false

0001562528

0001562528

2024-11-08

2024-11-08

0001562528

us-gaap:CommonStockMember

2024-11-08

2024-11-08

0001562528

us-gaap:SeriesEPreferredStockMember

2024-11-08

2024-11-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

November 8, 2024

Franklin

BSP Realty Trust, Inc.

(Exact Name of Registrant as Specified in Its Charter)

| Maryland |

001-40923 |

46-1406086 |

| (State or other jurisdiction |

(Commission File Number) |

(I.R.S. Employer |

| of incorporation) |

|

Identification No.) |

1345

Avenue of the Americas, Suite

32A

New York, New York 10105

(Address of principal executive offices, including

zip code)

Registrant’s telephone number, including

area code: (212) 588-6770

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see

General Instruction A.2 below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading

Symbol(s) |

Name of each exchange on which

registered |

| Common

Stock, par value $0.01 per share |

FBRT |

New York Stock Exchange |

| 7.50%

Series E Cumulative Redeemable Preferred Stock, par value $0.01 per share |

FBRT PRE |

New York Stock Exchange |

Indicated by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter)

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

At-the-Market-Offering Sales Agreement Amendment

On November 8, 2024,

Franklin BSP Realty Trust, Inc. (the “Company”), Benefit Street Partners Realty Operating Partnership, L.P., a Delaware

limited partnership (the “Operating Partnership”), and Benefit Street Partners L.L.C. entered into an amendment

(“Amendment No. 1”) to the Sales Agreement dated April 14, 2023 (as amended by Amendment No. 1, the “Sales

Agreement”) with Barclays Capital Inc., B. Riley Securities, Inc., Citizens JMP Securities, LLC, JonesTrading Institutional

Services LLC, J.P. Morgan Securities LLC and Raymond James & Associates, Inc. as sales agents (in such capacity, each an

“Agent” and together, the “Agents”), pursuant to which the Company may sell, from time to time, and at

various prices, through the Agents, of shares of the Company’s common stock (the “Common Stock”) in a $200.0

million at-the-market offering program (“ATM program”).

The amendment was entered into to extend the term

of the Sales Agreement in connection with the filing of the Company’s new registration statement on Form S-3 filed with the Securities

and Exchange Commission on November 8, 2024 (the “Registration Statement”). The Company has not sold any shares of Common

Stock under the Sales Agreement to date. The Company does not presently intend to utilize the ATM program given current market conditions,

but the Company believes that the ATM program, together with the Company’s existing share repurchase program, provides the Company

with maximum flexibility to capitalize on a wide range of potential capital markets environments.

Subject to the terms and conditions of the Sales

Agreement, the Agents will use their commercially reasonable efforts, consistent with their normal trading and sales practices and applicable

law and regulations, to sell the Common Stock that may be designated by the Company pursuant to the Sales Agreement on the terms and subject

to the conditions of the Sales Agreement. Sales, if any, of the Common Stock made through the Agents, pursuant to the Sales Agreement,

may be made in “at the market” offerings (as defined in Rule 415 under the Securities Act of 1933, as amended (the “Securities

Act”)), by means of ordinary brokers’ transactions on the New York Stock Exchange or otherwise, at market prices prevailing

at the time of sale, in block transactions, in negotiated transactions, in any manner permitted by applicable law or as otherwise as may

be agreed by the Company and any Agent. The Company will offer and sell shares of common stock through only one Agent on any given trading

day.

The Company or any Agent

may at any time suspend an offering of Common Stock pursuant to the terms of the Sales Agreement. The offering of Common Stock

pursuant to the Sales Agreement will terminate upon the earliest of (i) the sale of shares of our common stock subject to the Sales

Agreement and any terms agreement having an aggregate gross sales price of $200,000,000 and (ii) the termination of the Sales

Agreement by us. In addition, each sales agent has the right to terminate the Sales Agreement only as to

itself.

The Company and the Operating Partnership made

certain customary representations, warranties and covenants concerning the Company, the Operating Partnership and the registration statement

in the Sales Agreement and also agreed to indemnify the Agents against certain liabilities, including liabilities under the Securities

Act.

