Buffett's Berkshire Hathaway Bets Billions on Verizon and Chevron -- Update

February 16 2021 - 6:18PM

Dow Jones News

By Jenna Telesca

The billionaire Warren Buffett added two more big, American

brands to Berkshire Hathaway Inc.'s investment portfolio.

Mr. Buffett's conglomerate has purchased $8.6 billion in stock

in Verizon Communications Inc., the largest U.S. mobile carrier,

and $4.1 billion in gas-and-oil company Chevron Corp. according to

a snapshot of investments held in the quarter ended Dec. 31.

It isn't clear in a filing if Mr. Buffett made the decision to

invest in the two firms or if the decision was made by Berkshire

money managers Todd Combs and Ted Weschler. The two are expected to

take over all of Berkshire's investments once Mr. Buffett is no

longer in the top job.

In the early months of the pandemic, the 90-year old Mr. Buffett

said he was optimistic that the American economy would recover over

time from Covid-19 turmoil.

"You can bet on America, but you are going to have to be careful

on how you bet," Mr. Buffett said in May. "Simply because markets

can do anything."

The bets on Verizon and Chevron show Berkshire's confidence in

the long-term value of these traditional U.S. corporations as well

as the telecommunications and fossil fuel industries. In 2020,

Chevron had its worst year since 2016, and Verizon's fourth-quarter

profit fell after it booked higher costs and gained fewer new

customers than usual.

Berkshire adjusted some of its drugmaker investments bets. The

conglomerate sold off its $136 million investment in the Covid-19

vaccine maker Pfizer Inc., while increasing stakes in the

pharmaceutical brands AbbVie Inc., Merck & Co. and Bristol

Myers Squibb Co.

The conglomerate continued to cut back from financial firms,

selling off its remaining $93 million investment in JPMorgan Chase

& Co., and whittling away at its stake in Wells Fargo & Co.

by $1.4 billion.

Last year Berkshire Hathaway sold stakes in airlines, including

United Airlines Holdings Inc., American Airlines Group Inc., Delta

Air Lines Inc. and Southwest Airlines Co. Mr. Buffett said that he

thought consumer behavior regarding travel had changed for the long

term.

Industry observers have been waiting for Mr. Buffett to use a

large chunk of Berkshire's more than $150 billion stockpile.

Instead, Berkshire has been spending billions on its own stock,

investing $15.7 billion on buybacks alone in the first three

quarters of 2020.

(END) Dow Jones Newswires

February 16, 2021 19:03 ET (00:03 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

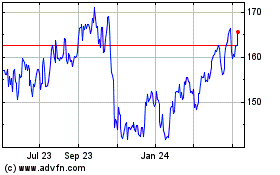

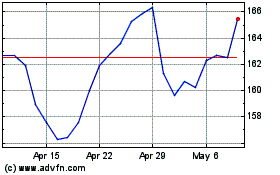

Chevron (NYSE:CVX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Chevron (NYSE:CVX)

Historical Stock Chart

From Apr 2023 to Apr 2024