Record Quarterly and Full-Year Revenues of

$3.77 billion and $14.57 billion, respectively

Record Quarterly and Full-Year Diluted EPS

of $6.32 and $21.52, respectively

Record Remaining Performance Obligations of

$10.10 billion, 14.2% Increase Year-over-Year

2025 Revenues and Diluted EPS Guidance of

$16.1 billion - $16.9 billion and $22.25 - $24.00

Increases Share Repurchase Program $500

Million

EMCOR Group, Inc. (NYSE: EME) today reported results for the

fourth quarter and year ended December 31, 2024.

Fourth Quarter 2024 Results of

Operations

For the fourth quarter of 2024, revenues totaled $3.77 billion,

an increase of 9.6%, compared to $3.44 billion for the fourth

quarter of 2023. Net income for the fourth quarter of 2024 was

$292.2 million, or $6.32 per diluted share, compared to net income

of $211.5 million, or $4.47 per diluted share, for the fourth

quarter of 2023.

Operating income for the fourth quarter of 2024 was $388.6

million, or 10.3% of revenues, compared to operating income of

$289.2 million, or 8.4% of revenues, for the fourth quarter of

2023. Operating income included depreciation and amortization

expense (inclusive of amortization of identifiable intangible

assets) of $35.3 million and $31.2 million for the fourth quarter

of 2024 and 2023, respectively.

Selling, general and administrative expenses (“SG&A”) for

the fourth quarter of 2024 totaled $368.5 million, or 9.8% of

revenues, compared to $328.5 million, or 9.6% of revenues, for the

fourth quarter of 2023.

The Company's income tax rate for the fourth quarter of 2024 was

26.7%, compared to 27.5% for the fourth quarter of 2023.

Remaining performance obligations as of December 31, 2024 were a

record $10.10 billion compared to $8.85 billion as of December 31,

2023, an increase of $1.25 billion year-over-year.

Full-Year 2024 Results of

Operations

Revenues for the 2024 full-year period totaled $14.57 billion,

an increase of 15.8%, compared to $12.58 billion for the 2023

full-year period. Net income for the 2024 full-year period was $1.0

billion, or $21.52 per diluted share, compared to $633.0 million,

or $13.31 per diluted share, for the 2023 full-year period. Net

income for the 2023 full-year period included a long-lived asset

impairment charge of $2.4 million, or $1.7 million after taxes.

Excluding this impairment charge, non-GAAP net income for the 2023

full-year period was $634.7 million, or $13.34 per diluted

share.

Operating income for the 2024 full-year period was $1.34

billion, or 9.2% of revenues, compared to $875.8 million, or 7.0%

of revenues, for the 2023 full-year period. Excluding the

previously referenced impairment charge, non-GAAP operating income

for the 2023 full-year period was $878.1 million, or 7.0% of

revenues. Operating income included depreciation and amortization

expense (inclusive of amortization of identifiable intangible

assets) of $133.7 million and $119.0 million for the 2024 and 2023

full-year periods, respectively.

Refer to the attached tables for a reconciliation of non-GAAP

operating income, non-GAAP operating margin, non-GAAP net income,

and non-GAAP diluted earnings per share to the comparable GAAP

measures.

SG&A totaled $1.42 billion, or 9.7% of revenues, for the

2024 full-year period, compared to $1.21 billion, or 9.6% of

revenues, for the 2023 full-year period.

The Company's income tax rate for the 2024 full-year period was

26.9%, compared to 27.5% for the 2023 full-year period.

Tony Guzzi, Chairman, President, and Chief Executive Officer of

EMCOR, commented, “The Company reported outstanding results for the

fourth quarter and full year of 2024. We achieved record revenues,

operating income, operating margin, and diluted earnings per share

for both the quarter and annual periods, reflecting strong demand

for our services and exceptional execution by our team. Looking

ahead, we anticipate continued momentum in demand, as evidenced by

the 14.2% year-over-year increase in our remaining performance

obligations."

