0001130464false00011304642024-11-062024-11-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): Nov. 6, 2024 |

Black Hills Corporation

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

South Dakota |

001-31303 |

46-0458824 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

7001 Mount Rushmore Road |

|

Rapid City, South Dakota |

|

57702 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 605 721-1700 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common stock of $1.00 par value |

|

BKH |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On Nov. 6, 2024, Black Hills Corporation ("the Company") issued a press release announcing financial results for the third quarter of 2024.

The press release is attached as Exhibit 99 to this Form 8-K. This information is being furnished pursuant to Item 2.02 of Form 8-K and shall not be deemed to be "filed" for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

BLACK HILLS CORPORATION |

|

|

|

|

Date: |

Nov. 6, 2024 |

By: |

/s/ Kimberly F. Nooney |

|

|

|

Kimberly F. Nooney

Senior Vice President

and Chief Financial Officer |

Black Hills Corp. Reaffirms 2024 Earnings Guidance and Reports 2024 Third-Quarter Results

•Reaffirms 2024 earnings guidance range of $3.80 to $4.00 per share

•Received approval of and implemented new customer rates at Arkansas natural gas utility

•Filed settlement agreement for new customer rates at Iowa natural gas utility

•Completed key financing activities for 2024 and achieved long-term capitalization target

RAPID CITY, S.D. — Nov. 6, 2024 — Black Hills Corp. (NYSE: BKH) today announced financial results for the third quarter of 2024. Net income available for common stock and earnings per share for the three and nine months ended Sept. 30, 2024, compared to the three and nine months ended Sept. 30, 2023, were:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended Sept. 30, |

|

|

Nine Months Ended Sept. 30, |

|

|

2024 |

|

2023 |

|

|

2024 |

|

2023 |

|

|

(in millions, except per share amounts) |

|

Operating Income |

$ |

75.8 |

|

$ |

97.8 |

|

|

$ |

339.8 |

|

$ |

336.2 |

|

Net income available for common stock |

$ |

24.4 |

|

$ |

45.4 |

|

|

$ |

175.0 |

|

$ |

182.5 |

|

Earnings per share, Diluted |

$ |

0.35 |

|

$ |

0.67 |

|

|

$ |

2.52 |

|

$ |

2.74 |

|

Earnings of $0.35 per share for the third quarter benefited from new rates, rider recovery and customer growth, which partially offset higher operating expenses, including depreciation, and the impacts of unplanned generation outages and higher interest expense. Earnings during the same period in 2023 benefited from one-time insurance proceeds and a gain on the sale of land.

Earnings of $2.52 per share year to date benefited from new rates, rider recovery and customer growth, which partially offset unfavorable weather, lower energy market pricing for off-system sales, the impacts of unplanned generation outages, higher operating expenses, including depreciation, and higher interest expense and the impact of new shares issued. Earnings during the same period in 2023 benefited from a one-time state income tax rate reduction in Nebraska, gains on the sales of land and wind assets, and insurance proceeds.

“We are on track to achieve our 2024 earnings guidance as we continue to execute on our strategy while navigating ongoing cost pressures and mild weather,” said Linn Evans, president and CEO of Black Hills Corp. “Our team made progress on our regulatory initiatives, with new natural gas utility rates effective in Arkansas and a constructive settlement reached in Iowa. We also completed our key financing activities for the year, ending the quarter at our long-term capitalization target of 55% debt.

“I'm excited about our strategic progress in delivering safe, reliable and cost-effective energy for our customers. Our 260-mile Ready Wyoming transmission project remains on track and will expand system capacity and power market access. We also continue to pursue new renewable resources in Colorado and dispatchable, baseload generation in South Dakota. For more than a decade, our innovative service model has successfully supported data center demand, and we look forward to serving Meta’s new AI data center in Cheyenne, Wyoming by 2026,” concluded Evans.

THIRD-QUARTER 2024 HIGHLIGHTS AND UPDATES

Electric Utilities

•On July 11, Wyoming Electric announced its partnership with Meta to provide power for its newest AI data center to be constructed in Cheyenne, Wyoming. The company will serve Meta under its Large Power Contract Service tariff and procure customized energy resources essential to Meta's operations and sustainability objectives. Through its innovative tariffs, Black Hills is advancing its data center and blockchain growth strategy, expecting to grow earnings contribution from these customers from 5% of earnings per share in 2023 to 10% or more by 2028.

•During the third quarter, Wyoming Electric continued construction on Ready Wyoming, a 260-mile electric transmission expansion project. Construction is on schedule and is expected to be completed in multiple segments in 2024 and 2025.

