Current Report Filing (8-k)

February 26 2020 - 3:13PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 25, 2020

Elastic N.V.

(Exact

name of registrant as specified in its charter)

|

|

|

|

|

|

|

The Netherlands

|

|

001-38675

|

|

Not Applicable

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification Number)

|

800 West El Camino Real, Suite 350

Mountain View, California 94040

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (650) 458-2620

N/A

(Former name or

former address if changed since last report.)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

of which registered

|

|

Ordinary Shares, €0.01 Par Value

|

|

ESTC

|

|

The New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of

1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange

Act. ☒

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain

Officers; Compensatory Arrangements of Certain Officers.

Transition of Aaron Katz as Chief Revenue Officer

On February 26, 2020, based on mutual agreement, Aaron Katz transitioned from Chief Revenue Officer (“CRO”) of Elastic N.V. (“the

“Company”) to an advisory role to Shay Banon, the Company’s Chief Executive Officer and Chairman. Mr. Katz’s transition from CRO is not the result of any material disagreement with the Company relating to the Company’s

operations, policies or practices.

In connection with his transition from CRO, Elasticsearch Inc. and Mr. Katz entered into a separation and

transition agreement on February 25, 2020 (the “Separation Agreement”). During the period from February 26, 2020 through August 1, 2020 (the “Scheduled Separation Date”), Mr. Katz will continue as an employee

of Elasticsearch Inc. and provide certain transition services. Under the Separation Agreement, Mr. Katz is entitled to the following severance payments and benefits assuming that he remains employed with the Company through the Scheduled

Separation Date or if he is terminated without Cause (as such term is defined in the Company’s Executive Change in Control Severance Plan) prior to the Scheduled Separation Date: (1) a lump sum cash payment equal to $165,000, which

represents six months of his annual base salary; (ii) a lump sum cash payment in the amount of $148,500, which represents 50% of the annual target incentive bonus for the year of Mr. Katz’s termination of employment under the

Company’s Executive Incentive Compensation Plan; and (iii) reimbursement of the COBRA premiums of Mr. Katz and his dependents for up to 12 months following the date Mr. Katz and his dependents suffer a loss of health coverage

under the Company’s group health plan, subject to Mr. Katz timely electing COBRA continuation coverage. Under the Separation Agreement, Mr. Katz’s employment will automatically terminate on the Scheduled Separation Date. The

Separation Agreement also includes, among other terms, a general release of claims in favor of the Company and certain other parties, continued confidentiality obligations by Mr. Katz, and a nondisparagement provision.

The foregoing summary of the Separation Agreement does not purport to be complete and is qualified by reference to the Separation Agreement, which is attached

to this Current Report on Form 8-K as Exhibit 10.1 and is incorporated herein by reference.

On February 26, 2020, the Company issued a press release announcing the transition of its Chief Revenue Officer.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

Dated: February 26, 2020

|

|

|

|

|

ELASTIC N.V.

|

|

|

|

|

By:

|

|

/s/ Janesh Moorjani

|

|

Name:

|

|

Janesh Moorjani

|

|

Title:

|

|

Chief Financial Officer

|

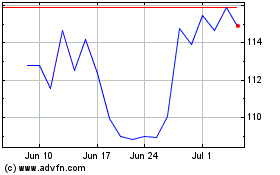

Elastic NV (NYSE:ESTC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Elastic NV (NYSE:ESTC)

Historical Stock Chart

From Apr 2023 to Apr 2024