As filed with the Securities and Exchange Commission on November 26, 2024.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-3

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

Cencora, Inc.

(Exact name of registrant as specified in its charter)

| |

Delaware

(State or other jurisdiction of

incorporation or organization)

|

|

|

23-3079390

(I.R.S. Employer

Identification Number)

|

|

1 West First Avenue

Conshohocken, PA

19428-1800

(610) 727-7000

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Elizabeth S. Campbell

Executive Vice President and Chief Legal Officer

Cencora, Inc.

1 West First Avenue

Conshohocken, PA 19428-1800

(610) 727-7000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Please address a copy of all communications to:

| |

Andrew T. Budreika

Rahul K. Patel

Morgan, Lewis & Bockius LLP

2222 Market Street

Philadelphia, PA 19103

(215) 963-5000

|

|

|

Kourosh Q. Pirouz

Senior Vice President, Group General Counsel and Corporate Secretary

Cencora, Inc.

1 West First Avenue

Conshohocken, PA 19428-1800

(610) 727-7000

|

|

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box: ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 other than securities offered only in connection with dividend or interest reinvestment plans, check the following box: ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☒

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large, accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large, accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| |

Large accelerated filer

☒

|

|

|

Accelerated filer

☐

|

|

| |

Non-accelerated filer

☐

|

|

|

Smaller reporting company

☐

|

|

| |

|

|

|

Emerging growth company

☐

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act. ☐

PROSPECTUS

Cencora, Inc.

Common Stock

Preferred Stock

Debt Securities

Depositary Shares

Warrants

Purchase Contracts

Units

We, from time to time, may offer and sell, in one or more offerings, shares of our common stock, shares of our preferred stock, debt securities, depositary shares, warrants, purchase contracts and units. We may offer and sell these securities in amounts, at prices and on terms determined at the time of the offering.

This prospectus describes the general terms of these securities and the general manner in which these securities will be offered. Each time securities are offered under this prospectus, we will provide a prospectus supplement and attach it to this prospectus. The prospectus supplement will contain more specific information about the terms of the offering and the offered securities and may also supplement, update or amend information contained in this prospectus.

We may offer and sell these securities to or through underwriters, dealers or agents, directly to purchasers or through a combination of these methods. If we use underwriters, dealers or agents to sell these securities, we will name them and describe their compensation arrangements in the prospectus supplement relating to such offering.

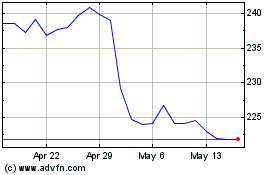

Our common stock is listed on the New York Stock Exchange under the symbol “COR”. We have not yet determined whether any of the other securities covered by this prospectus will be listed on any exchange, inter-dealer quotation system or over- the-counter market. If we decide to seek listing of any such securities upon issuance, the prospectus supplement relating to the offering of such securities will disclose the exchange, quotation system or market on which the securities will be listed.

Our executive offices are located at 1 West First Avenue, Conshohocken, PA 19428-1800, and our telephone number is (610) 727-7000.

Investing in these securities involves certain risks. See “Risk Factors” on page 1 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus or any accompanying prospectus supplement is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is November 26, 2024

TABLE OF CONTENTS

| |

|

|

Page

|

|

|

|

|

|

|

|

1 |

|

|

|

|

|

|

|

|

1 |

|

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

|

4 |

|

|

|

|

|

|

|

|

6 |

|

|

|

|

|

|

|

|

6 |

|

|

|

|

|

|

|

|

7 |

|

|

|

|

|

|

|

|

12 |

|

|

|

|

|

|

|

|

22 |

|

|

|

|

|

|

|

|

24 |

|

|

|

|

|

|

|

|

25 |

|

|

|

|

|

|

|

|

26 |

|

|

|

|

|

|

|

|

27 |

|

|

|

|

|

|

|

|

28 |

|

|

|

|

|

|

|

|

28

|

|

|

RISK FACTORS

Investing in our securities involves risks. Before investing in our securities, you should carefully consider the specific risks set forth under the caption “Risk Factors” in our filings with the Securities and Exchange Commission (the “SEC”) that are incorporated by reference into this prospectus and under the caption “Risk Factors” in any accompanying prospectus supplement or free writing prospectus that we deliver to you. You should also carefully consider all other information contained in or incorporated by reference into this prospectus or in any accompanying prospectus supplement or free writing prospectus that we deliver to you. A discussion of the documents incorporated by reference into this prospectus is set forth below under the heading “Documents Incorporated by Reference.”

ABOUT THIS PROSPECTUS

This document is called a prospectus and is part of a registration statement on Form S-3 that we filed with the SEC using a “shelf” registration process. Under this shelf process, we may offer and sell, from time to time in one or more offerings, the securities described in this prospectus. This prospectus provides you with a general description of the securities we may offer and the general manner in which these securities may be offered. Each time we sell securities under this prospectus, we will provide you with a prospectus supplement that will contain specific information about the terms of that offering and the offered securities. That prospectus supplement may also supplement, update or amend information contained in or incorporated by reference into this prospectus.

The registration statement of which this prospectus is a part contains additional information about us and the securities we may offer by this prospectus. Specifically, we have filed and incorporated by reference certain legal documents that control the terms of the securities offered by this prospectus as exhibits to the registration statement. We will file or incorporate by reference certain other legal documents that will control the terms of the securities we may offer by this prospectus as exhibits to the registration statement or to reports we file with the SEC that are incorporated by reference into this prospectus.

In addition, we may prepare and deliver one or more “free writing prospectuses” to you in connection with any offering of securities under this prospectus. Any such free writing prospectus may contain additional information about us, our business, the offered securities, the manner in which such securities are being offered, our intended use of the proceeds from the sale of such securities, risks relating to our business or an investment in such securities or other information.

This prospectus and certain of the documents incorporated by reference into this prospectus contain, and any accompanying prospectus supplement or free writing prospectus that we deliver to you may contain, summaries of information contained in documents that we have filed or will file as exhibits to our SEC filings. Such summaries do not purport to be complete and are subject to, and qualified in their entirety by reference to, the actual documents filed with the SEC.

Copies of the registration statement of which this prospectus is a part and of the documents incorporated by reference into this prospectus may be obtained as described below under the heading “Documents Incorporated by Reference” and under the heading “Where You Can Find More Information.”

You should not assume that the information contained in this prospectus, the registration statement to which this prospectus is a part, any accompanying prospectus supplement or any free writing prospectus that we deliver to you is accurate as of any date other than the date of such documents or that the information incorporated by reference into this prospectus is accurate as of any date other than the date of the document incorporated by reference. Our business, operating results, financial condition, capital resources and prospects may have changed since that date.