•During the third quarter, South Dakota Electric continued to pursue adding 100 megawatts of utility-owned, dispatchable natural gas resources by the second half of 2026. During the first quarter of 2025, South Dakota Electric expects to file for a permit to construct the project in South Dakota and request a certificate of public convenience and necessity (CPCN) in Wyoming.

•During the third quarter, Colorado Electric continued its resource planning process to add renewable resources to achieve an 80% emissions reduction by 2030 outlined in its Clean Energy Plan.

•On June 14, Colorado Electric filed a rate review with the Colorado Public Utilities Commission seeking the recovery of significant infrastructure investments in its 3,200-mile electric distribution and 600-mile electric transmission systems. The rate review requested $37 million in new annual revenue based on a capital structure of 53% equity and 47% debt and a return on equity of 10.5%. The company requested new rates effective in the first quarter of 2025.

Gas Utilities

•On Oct. 15, Iowa Gas filed for approval from the Iowa Utilities Commission of a settlement agreement with the Iowa Office of Consumer Advocate for its rate review request filed May 1, 2024. The settlement, pending commission approval, includes $15 million of new annual revenue based on a weighted average cost of capital of 7.21%. The settlement allows for final rates during the first quarter of 2025, replacing interim rates which were effective on May 11, 2024.

•On Oct. 1, Arkansas Gas received approval from the Arkansas Public Service Commission of a settlement agreement for its rate review request filed Dec. 4, 2023. The agreement will provide $25 million of new annual revenue based on a capital structure of 46% equity and 54% debt and a return on equity of 9.85%. New rates were effective in October 2024.

Corporate and Other

•On Oct. 28, Black Hills’ board of directors approved a quarterly dividend of $0.65 per share payable on Dec. 1, 2024, to common shareholders of record at the close of business on Nov. 18, 2024. The dividend, on an annualized rate, represents 54 consecutive years of dividend increases, the second longest track record in the electric and natural gas industry.

•During the third quarter, Black Hills issued 1.9 million shares of new common stock for net proceeds of $109 million under its at-the-market equity offering program, including a block equity trade. Year to date, the company issued a total of 3.3 million shares of new common stock for net proceeds of $182 million, completing the company's planned equity issuance for 2024.

2024 EARNINGS GUIDANCE REAFFIRMED

Black Hills reaffirms its guidance issued on Feb. 7, 2024, for 2024 earnings per share available for common stock to be in the range of $3.80 to $4.00, which was based on the following assumptions:

•Normal weather conditions within our utility service territories including temperatures, precipitation levels and wind conditions;

•Normal operations and weather conditions for planned construction, maintenance and/or capital investment projects;

•Constructive and timely outcomes of utility regulatory dockets;

•No significant unplanned outages at our generating facilities;

•Equity issuance of $170 million to $190 million through the at-the-market equity offering program; and

•Production tax credits of approximately $18 million associated with wind generation assets.

During the first nine months of 2024, Black Hills issued equity within the forecasted range, completed the sale of production tax credits, and mitigated the financial impacts of mild weather and unplanned generation outages.

BLACK HILLS CORPORATION

CONSOLIDATED FINANCIAL RESULTS

(Minor differences may result due to rounding)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended Sept. 30, |

