Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

November 18 2022 - 4:27PM

Edgar (US Regulatory)

Terms of the Notes

The Contingent Income Issuer Callable Yield Notes Linked to

the Least Performing of the Nasdaq-100® Index, the Russell 2000® Index and the S&P 500® Index (the

“Notes”) provide a monthly Contingent Coupon Payment of $12.083 on the applicable Contingent Payment Date if, on any monthly

Observation Date, the Observation Value of each Underlying is greater than or equal to its Coupon Barrier. Beginning on March 3,

2023, and on each monthly Call Date thereafter, we have the right to redeem all, but not less than all, of the Notes at 100% of the principal

amount, together with the relevant Contingent Coupon Payment. No further amounts will be payable following an Optional Early Redemption.

If the Notes are not called, at maturity you will receive the Redemption Amount, calculated as described under “Redemption Amount

Determination”.

| Issuer: |

BofA Finance LLC (“BofA Finance”) |

| Guarantor: |

Bank of America Corporation (“BAC”) |

| Term: |

Approximately 18 months, unless previously called. |

| Underlyings: |

The Nasdaq-100® Index, the Russell 2000® Index and the S&P 500® Index. |

| Pricing and Issue Dates*: |

November 30, 2022 and December 5, 2022, respectively. |

| Observation Dates†*: |

Monthly. Please see the Preliminary Pricing Supplement for further details. |

| Coupon Barrier: |

For each Underlying, 70% of its Starting Value. |

| Call Dates*: |

Monthly. Please see the Preliminary Pricing Supplement for further details. |

| Threshold Value: |

For each Underlying, 70% of its Starting Value. |

| Contingent Coupon Payment*: |

If, on any monthly Observation Date, the Observation Value of each Underlying is greater than or equal to its Coupon Barrier, we will pay a Contingent Coupon Payment of $12.083 per $1,000 in principal amount of Notes (equal to a rate of 1.2083% per month or 14.50% per annum) on the applicable Contingent Payment Date (including the Maturity Date). |

| Optional Early Redemption: |

On any Call Date, we have the right to redeem all (but not less than all) of the Notes at the Early Redemption Amount. No further amounts will be payable following an Optional Early Redemption. We will give notice to the trustee at least five business days but not more than 60 calendar days before the applicable Call Date. |

| Early Redemption Amount: |

For each $1,000 principal amount of Notes, $1,000 plus the applicable Contingent Coupon Payment. |

| Initial Estimated Value Range: |

$920.00-$970.00 per Note. |

| Underwriting Discount*: |

$7.00 (0.70% of the public offering price) per Note. |

| CUSIP: |

09709VAV8. |

| Preliminary Pricing Supplement: |

https://www.sec.gov/Archives/edgar/data/70858/000148105722004204/form424b2.htm |

|

* Subject

to change prior to the Pricing Date.

† Subject

to adjustment. Please see the Preliminary Pricing Supplement for further details. |

Redemption Amount Determination

(assuming the Notes have not been previously called)

Hypothetical Returns at Maturity

Underlying Return of the

Least Performing Underlying |

Redemption

Amount per Note |

Return

on the Notes(1) |

| 60.00% |

$1,012.083 |

1.2083% |

| 50.00% |

$1,012.083 |

1.2083% |

| 40.00% |

$1,012.083 |

1.2083% |

| 30.00% |

$1,012.083 |

1.2083% |

| 20.00% |

$1,012.083 |

1.2083% |

| 10.00% |

$1,012.083 |

1.2083% |

| 5.00% |

$1,012.083 |

1.2083% |

| 2.00% |

$1,012.083 |

1.2083% |

| 0.00% |

$1,012.083 |

1.2083% |

| -10.00% |

$1,012.083 |

1.2083% |

| -20.00% |

$1,012.083 |

1.2083% |

| -30.00%(2) |

$1,012.083 |

1.2083% |

| -30.01% |

$699.900 |

-30.0100% |

| -50.00% |

$500.000 |

-50.0000% |

| -100.00% |

$0.000 |

-100.0000% |

|

(1)

The “Return on the Notes” is calculated based on the Redemption

Amount and potential final Contingent Coupon Payment, not including any Contingent Coupon Payments paid prior to maturity.