Mr. Guzzi added, “Our U.S. Construction segments posted

another quarter of exceptional results, concluding an outstanding

year. On a combined basis, these segments achieved record revenues

and operating income for both the fourth quarter and full year. We

remain confident in the future of these businesses given several

tailwinds, including a strong project pipeline with a solid margin

profile. Our U.S. Mechanical Construction segment had a

particularly exceptional year with 26.2% annual revenue growth,

most of which was organic, driven by strong performance across

virtually every end market in which we operate. We believe that our

investments in building information modeling, prefabrication, and

digital tools have increased our productivity and led to

operational efficiencies across this segment, as evidenced in part

by an operating margin of 12.5% for the full year. Our U.S.

Electrical Construction segment continued to perform very well

as we benefited from consistent strong demand, particularly in the

data center market. This segment also benefited from growth within

the high-tech manufacturing market sector, as demand for our

electrical construction services strengthened throughout the year,

and the manufacturing and industrial market sector as we performed

various projects for our energy sector customers. This performance

is reflected in the segment’s revenue growth of 20.1% and operating

margin of 13.4% for the full year. Despite facing several headwinds

within our site-based services businesses, our U.S. Building

Services segment had a solid year, with full-year 2024 revenues

remaining essentially in line with those of 2023, as demand for

mechanical services remained resilient, driven by energy efficiency

retrofits and building automation and controls projects. Our

U.S. Industrial Services segment continued to improve at a

measured pace, delivering revenue growth of 9.4% and operating

income growth of 25.0%, year-over-year. Our U.K. Building

Services segment performed as we anticipated, reporting an

operating margin of 5.0% for the full year, despite operating in a

challenging macroeconomic environment.”

Full-Year 2025 Guidance

Based on anticipated project mix and current visibility into the

coming year, EMCOR expects the following for the 2025 full year

period:

- Revenues to be between $16.1 billion and $16.9

billion

- Operating Margins to be between 8.5% and 9.2%

- Diluted Earnings Per Share to be in the range of $22.25

to $24.00

Mr. Guzzi continued, "2024 was a remarkable year for EMCOR,

marked by outstanding execution for our customers and

record-breaking achievements across nearly every metric for the

Company. Our total and organic revenue growth of 15.8% and 13.8%,

respectively, and operating income growth of 53.6%, were fueled by

our execution in key market sectors such as network and

communications, high-tech manufacturing, institutional, healthcare,

and manufacturing and industrial. The demand for our services in

these areas remained strong as these projects require excellence in

specialty trade contracting and a track record of delivering

quality results. Despite challenges in certain parts of the

business, our team consistently demonstrated resilience and

adaptability, showcasing the strength of EMCOR. We continued to

realize the benefits of our organic growth initiatives as our

investments in virtual design and construction and prefabrication

created efficiencies that helped differentiate us from our

competitors, especially when combined with the project-level

expertise of our teams and the strength and flexibility of our

balance sheet.”

Mr. Guzzi concluded, "Looking ahead to 2025, we are confident in

our ability to win and execute complex projects in key sectors and

geographies. Our record remaining performance obligations of $10.10

billion provide solid visibility into 2025. Recent acquisitions,

including Miller Electric Company, which closed on February 3,

2025, reflect our focus on expanding and complementing our existing

capabilities to better serve our customers. We will maintain our

disciplined approach to capital allocation, focusing on organic

growth, strategic acquisitions, and returning capital to

shareholders.”

Increases Share Repurchase

Program

The Company also announced that its Board of Directors has

authorized an additional $500 million for the purchase of shares of

its outstanding common stock under its existing share repurchase

program.

Tony Guzzi, Chairman, President, and Chief Executive Officer of

EMCOR, remarked, "Our continued outstanding performance in 2024,

combined with our long-term confidence in our business, strong free

cash flow and financial position, and commitment to returning cash

to our shareholders as part of a balanced capital allocation

strategy, are all reflected in another increase of our share

repurchase program.”