|

|

Nine Months Ended Sept. 30, |

|

|

2024 |

|

2023 |

|

|

2024 |

|

2023 |

|

|

(in millions, except per share amount) |

|

Revenue |

$ |

401.6 |

|

$ |

407.1 |

|

|

$ |

1,530.6 |

|

$ |

1,739.6 |

|

|

|

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

Fuel, purchased power, and cost of natural gas sold |

|

94.5 |

|

|

102.2 |

|

|

|

518.2 |

|

|

749.8 |

|

Operations and maintenance |

|

145.6 |

|

|

125.7 |

|

|

|

420.8 |

|

|

412.5 |

|

Depreciation and amortization |

|

69.3 |

|

|

64.9 |

|

|

|

201.8 |

|

|

191.2 |

|

Taxes - property and production |

|

16.4 |

|

|

16.5 |

|

|

|

50.0 |

|

|

49.9 |

|

Total operating expenses |

|

325.8 |

|

|

309.3 |

|

|

|

1,190.8 |

|

|

1,403.4 |

|

|

|

|

|

|

|

|

|

|

|

Operating income |

|

75.8 |

|

|

97.8 |

|

|

|

339.8 |

|

|

336.2 |

|

|

|

|

|

|

|

|

|

|

|

Interest expense, net |

|

(45.2 |

) |

|

(41.0 |

) |

|

|

(131.9 |

) |

|

(126.0 |

) |

Other income (expense), net |

|

(1.3 |

) |

|

(0.6 |

) |

|

|

(1.7 |

) |

|

(1.5 |

) |

Income tax benefit (expense) |

|

(2.9 |

) |

|

(7.4 |

) |

|

|

(23.6 |

) |

|

(16.0 |

) |

Net income |

|

26.4 |

|

|

48.8 |

|

|

|

182.6 |

|

|

192.7 |

|

Net income attributable to non-controlling interest |

|

(2.0 |

) |

|

(3.4 |

) |

|

|

(7.6 |

) |

|

(10.2 |

) |

Net income available for common stock |

$ |

24.4 |

|

$ |

45.4 |

|

|

$ |

175.0 |

|

$ |

182.5 |

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding: |

|

|

|

|

|

|

Basic |

|

70.5 |

|

|

67.3 |

|

|

|

69.2 |

|

|

66.7 |

|

Diluted |

|

70.6 |

|

|

67.4 |

|

|

|

69.3 |

|

|

66.7 |

|

|

|

|

|

|

|

|

|

|

|

Earnings per share: |

|

|

|

|

|

|

|

|

|

Earnings Per Share, Basic |

$ |

0.35 |

|

$ |

0.67 |

|

|

$ |

2.53 |

|

$ |

2.74 |

|

Earnings Per Share, Diluted |

$ |

0.35 |

|

$ |

0.67 |

|

|

$ |

2.52 |

|

$ |

2.74 |

|

CONSOLIDATING INCOME STATEMENTS -- THIRD QUARTER

(Minor differences may result due to rounding)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended Sept. 30, 2024 |

Electric Utilities |

|

Gas Utilities |

|

Corporate and Other |

|

Total |

|

|

(in millions) |

|

Revenue |

$ |

232.5 |

|

$ |

173.6 |

|

$ |

(4.5 |

) |

$ |

401.6 |

|

|

|

|

|

|

|

|

|

|

Fuel, purchased power and cost of natural gas sold |

|

54.9 |

|

|

39.7 |

|

|

(0.1 |

) |

|

94.5 |

|

Operations and maintenance |

|

65.1 |

|

|

84.8 |

|

|

(4.3 |

) |

|

145.6 |

|

Depreciation and amortization |

|

38.0 |

|

|

31.3 |

|

|

0.1 |

|

|

69.3 |

|

Taxes - property and production |

|

9.4 |

|

|

6.9 |

|

|

- |

|

|

16.4 |

|

Operating income (loss) |

|

65.1 |

|

|

10.9 |

|

|

(0.2 |

) |

|

75.8 |

|

|

|

|

|

|

|

|

|

|

Interest expense, net |

|

|

|

|

|

|

|

(45.2 |

) |

Other income (expense), net |

|

|

|

|

|

|

|

(1.3 |

) |

Income tax benefit (expense) |

|

|

|

|

|

|

|

(2.9 |

) |

Net income |

|

|

|

|

|

|

|

26.4 |

|

Net income attributable to non-controlling interest |

|

|

|

|

|

|

|

(2.0 |

) |

Net income available for common stock |

|

|

|

|

|

|

$ |

24.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended Sept. 30, 2023 |

Electric Utilities |

|

Gas Utilities |

|

Corporate and Other |

|

Total |

|

|

(in millions) |

|

Revenue |

$ |

237.3 |

|

$ |

174.3 |

|

$ |

(4.5 |

) |

$ |

407.1 |

|

|

|

|

|

|

|

|

|

|

Fuel, purchased power and cost of natural gas sold |

|

55.4 |

|

|

46.9 |

|

|

(0.1 |

) |

|

102.2 |

|

Operations and maintenance |

|

53.9 |

|

|

75.7 |

|

|

(3.9 |

) |

|

125.7 |

|

Depreciation and amortization |

|

35.8 |

|

|

29.0 |

|

|

0.1 |

|

|

64.9 |

|

Taxes - property and production |

|

9.2 |

|

|

7.3 |

|

|

- |

|

|

16.5 |

|

Operating income (loss) |

|

83.0 |

|

|

15.4 |

|

|

(0.6 |

) |

|

97.8 |

|

|

|

|

|

|

|

|

|

|

Interest expense, net |

|

|

|

|

|

|

|

(41.0 |

) |

Other income (expense), net |

|

|

|

|

|

|

|

(0.6 |

) |

Income tax benefit (expense) |

|

|

|

|

|

|

|

(7.4 |

) |

Net income |

|

|

|

|

|

|

|

48.8 |

|

Net income attributable to non-controlling interest |

|

|

|

|

|

|

|

(3.4 |

) |

Net income available for common stock |

|

|

|

|

|

|

$ |

45.4 |

|

Three Months Ended Sept. 30, 2024, Compared to the Three Months Ended Sept. 30, 2023