You should rely only on the information contained in or incorporated by reference into this prospectus, the registration statement of which this prospectus is a part, any accompanying prospectus supplement, and any free writing prospectus that we deliver to you. We have not authorized anyone to provide you with different information. If you receive any other information, you should not rely on it. The distribution of this prospectus and sale of these securities in certain jurisdictions may be restricted. Persons in possession of this prospectus are required to inform themselves about and observe any such restrictions. We are not making an offer of these securities in any jurisdiction where the offer is not permitted.

On August 30, 2023, AmerisourceBergen Corporation changed its corporate name to Cencora, Inc. All references in this prospectus to “we,” “us,” “our,” and “Cencora” refer only to Cencora, Inc. and not to any existing or future subsidiaries of Cencora, Inc., unless the context otherwise requires.

WHERE YOU CAN FIND MORE INFORMATION

We are subject to certain information reporting requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and, in accordance with these requirements, we file annual, quarterly and current reports, proxy statements and other information with the SEC. Our SEC filings are available to you at the SEC’s website at http://www.sec.gov and our website at www.cencora.com. The information contained in, or that can be accessed through, our website or the SEC’s website is not a part of this prospectus or any accompanying prospectus supplement, except as expressly set forth under “Documents Incorporated by Reference.”

We have filed with the SEC a registration statement on Form S-3 relating to the securities offered by this prospectus. This prospectus is a part of that registration statement, which includes additional information about us and the securities offered by this prospectus. You may review and obtain a copy of the registration statement and the exhibits that are a part of the registration statement through the SEC’s website or our website. You can also call or write us for a copy as described below under “Documents Incorporated by Reference.”

DOCUMENTS INCORPORATED BY REFERENCE

The SEC allows us to “incorporate by reference” the information we file with the SEC under the Exchange Act, which means that we can disclose important information to you by referring you to those documents. Information incorporated by reference is considered to be a part of this prospectus, and information that we file later with the SEC will automatically update, modify and, where applicable, supersede this information. We incorporate by reference into this prospectus the specific documents listed below and all documents filed by us with the SEC pursuant to Section 13(a), 13(c), 14, or 15(d) of the Exchange Act between the date of this prospectus and the termination of the offering of securities under this prospectus (other than, in each case, documents or information deemed to be furnished and not filed in accordance with SEC rules), which future filings shall be deemed to be incorporated by reference into this prospectus and to be part of this prospectus from the date we subsequently file such documents. The SEC file number for these documents is 001-16671.

•

Our Annual Report on Form 10-K for the fiscal year ended September 30, 2024, filed with the SEC on November 26, 2024;

•

•

The description of our common stock contained in Exhibit 4.16 to our Annual Report on Form 10-K for the fiscal year ended September 30, 2024, filed with the SEC on November 26, 2024, including any amendment or report filed for the purpose of updating such description.

Any statement contained in this prospectus or in any document incorporated by reference into this prospectus shall be deemed to be modified or, where applicable, superseded for the purposes of this prospectus to the extent that a statement contained in this prospectus or any subsequently filed document that also is incorporated by reference into this prospectus modifies or supersedes such prior statement. Any statement so modified or superseded will not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

We will provide to each person, including any beneficial owner, to whom a prospectus is delivered, upon written or oral request and without charge, a copy of the documents referred to above that we have incorporated by reference into this prospectus and a copy of the registration statement of which this prospectus is a part. You can request copies of such documents if you call or write us at the following address or telephone number:

Cencora, Inc.

1 West First Avenue

Conshohocken, PA 19428-1800

Telephone: (610) 727-7000

Attention: Corporate Secretary

Exhibits to the documents will not be sent, however, unless those exhibits have specifically been incorporated by reference into such document. You may also obtain copies of our SEC filings statement as described above under the heading “Where You Can Find More Information.”

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain of the statements contained in this prospectus and the documents incorporated by reference into this prospectus are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Exchange Act. These forward-looking statements may include, without limitation, statements regarding our financial position, business strategy and the plans and objectives of management for our future operations; future liabilities and other obligations; anticipated trends and prospects in the industries in which our business operates; new products, services and related strategies; and capital allocation, including share repurchases and dividends. These statements may constitute projections, forecasts and forward-looking statements, and are not guarantees of performance. Such statements can be identified by the fact that they do not relate strictly to historical or current facts. When used in this prospectus, words such as “aim,” “anticipate,” “believe,” “can,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “on track,” “opportunity,” “plan,” “possible,” “potential,” “predict,” “project,” “seek,” “should,” “strive,” “sustain,” “synergy,” “target,” “will,” “would” and similar expressions are intended to identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking.

These forward-looking statements are based on management’s current expectations and beliefs, are subject to uncertainty and changes in circumstances, and are based on assumptions as of the date hereof. Although we believe that the assumptions underlying the forward-looking statements are reasonable, we can give no assurance that our expectations will be attained. Factors that could have a material adverse effect on our financial condition, liquidity, results of operations or future prospects or that could cause actual results, performance or achievements to differ materially from our expectations include, but are not limited to:

•

our ability to respond to general macroeconomic conditions and geopolitical uncertainties, including financial market volatility and disruption, inflationary concerns, interest and currency exchange rates, and uncertain economic conditions in the United States and abroad;

•

our ability to respond to changes to customer or supplier mix and payment terms, or to changes to manufacturer pricing

•

the retention of key customer or supplier relationships under less favorable economics or the adverse resolution of any contract or other dispute with customers or suppliers;

•

competition and industry consolidation of both customers and suppliers resulting in increasing pressure to reduce prices for our products and services;

•

risks associated with our strategic, long-term relationship with Walgreens Boots Alliance, Inc. (“WBA”), including with respect to the pharmaceutical distribution agreement and/or the global generic purchasing services arrangement;

•

risks that acquisitions of or investments in businesses, including the acquisitions of Alliance Healthcare and PharmaLex, the investment in OneOncology, and the potential acquisition of Retina Consultants of America, fail to achieve expected or targeted future financial and operating performance and results;

•

our ability to effectively manage our growth;

•

our ability to maintain the strength and security of information technology systems;

•

any inability or failure by us or third-party business partners to anticipate or detect data or information security breaches or other cyber-attacks;

•

our ability to manage foreign expansion, including non-compliance with the U.S. Foreign Corrupt Practices Act, anti-bribery laws, economic sanctions and import laws and regulations;

•

risks associated with our international operations, including financial and other impacts of macroeconomic and geopolitical trends and events, including the conflicts in Ukraine and between Israel and Hamas and related regional and global ramifications;

•

unfavorable trends in brand and generic pharmaceutical pricing, including in rate or frequency of price inflation or deflation;

•

changes in the United States healthcare and regulatory environment, including changes that could impact prescription drug reimbursement under Medicare and Medicaid and declining reimbursement rates for pharmaceuticals;

•

the bankruptcy, insolvency, or other credit failure of a major supplier or significant customer;

•

our ability to comply with increasing governmental regulations regarding the pharmaceutical supply chain;

•

continued federal and state government enforcement initiatives to detect and prevent suspicious orders of controlled substances and the diversion of controlled substances;

•

uncertainties associated with litigation, including the outcome of any legal or governmental proceedings that may be instituted against us, continued prosecution or suit by federal and state governmental entities and other parties of alleged violations of laws and regulations regarding controlled substances, and any related disputes;

•

the outcome of any legal or governmental proceedings that may be instituted against us, including material adverse resolution of pending legal proceedings;

•

risks generally associated with data privacy regulation and the protection and international transfer of personal data;

•

our ability to address events outside of our control, such as widespread public health issues, natural disasters, political events, and other catastrophic events; and

•

the impairment of goodwill or other intangible assets resulting in a charge to earnings.

