Caterpillar Digs Into Services -- WSJ

April 09 2019 - 2:02AM

Dow Jones News

Monitoring cloud-connected machinery and parts sales seen as

steadier revenue

By Austen Hufford

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (April 9, 2019).

Caterpillar Inc. wants to steady its boom-and-bust business with

more sales of parts and repairs.

To drum up the new revenue, Caterpillar is connecting machinery

to the cloud and alerting miners and builders when they need a

tuneup or a new tire. Caterpillar has said that helps customers get

the most out of equipment like its huge mining trucks that can cost

more than a million dollars.

Caterpillar executives also hope that monitoring service and the

added sales of parts and repairs that it generates will create a

steadier revenue stream than sales of new equipment that tend to

surge and sink along commodity and building cycles.

Diversifying its business is particularly important for

Caterpillar as some of its major markets show signs of strain.

Caterpillar said in January that its profit this year would rise

less than expected in part because of slower sales in China, where

it makes about 10% of its sales. Other U.S. manufacturers are also

reporting lower output as economic growth slows in many parts of

the world.

"Parts and services are the area where we can actually reduce

some of the cyclicality," Chief Financial Officer Andrew Bonfield

said last month. He said Caterpillar should emulate car makers and

dealers that sell service agreements along with their vehicles.

Deerfield, Ill.-based Caterpillar earned $54.7 billion in

revenue last year, up from $38.5 billion in 2016, during the

commodity bust, but down from an all-time high of $65.88 billion in

2012. During the global financial crisis in 2009, Caterpillar

brought in $32.5 billion in revenue.

Caterpillar wouldn't say how much revenue it derives from sales

of parts and services, or provide a target for growing that

business. Industry analysts estimate that 25% to 30% of equipment

revenue comes from parts sales.

Tractor-maker Deere & Co., a Caterpillar competitor on

construction vehicles, has said about 20% of its product revenue

comes from the sale of parts.

Some of the connectivity offerings are as cheap as a cellphone

plan per machine, less than $30 a month. Many are offered free with

service agreements. Dealers typically bundle those subscriptions

with other monthly fees for maintenance and repairs based on how

many hours a piece of machinery is expected to operate. In some

regions, customers are able to get free fuel for two years on a new

piece of equipment if they sign up for the cloud-monitoring

service.

Caterpillar had 700,000 machines connected to its cloud services

last summer, up from 400,000 in 2016. In addition to new machines

bristling with cloud-enabled sensors, Caterpillar also is making

replacement parts that can feed data to the company, like a $50

engine-oil cap that alerts operators when more fluid is needed.

"Historically, everything was very reactive," Tom Bucklar, a

director in Caterpillar's digital unit, said on a company podcast

last year. "We are going to be able to predict what's going to

happen."

Caterpillar is counting on its dealers to make that sales

pitch.

Finning International Inc., Caterpillar's largest dealer, plans

to have 80% of the machinery it has sold across Canada, the U.K.

and South America connected to the company's cloud services by

year-end, up from 68% in November.

The cloud-enabled services system has generated sales and

allowed Finning to troubleshoot some equipment problems remotely

rather than send a technician to a customer's work site, said the

dealer's chief executive, L. Scott Thomson.

Some customers that are paying to have their equipment monitored

for faults said they aren't sure yet whether the added cost will be

offset by more efficient operations and fewer breakdowns.

Ebony Construction Co., a road-building company in Ohio,

recently connected its Caterpillar pavers and Kenworth trucks to a

cloud-monitoring system run by Verizon Communications Inc. Amy

Hall, Ebony's president, wants to use the system to monitor whether

her vehicles are idling wastefully.

"They tell you all these wonderful things," she said. "But how

does it really translate at the end of the day to making us safer

and more efficient?"

--Bob Tita contributed to this article.

Corrections & Amplifications Caterpillar is based in

Deerfield, Ill. An earlier version of this article incorrectly said

it is based in Peoria, Ill. (April 8, 2019)

Write to Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

April 09, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

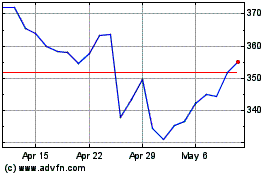

Caterpillar (NYSE:CAT)

Historical Stock Chart

From Mar 2024 to Apr 2024

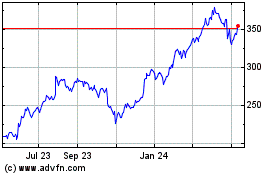

Caterpillar (NYSE:CAT)

Historical Stock Chart

From Apr 2023 to Apr 2024