expanding, sending major U.S. indexes to their best

weekly gains of the year.

Although lower rates are generally bad for banks, investors were

also considering the likelihood of a still-expanding U.S. economy

and the role lenders would play, said Devin Ryan, a banking analyst

with JMP Securities. Besides that, big U.S. banks had already

proved to investors over the last decade that they are capable of

making a profit in a low-rate environment.

The KBW bank index jumped 3.5% following Mr. Powell's speech on

Tuesday, its biggest one-day gain since late December.

"It's kind of a perverse move," said Mr. Ryan, referring to

those stocks' gains last week. "But we may now have an extended

business cycle, and that's what the market has found some comfort

in now that the Fed is going to be flexible."

Those stocks are now up 4.9% this month, pushing them up 12% for

the year.

Write to Michael Wursthorn at Michael.Wursthorn@wsj.com

(END) Dow Jones Newswires

June 10, 2019 16:39 ET (20:39 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

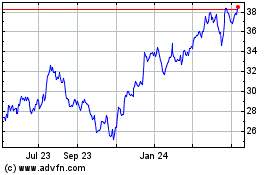

Bank of America (NYSE:BAC)

Historical Stock Chart

From Mar 2024 to Apr 2024

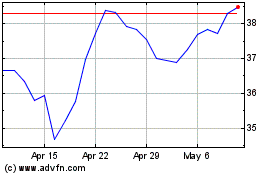

Bank of America (NYSE:BAC)

Historical Stock Chart

From Apr 2023 to Apr 2024