The risks and uncertainties referenced above are not intended to be exhaustive. We refer you to our Annual Report on Form 10-K for our most recent fiscal year, including under the captions “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and “Business,” and in any subsequent quarterly reports on Form 10-Q, including under the captions “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and in our subsequent filings and reports made with the Securities and Exchange Commission.

As a result of a number of known and unknown risks and uncertainties, our actual results or performance may be materially different from those expressed or implied by these forward-looking statements. You should not place undue reliance on these forward-looking statements. Unless required by federal securities laws, we assume no obligation to update any of these forward-looking statements, or to update the reasons actual results could differ materially from those anticipated, to reflect circumstances or events that occur after the statements are made.

CENCORA, INC.

Cencora is one of the largest global pharmaceutical sourcing and distribution services companies, helping both healthcare providers and pharmaceutical and biotech manufacturers improve patient access to products and enhance patient care. We deliver innovative programs and services designed to increase the effectiveness and efficiency of the pharmaceutical supply chain in both human and animal health. More specifically, we distribute a comprehensive offering of brand-name, specialty brand-name, and generic pharmaceuticals, over-the-counter healthcare products, home healthcare supplies and equipment, and related services to a wide variety of healthcare providers located in the United States and select global markets, including acute care hospitals and health systems, independent and chain retail pharmacies, mail order pharmacies, medical clinics, long-term care and alternate site pharmacies, physician practices, medical and dialysis clinics, veterinarians, and other customers. Additionally, we furnish healthcare providers and pharmaceutical manufacturers with an assortment of related services, including data analytics, outcomes research, reimbursement and pharmaceutical consulting services (including regulatory affairs, development consulting and scientific affairs, pharmacovigilance, and quality management and compliance) niche premium logistics services, inventory management, pharmacy automation, pharmacy management, and packaging solutions.

As used in this section of the prospectus only, references to “we” refer to Cencora, Inc. and its consolidated subsidiaries.

USE OF PROCEEDS

Unless we inform you otherwise in the prospectus supplement or a free writing prospectus, we intend to use the net proceeds from the sale of the securities for general corporate purposes, including, but not limited to, working capital, capital expenditures, repayment of indebtedness, investments in our subsidiaries, business acquisitions and the repurchase, redemption or retirement of our securities, including shares of our common stock. We may also invest the net proceeds in U.S. government securities, certificates of deposit or other interest-bearing securities. If we decide to use the net proceeds from a particular offering of securities for a specific purpose, we will describe that in the prospectus supplement relating to that offering.

DESCRIPTION OF COMMON STOCK AND PREFERRED STOCK

The following description of our common stock and preferred stock will apply generally to any future common stock or preferred stock that we may offer but this description is not complete. It is subject to, and qualified in its entirety by reference to, our amended and restated certificate of incorporation (which we refer to as our “certificate of incorporation”), our amended and restated bylaws (which we refer to as our “bylaws”), each of which is incorporated by reference as exhibits to the registration statement of which this prospectus is a part. We will describe the particular terms of any class or series of these securities in more detail in the applicable prospectus supplement. If any particular terms of the common stock or preferred stock described in the applicable prospectus supplement differ from any of the terms described herein, then the terms described herein will be deemed superseded by that prospectus supplement. The terms of these securities also may be affected by the General Corporation Law of the State of Delaware (which we refer to below as the “DGCL”).

Authorized Capital Stock

We are authorized to issue a total of 610,000,000 shares of capital stock consisting of 600,000,000 shares of common stock, par value $0.01 per share, and 10,000,000 shares of preferred stock, par value $0.01 per share.

Common Stock

Our authorized common stock consists of 600,000,000 shares of common stock, par value $0.01 per share. Each outstanding share of common stock is entitled to one vote per share. Except as may be provided in a certificate of designations for a series of preferred stock, the holders of common stock have the exclusive right to vote for the election of directors and for all other purposes as provided by law and do not have cumulative voting rights.

Subject to the preferences that may be applicable to any then outstanding shares of preferred stock, holders of common stock are entitled to receive ratably on a per share basis such dividends and other distributions in cash, stock or property of Cencora as may be declared by the board of directors from time to time out of the legally available assets or funds of Cencora. Upon our voluntary or involuntary liquidation, dissolution or winding up, holders of common stock are entitled to receive ratably all assets of Cencora available for distribution to its stockholders.

Holders of our common stock have no preemptive rights and no right to convert their common stock into any other securities. There are no redemption or sinking fund provisions applicable to our common stock.

Holders of common stock will have no liability for further calls or assessments and will not be personally liable for the payment of our debts except as they may be liable by reason of their own conduct or acts.

Our board of directors may authorize the issuance of preferred stock with voting, conversion, dividend, liquidation and other rights that may adversely affect the rights of the holder of our common stock.

Preferred Stock

Our authorized preferred stock consists of 10,000,000 shares of preferred stock, par value $0.01 per share. We may issue preferred stock from time to time in one or more series, without stockholder approval, when authorized by our board of directors. Subject to the limits imposed by the DGCL, our board of directors is authorized to fix for any series of preferred stock the number of shares of such series and the voting powers (if any), designation, preferences and relative, participating, optional or other special rights, and qualifications, limitations or restrictions of such series. As of the date of this prospectus, no shares of preferred stock are outstanding.

Unless otherwise set forth in the applicable certificate of designations for such series of preferred stock:

•

Holders of preferred stock will have no voting rights and will not be entitled to any notice of meeting of stockholders, except as required by applicable law;

•

Holders of preferred stock will be entitled to receive, when declared by the board of directors, out of legally available funds, dividends at the rates fixed by the board of directors for the respective series of preferred stock, and no more, before any dividends will be declared and paid, or set apart for payment, on our common stock with respect to the same dividend period;

•

Upon our voluntary or involuntary liquidation, dissolution or winding up, holders of each series of preferred stock will be entitled to receive the amount fixed for such series plus, in the case of any series on which dividends will have been determined by the board of directors to be cumulative, an amount equal to all dividends accumulated and unpaid to the date of final distribution whether or not earned or declared (subject to any cap set forth in the applicable certificate of designations for such series of preferred stock) before any distribution shall be paid, or set aside for payment, to holders of our common stock;

•

At the option of our board of directors, we may redeem all or part of the shares of any series of preferred stock on such terms and conditions fixed in the applicable certificate of designations for such series of preferred stock;

•

Holders of our preferred stock have no preemptive rights and will have no liability for further calls or assessments; and

•

Our board of directors may increase or decrease the number of shares of any series, but not below the number of shares of that series then outstanding, with the affirmative vote of the holders of a majority of the voting power of all outstanding shares of our common stock and all other outstanding shares entitled to vote thereon.

