Black Hills Corp. Natural Gas Utility Receives Approval for New Rates in Arkansas

October 02 2024 - 7:45AM

Black Hills Corp. (NYSE: BKH) today announced that its Arkansas

natural gas utility, Black Hills Energy Arkansas, Inc., doing

business as Black Hills Energy, received approval from the Arkansas

Public Service Commission of a unanimous settlement agreement for

new rates effective with October billing cycles. The new rates are

designed to recover approximately $130 million of pipeline system

investments since the utility’s last general rate filing in 2021.

“We are pleased to receive approval of a settlement that

supports our long-term commitment to our Arkansas customers and

communities to deliver safe and reliable natural gas service,” said

Linn Evans, president and CEO of Black Hills Corp. “The critical

infrastructure investments made on behalf of our customers are

essential to meeting the growing demand for energy while also

supporting continued resilience of our Arkansas natural gas

system.”

The approved settlement agreement will generate approximately

$25.4 million of new annual revenues and migrates approximately

$3.7 million in annual rider revenue to base rates for a total

annual base rate revenue increase of $29.1 million. The approval

allows a 9.85% return on equity and a capital structure of 46%

equity and 54% debt.

Black Hills Corp.Black Hills Corp. (NYSE: BKH)

is a customer-focused, growth-oriented utility company with a

tradition of improving life with energy and a vision to be the

energy partner of choice. Based in Rapid City, South Dakota, the

company serves 1.34 million natural gas and electric utility

customers in eight states: Arkansas, Colorado, Iowa, Kansas,

Montana, Nebraska, South Dakota and Wyoming. More information is

available at www.blackhillscorp.com.

Investor RelationsSal

Diazinvestorrelations@blackhillscorp.com

24-Hour Media Relations Line888-242-3969

Caution Regarding Forward-Looking

StatementsThis news release includes “forward-looking

statements” as defined by the Securities and Exchange Commission,

or SEC. We make these forward-looking statements in reliance on the

safe harbor protections provided under the Private Securities

Litigation Reform Act of 1995. All statements, other than

statements of historical facts, included in this news release that

address activities, events or developments that we expect, believe

or anticipate will or may occur in the future are forward-looking

statements, including anticipated revenues from the new rate

increase. These forward-looking statements are based on assumptions

which we believe are reasonable based on current expectations and

projections about future events and industry conditions and trends

affecting our business. However, whether actual results and

developments will conform to our expectations and predictions is

subject to a number of risks and uncertainties that, among other

things, could cause actual results to differ materially from those

contained in the forward-looking statements, the risk factors

described in Item 1A of Part I of our 2023 Annual Report on Form

10-K filed with the SEC, and other reports that we file with the

SEC from time to time.

New factors that could cause actual results to differ materially

from those described in forward-looking statements emerge from

time-to-time, and it is not possible for us to predict all such

factors, or the extent to which any such factor or combination of

factors may cause actual results to differ from those contained in

any forward-looking statement. We assume no obligation to update

publicly any such forward-looking statements, whether as a result

of new information, future events or otherwise.

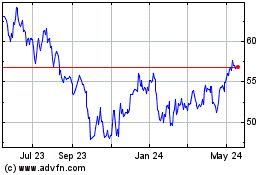

Black Hills (NYSE:BKH)

Historical Stock Chart

From Oct 2024 to Nov 2024

Black Hills (NYSE:BKH)

Historical Stock Chart

From Nov 2023 to Nov 2024