0001401257false00014012572024-10-142024-10-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________

FORM 8-K

___________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 14, 2024

FORUM ENERGY TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

Delaware | | 001-35504 | | 61-1488595 |

(State or other jurisdiction of incorporation or organization) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| | | | | | | | | | | | | | |

| 10344 Sam Houston Park Drive | Suite 300 | Houston | TX | 77064 |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant's telephone number, including area code

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

Title of each class | | Trading Symbol | | Name of each exchange on which registered |

Common Stock, par value $0.01 per share | | FET | | NYSE |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02 Results of Operations and Financial Condition.

On October 14, 2024, Forum Energy Technologies, Inc. (the “Company”) issued a press release announcing certain preliminary results for the three months ended September 30, 2024. As of the date of the press release, the Company is finalizing its financial results for the three months ended September 30, 2024. Revenue, Adjusted EBITDA and Free Cash Flow (before acquisitions) for the three months ended September 30, 2024 included in the press release are preliminary, estimated and unaudited, and based on information available to management as of the date of the press release. As a result, the Company’s actual results for the three months ended September 30, 2024 could vary materially from, and investors should not place undue reliance upon, this preliminary information. The Company undertakes no obligation to update or supplement the information provided in the press release until it releases its financial results for the three months ended September 30, 2024.

The Company’s independent registered public accounting firm has not audited, reviewed, compiled or applied agreed-upon procedures with respect to the preliminary financial information included in the press release. Accordingly, the Company’s independent registered public accounting firm does not express an opinion or any other form of assurance with respect thereto.

A copy of the press release is furnished herewith as Exhibit 99.1 and incorporated herein by reference.

The information contained in this Item 2.02, including Exhibit 99.1, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be incorporated by reference into a filing under the Securities Act of 1933, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 8.01 Other Events.

On October 14, 2024, Forum issued a press release announcing the contemplated offering (the “Offering”) by Forum of $100.0 million aggregate principal amount of USD denominated 5-year senior secured bonds, subject to market conditions. A copy of the press release announcing the Offering is attached hereto as Exhibit 99.2 and incorporated by reference herein.

Forum intends to use the net proceeds from the Offering, together with cash on hand, to redeem in full all outstanding 9.000% Convertible Senior Secured Notes due 2025 and to repay all borrowings outstanding under the seller term loan issued in connection with the acquisition of Variperm Energy Services.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Exhibit Title or Description |

| | Press release announcing preliminary estimated financial information, dated October 14, 2024. |

| | Press release announcing the Offering, dated October 14, 2024. |

| 104 | | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | | |

Date: October 15, 2024 | FORUM ENERGY TECHNOLOGIES, INC.

| |

| /s/ John C. Ivascu | |

| John C. Ivascu | |

| Executive Vice President, General Counsel, Chief Compliance Officer and Corporate Secretary | |

Forum Energy Technologies Provides Preliminary Third Quarter 2024 Selected Financial Results

HOUSTON, TEXAS, October 14, 2024 - Forum Energy Technologies, Inc. (NYSE: FET) (the “Company” or “FET”) today announced the following preliminary selected Third Quarter 2024 financial results, compared to the Second Quarter 2024.

• Revenue of approximately $208 million, compared to $205 million

• Bookings of approximately $205 million, compared to $180 million

•Adjusted EBITDA of approximately $26 million, compared to $26 million

• Free Cash Flow (before acquisitions) of approximately $24 million, compared to $21 million

These preliminary Third Quarter 2024 revenue and Adjusted EBITDA results are within our previously announced guidance ranges. Provided below is a table reconciling GAAP to non-GAAP Second Quarter 2024 financial information.

FET (Forum Energy Technologies) is a global manufacturing company, serving the oil, natural gas, industrial and renewable energy industries. With headquarters located in Houston, Texas, FET provides value added solutions aimed at improving the safety, efficiency, and environmental impact of its customers' operations. For more information, please visit www.f-e-t.com.

Non-GAAP Financial Measures and Other Legal Disclosures

The Company presents its financial results in accordance with U.S. generally accepted accounting principles (“GAAP”). However, management believes that non-GAAP measures are useful tools for evaluating the Company’s overall financial performance. Not all companies define these measures in the same way. In addition, these non-GAAP financial measures are not a substitute for those prepared in accordance with GAAP and should, therefore, be considered only as a supplement.