The Company intends to use the net proceeds from

this offering to originate additional commercial mortgage loans and other target assets and investments. The Company may also use a portion

of the net proceeds for other general corporate purposes, including, but not limited to, the payment of liabilities and other working

capital needs.

The Company will pay each Agent a Commission that

will not exceed 2.0% of the gross sales price of all shares of Common Stock sold through it as our Agent pursuant to the Sales Agreement.

The Common Stock sold under the ATM program will

be issued pursuant to a prospectus supplement and the accompanying base prospectus, each dated November 8, 2024, forming part of the Company’s

new shelf registration statement on Form S-3 filed with the Securities and Exchange Commission on November 8, 2024.

The form of the Sales Agreement is attached to

this Current Report on Form 8-K as Exhibits 1.1 and 1.2 and is incorporated herein by reference. The summary set forth above

is qualified in its entirety by reference to Exhibits 1.1 and 1.2. A copy of

the opinion of Hogan Lovells US LLP regarding the legality of the Common Stock that may be issued under the ATM Program is attached hereto

as Exhibit 5.1 to this Current Report on Form 8-K.

Resale Prospectus Supplement

In

connection with the filing of the new Registration Statement, on November 8, 2024, the Company also filed a prospectus supplement to

the prospectus that forms a part of the Registration Statement registering the sale from time to time by the selling stockholder

named therein of up to 1,882,841 shares of Common Stock (representing the amount of unsold shares previously registered for

resale by the selling stockholder) on the prospectus supplement dated December 22, 2023 to the base prospectus forming a part of the

Company’s prior registration statement on Form S-3 filed on November 12, 2021. The Company will not receive any proceeds from

the sale of the Common Stock by the selling stockholder. A copy of the opinion of Hogan Lovells US LLP regarding the legality of the

Common Stock is attached hereto as Exhibit 5.2 to this Current Report on Form 8-K.

| Item 9.01 | Financial Statements and Exhibits |

(d) The following exhibits are attached to this Current Report on Form

8-K:

| 1.1 |

|

Sales Agreement, dated April 14, 2023, by and among Franklin BSP Realty Trust, Inc., Benefit Street Partners Realty Operating Partnership, L.P., Benefit Street Partners L.L.C. and each sales agent (incorporated by reference to exhibit 1.1 to the Registrant’s Current Report on Form 8-K filed with the SEC on April 14, 2023). |

| 1.2 |

|

Amendment No. 1 to Sales Agreement, dated November 8, 2024, by and among Franklin BSP Realty Trust, Inc., Benefit Street Partners Realty Operating Partnership, L.P., Benefit Street Partners L.L.C. and each sales agent. |

| 5.1 |

|

Opinion of Hogan Lovells US LLP regarding the legality of the Common Stock (ATM Program) |

| 5.2 |

|

Opinion of Hogan Lovells US LLP regarding the legality of the Common Stock (Selling Stockholder) |

| 23.1 |

|

Consent of Hogan Lovells US LLP (included in Exhibit 5.1) |

| 23.2 |

|

Consent of Hogan Lovells US LLP (included in Exhibit 5.2) |

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrants have duly caused this report to be signed on their behalf by the undersigned hereunto

duly authorized.

| |

Franklin BSP Realty Trust, Inc. |

| |

|

| |

By: |

/s/ Jerome S. Baglien |

| |

Name: |

Jerome S. Baglien |

| |

Title: |

Chief Financial Officer, Chief Operating Officer and Treasurer |

November 8, 2024

Exhibit 1.2

Franklin

BSP Realty Trust, Inc.

$200,000,000

Common Stock (par value $0.01 per share)

AMENDMENT NO. 1 to the

SALES AGREEMENT

November

8, 2024

Barclays Capital Inc.

745 Seventh Avenue

New York, NY 10019

B. Riley Securities, Inc.

299 Park Avenue, 21st Floor

New York, NY 10171

Citizens JMP Securities, LLC

600 Montgomery Street, Suite 1100

San Francisco, CA 94111

JonesTrading Institutional Services LLC

325 Hudson Street, 6th Floor

New York, NY 10013

J.P. Morgan Securities LLC

383 Madison Avenue

New York, NY 10017

Raymond James & Associates, Inc.