For any series of preferred stock that we may offer, our board of directors will determine and the prospectus supplement relating to such series will describe:

•

The designation and number of shares of such series;

•

The rate and time at which, and the preferences and conditions under which, any dividends will be paid on shares of such series, as well as whether such dividends are cumulative or non-cumulative and participating or non-participating;

•

Any provisions relating to convertibility or exchangeability of the shares of such series;

•

The rights and preferences, if any, of holders of shares of such series upon our liquidation, dissolution or winding up of our affairs;

•

The voting powers, if any, of the holders of shares of such series;

•

Any provisions relating to the redemption of the shares of such series;

•

Any limitations on our ability to pay dividends or make distributions on, or acquire or redeem, other securities while shares of such series are outstanding;

•

Any conditions or restrictions on our ability to issue additional shares of such series or other securities; and

•

Any other specific terms, preferences, limitations or restrictions.

Certain Anti-Takeover Provisions of Our Certificate of Incorporation, Bylaws and Delaware Law

The following is a summary of certain provisions of our certificate of incorporation, bylaws and the DGCL that may have the effect of delaying, deterring or preventing hostile takeovers or changes in control or management of Cencora. Such provisions could deprive our stockholders of opportunities to realize a premium on their stock. At the same time, these provisions may have the effect of inducing any persons seeking to acquire or control

us to negotiate terms acceptable to our board of directors. Throughout the summary we have included parenthetical references to sections of our certificate of incorporation and bylaws to help you locate the provisions being discussed.

Undesignated Preferred Stock

Our certificate of incorporation authorizes our board of directors to issue shares of preferred stock and set the voting powers, designations, preferences, and other rights related to that preferred stock without stockholder approval. Any such designation and issuance of shares of preferred stock could delay, defer or prevent any attempt to acquire or control us. (Section 4.03 of our certificate of incorporation).

Vacancies on the Board of Directors

Our certificate of incorporation and our bylaws provide that, subject to any rights of holders of our preferred stock, any vacancies in our board of directors for any reason will be filled only by a majority of our directors remaining in office, and directors so elected will hold office until the next election of directors. The inability of our stockholders to fill vacancies on the board of directors may make it more difficult to change the composition of our board of directors. (Section 5.06 of our certificate of incorporation and Section 3.12 of our bylaws)

No Cumulative Voting

Our certificate of incorporation and bylaws do not provide for cumulative voting. Accordingly, the holders of a majority of the shares of common stock entitled to vote in any election of directors may elect all of the directors standing for election. (Section 6.01 of our certificate of incorporation and Section 2.09 of our bylaws)

No Stockholder Action by Written Consent

Our certificate of incorporation and our bylaws provide that our stockholders may not act by written consent, which may require our stockholders to wait for a regularly scheduled annual meeting to change the composition of our board of directors. (Section 6.03 of our certificate of incorporation and Section 2.10 of our bylaws)

Ability to Call Special Meetings of Stockholders

Our certificate of incorporation and our bylaws provide that special meetings of stockholders may be called at any time by our board of directors pursuant to a resolution duly adopted by a majority of the members of our board of directors and our stockholders holding at least 25% of the outstanding shares of common stock, subject to the procedures and other requirements set forth in our bylaws. (Section 6.03 of our certificate of incorporation and Section 2.02 of our bylaws)

Advance Notification of Stockholder Nominations and Proposals

Our certificate of incorporation and our bylaws provide that in order for nominations of directors or other business to be properly brought before an annual meeting by our stockholders, subject to certain limited exceptions, the stockholders must give notice to us not less than 90 days nor more than 120 days prior to the anniversary of our previous annual meeting of stockholders. The notice must contain specific information regarding the nominee for director, or other business to be addressed, as well as information regarding the stockholder who is proposing the nomination. (Section 6.04 of our certificate of incorporation and Section 2.03 of our bylaws)

Amendments to Bylaws

Our certificate of incorporation and our bylaws provide that our board of directors is expressly authorized to make, alter, amend or repeal the bylaws without the assent or vote of our stockholders. Our certificate of incorporation and our bylaws also provide that our stockholders may, at any annual or special meeting, make, alter, amend or repeal the bylaws by the affirmative vote of a majority of the votes cast for and against the adoption, alteration, amendment or repeal by the holders of shares of our stock present in

person or represented by proxy at a meeting of our stockholders and entitled to vote on the adoption, alteration, amendment or repeal. (Section 11.01 of our certificate of incorporation and Section 10.01 of our bylaws)

Business Combinations under Delaware Law

We are a Delaware corporation. Section 203 of the DGCL prohibits a Delaware corporation from engaging in a business combination with an “interested stockholder” for a period of three years after the date of the transaction in which the person became an interested stockholder. The term “business combination” is broadly defined to include mergers, consolidations, and sales and other dispositions of assets having an aggregate market value equal to 10% or more of the consolidated assets of the corporation, and other specified transactions resulting in financial benefits to the interested stockholder. Under Section 203, an “interested stockholder” generally is defined as a person who, together with affiliates and associates, owns (or within the three prior years did own) 15% or more of the corporation’s outstanding voting stock.

This prohibition is effective unless:

•

the business combination or the transaction that resulted in the interested stockholder becoming an interested stockholder is approved by the corporation’s board of directors prior to the time the interested stockholder becomes an interested stockholder;

•

upon consummation of the transaction that resulted in the interested stockholder becoming an interested stockholder, the interested stockholder owned at least 85% of the voting stock of the corporation, other than stock held by directors who are also officers or by specified employee stock plans; or

•

at or after the time the stockholder becomes an interested stockholder, the business combination is approved by a majority of the board of directors and, at an annual or special meeting, by the affirmative vote of two-thirds of the outstanding voting stock that is not owned by the interested stockholder.

