Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

January 21 2022 - 5:08AM

Edgar (US Regulatory)

Filed Pursuant to Rule 433

Registration No. 333-257399

BANK OF AMERICA CORPORATION

PREFERRED STOCK, SERIES RR

$1,750,000,000

1,750,000

Depositary Shares, Each Representing a 1/25th Interest in a Share of Bank of America Corporation 4.375% Fixed-Rate Reset Non-Cumulative Preferred Stock,

Series RR

FINAL TERM SHEET

Dated January 20, 2022

|

|

|

|

|

Issuer:

|

|

Bank of America Corporation

|

|

|

|

|

Security:

|

|

Depositary Shares, each representing a 1/25th interest in a share of Bank of America Corporation 4.375% Fixed-Rate Reset Non-Cumulative

Preferred Stock, Series RR

|

|

|

|

|

Expected Ratings:

|

|

Baa3 (Moody’s) / BBB- (S&P) / BBB+ (Fitch)

|

|

|

|

|

Size:

|

|

$1,750,000,000 ($1,000 per Depositary Share)

|

|

|

|

|

Public Offering Price:

|

|

$1,000 per Depositary Share

|

|

|

|

|

Maturity:

|

|

Perpetual

|

|

|

|

|

Trade Date:

|

|

January 20, 2022

|

|

|

|

|

Settlement Date:

|

|

January 25, 2022 (T+3)

|

|

|

|

|

Dividend Rate

(Non-Cumulative):

|

|

From, and including, the Settlement Date to, but excluding the First Reset Date, a fixed rate of 4.375% per annum; and from, and including, the First Reset Date, for each Reset Period, a rate per annum equal to the Five-Year U.S.

Treasury Rate determined as of the most recent Reset Dividend Determination Date plus the Spread. The Dividend Rate will be reset on each Reset Date.

|

|

|

|

|

Dividend Periods:

|

|

Each quarterly period from, and including, a scheduled Dividend Payment Date to, but excluding, the next scheduled Dividend Payment Date, except that the initial Dividend Period will begin on and include the Settlement Date.

Dividend Periods will not be adjusted if a Dividend Payment Date is not a Business Day.

|

|

|

|

|

Spread:

|

|

276 bps

|

|

|

|

|

|

Five-Year U.S. Treasury Rate:

|

|

For more information on the determination of the Five-Year U.S. Treasury Rate, including the applicable fallback provisions, see “Description of the Preferred Stock—Dividends— Calculation of Dividends and

Determination of the Dividend Rate Applicable For Each Reset Period” in the Issuer’s preliminary prospectus supplement dated January 20, 2022 (the “Preliminary Prospectus Supplement”).

|

|

|

|

|

Reset Periods:

|

|

Each period from, and including, a Reset Date to, but excluding, the next following Reset Date.

|

|

|

|

|

First Reset Date:

|

|

January 27, 2027

|

|

|

|

|

Reset Dates:

|

|

The First Reset Date and each date falling on the fifth anniversary of the preceding Reset Date; Reset Dates will not be adjusted if any scheduled Reset Date is not a Business Day.

|

|

|

|

|

Reset Dividend Determination Date:

|

|

In respect of any Reset Period, the day falling three Business Days prior to the first day of such Reset Period.

|

|

|

|

|

Dividend Payment Dates:

|

|

January 27, April 27, July 27 and October 27 of each year beginning on April 27, 2022, each subject to following unadjusted business day convention

|

|

|

|

|

Day Count:

|

|

30/360

|

|

|

|

|

Business Days:

|

|

New York/Charlotte

|

|

|

|

|

Optional Redemption:

|

|

On any Dividend Payment Date on or after the First Reset Date and earlier upon certain events involving a capital treatment event as described and subject to limitations in the Preliminary Prospectus Supplement.

|

|

|

|

|

Listing:

|

|

None

|

|

|

|

|

Lead Manager and Sole Book-Runner:

|

|

BofA Securities, Inc.

|

|

|

|

|

|

Co-Managers:

|

|

American Veterans Group, PBC

Blaylock Van,

LLC

Multi-Bank Securities, Inc.

Penserra Securities LLC

Samuel A. Ramirez & Company, Inc.

Siebert Williams

Shank & Co., LLC

ABN AMRO Securities (USA) LLC

Banco

de Sabadell, S.A.

BBVA Securities Inc.

Capital One

Securities, Inc.

CIBC World Markets Corp.

Citizens Capital

Markets, Inc.

Commonwealth Bank of Australia

Danske Markets

Inc.

Huntington Securities, Inc.

ING Financial Markets

LLC

Intesa Sanpaolo S.p.A.

KeyBanc Capital Markets Inc.

Lloyds Securities Inc.

Mizuho Securities USA LLC

nabSecurities, LLC

Natixis Securities Americas LLC

PNC Capital Markets LLC

Santander Investment Securities Inc.

Scotia Capital (USA) Inc.

SMBC Nikko Securities America, Inc.

Standard Chartered Bank

SVB Leerink LLC

TD Securities (USA) LLC

Truist Securities, Inc.

|

|

|

|

|

CUSIP/ISIN for the Depositary Shares:

|

|

060505GB4 / US060505GB47

|

Bank of

America Corporation (the “Issuer”) has filed a registration statement (including the Preliminary Prospectus Supplement and a prospectus dated August 4, 2021) with the SEC for the offering to which this communication relates. Before

you invest, you should read those documents and the other documents that the Issuer has filed with the SEC for more complete information about the Issuer and this offering. You may obtain these documents for free by visiting EDGAR on the SEC website

at www.sec.gov. Alternatively, the lead manager will arrange to send you the prospectus supplement and the prospectus if you request them by contacting BofA Securities, Inc., toll free at 1-800-294-1322. You may also request copies by e-mail from fixedincomeir@bofa.com or dg.prospectus_requests@bofa.com.

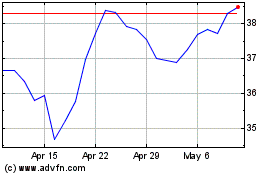

Bank of America (NYSE:BAC)

Historical Stock Chart

From Mar 2024 to Apr 2024

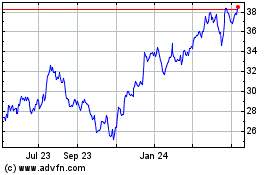

Bank of America (NYSE:BAC)

Historical Stock Chart

From Apr 2023 to Apr 2024