Repurchases under the authorization will be funded by the

Company's operations. Shares will be repurchased from time to time

on the open market or through privately negotiated transactions at

the Company's discretion, subject to market conditions, and in

accordance with applicable regulatory requirements. The share

repurchase program has no expiration date and does not obligate the

Company to acquire any particular amount of common stock and may be

suspended, recommenced, or discontinued at any time or from time to

time without prior notice.

Fourth Quarter and Full-Year 2024

Earnings Conference Call Information

EMCOR Group's fourth quarter conference call will be broadcast

live via the internet today, Wednesday, February 26, at 10:30 AM

Eastern Standard Time and can be accessed through the Company's

website at www.emcorgroup.com.

About EMCOR

EMCOR Group, Inc. is a Fortune 500 leader in mechanical and

electrical construction services, industrial and energy

infrastructure and building services. This press release and other

press releases may be viewed at the Company’s website at

www.emcorgroup.com. EMCOR routinely

posts information that may be important to investors in the

“Investor Relations” section of our website at www.emcorgroup.com. Investors and potential

investors are encouraged to consult the EMCOR website regularly for

important information about EMCOR.

Forward Looking Statements:

This release and related presentation contain forward-looking

statements. Such statements speak only as of February 26, 2025, and

EMCOR assumes no obligation to update any such forward-looking

statements, unless required by law. These forward-looking

statements include statements regarding anticipated future

operating and financial performance; the anticipated benefits and

financial impact of the acquisition of Miller Electric Company;

financial guidance and projections underlying that guidance; the

nature and impact of our remaining performance obligations and

timing of future projects; our ability to support organic growth

and balanced capital allocation; market opportunities and growth

prospects; customer trends; and project mix. These forward-looking

statements involve risks and uncertainties that could cause actual

results to differ materially from those anticipated (whether

expressly or implied) by the forward-looking statements.

Accordingly, these statements do not guarantee future performance

or events. Applicable risks and uncertainties include, but are not

limited to, adverse effects of general economic conditions;

domestic and international political developments and/or conflicts;

changes in the specific markets for EMCOR’s services; the continued

strength or weakness of the sectors from which we generate

revenues; adverse business conditions; scarcity of skilled labor;

productivity challenges; the nature and extent of supply chain

disruptions impacting availability and pricing of materials;

inflationary trends, including fluctuations in energy costs; the

impact of legislation and/or government regulations; changes in

interest rates; changes in foreign trade policy including the

effect of tariffs; the availability of adequate levels of surety

bonding; increased competition; the impact of legal proceedings,

claims, lawsuits, or governmental investigations; and unfavorable

developments in the mix of our business. Certain of the risk

factors associated with EMCOR’s business are also discussed in Part

I, Item 1A “Risk Factors,” of the Company’s 2024 Form 10-K, and in

other reports filed from time to time with the Securities and

Exchange Commission and available at www.sec.gov and

www.emcorgroup.com. Such risk factors should be taken into account

in evaluating our business, including any forward-looking

statements.

Non-GAAP Measures:

This release and related presentation also include certain

financial measures that were not prepared in accordance with U.S.

generally accepted accounting principles (GAAP). Reconciliations of

those non-GAAP financial measures to the most directly comparable

GAAP financial measures are included in this release. The Company

uses these non-GAAP measures as key performance indicators for the

purpose of evaluating performance internally. We also believe that

these non-GAAP measures provide investors with useful information

with respect to our ongoing operations. Any non-GAAP financial

measures presented are not, and should not be viewed as,

substitutes for financial measures required by GAAP, have no

standardized meaning prescribed by GAAP, and may not be comparable

to the calculation of similar measures of other companies.

EMCOR GROUP, INC.