These restrictions generally prohibit or delay the accomplishment of mergers or other takeover or change-in-control attempts that are not approved by a company’s board of directors. A corporation can elect to have Section 203 of the DGCL not apply to it by expressly providing so in its certificate of incorporation or bylaws; we have not made such an election. (Section 9.01 of our certificate of incorporation)

Limitation of Personal Liability of Directors and Officers

Our certificate of incorporation provides that our directors are entitled to the benefits of all limitations on the liability of directors that are now or hereafter become available under the DGCL. The DGCL authorizes corporations to limit or eliminate the personal liability of directors to corporations and their stockholders for monetary damages for breaches of directors’ fiduciary duties. The DGCL and our certificate of incorporation do not permit exculpation for liability:

•

for any breach of the director’s duty of loyalty to us or our stockholders;

•

for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law;

•

under section 174 of the DGCL, which pertains, among other things, to liability for the unlawful payment of dividends; or

•

for any transaction from which the director derived an improper personal benefit. (Section 7.01 of our certificate of incorporation)

In addition, subject to certain exceptions set forth therein, our certificate of incorporation provides that we will indemnify any person who is or was a director or officer of ours, or is or was serving at our request as a director, officer or trustee of another corporation, trust or other enterprise, with respect to actions taken or omitted by such person in any capacity in which such person serves us or such other corporation, trust or other enterprise, to the full extent authorized or permitted by law, as now or hereafter in effect, and such right to indemnification will continue as to a person who has ceased to be a director, officer

or trustee, as the case may be, and will inure to the benefit of such person’s heirs, executors and personal and legal representatives. (Section 7.02 of our certificate of incorporation)

In addition, our certificate of incorporation provides that we may advance to a director or officer expenses incurred in defending any action in advance of its final disposition. (Section 7.03 of our certificate of incorporation)

The limitation of liability, indemnification and advancement of expenses provisions in our certificate of incorporation may discourage stockholders from bringing a lawsuit against directors for breach of their fiduciary duty. These provisions may also have the effect of reducing the likelihood of derivative litigation against directors and officers, even though such an action, if successful, might otherwise benefit us and our stockholders. In addition, your investment may be adversely affected to the extent we pay the costs of settlement and damage awards against directors and officers in accordance with these indemnification provisions.

Forum Selection

Our bylaws provide, unless we consent in writing to an alternative forum, that the sole and exclusive forum for (i) any derivative action or proceeding brought on our behalf, (ii) any action asserting a claim of breach of a fiduciary duty owed by any of our directors, officers or other employees to us or our stockholders, (iii) any action asserting a claim against us or any of our directors, officers or other employees arising pursuant to any provision of the DGCL, our certificate of incorporation or our bylaws (in each case, as they may be amended from time to time), or (iv) any action asserting a claim against us or any of our directors, officers or other employees governed by the internal affairs doctrine, will be the Court of Chancery of the State of Delaware (or, if the Court of Chancery lacks subject matter jurisdiction, another state court located in the State of Delaware or, if no state court located in the State of Delaware has jurisdiction, the federal district court for the District of Delaware), excluding any complaint asserting a cause of action arising under the Securities Act, for which the federal district courts of the United States of America shall be the sole and exclusive forum. (Section 9.06 of our bylaws) Any person that purchases or otherwise acquires an interest in our stock will be deemed to have notice of and agree to comply with the foregoing provisions.

Transfer Agent and Registrar

Computershare serves as the registrar and transfer agent for our common stock. The transfer agent for any series of preferred stock covered by this prospectus will be identified in the prospectus supplement relating to that series of preferred stock.

Stock Exchange Listing

Our common stock is listed on the New York Stock Exchange under the trading symbol “COR”. We have not yet determined whether any series of preferred stock covered by this prospectus will be listed on any exchange, inter-dealer quotation system or over- the-counter market. If we decide to seek listing of any series of preferred stock upon issuance, the prospectus supplement relating to that series of preferred stock will disclose the exchange, quotation system or market on which such preferred stock will be listed.

DESCRIPTION OF DEBT SECURITIES

The debt securities will be issued under an indenture, dated as of November 19, 2009, between us and U.S. Bank Trust Company, National Association (as successor-in-interest to U.S. Bank National Association), as trustee. We have filed the indenture with the SEC as an exhibit to the registration statement of which this prospectus forms a part. The following summary of certain general terms and provisions of the indenture is not complete and is qualified in its entirety by reference to the indenture. Throughout the summary we have included parenthetical references to the indenture sections to help you locate the provisions being discussed. The indenture is subject to and governed by the Trust Indenture Act of 1939, as amended.

When we offer to sell a particular series of debt securities, we will describe the specific terms for the securities in a prospectus supplement. The prospectus supplement will also indicate whether the general terms and provisions described in this prospectus apply to a particular series of debt securities. Accordingly, for a description of the terms of a particular series of debt securities, reference must be made to both the prospectus supplement relating thereto and to the following summary.

As used in this section of the prospectus, references to “holders” mean those who own debt securities registered in their own names on the books that we or the trustee maintain for this purpose, and not those who own beneficial interests in debt securities registered in street name or in debt securities issued in book-entry form through one or more depositaries. Owners of beneficial interests in the debt securities should read the section below entitled “Legal Ownership of Debt Securities.”

General

The indenture provides that we may issue unsecured senior or subordinated debt securities from time to time in one or more series, with different terms. The senior debt securities will constitute unsecured and unsubordinated obligations of ours and will rank pari passu with our other unsecured and unsubordinated obligations. The subordinated debt securities will constitute our unsecured and subordinated obligations and will be junior in right of payment to our “senior indebtedness” (including senior debt securities), as described below under the heading “Subordinated Debt.” Because the debt securities (both senior and subordinated) will be our unsecured obligations, our secured debt and other secured obligations will be effectively senior to the debt securities to the extent of the value of the assets securing such debt or other obligations.

We conduct most of our operations through subsidiaries. Consequently, our ability to pay our obligations, including our obligation to pay principal or interest on the debt securities, to pay the debt securities at maturity or upon redemption, or to buy the debt securities, may depend on our subsidiaries repaying investments and advances we have made to them, and on our subsidiaries’ earnings and their distributing those earnings to us. The debt securities will be effectively subordinated to all obligations (including trade payables and preferred stock obligations) of our subsidiaries. Our subsidiaries are separate and distinct legal entities and have no obligation, contingent or otherwise, to pay any amounts due on the debt securities or to make funds available to us to do so. Our subsidiaries’ ability to pay dividends or make other payments or advances to us will depend on their operating results and will be subject to applicable laws and contractual restrictions. The indenture does not limit our subsidiaries’ ability to enter into other agreements that prohibit or restrict dividends or other payments or advances to us.

