Black Hills Corp. Completes 2024 Equity Issuances

August 19 2024 - 3:15PM

Black Hills Corp. (NYSE: BKH) announced that it executed a block

equity trade through its at-the-market (“ATM”) equity offering

program to satisfy its equity needs for 2024.

For the year, the company received net proceeds of $181.6

million, for a total issuance of 3.3 million shares, which are

being used to fund its capital expenditure program and for general

corporate purposes. The completion of this transaction achieved the

company’s previously stated 2024 equity needs of $170 million to

$190 million.

"Fulfilling our 2024 equity needs supports the execution of our

long-term strategic plan," said Linn Evans, president and CEO of

Black Hills Corp. "The financing is being used to fund our capital

requirements for growth initiatives, such as the Ready Wyoming

electric transmission expansion project, and other safety and

integrity investments to provide safe, reliable, and cost-effective

energy for our customers."

Black Hills CorporationBlack Hills Corp. (NYSE:

BKH) is a customer-focused, growth-oriented utility company with a

tradition of improving life with energy and a vision to be the

energy partner of choice. Based in Rapid City, South Dakota, the

company serves 1.34 million natural gas and electric utility

customers in eight states: Arkansas, Colorado, Iowa, Kansas,

Montana, Nebraska, South Dakota and Wyoming. More information is

available at www.blackhillscorp.com.

CAUTION REGARDING FORWARD-LOOKING

STATEMENTS

This news release includes “forward-looking statements” as

defined by the Securities and Exchange Commission, or SEC. We make

these forward-looking statements in reliance on the safe harbor

protections provided under the Private Securities Litigation Reform

Act of 1995. All statements, other than statements of historical

facts, included in this news release that address activities,

events or developments that we expect, believe or anticipate will

or may occur in the future are forward-looking statements. These

forward-looking statements are based on assumptions which we

believe are reasonable based on current expectations and

projections about future events, including future anticipated

equity needs, and industry conditions and trends affecting our

business. However, whether actual results and developments will

conform to our expectations and predictions is subject to a number

of risks and uncertainties that, among other things, could cause

actual results to differ materially from those contained in the

forward-looking statements, the risk factors described in Item 1A

of Part I of our 2023 Annual Report on Form 10-K filed with the

SEC, and other reports that we file with the SEC from time to time.

New factors that could cause actual results to differ materially

from those described in forward looking statements emerge from

time-to-time, and it is not possible for us to predict all such

factors, or the extent to which any such factor or combination of

factors may cause actual results to differ from those contained in

any forward-looking statement. We assume no obligation to update

publicly any such forward-looking statements, whether as a result

of new information, future events or otherwise.

Investor RelationsSal

Diaz605-399-5079investorrelations@blackhillscorp.com

24-Hour Media Relations Line

888-242-3969

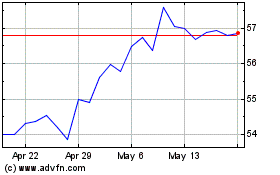

Black Hills (NYSE:BKH)

Historical Stock Chart

From Oct 2024 to Nov 2024

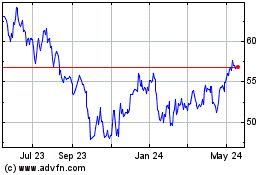

Black Hills (NYSE:BKH)

Historical Stock Chart

From Nov 2023 to Nov 2024