880 Carillon Parkway, Tower 3

St. Petersburg, FL 33716

Addressees:

Reference is made to the Sales

Agreement, dated April 14, 2023 (the “Agreement”), by and among Franklin BSP Realty Trust, Inc., a Maryland

corporation (the “Company”), Benefit Street Partners Realty Operating Partnership, L.P., a Delaware limited

partnership and the Company’s operating partnership (the “Operating Partnership”), Benefit Street Partners

L.L.C., a Delaware limited liability company and the Company’s advisor (the “Advisor”) and Barclays Capital

Inc., B. Riley Securities, Inc., Citizen JMP Securities, LLC, JonesTrading Institutional Services LLC, J.P. Morgan Securities LLC and

Raymond James & Associates, Inc., as sales agents (the “Agents”). Pursuant to the Agreement, the Company

proposes to sell from time to time through the Agents shares of the Company’s common stock, par value $0.01 per share (the “Common

Stock”), having an aggregate offering price of up to $200,000,000 (the “Stock”) on the terms set

forth in the Agreement. Capitalized terms used but not defined herein shall have the meanings ascribed to such terms in the Agreement.

The Company, the Operating Partnership,

the Advisor and the Agents wish to amend the Agreement through this Amendment No. 1 to the Sales Agreement (this “Amendment”)

to modify the Agreement solely as set forth below with effect on and after the date hereof.

I.

Amendments to the Agreement. The Company, the Operating Partnership, the Advisor and the Agents agree, from and after the

date hereof, that:

1.

The reference in the first sentence of Section 1(a) of the Agreement to “Form S-3 (File No. 333-261039)” shall be replaced

with “Form S-3 (Filed with the Commission on November 8, 2024).”

2.

The definition of “Registration Statement” in Section 1(a)(viii) of the Agreement is deleted in its entirety and replaced

with the following:

“Registration

Statement” means, collectively, the various parts of such shelf registration

statement on Form S-3 filed with the Commission on November 8, 2024 relating to the Stock, each as amended, as of the Effective Date for

such part, including any Prospectus and all exhibits to such Registration Statement, including the information deemed by virtue of Rule

430B under the Securities Act to be part of such Registration Statement as of the Effective Date; provided, however, that upon

the termination or expiration of the Registration Statement on Form S-3 filed with the Commission on November 8, 2024 or the filing of

a new Registration Statement on Form S-3, “Registration Statement” shall refer to the most recent shelf registration

statement on Form S-3 relating to the Stock filed by the Company as of its most recent Effective Date, including any Prospectus and all

exhibits to such Registration Statement, including the information deemed by virtue of Rule 430B under the Securities Act to be part of

such Registration Statement as of the Effective Date. Any reference to the Prospectus shall be deemed to refer to and include any

documents incorporated by reference therein pursuant to Form S-3 under the Securities Act as of the date of the Prospectus, as the case

may be.

3.

Section 8(c) of the Agreement is deleted in its entirety and replaced with the following:

(c) This Agreement shall

remain in full force and effect until such time as Stock having an aggregate offering price of $200,000,000 shall have been issued and

sold hereunder, unless terminated earlier pursuant to Section 8(a) or (b) above or otherwise by mutual agreement of the parties; provided

that any such termination by mutual agreement or pursuant to this clause (c) shall in all cases be deemed to provide that Section 1, Section

2, Section 5, Section 7, and Section 8 of this Agreement shall remain in full force and effect.

4.

All references in the Agreement to “JMP Securities LLC” shall be replaced with “Citizens JMP Securities, LLC.”

5.

All references in the Agreement to “Ernst & Young LLP” shall be replaced with “PricewaterhouseCoopers LLP.”

II. Governing

Law. This Amendment and any transaction contemplated by this Amendment shall be governed by and construed in accordance with the

laws of the State of New York without regard to conflict of laws principles that would result in the application of any other law than

the laws of the State of New York (other than Section 5-1401 of the General Obligations Law).

