The High Cost of Target-Date Funds -- Journal Report

December 04 2020 - 12:00PM

Dow Jones News

By Chana R. Schoenberger

Are investors paying too much for target-date funds?

Target-date funds are designed to give investors a diversified

portfolio that automatically rebalances over time, as a goal like

retirement or college approaches. The funds are growing

increasingly popular, particularly in 401(k) accounts and among

younger investors.

But a new academic paper, released in October but as yet

unpublished, points a finger at the fees that target-date fund

investors pay, which, the researchers calculate, total an average

of one-third of a percentage point annually. Instead of spending

extra to have a target-date fund manage their asset allocation,

investors should replicate the portfolios using cheaper

exchange-traded funds, the authors write in "Off Target: On the

Underperformance of Target-Date Funds."

The problem is that target-date funds are funds that invest in

other funds (known as "funds of funds"), say authors David Brown of

the University of Arizona's Eller College of Management and Shaun

Davies of the Leeds School of Business at the University of

Colorado Boulder. Each fund is a mini-portfolio of underlying

mutual funds and ETFs, and each can levy two levels of fees.

While only about 20% of funds use this arrangement, many 401(k)

investors may be forced to choose them in their portfolio. What's

more, many of the double-fee funds also contain actively managed

funds, which charge more than passive funds because they come with

higher staff costs.

Rare switches

Employees often have their money placed into target-date funds

automatically when they start a new job and launch a new 401(k),

and rarely take the initiative to switch their fund allocation.

"People interpret that as advice and don't change it," Prof.

Davies says.

Because of this inertia, younger investors in particular are

invested heavily in these funds. Among 401(k) account holders in

their 20s, 48% of their retirement savings were held in target-date

funds at the end of 2016, according to the Employee Benefit

Research Institute.

Profs. Brown and Davies identified two causes of target-date

funds' underperformance compared to similarly constructed

portfolios of cheap ETFs: fees and cash drag. The average ETF

portfolio outperformed its mirroring target-date fund by 8 to 11

basis points each month, or 93 to 128 basis points annually,

between 2006 and 2017, the authors found in an analysis

representing what an investor would pay on average if they chose a

target-date fund provider at random.

Most of the underperformance -- two-thirds of the effect -- can

be traced to higher management fees in target-date funds, they

wrote. The funds charged an unnecessary 33 basis points as an

asset-weighted average for 2017 alone, which left investors out of

pocket an extra $2.5 billion, they calculated.

"It is difficult to rationalize that our results simply reflect

[target-date] fund sponsors' operational expenses," they wrote.

These fees do seem to be falling over time as target-date funds

jostle for market share. Vanguard Group, Fidelity Investments,

American Funds, T. Rowe Price and BlackRock -- the five largest

target-date-fund companies, which command the majority of the

market -- don't charge double fees today, says Jason Kephart, a

multiasset-manager research strategist at Morningstar.

"Our target retirement funds do not levy additional fees beyond

the low-cost, underlying index-fund strategies," says Emily

Farrell, a spokeswoman for Vanguard, by far the biggest fund

provider in this area with $907 billion in target-date retirement

assets under management, double its 2016 tally.

Fidelity similarly defends its fees.

"Our target-date-fund pricing is very competitive, with each

Freedom Fund charging shareholders for its operating expenses

directly with a single top-line fee," says Fidelity spokesman Adam

Banker.

Do it yourself?

The paper's authors argue that there's no need to pay even

relatively small fees, since the funds are easy to reproduce on

your own. Each quarter, investors can look at the publicly

disclosed holdings of target-date funds aimed at their projected

retirement year, and adjust their own portfolio of low-cost ETFs

accordingly.

If an investor liked Fidelity's glide paths, or policies for

shifting allocations over time, "they could replicate Fidelity's

glide paths pretty easily," Prof. Brown says.

Ms. Schoenberger is a writer in New York. She can be reached at

reports@wsj.com.

(END) Dow Jones Newswires

December 04, 2020 12:45 ET (17:45 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

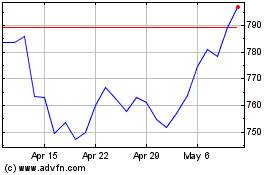

BlackRock (NYSE:BLK)

Historical Stock Chart

From Mar 2024 to Apr 2024

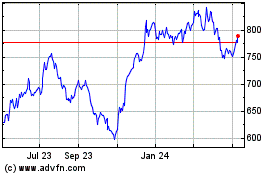

BlackRock (NYSE:BLK)

Historical Stock Chart

From Apr 2023 to Apr 2024