Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses

February 26 2025 - 8:09AM

Edgar (US Regulatory)

FILED PURSUANT TO RULE 433

File No. 333-270327

CITIGROUP INC.

$2,000,000,000

5.612%

FIXED RATE / FLOATING RATE CALLABLE

SENIOR NOTES DUE 2056

Terms and Conditions

|

|

|

| Issuer: |

|

Citigroup Inc. |

|

|

| Ratings*: |

|

A3 /BBB+ / A (Stable Outlook / Stable Outlook / Stable Outlook) (Moody’s / S&P / Fitch) |

|

|

| Ranking: |

|

Senior |

|

|

| Trade Date: |

|

February 25, 2025 |

|

|

| Settlement Date: |

|

March 4, 2025 (T+5 days) |

|

|

| Maturity: |

|

March 4, 2056 |

|

|

| Par Amount: |

|

$2,000,000,000 |

|

|

| Treasury Benchmark: |

|

4.500% due November 15, 2054 |

|

|

| Treasury Price: |

|

$98-31+ |

|

|

| Treasury Yield: |

|

4.562% |

|

|

| Re-offer Spread to Benchmark: |

|

T30+105 bp |

|

|

| Re-offer Yield: |

|

5.612% |

|

|

| Fixed Rate Coupon & Payment Dates: |

|

5.612% per annum, payable semiannually in arrears on each March 4 and September 4, beginning on September 4, 2025, from, and

including, the Settlement Date to, but excluding, March 4, 2055 (the “fixed rate period”).

Following business day convention during the fixed rate period. Business days during fixed rate period New York. |

|

|

| Floating Rate Coupon & Payment Dates: |

|

From, and including, March 4, 2055 (the “floating rate period”), an annual floating rate equal to SOFR (as defined in the

Issuer’s base prospectus dated March 7, 2023 (the “Prospectus”) and compounding daily over each interest period as described in the Prospectus) plus 1.746%, payable quarterly in arrears, on the second business day following each

interest period end date, beginning on June 8, 2055 and ending at Maturity or any earlier redemption date. An “interest period end date” means the 4th of each March, June, September

and December, beginning on June 4, 2055 and ending at Maturity or any earlier redemption date.

Modified following business day convention applicable to each interest period end date during the floating rate period. Business days during floating rate

period New York and U.S. Government Securities Business (as defined in the Prospectus). |

|

|

| Public Offering Price: |

|

100.000% |

|

|

| Net Proceeds to Citigroup: |

|

$1,982,500,000 (before expenses) |

|

|

| Day Count: |

|

30/360 during the fixed rate period, Actual/360 during the floating rate period |

|

|

| Defeasance: |

|

Applicable. Provisions of Sections 12.02 and 12.03 of the Indenture apply |

CITIGROUP INC.

$2,000,000,000

5.612%

FIXED RATE / FLOATING RATE CALLABLE

SENIOR NOTES DUE 2056

|

|

|

| Redemption at Issuer Option: |

|

We may redeem the notes, at our option, in whole at any time or in part from time to time, on or after September 4, 2025 (or if

additional notes are issued after March 4, 2025, beginning six months after the issue date of such additional notes) and prior to March 4, 2055 at a redemption price equal to the greater of (i) the make-whole amount (as described in

the Prospectus) and (ii) 100% of the principal amount of the notes being redeemed, plus, in either case, accrued and unpaid interest thereon to, but excluding, the date of redemption. The make-whole spread to be added to the Treasury Rate (as

defined in the Prospectus) will equal 20 basis points. We may redeem the notes, at

our option, (i) in whole, but not in part, on March 4, 2055, or (ii) in whole at any time or in part from time to time, on or after February 4, 2056 at a redemption price equal to the sum of 100% of the principal amount of the

notes being redeemed plus accrued and unpaid interest thereon to, but excluding, the date of redemption.