FINANCIAL HIGHLIGHTS CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS (In thousands, except share and per share

information)

(Unaudited)

For the quarters ended

December 31,

For the years ended

December 31,

2024

2023

2024

2023

Revenues

$

3,770,019

$

3,439,221

$

14,566,116

$

12,582,873

Cost of sales

3,013,004

2,821,476

11,801,065

10,493,534

Gross profit

757,015

617,745

2,765,051

2,089,339

Selling, general and administrative

expenses

368,451

328,549

1,420,188

1,211,233

Impairment loss on long-lived assets

—

—

—

2,350

Operating income

388,564

289,196

1,344,863

875,756

Net periodic pension income (cost)

224

(279

)

894

(1,119

)

Interest income (expense), net

9,666

2,830

31,625

(1,784

)

Income before income taxes

398,454

291,747

1,377,382

872,853

Income tax provision

106,293

80,232

370,237

239,524

Net income including noncontrolling

interests

292,161

211,515

1,007,145

633,329

Net (loss) income attributable to

noncontrolling interests

—

(2

)

—

335

Net income attributable to EMCOR Group,

Inc.

$

292,161

$

211,517

$

1,007,145

$

632,994

Basic earnings per common share:

$

6.35

$

4.49

$

21.61

$

13.37

Diluted earnings per common share:

$

6.32

$

4.47

$

21.52

$

13.31

Weighted average shares of common stock

outstanding:

Basic

45,989,277

47,097,762

46,616,079

47,358,467

Diluted

46,198,291

47,331,532

46,808,293

47,564,258

Dividends declared per common share

$

0.25

$

0.18

$

0.93

$

0.69

EMCOR GROUP, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS (In thousands)

December 31, 2024

December 31, 2023

ASSETS

Current assets:

Cash and cash equivalents

$

1,339,550

$

789,750

Accounts receivable, net

3,577,537

3,203,490

Contract assets

284,791

269,885

Inventories

95,667

110,774

Prepaid expenses and other

91,644

73,072

Total current assets

5,389,189

4,446,971

Property, plant, and equipment, net

207,489

179,378

Operating lease right-of-use assets

316,128

310,498

Goodwill

1,018,415

956,549

Identifiable intangible assets, net

648,180

586,032

Other assets

137,072

130,293

Total assets

$

7,716,473

$

6,609,721

LIABILITIES AND EQUITY

Current liabilities:

Accounts payable

$

937,087

$

935,967

Contract liabilities

2,047,540

1,595,109

Accrued payroll and benefits

751,434

596,936

Other accrued expenses and liabilities

336,555

315,107

Operating lease liabilities, current

81,247

75,236

Total current liabilities

4,153,863

3,518,355

Operating lease liabilities, long-term

261,575

259,430

Other long-term obligations

362,341

361,121

Total liabilities

4,777,779

4,138,906

Equity:

Total EMCOR Group, Inc. stockholders’

equity

2,937,657

2,469,778

Noncontrolling interests

1,037

1,037

Total equity

2,938,694

2,470,815

Total liabilities and equity

$

7,716,473

$

6,609,721

EMCOR GROUP, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS For the

Years Ended December 31, 2024 and 2023 (In thousands)

2024

2023

Cash flows - operating activities:

Net income including noncontrolling

interests

$

1,007,145

$

633,329

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization

56,678

51,822

Amortization of identifiable intangible

assets

77,002

67,143

Provision for credit losses

17,303

7,859

Deferred income taxes

(29,115

)

(16,651

)

Gain on sale or disposal of property,

plant, and equipment

(1,012

)

(2,057

)

Non-cash expense from contingent

consideration arrangements

8,892

2,287

Non-cash expense for impairment of

long-lived assets

—

2,350

Non-cash share-based compensation

expense

19,978

13,739

Other reconciling items

(1,700

)

(2,019

)

Changes in operating assets and

liabilities, excluding the effect of businesses acquired

252,723

141,853

Net cash provided by operating

activities

1,407,894

899,655

Cash flows - investing activities:

Payments for acquisitions of businesses,

net of cash acquired

(228,173

)

(96,491

)

Proceeds from sale or disposal of

property, plant, and equipment

3,839

13,604

Purchases of property, plant, and

equipment

(74,950

)

(78,404

)

Net cash used in investing

activities

(299,284

)

(161,291

)

Cash flows - financing activities:

Proceeds from revolving credit

facility

—

200,000

Repayments of revolving credit

facility

—

(200,000

)

Repayments of long-term debt and debt

issuance costs

—

(246,171

)

Repayments of finance lease

liabilities

(2,855

)

(2,776

)

Dividends paid to stockholders

(43,384

)

(32,684

)

Repurchases of common stock

(489,820

)

(127,713

)

Taxes paid related to net share

settlements of equity awards

(15,397

)

(6,060

)

Issuances of common stock under employee

stock purchase plan

943

9,189

Payments for contingent consideration

arrangements

(4,852

)

(5,839

)

Net cash used in financing

activities

(555,365

)

(412,054

)

Effect of exchange rate changes on

cash, cash equivalents, and restricted cash

(2,600

)

6,372

Increase in cash, cash equivalents, and

restricted cash

550,645

332,682

Cash, cash equivalents, and restricted

cash at beginning of year (1)

789,750

457,068

Cash, cash equivalents, and restricted

cash at end of period (2)

$

1,340,395

$

789,750

(1)

Includes $0.6 million of restricted cash

classified as “Prepaid expenses and other” in the Condensed

Consolidated Balance Sheets as of December 31, 2022.

(2)

Includes $0.8 million of restricted cash

classified as “Prepaid expenses and other” in the Condensed

Consolidated Balance Sheets as of December 31, 2024.

EMCOR GROUP, INC.

SEGMENT INFORMATION (In thousands, except for

percentages)

(Unaudited)

For the quarters ended

December 31,

2024

% of Total

2023

% of Total

Revenues from unrelated

entities:

United States electrical construction and

facilities services

$

933,192

25%

$

763,404

22%

United States mechanical construction and

facilities services

1,660,600

44%

1,472,532

43%

United States building services

755,626

20%

802,029

23%

United States industrial services

312,680

8%

292,476

9%

Total United States operations

3,662,098

97%

3,330,441

97%

United Kingdom building services

107,921

3%

108,780

3%

Consolidated revenues

$

3,770,019

100%

$

3,439,221

100%

For the years ended

December 31,

2024

% of Total

2023

% of Total

Revenues from unrelated

entities:

United States electrical construction and

facilities services

$

3,342,927

23%

$

2,783,723

22%

United States mechanical construction and

facilities services

6,405,657

44%

5,074,803

41%

United States building services

3,114,817

21%

3,120,134

25%

United States industrial services

1,277,190

9%

1,167,790

9%

Total United States operations

14,140,591

97%

12,146,450

97%

United Kingdom building services

425,525

3%

436,423

3%

Consolidated revenues

$

14,566,116

100%

$

12,582,873

100%

EMCOR GROUP, INC.

SEGMENT INFORMATION (In thousands, except for

percentages)

(Unaudited)

For the quarters ended

December 31,

2024

% of Segment Revenues

2023

% of Segment Revenues

Operating income (loss):

United States electrical construction and

facilities services

$

147,902

15.8%

$

76,275

10.0%

United States mechanical construction and

facilities services

220,622

13.3%

186,094

12.6%

United States building services

40,860

5.4%

42,052

5.2%

United States industrial services

10,209

3.3%

12,642

4.3%

Total United States operations

419,593

11.5%

317,063

9.5%

United Kingdom building services

4,834

4.5%

5,461

5.0%

Corporate administration

(35,863

)

(33,328

)

Consolidated operating income

388,564

10.3%

289,196

8.4%

Other items:

Net periodic pension income (cost)

224

(279

)