III. Counterparts.

This Amendment may be executed in one or more counterparts and, if executed in more than one counterpart, the executed counterparts shall

each be deemed to be an original but all such counterparts shall together constitute one and the same instrument. Delivery of an executed

Amendment by one party to any other party may be made by facsimile, electronic mail (including any electronic signature complying with

the New York Electronic Signatures and Records Act (N.Y. State Tech. §§ 301-309), as amended from time to time, or other applicable

law) or other transmission method, and the parties hereto agree that any counterpart so delivered shall be deemed to have been duly and

validly delivered and be valid and effective for all purposes.

IV.

Agreement Remains in Effect. Except as provided herein, all provisions, terms and conditions of the Agreement shall remain

in full force and effect. As amended hereby, the Agreement is ratified and confirmed in all respects.

V.

Recognition of the U.S. Special Resolution Regimes.

1.

In the event that any Agent that is a Covered Entity becomes subject to a proceeding under a U.S. Special Resolution Regime, the

transfer from such Agent of this Amendment, and any interest and obligation in or under this Amendment, will be effective to the same

extent as the transfer would be effective under the U.S. Special Resolution Regime if this Amendment, and any such interest and obligation,

were governed by the laws of the United States or a state of the United States.

2.

In the event that any Agent that is a Covered Entity or a BHC Act Affiliate of such Agent becomes subject to a proceeding under

a U.S. Special Resolution Regime, Default Rights under this Amendment that may be exercised against such Agent are permitted to be exercised

to no greater extent than such Default Rights could be exercised under the U.S. Special Resolution Regime if this Amendment were governed

by the laws of the United States or a state of the United States.

For the purposes of this Section

V, a “BHC Act Affiliate” has the meaning assigned to the term “affiliate” in, and shall be interpreted in accordance

with, 12 U.S.C. § 1841(k). “Covered Entity” means any of the following: (i) a “covered entity” as that term

is defined in, and interpreted in accordance with, 12 C.F.R. § 252.82(b); (ii) a “covered bank” as that term is defined

in, and interpreted in accordance with, 12 C.F.R. § 47.3(b); or (iii) a “covered FSI” as that term is defined in, and

interpreted in accordance with, 12 C.F.R. § 382.2(b). “Default Right” has the meaning assigned to that term in, and shall

be interpreted in accordance with, 12 C.F.R. §§ 252.81, 47.2 or 382.1, as applicable. “U.S. Special Resolution Regime”

means each of (i) the Federal Deposit Insurance Act and the regulations promulgated thereunder and (ii) Title II of the Dodd-Frank Wall

Street Reform and Consumer Protection Act and the regulations promulgated thereunder.

[Signature

Page Follows]

If the foregoing correctly

sets forth the agreement between the Company, the Operating Partnership, the Advisor and the Agents, please indicate your acceptance in

the space provided for that purpose below.

| |

Very truly yours, |

| |

|

|

|

| |

FRANKLIN BSP REALTY TRUST, INC. |

| |

|

|

|

| |

By: |

/s/ Jerome S. Baglien |

| |

|

Name: |

Jerome S. Baglien |

| |

|

Title: |

Chief Financial Officer, Chief Operating Officer and President |

| |

|

|

|

| |

|

|

|

|

BENEFIT STREET PARTNERS REALTY OPERATING PARTNERSHIP, L.P.