SOFR for each calendar day from, and including, the Rate Cut-Off Date to, but excluding, the redemption date will equal

SOFR in respect of the Rate Cut-Off Date. |

|

|

| Rate Cut-Off Date: |

|

The second U.S. Government Securities Business Day prior to a redemption date and Maturity. |

|

|

| Redemption for Tax Purposes: |

|

We may redeem the notes, at our option, in whole at any time, but not in part at a redemption price equal to 100% of the principal amount of

the notes plus accrued and unpaid interest thereon to, but excluding, the date of redemption, if, as a result of changes in U.S. tax law, withholding tax or information reporting requirements are imposed on payments on the notes to non-U.S. persons. SOFR for each calendar day from, and including, the Rate

Cut-Off Date to, but excluding, the redemption date will equal SOFR in respect of the Rate Cut-Off Date. |

|

|

| Sinking Fund: |

|

Not applicable |

|

|

| Minimum Denominations/Multiples: |

|

$1,000 / multiples of $1,000 in excess thereof |

|

|

| CUSIP: |

|

17327C AY9 |

|

|

| ISIN: |

|

US17327CAY93 |

|

|

| Sole Book Manager: |

|

Citigroup Global Markets Inc. |

CITIGROUP INC.

$2,000,000,000

5.612%

FIXED RATE / FLOATING RATE CALLABLE

SENIOR NOTES DUE 2056

|

|

|

| Senior Co-Managers: |

|

ANZ Securities, Inc. BBVA Securities Inc.

BMO Capital Markets Corp. Capital One Securities, Inc.

Danske Markets Inc. Deutsche Bank Securities Inc.

ING Financial Markets LLC Lloyds Securities Inc.

Mizuho Securities USA LLC MUFG Securities Americas Inc.

Natixis Securities Americas LLC Nomura Securities International,

Inc. Nordea Bank Abp PNC Capital Markets LLC

RBC Capital Markets, LLC Santander US Capital Markets LLC

Scotia Capital (USA) Inc. SG Americas Securities, LLC

SMBC Nikko Securities America, Inc. Standard Chartered Bank

TD Securities (USA) LLC Truist Securities, Inc.

U.S. Bancorp Investments, Inc. |

|

|

| Junior Co-Managers: |

|

American Veterans Group, PBC Banco de Sabadell,

S.A. BNY Mellon Capital Markets, LLC CastleOak Securities,

L.P. CIBC World Markets Corp. Citizens JMP Securities,

LLC Commerz Markets LLC Commonwealth Bank of Australia

DBS Bank Ltd. Desjardins Securities Inc.

Drexel Hamilton, LLC Fifth Third Securities, Inc.

Huntington Securities, Inc. Intesa Sanpaolo IMI Securities

Corp. KeyBanc Capital Markets Inc. M&T Securities,

Inc. Macquarie Capital (USA) Inc. nabSecurities, LLC

National Bank of Canada Financial Inc. NatWest Markets Securities

Inc. Nykredit Bank A/S Rabo Securities USA, Inc.

RB International Markets (USA) LLC Regions Securities LLC

Westpac Capital Markets LLC |

| * |

Note: A securities rating is not a recommendation to buy, sell, or hold securities and may be subject to

revision or withdrawal at any time. |

Citigroup Inc. has filed a registration statement (including a prospectus) with the Securities and

Exchange Commission for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and the other documents Citigroup has filed with the SEC for more complete information about

Citigroup and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. The file number for Citigroup’s registration statement is No. 333-270327.

Alternatively, you can request the prospectus by calling toll-free in the United States 1-800-831-9146.

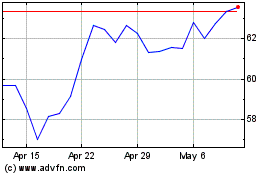

Citigroup (NYSE:C)

Historical Stock Chart

From Jan 2025 to Feb 2025

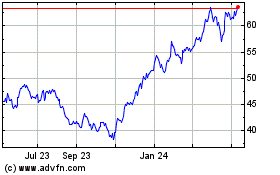

Citigroup (NYSE:C)

Historical Stock Chart

From Feb 2024 to Feb 2025