Disney Shares Surge After Disney+ Streaming Services Update

April 12 2019 - 10:56AM

Dow Jones News

By Patrick Thomas

Walt Disney Co. shares surged to a fresh record Friday, as

investors and analysts cheered the opportunity for Disney+, the

newest addition to the company's suite of streaming services, to

win subscribers in an increasingly crowded landscape.

Stock in the California entertainment company traded as high as

$130.90, breaking the previous intraday record set in August of

2015. Disney shares are up 9% from Thursday's close to $127,

bringing their gains so far this year to 16%.

On Thursday, Disney executives said the new subscription service

will launch in November at a price of $6.99 a month. Disney+ will

be ad-free and anchored by programming based on Disney's biggest

franchises, the company said.

Within its first year, the streaming service will offer more

than 7,500 episodes of television and 25 episodic series, alongside

more than 100 recent movies and 400 library titles, Disney said.

There will be nine original pieces of content at launch on Nov. 12,

and 25 in the first year, from the Disney Channel, Marvel, National

Geographic and its Star Wars production company, Lucasfilm Ltd.

The company expects Disney+ to have between 60 million and 90

million subscribers by the end of fiscal 2024, which was ahead of

estimates from several analysts. JPMorgan Chase & Co. analysts

said in a research note Disney's subscriber projection was at the

high-end of their expectations. With the $6.99 price point for

Disney+, JPMorgan analysts said they expect an early surge of

subscribers when the service launches.

Disney+ is slated to join sports-centered streaming service

ESPN+ and Hulu, which has more than 25 million subscribers.

Shares of rival Netflix Inc. tumbled about 3.5% Friday, as

investors weighed the latest entrant into the battle for streaming

customers. Netflix had 139 million paid members world-wide as of

Dec. 31.

Disney's acquisition of a majority stake in streaming technology

company BAMTech LLC in 2017 helped fuel its streaming ambitions,

Chief Executive Robert Iger said in an interview aired Friday on

CNBC. Mr. Iger said, that without BAMTech, Disney wouldn't have

bought the entertainment assets of 21st Century Fox, giving the

company access to content including titles such as "The

Simpsons."

"The light bulb went off," Mr. Iger said referring to the Fox

assets. "We evaluated what we are buying through this new

lens."

Disney closed its $71.3 billion acquisition of the Fox assets in

March, handing it control of Fox's movie and television production

studios, the FX cable network, and National Geographic properties

among others. .

Write to Patrick Thomas at Patrick.Thomas@wsj.com

(END) Dow Jones Newswires

April 12, 2019 11:41 ET (15:41 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

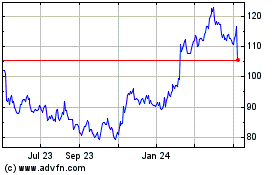

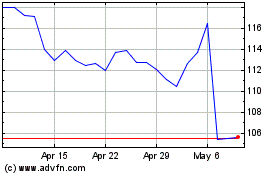

Walt Disney (NYSE:DIS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Walt Disney (NYSE:DIS)

Historical Stock Chart

From Apr 2023 to Apr 2024