The variance to the prior year included the following:

•Electric Utilities’ operating income decreased $17.9 million primarily due to higher operating expenses and unfavorable impacts from current year unplanned generation outages partially offset by new rates and rider recovery; and prior-year one-time benefits from a gain on sale of land to support data center growth and a recovery from our business interruption insurance;

•Gas Utilities’ operating income decreased $4.5 million primarily due to higher operating expenses partially offset by new rates and rider recovery driven by the Colorado Gas, Iowa Gas, Rocky Mountain Natural Gas and Wyoming Gas rate reviews;

•Net interest expense increased $4.2 million primarily due to higher interest rates partially offset by increased interest income; and

•Income tax expense decreased $4.5 million primarily driven by lower pre-tax income.

CONSOLIDATING INCOME STATEMENTS -- YEAR-TO-DATE

(Minor differences may result due to rounding)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended Sept. 30, 2024 |

Electric Utilities |

|

Gas Utilities |

|

Corporate and Other |

|

Total |

|

|

(in millions) |

|

Revenue |

$ |

659.8 |

|

$ |

884.2 |

|

$ |

(13.4 |

) |

$ |

1,530.6 |

|

|

|

|

|

|

|

|

|

|

Fuel, purchased power and cost of natural gas sold |

|

155.7 |

|

|

362.9 |

|

|

(0.4 |

) |

|

518.2 |

|

Operations and maintenance |

|

190.5 |

|

|

242.6 |

|

|

(12.3 |

) |

|

420.8 |

|

Depreciation and amortization |

|

108.9 |

|

|

92.8 |

|

|

0.1 |

|

|

201.8 |

|

Taxes - property and production |

|

28.7 |

|

|

21.3 |

|

|

- |

|

|

50.0 |

|

Operating income (loss) |

|

176.0 |

|

|

164.6 |

|

|

(0.8 |

) |

|

339.8 |

|

|

|

|

|

|

|

|

|

|

Interest expense, net |

|

|

|

|

|

|

|

(131.9 |

) |

Other income (expense), net |

|

|

|

|

|

|

|

(1.7 |

) |

Income tax benefit (expense) |

|

|

|

|

|

|

|

(23.6 |

) |

Net income |

|

|

|

|

|

|

|

182.6 |

|

Net income attributable to non-controlling interest |

|

|

|

|

|

|

|

(7.6 |

) |

Net income available for common stock |

|

|

|

|

|

|

$ |

175.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended Sept. 30, 2023 |

Electric Utilities |

|

Gas Utilities |

|

Corporate and Other |

|

Total |

|

|

(in millions) |

|

Revenue |

$ |

649.1 |

|

$ |

1,103.9 |

|

$ |

(13.4 |

) |

$ |

1,739.6 |

|

|

|

|

|

|

|

|

|

|

Fuel, purchased power and cost of natural gas sold |

|

147.2 |

|

|

602.9 |

|

|

(0.3 |

) |

|

749.8 |

|

Operations and maintenance |

|

176.8 |

|

|

246.8 |

|

|

(11.1 |

) |

|

412.5 |

|

Depreciation and amortization |

|

106.7 |

|

|

84.4 |

|

|

0.1 |

|

|

191.2 |

|

Taxes - property and production |

|

27.7 |

|

|

22.1 |

|

|

0.1 |

|

|

49.9 |

|

Operating income (loss) |

|

190.7 |

|

|

147.7 |

|

|

(2.2 |

) |

|

336.2 |

|

|

|

|

|

|

|

|

|

|

Interest expense, net |

|

|

|

|

|

|

|

(126.0 |

) |

Other income (expense), net |

|

|

|

|

|

|

|

(1.5 |

) |

Income tax benefit (expense) |

|

|

|

|

|

|

|

(16.0 |

) |

Net income |

|

|

|

|

|

|

|

192.7 |

|

Net income attributable to non-controlling interest |

|

|

|

|

|

|

|

(10.2 |

) |

Net income available for common stock |

|

|

|

|

|

|

$ |

182.5 |

|

Nine Months Ended Sept. 30, 2024, Compared to the Nine Months Ended Sept. 30, 2023

The variance to the prior year included the following:

•Electric Utilities’ operating income decreased $14.7 million primarily due to higher operating expenses and unfavorable impacts from current year unplanned generation outages partially offset by new rates and rider recovery; and prior-year one-time benefits from a gain on the sale of Northern Iowa Windpower assets, a gain on sale of land to support data center growth, and a recovery from our business interruption insurance;

•Gas Utilities’ operating income increased $16.9 million primarily due to new rates and rider recovery driven by the Colorado Gas, Iowa Gas, Rocky Mountain Natural Gas and Wyoming Gas rate reviews and retail customer growth and usage partially offset by higher operating expenses and unfavorable weather;

•Net interest expense increased $5.9 million primarily due to higher interest rates partially offset by increased interest income;

•Income tax expense increased $7.6 million driven by a higher effective tax rate primarily due to a prior-year $8.2 million tax benefit from a Nebraska income tax rate decrease; and

•Net income attributable to non-controlling interest decreased $2.6 million due to lower net income from Colorado IPP primarily driven by an unplanned generation outage.