The indenture does not limit the amount of debt securities that we may issue. We have the right, from time to time, to issue debt securities of any series previously issued. (Section 3.01)

The prospectus supplement will describe the terms of any debt securities being offered, including:

•

classification as senior or subordinated debt securities;

•

ranking of the specific series of debt securities relative to other outstanding indebtedness, including subsidiaries’ debt;

•

if the debt securities are subordinated, the aggregate amount of outstanding indebtedness, as of a recent date, that is senior to the subordinated securities, and any limitation on the issuance of additional senior indebtedness;

•

the designation, aggregate principal amount and authorized denominations;

•

the maturity date;

•

the interest rate, if any, and the method for calculating the interest rate;

•

the interest payment dates and the record dates for the interest payments;

•

any mandatory or optional redemption terms or prepayment, conversion, sinking fund or exchangeability or convertibility provisions;

•

the place where we will pay principal and interest;

•

if other than denominations of $1,000 or multiples of $1,000, the denominations the debt securities will be issued in;

•

whether the debt securities will be issued in the form of global securities or certificates;

•

the inapplicability of and additional provisions, if any, relating to the defeasance of the debt securities;

•

the currency or currencies, if other than the currency of the United States, in which principal and interest will be paid;

•

any material United States federal income tax consequences;

•

the dates on which premium, if any, will be paid;

•

our right, if any, to defer payment of interest and the maximum length of this deferral period;

•

any listing on a securities exchange;

•

the initial public offering price; and

•

other specific terms, including any additional events of default or covenants. (Section 3.01)

Subordinated Debt

Subordinated debt securities will be subordinate and junior in right of payment, to the extent and in the manner set forth in the indenture, to all of our “senior indebtedness.” The indenture defines “senior indebtedness” as all obligations or indebtedness of, or guaranteed or assumed by, us for borrowed money whether or not represented by bonds, debentures, notes or other similar instruments, and amendments, renewals, extensions, modifications and refunding of any such indebtedness or obligation, in each case, whether outstanding on the date hereof or the date the subordinated debt securities are issued or created, incurred, or thereafter guaranteed or assumed. “Senior indebtedness” does not include the subordinated debt securities or any other obligations specifically designated as being subordinate in right of payment to senior indebtedness. (Section 13.01)

In general, the holders of all senior indebtedness are first entitled to receive payment of the full amount unpaid on senior indebtedness before the holders of any of the subordinated debt securities are entitled to receive a payment on account of the principal or interest on the indebtedness evidenced by the subordinated debt securities in certain events. (Section 13.01) These events include:

•

any insolvency or bankruptcy proceedings, or any receivership, liquidation, reorganization or other similar proceedings which concern us or a substantial part of our property;

•

a default having occurred for the payment of principal, premium, if any, or interest on or other monetary amounts due and payable on any senior indebtedness or any other default having occurred concerning any senior indebtedness, which permits the holder or holders of any senior indebtedness to accelerate the maturity of any senior indebtedness with notice or lapse of time, or both. Such an event of default must have continued beyond the period of grace, if any, provided for such event of default, and such an event of default shall not have been cured or waived or shall not have ceased to exist; or

•

the principal of, and accrued interest on, any series of the subordinated debt securities having been declared due and payable upon an event of default pursuant to Section 5.02 of the indenture. This

declaration must not have been rescinded and annulled as provided in the indenture. (Sections 13.02, 13.03, 13.04, and 13.05)

Because the subordinated debt securities will be our unsecured obligations, our secured debt and other secured obligations will also be effectively senior to the subordinated debt securities to the extent of the value of the assets securing such debt or other obligations.

Events of Default

When we use the term “Event of Default” in the indenture with respect to the debt securities of any series, here are some examples of what we mean:

(1) default in paying interest on the debt securities when it becomes due and the default continues for a period of 30 days or more;

(2) default in paying principal, or premium, if any, on the debt securities when due;

(3) default is made in the payment of any sinking or purchase fund or analogous obligation when the same becomes due, and such default continues for 30 days or more;

(4) default in the performance, or breach, of any covenant in the indenture (other than defaults specified in clause (1), (2) or (3) above) and the default or breach continues for a period of 90 days or more after we receive written notice from the trustee or we and the trustee receive notice from the holders of at least 51% in aggregate principal amount of the outstanding debt securities of the series;

(5) certain events of bankruptcy, insolvency, reorganization, administration or similar proceedings with respect to Cencora, Inc. has occurred; or

(6) any other Events of Default set forth in the prospectus supplement. (Section 5.01)

If an Event of Default (other than an Event of Default specified in clause (5)) under the indenture occurs with respect to the debt securities of any series and is continuing, then the trustee or the holders of at least 51% in principal amount of the outstanding debt securities of that series may by written notice require us to repay immediately the entire principal amount of the outstanding debt securities of that series (or such lesser amount as may be provided in the terms of the securities), together with all accrued and unpaid interest and premium, if any. (Section 5.02) If an Event of Default under the indenture specified in clause (5) occurs and is continuing, then the entire principal amount of the outstanding debt securities (or such lesser amount as may be provided in the terms of the securities) will automatically become due and payable immediately without any declaration or other act on the part of the trustee or any holder. (Section 5.02)

After a declaration of acceleration, the holders of a majority in principal amount of outstanding debt securities of any series may rescind this accelerated payment requirement if all existing Events of Default, except for nonpayment of the principal and interest on the debt securities of that series that has become due solely as a result of the accelerated payment requirement, have been cured or waived and if the rescission of acceleration would not conflict with any judgment or decree. (Section 5.02) The holders of a majority in principal amount of the outstanding debt securities of any series also have the right to waive past defaults, except a default in paying principal or interest on any outstanding debt security, or in respect of a covenant or a provision that cannot be modified or amended without the consent of all holders of the debt securities of that series. (Section 5.13)

Holders of at least 51% in principal amount of the outstanding debt securities of a series may seek to institute a proceeding only after they have notified the trustee of a continuing Event of Default in writing and made a written request, and offered reasonable indemnity, to the trustee to institute a proceeding and the trustee has failed to do so within 60 days after it received this notice. In addition, within this 60-day period the trustee must not have received directions inconsistent with this written request by holders of a majority in principal amount of the outstanding debt securities of that series. (Section 5.07) These limitations do not apply, however, to a suit instituted by a holder of a debt security for the enforcement of the payment of principal, interest or any premium on or after the due dates for such payment. (Section 5.08)

During the existence of an Event of Default, the trustee is required to exercise the rights and powers vested in it under the indenture and use the same degree of care and skill in its exercise as a prudent man would under the circumstances in the conduct of that person’s own affairs. (Section 6.01) If an Event of Default has occurred and is continuing, the trustee is not under any obligation to exercise any of its rights or powers at the request or direction of any of the holders unless the holders have offered to the trustee reasonable security or indemnity. (Section 5.07) Subject to certain provisions, the holders of a majority in principal amount of the outstanding debt securities of any series have the right to direct the time, method and place of conducting any proceeding for any remedy available to the trustee, or exercising any trust, or power conferred on the trustee. (Section 5.12)

The trustee will, within 90 days after any default occurs, give notice of the default to the holders of the debt securities of that series, unless the default was already cured or waived. Unless there is a default in paying principal, interest or any premium when due, the trustee can withhold giving notice to the holders if it determines in good faith that the withholding of notice is in the interest of the holders. (Section 6.02)

Modification and Waiver

The indenture may be amended or modified without the consent of any holder of debt securities in order to:

•

evidence a succession of the trustee;

•

cure ambiguities, defects or inconsistencies;

•

provide for the assumption of our obligations in the case of a merger or consolidation or transfer of all or substantially all of our assets;