(2)

This is the Underlying Return which corresponds to the Coupon Barrier

and Threshold Value of the Least Performing Underlying.

|

Risk Factors

| · | Your investment may result in a loss; there is no guaranteed return of principal. |

| · | Your return on the Notes is limited to the return represented by the Contingent Coupon Payments, if any,

over the term of the Notes. |

| · | The Notes are subject to Optional Early Redemption. |

| · | You may not receive any Contingent Coupon Payments and the Notes do not provide for any regular fixed

coupon payments. |

| · | Your return on the Notes may be less than the yield on a conventional debt security of comparable maturity.

|

| · | The Contingent Coupon Payment, Early Redemption Amount or Redemption Amount, as applicable, will not

reflect the levels of the Underlyings other than on the Observation Dates. |

| · | Because the Notes are linked to the least performing (and not the average performance) of the Underlyings,

you may not receive any return on the Notes and may lose a significant portion or all |

| | of your principal amount even if the Observation

Value or Ending Value of one Underlying is always greater than or equal to its Coupon Barrier or Threshold Value, as applicable. |

| · | Any payment on the Notes is subject to the credit risk of BofA Finance and the Guarantor, and actual

or perceived changes in BofA Finance’s or the Guarantor’s creditworthiness are expected to affect the value of the Notes.

|

| · | The public offering price you pay for the Notes will exceed their initial estimated value. |

| · | We cannot assure you that a trading market for your Notes will ever develop or be maintained. |

| · | The Notes are subject to risks associated with small-size capitalization companies. |

You may revoke your offer to purchase the Notes at any time

prior to the time at which we accept such offer on the date the Notes are priced. We reserve the right to change the terms of, or reject

any offer to purchase, the Notes prior to their issuance. In the event of any changes to the terms of the Notes, we will notify you and

you will be asked to accept such changes in connection with your purchase. You may also choose to reject such changes in which case we

may reject your offer to purchase.

Please see the Preliminary Pricing Supplement for complete product

disclosure, including related risks and tax disclosure.

This fact sheet is a summary of the terms of the Notes and

factors that you should consider before deciding to invest in the Notes. BofA Finance has filed a registration statement (including preliminary

pricing supplement, product supplement, prospectus supplement and prospectus) with the Securities and Exchange Commission, or SEC, for

the offering to which this fact sheet relates. Before you invest, you should read this fact sheet together with the Preliminary Pricing

Supplement dated November 18, 2022, Product Supplement EQUITY-1 dated January 3, 2020 and Prospectus Supplement and Prospectus dated December

31, 2019 to understand fully the terms of the Notes and other considerations that are important in making a decision about investing in

the Notes. If the terms described in the applicable Preliminary Pricing Supplement are inconsistent with those described herein, the terms

described in the applicable Preliminary Pricing Supplement will control. You may get these documents without cost by visiting EDGAR on

the SEC Web site at sec.gov or by clicking on the hyperlinks to each of the respective documents incorporated by reference in the Preliminary

Pricing Supplement. Alternatively, BofA Finance, any agent or any dealer participating in this offering will arrange to send you the Preliminary

Pricing Supplement, Product Supplement EQUITY-1 and Prospectus Supplement and Prospectus if you so request by calling toll-free at 1-800-294-1322.

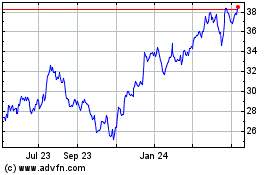

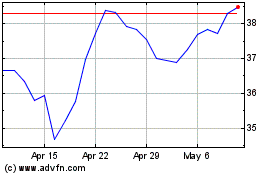

Bank of America (NYSE:BAC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Bank of America (NYSE:BAC)

Historical Stock Chart

From Apr 2023 to Apr 2024