OPERATING STATISTICS

Electric Utilities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue (in millions) |

|

Quantities Sold (GWh) |

|

|

Three Months Ended Sept. 30, |

|

Nine Months Ended Sept. 30, |

|

Three Months Ended Sept. 30, |

|

Nine Months Ended Sept. 30, |

|

By customer class |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Residential |

$ |

66.1 |

|

$ |

63.1 |

|

$ |

179.4 |

|

$ |

170.3 |

|

|

411.1 |

|

|

393.9 |

|

|

1,123.4 |

|

|

1,090.6 |

|

Commercial |

|

71.3 |

|

|

69.5 |

|

|

202.6 |

|

|

195.1 |

|

|

571.9 |

|

|

567.1 |

|

|

1,590.6 |

|

|

1,576.1 |

|

Industrial |

|

42.0 |

|

|

43.0 |

|

|

128.4 |

|

|

116.4 |

|

|

531.5 |

|

|

553.5 |

|

|

1,643.4 |

|

|

1,511.6 |

|

Municipal |

|

4.4 |

|

|

4.7 |

|

|

12.8 |

|

|

13.2 |

|

|

41.4 |

|

|

42.7 |

|

|

111.7 |

|

|

116.1 |

|

Subtotal Retail Revenue - Electric |

|

183.8 |

|

|

180.3 |

|

|

523.2 |

|

|

495.0 |

|

|

1,555.9 |

|

|

1,557.2 |

|

|

4,469.1 |

|

|

4,294.4 |

|

Contract Wholesale |

|

3.8 |

|

|

6.8 |

|

|

13.2 |

|

|

15.4 |

|

|

99.4 |

|

|

140.6 |

|

|

385.0 |

|

|

403.7 |

|

Off-system/Power Marketing Wholesale (a) |

|

7.4 |

|

|

9.6 |

|

|

14.8 |

|

|

31.7 |

|

|

227.0 |

|

|

138.4 |

|

|

506.8 |

|

|

518.5 |

|

Other (b) |

|

25.6 |

|

|

25.0 |

|

|

75.2 |

|

|

69.1 |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

Total Regulated |

|

220.6 |

|

|

221.7 |

|

|

626.4 |

|

|

611.2 |

|

|

1,882.3 |

|

|

1,836.2 |

|

|

5,360.9 |

|

|

5,216.6 |

|

Non-Regulated (c) |

|

11.9 |

|

|

15.6 |

|

|

33.4 |

|

|

37.9 |

|

|

25.0 |

|

|

25.4 |

|

|

74.2 |

|

|

102.6 |

|

Total Revenue and Quantities Sold |

$ |

232.5 |

|

$ |

237.3 |

|

$ |

659.8 |

|

$ |

649.1 |

|

|

1,907.3 |

|

|

1,861.6 |

|

|

5,435.1 |

|

|

5,319.2 |

|

Other Uses, Losses, or Generation, net (d) |

|

|

|

|

|

|

|

|

|

110.7 |

|

|

97.7 |

|

|

237.5 |

|

|

345.6 |

|

Total Energy |

|

|

|

|

|

|

|

|

|

2,018.0 |

|

|

1,959.3 |

|

|

5,672.6 |

|

|

5,664.8 |

|

(a)Off-system/Power Marketing Wholesale revenues decreased for the nine months ended September 30, 2024, compared to the same period in the prior year primarily due to lower excess capacity and lower commodity prices.

(b)Primarily related to transmission revenues from the Common Use System.

(c)Includes Integrated Generation and non-regulated services to our retail customers under the Service Guard Comfort Plan and Tech Services.

