AM Best Affirms Credit Ratings of First American Title Insurance Group Members and First American Financial Corporation

October 24 2024 - 1:21PM

Business Wire

AM Best has affirmed the Financial Strength Rating (FSR)

of A (Excellent) and the Long-Term Issuer Credit Ratings (Long-Term

ICRs) of “a” (Excellent) of First American Title Insurance Company

(Omaha, NE) and its title affiliates, which are referred to as

First American Title Insurance Group (FATIG). In addition, AM Best

has affirmed the Long-Term ICR of “bbb” (Good) of the parent

holding company, First American Financial Corporation (FAF)

(Delaware) [NYSE: FAF]. The outlook of these Credit Ratings

(ratings) is stable. (See below for a detailed listing of the

companies and ratings.)

The ratings reflect FATIG’s balance sheet strength, which AM

Best assesses as strongest, as well as its adequate operating

performance, neutral business profile and appropriate enterprise

risk management (ERM).

FATIG’s strongest balance sheet strength is supported by its

risk-adjusted capitalization at the strongest level, as measured by

Best’s Capital Adequacy Ratio (BCAR), superior surplus levels and

conservative investment strategy. Additionally, FATIG benefits from

a strong franchise value, financial flexibility and operational

support from FAF, which maintains relatively modest financial

leverage and solid interest coverage. The group’s operating results

have been in line with the title industry composite averages and

supportive of the adequate operating performance assessment. FATIG

is the second-largest underwriter in the U.S. title insurance

industry and continues to maintain a solid market position based on

2023 direct premiums written, despite unfavorable macroeconomic

market conditions with rising interest rates and a slowdown in the

real estate sector. Policies are distributed on a direct basis and

through a network of independent agents. The group invests heavily

in its title plant, which is one of the most comprehensive in the

industry. The ratings also reflect FATIG’s robust ERM practices in

line with its corporate objectives, regulatory requirements and

rating agency guidelines.

Negative rating action could occur if challenges from rising

interest rates and a slowing economy pose a significant decline in

operating profitability or a material decline in risk-adjusted

capitalization levels. Negative rating action also could result

should the holding company experience liquidity issues or a

significant increase in leverage. Positive rating action could

occur if the group experiences significant improvements in

operating profitability and/or a material increase in risk-adjusted

capitalization levels.

The FSR of A (Excellent) and the Long-Term ICRs of “a”

(Excellent) have been affirmed with stable outlooks for the members

of First American Title Insurance Group:

- First American Title Insurance Company

- First American Title Insurance Company of Australia Pty

Limited

- First American Title Insurance Company of Louisiana

- First European Title Insurance Company Limited

- First Title Insurance plc

- Ohio Bar Title Insurance Company

This press release relates to Credit Ratings that have been

published on AM Best’s website. For all rating information relating

to the release and pertinent disclosures, including details of the

office responsible for issuing each of the individual ratings

referenced in this release, please see AM Best’s Recent

Rating Activity web page. For additional information

regarding the use and limitations of Credit Rating opinions, please

view Guide to Best's Credit Ratings. For information

on the proper use of Best’s Credit Ratings, Best’s Performance

Assessments, Best’s Preliminary Credit Assessments and AM Best

press releases, please view Guide to Proper Use of Best’s

Ratings & Assessments.

AM Best is a global credit rating agency, news publisher and

data analytics provider specializing in the insurance industry.

Headquartered in the United States, the company does business in

over 100 countries with regional offices in London,

Amsterdam, Dubai, Hong Kong, Singapore and Mexico City. For more

information, visit www.ambest.com.

Copyright © 2024 by A.M. Best Rating

Services, Inc. and/or its affiliates. ALL RIGHTS RESERVED.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241024170601/en/

Chul Lee Senior Financial Analyst +1 908 882

2005 chul.lee@ambest.com

Fred Eslami Associate Director +1 908 882

1759 fred.eslami@ambest.com

Christopher Sharkey Associate Director, Public

Relations +1 908 882 2310

christopher.sharkey@ambest.com

Al Slavin Senior Public Relations Specialist +1

908 882 2318 al.slavin@ambest.com

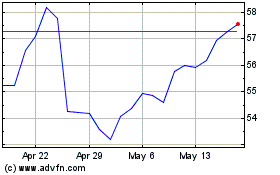

First American (NYSE:FAF)

Historical Stock Chart

From Nov 2024 to Dec 2024

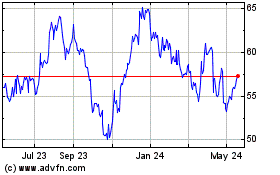

First American (NYSE:FAF)

Historical Stock Chart

From Dec 2023 to Dec 2024