|

| |

|

| |

By: Franklin BSP Realty Trust, Inc., its general partner |

| |

|

|

| |

By: |

/s/ Jerome S. Baglien |

| |

|

Name: |

Jerome S. Baglien |

| |

|

Title: |

Chief Financial Officer, Chief Operating Officer and President |

| |

|

|

|

| |

BENEFIT STREET PARTNERS L.L.C. |

| |

|

| |

By: |

/s/ Bryan Martoken |

| |

|

Name: |

Bryan Martoken |

| |

|

Title: |

Chief Financial Officer |

| Accepted: |

|

| |

|

|

| Barclays Capital Inc. |

|

| |

|

| By: |

/s/ Warren Fixmer |

|

| |

Name: Warren Fixmer |

|

| |

Title: Managing Director |

|

| |

|

|

| B. Riley Securities, Inc. |

|

| |

|

|

| By: |

/s/ Mike Cavanagh |

|

| |

Name: Mike Cavanagh |

|

| |

Title: Managing Director |

|

| |

|

|

| Citizens JMP Securities, LLC |

|

| |

|

|

| By: |

/s/ Jorge Solares-Parkhurst |

|

| |

Name: Jorge Solares-Parkhurst |

|

| |

Title: Managing Director |

|

| |

|

|

| JonesTrading Institutional Services LLC |

|

| |

|

|

| By: |

/s/ Burke Cook |

|

| |

Name: Burke Cook |

|

| |

Title: General Counsel & Secretary |

|

| |

|

|

| J.P. Morgan Securities LLC |

|

| |

|

|

| By: |

/s/ Sanjeet Dewal |

|

| |

Name: Sanjeet Dewal |

|

| |

Title: Managing Director |

|

| |

|

|

| Raymond James & Associates, Inc. |

|

| |

|

|

| By: |

/s/ Jozsi Popper |

|

| |

Name: Jozsi Popper |

|

| |

Title: Managing Director |

|

Exhibit 5.1

|

Hogan Lovells US LLP

Columbia Square

555 Thirteenth Street NW

Washington, DC 20004

T +1 202 637 5600

F +1 202 637 5910

www.hoganlovells.com |

November 8, 2024

Board of Directors

Franklin BSP Realty Trust, Inc.

1345 Avenue of the Americas, Suite 32A

New York, New York 10105

To the addressees referred to above:

We are acting as counsel to Franklin BSP Realty

Trust, Inc., a Maryland corporation (the “Company”), and Benefit Street Partners Realty Operating Partnership,

L.P., a Delaware limited partnership (the “Operating Partnership”), in connection with the issuance and sale from time

to time and at various prices, through Barclays Capital Inc., B. Riley Securities, Inc., Citizens JMP Securities, LLC, JonesTrading

Institutional Services LLC, J.P. Morgan Securities LLC and Raymond James & Associates, Inc., as sales agents (the “Agents”),

of shares of the Company’s common stock, par value $0.01 per share (the “Common Stock”), having an aggregate

offering price of up to $200,000,000 (the “Shares”), pursuant to the terms of the Sales Agreement, dated as of April 14,

2023, as amended by Amendment No. 1 to the Sales Agreement, dated November [8], 2024 (as so amended, the “Sales Agreement”),

by and among the Company, the Operating Partnership, Benefit Street Partners L.L.C., a Delaware limited liability company, and the Agents.

The offering of the Shares by the Company is being made pursuant to a prospectus supplement dated November [8], 2024 and the accompanying

base prospectus dated November [8], 2024 (such documents, collectively, the “Prospectus”) that form part of the

Company’s effective registration statement on Form S-3 that became effective upon filing with the Securities and Exchange Commission

on November [8], 2024 (the “Registration Statement”). This opinion letter is furnished to you at your request

to enable you to fulfill the requirements of Item 601(b)(5) of Regulation S-K, 17 C.F.R. § 229.601(b)(5), in

connection with the Registration Statement.

For purposes of this opinion letter, we have examined

copies of such agreements, instruments and documents as we have deemed an appropriate basis on which to render the opinions hereinafter

expressed. In our examination of the aforesaid documents, we have assumed the genuineness of all signatures, the legal capacity

of all natural persons, the accuracy and completeness of all documents submitted to us, the authenticity of all original documents, and

the conformity to authentic original documents of all documents submitted to us as copies (including pdfs). We also have assumed that

the Shares will not be issued in violation of the ownership limit contained in the Company’s Articles of Amendment and Restatement.

As to all matters of fact, we have relied on the representations and statements of fact made in the documents so reviewed, and we have

not independently established the facts so relied on. This opinion letter is given, and all statements herein are made, in the context

of the foregoing.