Interest income, net

9,666

2,830

Income before income taxes

$

398,454

$

291,747

For the years ended

December 31,

2024

% of Segment Revenues

2023

% of Segment Revenues

Operating income (loss):

United States electrical construction and

facilities services

$

447,186

13.4%

$

230,640

8.3%

United States mechanical construction and

facilities services

799,613

12.5%

530,644

10.5%

United States building services

176,720

5.7%

182,995

5.9%

United States industrial services

44,213

3.5%

35,375

3.0%

Total United States operations

1,467,732

10.4%

979,654

8.1%

United Kingdom building services

21,485

5.0%

25,681

5.9%

Corporate administration

(144,354

)

(127,229

)

Impairment loss on long-lived assets

—

(2,350

)

Consolidated operating income

1,344,863

9.2%

875,756

7.0%

Other items:

Net periodic pension income (cost)

894

(1,119

)

Interest income (expense), net

31,625

(1,784

)

Income before income taxes

$

1,377,382

$

872,853

EMCOR GROUP, INC. RECONCILIATION OF

ORGANIC REVENUE GROWTH (In thousands, except for percentages)

(Unaudited)

The following table provides a reconciliation between organic

revenue growth, a non-GAAP measure, and total revenue growth for

the quarter and year ended December 31, 2024.

For the quarter ended December

31, 2024

For the year ended December

31, 2024

$

%

$

%

GAAP revenue growth

$

330,798

9.6%

$

1,983,243

15.8%

Incremental revenues from acquisitions

(77,802

)

(2.2)%

(251,540

)

(2.0)%

Organic revenue growth, a non-GAAP

measure

$

252,996

7.4%

$

1,731,703

13.8%

EMCOR GROUP, INC. RECONCILIATION OF

OTHER NON-GAAP MEASURES (In thousands, except for percentages

and per share data) (Unaudited)

In our press release, we provide non-GAAP operating income,

non-GAAP operating margin, non-GAAP net income, and non-GAAP

diluted earnings per common share for the year ended December 31,

2023. The following tables provide a reconciliation between these

amounts determined on a non-GAAP basis and the most directly

comparable GAAP measures.

For the years ended

December 31,

2024

2023

GAAP operating income

$

1,344,863

$

875,756

Impairment loss on long-lived assets

—

2,350

Non-GAAP operating income

$

1,344,863

$

878,106

For the years ended

December 31,

2024

2023

GAAP operating margin

9.2%

7.0%

Impairment loss on long-lived assets

—%

0.0%

Non-GAAP operating margin

9.2%

7.0%

For the years ended

December 31,

2024

2023

GAAP net income

$

1,007,145

$

632,994

Impairment loss on long-lived assets

—

2,350

Tax effect of impairment loss on

long-lived assets

—

(651

)

Non-GAAP net income

$

1,007,145

$

634,693

For the years ended

December 31,

2024

2023

GAAP diluted earnings per common share

$

21.52

$

13.31

Impairment loss on long-lived assets

—

0.05

Tax effect of impairment loss on

long-lived assets

—

(0.01

)

Non-GAAP diluted earnings per common

share

$

21.52

$

13.34

_________ Amounts presented in this table may not foot due to

rounding.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250226342943/en/

EMCOR GROUP, INC. Andrew G. Backman Vice President, Investor

Relations (203) 849-7938 FTI Consulting, Inc. Investors: Blake

Mueller (718) 578-3706

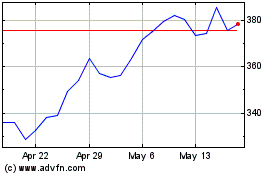

EMCOR (NYSE:EME)

Historical Stock Chart

From Jan 2025 to Feb 2025

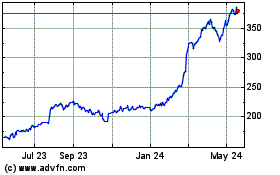

EMCOR (NYSE:EME)

Historical Stock Chart

From Feb 2024 to Feb 2025