(d)Includes company uses and line losses.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue (in millions) |

|

Quantities Sold (GWh) |

|

|

Three Months Ended Sept. 30, |

|

Nine Months Ended Sept. 30, |

|

Three Months Ended Sept. 30, |

|

Nine Months Ended Sept. 30, |

|

By business unit |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Colorado Electric |

$ |

74.9 |

|

$ |

80.8 |

|

$ |

208.7 |

|

$ |

216.9 |

|

|

675.4 |

|

|

653.2 |

|

|

1,816.8 |

|

|

1,794.5 |

|

South Dakota Electric |

|

86.0 |

|

|

83.0 |

|

|

242.5 |

|

|

240.6 |

|

|

669.8 |

|

|

622.7 |

|

|

1,882.3 |

|

|

1,876.7 |

|

Wyoming Electric |

|

60.3 |

|

|

58.4 |

|

|

176.7 |

|

|

155.0 |

|

|

537.1 |

|

|

560.3 |

|

|

1,661.8 |

|

|

1,545.4 |

|

Integrated Generation |

|

11.3 |

|

|

15.1 |

|

|

31.9 |

|

|

36.6 |

|

|

25.0 |

|

|

25.4 |

|

|

74.2 |

|

|

102.6 |

|

Total Revenue and Quantities Sold |

$ |

232.5 |

|

$ |

237.3 |

|

$ |

659.8 |

|

$ |

649.1 |

|

|

1,907.3 |

|

|

1,861.6 |

|

|

5,435.1 |

|

|

5,319.2 |

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended Sept. 30, |

Nine Months Ended Sept. 30, |

|

2024 |

2023 |

2024 |

2023 |

Degree Days |

Actual |

Variance from Normal |

Actual |

Variance from Normal |

Actual |

Variance from Normal |

Actual |

Variance from Normal |

Heating Degree Days: |

|

|

|

|

|

|

|

|

Colorado Electric |

19 |

(57)% |

26 |

(42)% |

3,050 |

(8)% |

3,365 |

5% |

South Dakota Electric |

48 |

(71)% |

140 |

(15)% |

4,080 |

(12)% |

4,621 |

2% |

Wyoming Electric |

109 |

(35)% |

152 |

(12)% |

4,135 |

(8)% |

4,534 |

4% |

Combined (a) |

47 |

(58)% |

91 |

(19)% |

3,624 |

(10)% |

4,031 |

4% |

|

|

|

|

|

|

|

|

|

Cooling Degree Days: |

|

|

|

|

|

|

|

|

Colorado Electric |

904 |

5% |

909 |

6% |

1,247 |

10% |

1,040 |

(10)% |

South Dakota Electric |

789 |

57% |

460 |

(11)% |

903 |

48% |

496 |

(21)% |

Wyoming Electric |

368 |

(6)% |

315 |

(20)% |

486 |

6% |

329 |

(30)% |

Combined (a) |

756 |

17% |

635 |

(2)% |

975 |

19% |

710 |

(15)% |

(a)Degree days are calculated based on a weighted average of total customers by state.

|

|

|

|

|

|

Three Months Ended Sept. 30, |

Nine Months Ended Sept. 30, |

Contracted generating facilities Availability(a) by fuel type |

2024 |

2023 |

2024 |

2023 |

Coal (b) |

90.7% |

96.3% |

87.3% |

93.7% |

Natural gas and diesel oil (b) |

98.0% |

94.2% |

95.4% |

94.0% |

Wind |

92.3% |

93.4% |

91.6% |

93.4% |

Total Availability |

95.1% |

94.7% |

92.5% |

93.8% |

|

|

|

|

|

Wind Capacity Factor (a) |

32.0% |

31.3% |

36.2% |

37.9% |

(a)Availability and Wind Capacity Factor are calculated using a weighted average based on capacity of our generating fleet.

(b)2024 included unplanned outages at Wygen I and Colorado IPP.

OPERATING STATISTICS (continued)

Gas Utilities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue

(in millions) |

|

Quantities Sold and Transported

(Dth in millions) |

|

|

Three Months Ended Sept. 30, |

|

Nine Months Ended Sept. 30, |

|

Three Months Ended Sept. 30, |

|

Nine Months Ended Sept. 30, |

|

By customer class |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Residential |

