Passenger traffic up 7.9% YoY in Argentina and

2.8% in Brazil, further supported by growth across most

geographies

Corporación América Airports S.A. (NYSE: CAAP), (“CAAP”

or the “Company”) the largest private sector airport operator in

the world by number of airports, reported today preliminary

year-over-year passenger traffic growth of 5.5% in February

2019.

Passenger Traffic, Cargo Volume and

Aircraft Movements Highlights

Statistics

Feb'19

Feb'18 % Var.

YTD’19 YTD’18

% Var Domestic Passengers (thousands)

3,584

3,264 9.8 % 7,590

6,925 9.6 % International

Passengers (thousands)

2,050 2,077

-1.3 % 4,371 4,440 -1.6 %

Transit Passengers (thousands)

745 708

5.3 % 1,614 1,605

0.5 %

Total Passengers (thousands)

6,380

6,049 5.5

% 13,575 12,970

4.7 % Cargo Volume (thousand

tons)

33.8 30.3

11.8 % 66.6 62.0

7.5 % Total Aircraft

Movements (thousands)

66.5 64.9

2.5 % 141.2

139.5 1.2 %

Passenger Traffic

Overview

Total passenger traffic in February 2019 increased 5.5%

YoY, primarily reflecting growth of 7.9% in Argentina, 2.8% in

Brazil and 8.2% in Ecuador.

In Argentina, total passenger traffic increased 7.9% YoY, mainly

driven by 17.2% growth in domestic passengers, benefiting from the

launch of several new routes and addition to new airlines during

2018, together with a mix-shift to domestic from international

travel by local passengers. This was partially offset by a decline

of 5.4% in international passengers, reflecting continued

challenging macro conditions. After a full year of operations, El

Palomar Airport, our facility servicing low-cost flights located in

Greater Buenos Aires, ranked 7th in terms of passenger traffic

across our network. Also driven by low-cost Airlines Norwegian and

Flybondi, our Mendoza, Córdoba and Iguazú airports posted increases

in domestic traffic of 39.7%, 23.9% and 27.2%, respectively in

February.

In Italy, passenger traffic rose 5.2%, driven by an increase of

5.2% in Pisa Airport mainly related to the addition of frequencies

by Ryanair and flights by Pobeda to Moscow. In Florence Airport,

passenger traffic increased 5.3%, due to easier comps as last year

traffic was impacted by Air France pilots’ strike, together with

the good performance of TAP’s connection to Lisbon and the

additional flights to Madrid by Iberia.

In Brazil, passenger traffic at Brasilia airport increased 3.5%,

mainly due to an increase of 2.1% in domestic traffic, offset by a

decline in international traffic mainly as a result of the change

in methodology in traffic count by ANAC. Based on the prior

methodology, international traffic would have increased 32.5% YoY

at this airport. Domestic traffic growth remained impacted by a

reduction in less profitable routes and frequencies by LATAM

Airlines, and a decline of approximately 20% in seat supply at

Avianca Brasil. By contrast, Gol continues with its plan to expand

operations at Brasilia Airport, with new domestic flights to be

launched during the first half of the year. International traffic

at Brasilia Airport declined 10.2% impacted by the new methodology

in traffic count applied since June 2018 as discussed above. This

more than offset traffic growth resulting from the continued good

performance of routes to Miami and Orlando opened by Gol Airlines

in November and the addition of a new direct flight to Buenos Aires

during December.

In Ecuador, passenger traffic increased 8.2%, with international

passenger traffic at Guayaquil Airport up 11.8%, mainly attributed

to the continued good performance of the Spirit Airlines flight to

Fort Lauderdale introduced in March 2018 and the increase in

frequencies by COPA Airlines.

Cargo Volume and Aircraft

Movements

Cargo volume increased 11.8% in February 2019 mainly as a

result a 98.5% increase in Brazil, mainly related to an increase in

exports, offset by a decline of 7.9% in Argentina, related to the

continued challenging macroeconomic conditions.

Aircraft movements increased 2.5% in February 2019,

mainly as a result of increases of 4.5% in Argentina and 24.0% in

Ecuador, partially offset by a 6.4% decline in Brazil.

Summary Passenger Traffic, Cargo Volume and Aircraft

Movements

Feb'19

Feb'18 % Var.

YTD’19 YTD’18

% Var Passenger Traffic (thousands)

Argentina

3,463 3,209 7.9 % 7,271

6,785 7.2 % Italy

429

408 5.2 % 889

855 4.0 % Brazil

1,521

1,479 2.8 % 3,387

3,332 1.6 % Uruguay

211

220 -4.2 % 458 479

-4.4 % Ecuador

342 316

8.2 % 695 646

7.6 % Armenia

167 149

11.9 % 379 338

12.1 % Peru

247 267 -7.6 % 496

535 -7.3 %

TOTAL

6,380 6,049

5.5 % 13,575

12,970 4.7 %

Cargo Volume (tons)

Argentina

17,067

18,530 -7.9 % 35,911

38,174 -5.9 % Italy

990

842 17.5 % 2,017

1,728 16.7 % Brazil

8,441

4,252 98.5 % 14,483

8,744 65.6 % Uruguay

1,937

1,945 -0.4 % 3,846

3,964 -3.0 % Ecuador

3,626

3,224 12.5 % 7,358

6,613 11.3 % Armenia

1,368

1,117 22.5 % 2,227

2,009 10.8 % Peru

418

371 12.5 % 787 759

3.8 %

TOTAL

33,846

30,281 11.8 %

66,629 61,990

7.5 % Aircraft

Movements

Argentina

36,403 34,845

4.5 % 76,543 74,030

3.4 % Italy

4,302 4,068

5.8 % 8,946 8,601 4.0 %

Brazil

12,710 13,576 -6.4

% 27,380 29,329 -6.6 %

Uruguay

2,848 3,447 -17.4

% 6,789 7,982 -14.9 %

Ecuador

6,545 5,279 24.0 %

13,699 11,509 19.0 %

Armenia

1,552 1,425 8.9 %

3,500 3,164 10.6 %

Peru 2,174

2,279 -4.6 % 4,338

4,888 -11.3 %

TOTAL

66,534 64,919

2.5 % 141,195

139,503 1.2 %

About Corporación América Airports

Corporación América Airports acquires, develops and operates

airport concessions. The Company is the largest private airport

operator in the world by the number of airports and the tenth

largest based on passenger traffic. Currently, the Company operates

52 airports in 7 countries across Latin America and Europe

(Argentina, Brazil, Uruguay, Peru, Ecuador, Armenia and Italy). In

2018, Corporación América Airports served 81.3 million passengers.

The Company is listed on the New York Stock Exchange where it

trades under the ticker “CAAP”. For more information, visit

http://investors.corporacionamericaairports.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190314005934/en/

Investor Relations ContactGimena

AlbanesiEmail: gimena.albanesi@caairports.comPhone: +5411

4852-6411

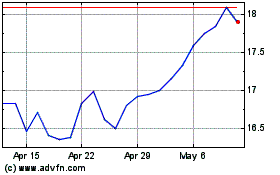

Corporacion America Airp... (NYSE:CAAP)

Historical Stock Chart

From Mar 2024 to Apr 2024

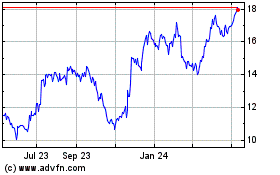

Corporacion America Airp... (NYSE:CAAP)

Historical Stock Chart

From Apr 2023 to Apr 2024