•

make any change that would provide any additional rights or benefits to the holders of the debt securities of a series;

•

add guarantors with respect to the debt securities of any series;

•

secure the debt securities of a series;

•

establish the form or forms of debt securities of any series;

•

maintain the qualification of the indenture under the Trust Indenture Act; or

•

make any change that does not adversely affect in any material respect the interests of any holder. (Section 9.01)

Other amendments and modifications of the indenture or the debt securities issued may be made with the consent of the holders of not less than a majority of the aggregate principal amount of the outstanding debt securities of each series affected by the amendment or modification. However, no modification or amendment may, without the consent of the holder of each outstanding debt security affected:

•

reduce the principal amount, or extend the fixed maturity, of the debt securities;

•

alter or waive the redemption provisions of the debt securities;

•

change the currency in which principal, any premium or interest is paid;

•

reduce the percentage in principal amount outstanding of debt securities of any series which must consent to an amendment, supplement or waiver or consent to take any action;

•

impair the right to institute suit for the enforcement of any payment on the debt securities;

•

waive a payment default with respect to the debt securities or any guarantor;

•

reduce the interest rate or extend the time for payment of interest on the debt securities;

•

adversely affect the ranking of the debt securities of any series; or

•

release any guarantor from any of its obligations under its guarantee or the indenture, except in compliance with the terms of the indenture. (Section 9.02)

Consolidation, Merger or Sale of Assets

The indenture provides that we may consolidate or merge with or into, or convey or transfer all or substantially all of our assets to, any entity (including, without limitation, a limited partnership or a limited liability company); provided that:

•

we will be the surviving corporation or, if not, that the successor will be a corporation that is organized and validly existing under the laws of any state of the United States of America or the District of Columbia and will expressly assume by a supplemental indenture our obligations under the indenture and the debt securities;

•

immediately after giving effect to such transaction, no Event of Default, and no default or other event which, after notice or lapse of time, or both, would become an Event of Default, will have happened and be continuing; and

•

we will have delivered to the trustee an opinion of counsel, stating that such consolidation, merger, conveyance or transfer complies with the indenture. (Section 8.01)

In the event of any such consolidation, merger, conveyance, transfer or lease, any such successor will succeed to and be substituted for us as obligor on the debt securities with the same effect as if it had been named in the indenture as obligor. (Section 8.02)

No Restrictive Covenants; No Protection in the Event of a Change of Control

Unless otherwise indicated in a prospectus supplement applicable to a particular series of debt securities, the indenture will not contain any restrictive covenants, including covenants restricting either us or our subsidiaries from:

•

entering into one or more additional indentures providing for the issuance of debt securities;

•

from incurring, assuming, or becoming liable with respect to any indebtedness or other obligation, whether secured or unsecured;

•

from entering into sale and leaseback transactions;

•

from paying dividends or making other distributions on our respective capital stock; or

•

from purchasing or redeeming our respective capital stock.

Also, unless otherwise indicated in a prospectus supplement applicable to a particular series of debt securities, the indenture will not contain any financial ratios or specified levels of net worth or liquidity to which either we or our subsidiaries must adhere or contain any provision that would require us to repurchase, redeem, or otherwise modify the terms of any of the debt securities upon a change in control or other event involving us that may adversely affect our creditworthiness or the value of the debt securities.

Satisfaction, Discharge and Covenant Defeasance

We may terminate our obligations under the indenture, when:

•

either:

•

all debt securities of any series issued that have been authenticated and delivered have been delivered to the trustee for cancellation; or

•

all the debt securities of any series issued that have not been delivered to the trustee for cancellation have become due and payable, will become due and payable within one year, or are to be called for redemption within one year and we have made arrangements satisfactory to the trustee for the giving of notice of redemption by such trustee in our name and at our expense, and in each case, we have irrevocably deposited or caused to be deposited with the trustee sufficient funds to pay and discharge the entire indebtedness on the series of debt securities to pay principal, interest and any premium; and

•

we have paid or caused to be paid all other sums then due and payable under the indenture; and

•

we have delivered to the trustee an officers’ certificate and an opinion of counsel, each stating that all conditions precedent under the indenture relating to the satisfaction and discharge of the indenture have been complied with. (Section 4.01)

We may elect to have our obligations under the indenture discharged with respect to the outstanding debt securities of any series (“legal defeasance”). Legal defeasance means that we will be deemed to have paid and discharged the entire indebtedness represented by the outstanding debt securities of such series under the indenture, except for:

•

the rights of holders of the debt securities to receive principal, interest and any premium when due;

•

our obligations with respect to the debt securities concerning issuing temporary debt securities, registration of transfer of debt securities, mutilated, destroyed, lost or stolen debt securities and the maintenance of an office or agency for payment for security payments held in trust;

•

the rights, powers, trusts, duties and immunities of the trustee; and

•

the defeasance provisions of the indenture. (Section 4.02)

In addition, we may elect to have our obligations released with respect to certain covenants in the indenture (“covenant defeasance”). Any omission to comply with these obligations will not constitute a default or an Event of Default with respect to the debt securities of any series. In the event covenant defeasance occurs, certain events, not including non-payment, bankruptcy and insolvency events, described under “Events of Default” above will no longer constitute an Event of Default for that series. (Section 4.03)

In order to exercise either legal defeasance or covenant defeasance with respect to outstanding debt securities of any series:

•

we must irrevocably have deposited or caused to be deposited with the trustee as trust funds for the purpose of making the following payments, specifically pledged as security for, and dedicated solely to the benefits of the holders of the debt securities of a series:

•

money in an amount,

•

U.S. government obligations (or equivalent government obligations in the case of debt securities denominated in other than U.S. dollars or a specified currency) that will provide, not later than one day before the due date of any payment, money in an amount, or

•

a combination of money and U.S. government obligations (or equivalent government obligations, as applicable),

in each case sufficient, in the written opinion (with respect to U.S. or equivalent government obligations or a combination of money and U.S. or equivalent government obligations, as applicable) of a nationally recognized firm of independent registered public accountants to pay and discharge, and which shall be applied by the trustee to pay and discharge, all of the principal (including mandatory sinking fund payments), interest and any premium at due date or maturity;

•

in the case of legal defeasance, we have delivered to the trustee an opinion of counsel stating that, under then applicable federal income tax law, the holders of the debt securities of that series will not recognize income, gain or loss for federal income tax purposes as a result of the deposit, defeasance and discharge to be effected and will be subject to the same federal income tax as would be the case if the deposit, defeasance and discharge did not occur;

•

in the case of covenant defeasance, we have delivered to the trustee an opinion of counsel to the effect that the holders of the debt securities of that series will not recognize income, gain or loss for U.S. federal income tax purposes as a result of the deposit and covenant defeasance to be effected and will be subject to the same federal income tax as would be the case if the deposit and covenant defeasance did not occur;