$ |

76.3 |

|

$ |

75.1 |

|

$ |

481.9 |

|

$ |

620.3 |

|

|

3.5 |

|

|

3.5 |

|

|

38.2 |

|

|

41.1 |

|

Commercial |

|

27.5 |

|

|

28.6 |

|

|

185.8 |

|

|

255.4 |

|

|

2.4 |

|

|

2.4 |

|

|

19.3 |

|

|

20.5 |

|

Industrial |

|

7.6 |

|

|

9.9 |

|

|

18.5 |

|

|

26.2 |

|

|

2.4 |

|

|

2.1 |

|

|

5.1 |

|

|

4.5 |

|

Other |

|

2.6 |

|

|

3.1 |

|

|

8.0 |

|

|

7.3 |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

Total Distribution (a) |

|

114.0 |

|

|

116.7 |

|

|

694.2 |

|

|

909.2 |

|

|

8.3 |

|

|

8.0 |

|

|

62.6 |

|

|

66.1 |

|

Transportation and Transmission |

|

43.3 |

|

|

42.8 |

|

|

131.4 |

|

|

131.8 |

|

|

35.8 |

|

|

36.8 |

|

|

117.0 |

|

|

118.2 |

|

Total Regulated |

|

157.3 |

|

|

159.5 |

|

|

825.6 |

|

|

1,041.0 |

|

|

44.1 |

|

|

44.8 |

|

|

179.6 |

|

|

184.3 |

|

Non-regulated Services (b) |

|

16.3 |

|

|

14.8 |

|

|

58.6 |

|

|

62.9 |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

Total Revenue and Quantities Sold |

$ |

173.6 |

|

$ |

174.3 |

|

$ |

884.2 |

|

$ |

1,103.9 |

|

|

44.1 |

|

|

44.8 |

|

|

179.6 |

|

|

184.3 |

|

(a)Gas distribution revenues decreased for the three and nine months ended September 30, 2024, compared to the same period in the prior year primarily due to lower commodity prices. Our Utilities have regulatory mechanisms that allow them to pass prudently incurred costs of energy through to the customer. Customer billing rates are adjusted periodically to reflect changes in our cost of energy.

(b)Includes Black Hills Energy Services and non-regulated services under the Service Guard Comfort Plan, Tech Services, and HomeServe.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue

(in millions) |

|

Quantities Sold and Transported

(Dth in millions) |

|

|

Three Months Ended Sept. 30, |

|

Nine Months Ended Sept. 30, |

|

Three Months Ended Sept. 30, |

|

Nine Months Ended Sept. 30, |

|

By business unit |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Arkansas Gas |

$ |

25.4 |

|

$ |

27.2 |

|

$ |

167.2 |

|

$ |

189.0 |

|

|

4.5 |

|

|

4.3 |

|

|

21.5 |

|

|

21.0 |

|

Colorado Gas |

|

31.5 |

|

|

31.5 |

|

|

191.5 |

|

|

227.9 |

|

|

3.3 |

|

|

3.6 |

|

|

21.3 |

|

|

23.3 |

|

Iowa Gas |

|

21.0 |

|

|

18.7 |

|

|

110.4 |

|

|

168.1 |

|

|

5.8 |

|

|

5.8 |

|

|

26.4 |

|

|

27.2 |

|

Kansas Gas |

|

19.6 |

|

|

22.8 |

|

|

90.8 |

|

|

118.5 |

|

|

8.5 |

|

|

9.1 |

|

|

26.1 |

|

|

27.4 |

|

Nebraska Gas |

|

54.2 |

|

|

55.3 |

|

|

218.9 |

|

|

277.9 |

|

|

16.5 |

|

|

17.0 |

|

|

58.1 |

|

|

59.8 |

|

Wyoming Gas |

|

21.9 |

|

|

18.8 |

|

|

105.4 |

|

|

122.5 |

|

|

5.5 |

|

|

5.0 |

|

|

26.2 |

|

|

25.6 |

|

Total Revenue and Quantities Sold |

$ |

173.6 |

|

$ |

174.3 |

|

$ |

884.2 |

|

$ |

1,103.9 |

|

|

44.1 |

|

|

44.8 |

|

|

179.6 |

|

|

184.3 |

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended Sept. 30, |

Nine Months Ended Sept. 30, |

|

2024 |

2023 |

2024 |

2023 |

Heating Degree Days |

Actual |

Variance from Normal |

Actual |

Variance from Normal |

Actual |

Variance from Normal |

Actual |

Variance from Normal |

Arkansas Gas (a) |

9 |

(40)% |

--- |

(100)% |

1,925 |

(18)% |

1,944 |

(18)% |

Colorado Gas |

80 |

(29)% |

91 |

(22)% |

3,613 |

(5)% |

4,078 |

7% |

Iowa Gas |

45 |

(47)% |

37 |

(59)% |

3,450 |

(19)% |

3,867 |

(10)% |

Kansas Gas (a) |

19 |

(26)% |

6 |

(78)% |

2,576 |

(11)% |

2,749 |

6% |

Nebraska Gas |

22 |

(65)% |

21 |

(67)% |

3,281 |

(12)% |

3,591 |

(5)% |

Wyoming Gas |

132 |

(37)% |

180 |

5% |

4,384 |

(6)% |

4,953 |

14% |

Combined (b) |

50 |

(43)% |

56 |

(35)% |

3,502 |

(11)% |

3,926 |

1% |

(a)Arkansas Gas and Kansas Gas have weather normalization mechanisms that mitigate the weather impact on gross margins.

(b)The combined heating degree days are calculated based on a weighted average of total customers by state excluding Kansas Gas due to its weather normalization mechanism. Arkansas Gas is partially excluded based on the weather normalization mechanism in effect from November through April.