Hogan

Lovells US LLP is a limited liability partnership registered in the state of Delaware. “Hogan Lovells” is an international

legal practice that includes Hogan Lovells US LLP and Hogan Lovells International LLP, with offices in: Alicante Amsterdam Baltimore

Berlin Beijing Birmingham Boston Brussels Colorado Springs Denver Dubai Dusseldorf Frankfurt Hamburg Hanoi Ho Chi Minh City Hong Kong

Houston Johannesburg London Los Angeles Luxembourg Madrid Mexico City Miami Milan Minneapolis Monterrey Munich New York Northern Virginia

Paris Philadelphia Riyadh Rome San Francisco São Paulo Shanghai Silicon Valley Singapore Sydney Tokyo Warsaw Washington, D.C.

Associated Offices: Budapest Jakarta Shanghai FTZ. Business Service Centers: Johannesburg Louisville. For more information see www.hoganlovells.com

This opinion letter is based as to matters of

law solely on the applicable provisions of the Maryland General Corporation Law, as amended. We express no opinion herein as to any other

statutes, rules, or regulations.

Based upon, subject to and limited by the foregoing,

we are of the opinion that following (i) execution and delivery by the Company and the Operating Partnership of the Sales Agreement,

(ii) authorization by the Company’s Board of Directors, or authorization by a duly authorized pricing committee thereof,

within the limitations established by resolutions duly adopted by the Company’s Board of Directors and duly authorized pricing committee

thereof and in each case made available to us, of the terms pursuant to which the Shares may be sold pursuant to the Sales Agreement,

(iii) authorization by a duly authorized executive officer, designated by the pricing committee to approve instruction notices under

the Sales Agreement, of the terms of the applicable instruction notice executed in a manner consistent with the foregoing and pursuant

to which the Shares may be sold pursuant to the Sales Agreement, (iv) issuance of the Shares pursuant to the terms established by

the Board of Directors and the pricing committee thereof and the terms of the applicable instruction notice, and (v) receipt by the

Company of the proceeds for the Shares sold pursuant to such terms and such applicable instruction notice, the Shares will be validly

issued, fully paid, and nonassessable.

This opinion letter has been prepared for use

in connection with the filing by the Company of a Current Report on Form 8-K relating to the offer and sale of the Shares, which

Form 8-K will be incorporated by reference into the Registration Statement and Prospectus, and speaks as of the date hereof. We assume

no obligation to advise of any changes in the foregoing subsequent to the delivery of this letter.

We hereby consent to the filing of this opinion

letter as Exhibit 5.1 to the above described Form 8-K and to the reference to this firm under the caption “Legal Matters”

in the Prospectus. In giving this consent, we do not thereby admit that we are an “expert” within the meaning of the Securities

Act of 1933, as amended.

| |

Very

truly yours, |

| |

|

| |

/s/

HOGAN LOVELLS US LLP |

Exhibit 5.2

|

Hogan Lovells US LLP

Columbia Square

555 Thirteenth Street NW

Washington, DC 20004

T +1 202 637 5600

F +1 202 637 5910

www.hoganlovells.com |

November 8, 2024

Board of Directors

Franklin BSP Realty Trust, Inc.

1345 Avenue of the Americas, Suite 32A

New York, New York 10105

Ladies and Gentlemen:

We are acting as counsel to Franklin BSP Realty

Trust, Inc., a Maryland corporation (the “Company”), in connection with the public offering by entities affiliated

with Benefit Street Partners L.L.C. (collectively, the “Selling Stockholder”) of up to 1,882,841 shares of the Company’s

common stock, par value $0.01 per share (“Common Stock”) currently issued and outstanding (the “Shares”),

pursuant to the prospectus supplement, dated November 8, 2024 (the “Prospectus Supplement”) to the Company’s

registration statement on Form S-3 (the “Registration Statement”) filed with the Securities and Exchange Commission

under the Securities Act of 1933, as amended (the “Act”) on November 8, 2024, including a base prospectus (the

“Base Prospectus” and together with the Prospectus Supplement, the “Prospectus”) that forms a part

thereof. This opinion letter is furnished to you at your request to enable you to fulfill the requirements of Item 601(b)(5) of Regulation

S-K, 17 C.F.R. § 229.601(b)(5), in connection with the Registration Statement.