•

no Event of Default or default with respect to the outstanding debt securities of that series has occurred and is continuing at the time of such deposit after giving effect to the deposit or, in the case of legal defeasance, no default relating to bankruptcy or insolvency has occurred and is continuing

at any time on or before the 91st day after the date of such deposit, it being understood that this condition is not deemed satisfied until after the 91st day;

•

the legal defeasance or covenant defeasance will not cause the trustee to have a conflicting interest within the meaning of the Trust Indenture Act, assuming all debt securities of a series were in default within the meaning of such Act;

•

the legal defeasance or covenant defeasance will not result in a breach or violation of, or constitute a default under, any other agreement or instrument to which we are a party;

•

the legal defeasance or covenant defeasance will not result in the trust arising from such deposit constituting an investment company within the meaning of the Investment Company Act of 1940, as amended, unless the trust is registered under such act or exempt from registration; and

•

we have delivered to the trustee an officers’ certificate and an opinion of counsel stating that all conditions precedent with respect to the defeasance or covenant defeasance have been complied with. (Sections 4.01 and 4.02)

Governing Law

Unless otherwise stated in the prospectus supplement, the debt securities and the indentures will be governed by New York law. (Section 1.12)

No Personal Liability of Directors, Officers, Stockholders or Employees

The indenture provides that there will be no recourse against any of our incorporators, stockholders, directors, officers or employees, past, present or future, for the payment of the principal of, premium, if any, or the interest, if any, on any securities of any series authenticated and delivered from time to time under the indenture, or for any claim based on such securities, or upon any obligation, covenant or agreement of the indenture. The indenture also provides that all such securities are solely corporate obligations, and that no personal liability attaches or will attach to any such incorporator, stockholder, director, officer or employee because of the incurring of the indebtedness authorized under the indenture. Each holder, as a condition of, and as part of the consideration for, the execution of the indenture and the issuance of such debt securities, waives and releases all such personal liability. (Section 1.16)

Concerning our Relationship with the Trustee

U.S. Bank is a lender and issuing bank in connection with our senior unsecured revolving credit facility, which we generally refer to as our “multi-currency revolving credit facility.” In addition, U.S. Bank provides certain cash management services to us and our subsidiaries.

Transfer and Exchange

The debt securities may be presented for exchange, and debt securities other than a global security may be presented for registration of transfer, at the principal corporate trust office or agency of the trustee. Holders will not have to pay any service charge for any registration of transfer or exchange of debt securities, but we may require payment of a sum sufficient to cover any tax or other governmental charge payable in connection with such registration of transfer or exchange of debt securities. (Section 3.05)

Legal Ownership of Debt Securities

Unless the prospectus supplement specifies otherwise, we will issue debt securities initially in the form of a global security. However, we may elect to issue debt securities in fully registered form. We refer to those who have debt securities registered in their own names on the books that we or our agent maintain for this purpose as the “holders” of those debt securities. These persons are the legal holders of the debt securities. We refer to those who, indirectly through others, own beneficial interests in debt securities that are not registered in their own names as “indirect holders” of those debt securities. As we discuss below, indirect holders are not legal holders, and investors in debt securities issued in book-entry form or in street name will be indirect holders.

Book-Entry Holders

If we issue debt securities in global — i.e., book-entry — form, the debt securities will be represented by one or more global securities registered in the name of a financial institution that holds them as depositary on behalf of other financial institutions that participate in the depositary’s book-entry system. These participating institutions, in turn, hold beneficial interests in the debt securities on behalf of themselves or their customers.

For registered debt securities, only the person in whose name a debt security is registered is recognized under the indenture as the holder of that debt security. (Section 3.08) Debt securities issued in global form will be issued in the form of a global security registered in the name of the depositary or its nominees. Consequently, for debt securities issued in global form, we will recognize only the depositary as the holder of the debt securities, and we will make all payments on the debt securities to the depositary. The depositary passes along the payments it receives to its participants, which in turn pass the payments along to their customers who are the beneficial owners. The depositary and its participants do so under agreements they have made with one another or with their customers; they are not obligated to do so under the terms of the debt securities.

As a result, investors in a book-entry security will not own debt securities directly. Instead, they will own beneficial interests in a global security, through a bank, broker or other financial institution that participates in the depositary’s book-entry system or holds an interest through a participant. As long as the debt securities are issued in global form, investors will be indirect holders, and not holders, of the debt securities.

In the future, we may terminate a global security under the circumstances specified below under the heading “What Is a Global Security? — Special Situations When a Global Security Will Be Terminated” or issue debt securities initially in non-global form. In these cases, investors may choose to hold their debt securities in their own names or in “street name.” Debt securities held by an investor in street name would be registered in the name of a bank, broker or other financial institution that the investor chooses, and the investor would hold only a beneficial interest in those debt securities through an account he or she maintains at that institution.

For debt securities held in street name, we will recognize only the intermediary banks, brokers and other financial institutions in whose names the debt securities are registered as the holders of those debt securities, and we will make all payments on those debt securities to them. These institutions pass along the payments they receive to their customers who are the beneficial owners, but only because they agree to do so in their customer agreements or because they are legally required to do so. Investors who hold debt securities in street name will be indirect holders, not holders, of those debt securities.

Legal Holders

Our obligations, as well as the obligations of the trustee and those of any third parties employed by us or the trustee, run only to the legal holders of the debt securities. We do not have obligations to investors who hold beneficial interests in global securities, in street name or by any other indirect means. This will be the case whether an investor chooses to be an indirect holder of a debt security or has no choice because we are issuing the debt securities only in global form.

For example, once we make a payment or give a notice to the holder, we have no further responsibility for the payment or notice even if that holder is required, under agreements with depositary participants or customers or by law, to pass it along to the indirect holders but does not do so. Similarly, if we want to obtain the approval of the holders for any purpose — e.g., to amend the applicable indenture or to relieve us of the consequences of a default or of our obligation to comply with a particular provision of the applicable indenture — we would seek approval only from the holders, and not the indirect holders, of the debt securities. Whether and how the holders contact the indirect holders is up to the holders.

When we refer below to “you,” we mean those who invest in the debt securities being offered by this prospectus, whether they are the holders or only indirect holders of those debt securities. When we refer to “your debt securities,” we mean the debt securities in which you hold a direct or indirect interest.

Special Considerations for Indirect Holders

If you hold debt securities through a bank, broker or other financial institution, either in book-entry form or in street name, you should check with your own institution to find out:

•

how it handles securities payments and notices;

•

whether it imposes fees or charges;

•

how it would handle a request for the holders’ consent, if ever required;

•

whether and how you can instruct it to send you debt securities registered in your own name so you can be a holder, if that is permitted in the future;

•

how it would exercise rights under the debt securities if there were a default or other event triggering the need for holders to act to protect their interests; and

•

if the debt securities are in book-entry form, how the depositary’s rules and procedures will affect these matters.