CONFERENCE CALL AND WEBCAST

Black Hills will host a live conference call and webcast at 11 a.m. EST on Thursday, Nov. 7, 2024, to discuss its financial and operating performance.

To access the live webcast and download a copy of the investor presentation, go to the “Investor Relations” section of the Black Hills website at www.blackhillscorp.com and click on “News and Events” and then “Events & Presentation.” The presentation will be posted on the website before the webcast. Listeners should allow at least five minutes for registering and accessing the presentation. For those unable to listen to the live broadcast, a replay will be available on the company’s website.

To ask a question during the live broadcast, users can access dial-in information and a personal identification number by registering for the event at https://register.vevent.com/register/BI9ac113e7b8ef4295bbbb150c1d14c3ac.

A listen-only webcast player and presentation slides can be accessed live at https://edge.media-server.com/mmc/p/gncgbawz with a replay of the event available for up to one year.

EEI FINANCIAL CONFERENCE ATTENDANCE

Leadership from Black Hills will be attending the 2024 Edison Electric Institute Financial Conference taking place from Nov. 10, 2024, through Nov. 12, 2024. An investor presentation will be available prior to the conference on Black Hills’ website at www.blackhillscorp.com under “Events and Presentations” in the “Investor Relations” section.

ABOUT BLACK HILLS CORP.

Black Hills Corp. (NYSE: BKH) is a customer-focused, growth-oriented utility company with a tradition of improving life with energy and a vision to be the energy partner of choice. Based in Rapid City, South Dakota, the company serves 1.34 million natural gas and electric utility customers in eight states: Arkansas, Colorado, Iowa, Kansas, Montana, Nebraska, South Dakota and Wyoming. More information is available at www.blackhillscorp.com, www.blackhillscorp.com/corporateresponsibility and www.blackhillsenergy.com.

CAUTION REGARDING FORWARD-LOOKING STATEMENTS

This press release includes “forward-looking statements” as defined by the Securities and Exchange Commission. We make these forward-looking statements in reliance on the safe harbor protections provided under the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical facts, included in this press release that address activities, events or developments that we expect, believe or anticipate will or may occur in the future are forward-looking statements. This includes, without limitations, our 2024 earnings guidance. These forward-looking statements are based on assumptions which we believe are reasonable based on current expectations and projections about future events and industry conditions and trends affecting our business. However, whether actual results and developments will conform to our expectations and predictions is subject to a number of risks and uncertainties that, among other things, could cause actual results to differ materially from those contained in the forward-looking statements, including without limitation, the risk factors described in Item 1A of Part I of our 2023 Annual Report on Form 10-K and other reports that we file with the SEC from time to time, and the following:

•The accuracy of our assumptions on which our earnings guidance is based;

•Our ability to obtain adequate cost recovery for our utility operations through regulatory proceedings and favorable rulings on periodic applications to recover costs for capital additions, plant retirements and decommissioning, fuel, transmission, purchased power, and other operating costs and the timing in which new rates would go into effect;

•Our ability to complete our capital program in a cost-effective and timely manner;

•Our ability to execute on our strategy;

•Our ability to successfully execute our financing plans;

•The effects of changing interest rates;

•Our ability to achieve our greenhouse gas emissions intensity reduction goals;

•Board of Directors’ approval of any future quarterly dividends;

•The impact of future governmental regulation;

•Our ability to overcome the impacts of supply chain disruptions on availability and cost of materials;

•The effects of inflation and volatile energy prices;

•Our ability to obtain sufficient insurance coverage at reasonable costs and whether such coverage will protect us against significant losses; and

•Other factors discussed from time to time in our filings with the SEC.

New factors that could cause actual results to differ materially from those described in forward-looking statements emerge from time-to-time, and it is not possible for us to predict all such factors, or the extent to which any such factor or combination of factors may cause actual results to differ from those contained in any forward-looking statement. We assume no obligation to update publicly any such forward-looking statements, whether as a result of new information, future events or otherwise.

|

|

Investor Relations: |

|

Sal Diaz |

|

Phone |

605-399-5079 |

Email |

investorrelations@blackhillscorp.com |

|

|

Media Contact: |

|

24-hour Media Assistance |

888-242-3969 |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

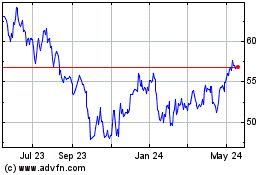

Black Hills (NYSE:BKH)

Historical Stock Chart

From Oct 2024 to Nov 2024

Black Hills (NYSE:BKH)

Historical Stock Chart

From Nov 2023 to Nov 2024