For purposes of this opinion letter, we have examined copies of such

agreements, instruments and documents as we have deemed an appropriate basis on which to render the opinions hereinafter expressed. In

our examination of the aforesaid documents, we have assumed the genuineness of all signatures, the legal capacity of all natural persons,

the accuracy and completeness of all documents submitted to us, the authenticity of all original documents, and the conformity to authentic

original documents of all documents submitted to us as copies (including pdfs). As to all matters of fact, we have relied on the representations

and statements of fact made in the documents so reviewed, and we have not independently established the facts so relied on. This opinion

letter is given, and all statements herein are made, in the context of the foregoing. For purposes of our opinion, we assume that, to

the extent that any of the Shares were originally issued by the Company prior to April 14, 2016, such Shares were, when originally

issued, duly authorized, validly issued, fully-paid and non-assessable, and were the subject of a legal opinion issued prior to the date

hereof by another firm of licensed attorneys to such effect.

Hogan

Lovells US LLP is a limited liability partnership registered in the state of Delaware. “Hogan Lovells” is an international

legal practice that includes Hogan Lovells US LLP and Hogan Lovells International LLP, with offices in: Alicante Amsterdam Baltimore

Berlin Beijing Birmingham Boston Brussels Colorado Springs Denver Dubai Dusseldorf Frankfurt Hamburg Hanoi Ho Chi Minh City Hong Kong

Houston Johannesburg London Los Angeles Luxembourg Madrid Mexico City Miami Milan Minneapolis Monterrey Munich New York Northern Virginia

Paris Philadelphia Riyadh Rome San Francisco São Paulo Shanghai Silicon Valley Singapore Sydney Tokyo Warsaw Washington, D.C.

Associated Offices: Budapest Jakarta Shanghai FTZ. Business Service Centers: Johannesburg Louisville. For more information see www.hoganlovells.com

This opinion letter is based as to matters of law solely on the Maryland

General Corporation Law, as amended. We express no opinion herein as to any other statutes, rules or regulations.

Based upon, subject to and limited by the foregoing, we are of the

opinion that the Shares are validly issued, fully paid, and nonassessable.

This opinion letter has been prepared for use in connection with the

filing by the Company of a Current Report on Form 8-K on the date hereof, which Form 8-K will be incorporated by reference into

the Registration Statement and Prospectus, and speaks as of the date hereof. We assume no obligation to advise of any changes in the foregoing

subsequent to the delivery of this letter.

We hereby consent to the filing of this opinion letter as Exhibit 5.1

to the above-described Form 8-K and to the reference to this firm under the caption “Legal Matters” in the Prospectus.

In giving this consent, we do not thereby admit that we are an “expert” within the meaning of the Act.

| Very

truly yours, |

|

| |

|

| /s/

HOGAN LOVELLS US LLP |

|

v3.24.3

Cover

|

Nov. 08, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 08, 2024

|

| Entity File Number |

001-40923

|

| Entity Registrant Name |

Franklin

BSP Realty Trust, Inc.

|

| Entity Central Index Key |

0001562528

|

| Entity Tax Identification Number |

46-1406086

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity Address, Address Line One |

1345

Avenue of the Americas

|

| Entity Address, Address Line Two |

Suite

32A

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10105

|

| City Area Code |

212

|

| Local Phone Number |

588-6770

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common

Stock, par value $0.01 per share

|

| Trading Symbol |

FBRT

|

| Security Exchange Name |

NYSE

|

| Series E Preferred Stock [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

7.50%

Series E Cumulative Redeemable Preferred Stock, par value $0.01 per share

|

| Trading Symbol |

FBRT PRE

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesEPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

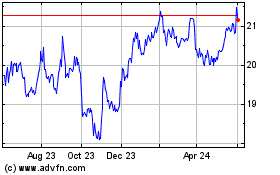

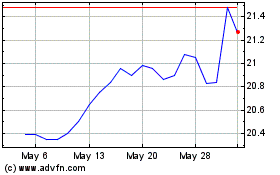

Franklin BSP Realty (NYSE:FBRT-E)

Historical Stock Chart

From Nov 2024 to Dec 2024

Franklin BSP Realty (NYSE:FBRT-E)

Historical Stock Chart

From Dec 2023 to Dec 2024