The unaudited financial information presented above for the Third Quarter 2024 reflects estimates based upon preliminary information available to the Company as of the date hereof, is not a comprehensive statement of the Company’s financial results or position as of or for the quarter ended September 30, 2024, and has not been audited or reviewed by the Company’s independent registered public accounting firm. The Company’s consolidated financial statements and operating data as of and for the quarter ended September 30, 2024 may vary materially from the preliminary financial information provided herein due to the completion of the Company’s financial closing procedures, final adjustments and other developments that may arise between now and the time the financial results for the Third Quarter 2024 are finalized. Accordingly, investors should not place undue reliance on these preliminary estimates. The Company is not able to provide reconciliations of Adjusted EBITDA and Free Cash Flow (before acquisitions) to the most directly comparable measure in accordance with GAAP without unreasonable effort because of the inherent difficulty in forecasting and quantifying certain amounts necessary for such reconciliations, including net income (loss), net cash provided by operating activities and the components of such GAAP measures.

Forward Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements, other than statements of historical facts, included in this press release that address activities, events or developments that the Company expects, believes or anticipates will or may occur in the future are forward-looking statements. Without limiting the generality of the foregoing, forward-looking statements contained in this press release specifically include the expectations of anticipated financial and operating results of the Company for the Third Quarter 2024, including any statement about the Company’s financial position, liquidity and capital resources, operations, performance, returns and other estimated financial results included in this press release.

These statements are based on certain assumptions and estimates made by the Company based on management's experience and perception of historical trends, current conditions, anticipated future developments and other factors believed to be appropriate. Such statements are subject to a number of assumptions, risks and uncertainties, many of which are beyond the control of the Company, which may cause actual results to differ materially from those implied or expressed by the forward-looking statements. Among other things, these include the risks described above and the volatility of oil and natural gas prices, oilfield development activity levels, the availability of raw materials and specialized equipment, the Company’s ability to deliver backlog in a timely fashion, the availability of skilled and qualified labor, competition in the oil and

natural gas industry, governmental regulation and taxation of the oil and natural gas industry, the Company’s ability to implement new technologies and services, the availability and terms of capital, and uncertainties regarding environmental regulations or litigation and other legal or regulatory developments affecting the Company’s business, and other important factors that could cause actual results to differ materially from those projected or estimated as described in the Company's filings with the U.S. Securities and Exchange Commission.

Any forward-looking statement speaks only as of the date on which such statement is made and the Company undertakes no obligation to correct or update any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by applicable law.

Forum Energy Technologies, Inc.

Reconciliation of GAAP to non-GAAP financial information

| | | | | | | | |

| (in millions) | Three months ended June 30, 2024 | |

| | |

| Net loss | $ (6.7) | |

| Interest expense | 8.7 | |

| Depreciation and amortization | 14.0 | |

| Income tax expense | 2.5 | |

| EBITDA | 18.5 | |

Restructuring and other costs | 1.0 | |

Transaction expenses | 1.2 | |

Inventory and other working capital adjustments | — | |

Stock-based compensation expense | 1.5 | |

Loss on extinguishment of debt | 0.5 | |

Loss on foreign exchange, net (1) | 3.1 | |

Adjusted EBITDA (2) | $ 25.8 | |

| | |

| Net cash provided by operating activities | $ 23.1 | |

| Capital expenditures for property and equipment | (1.5) | |

| Payments related to sale of property and equipment | (0.2) | |

Free Cash Flow (before acquisitions) (3) | $ 21.4 | |

| | |

| | |

(1)Foreign exchange, net primarily relates to cash and receivables denominated in U.S. dollars by some of the Company’s non-U.S. subsidiaries that report in a local currency, and therefore the loss (gain) has no economic impact in dollar terms.

(2)The Company believes that the presentation of EBITDA and Adjusted EBITDA are useful to the Company’s investors because (i) each of these financial metrics are useful to investors to assess and understand operating performance, especially when comparing those results with previous and subsequent periods or forecasting performance for future periods, primarily because management views the excluded items to be outside of the Company’s normal operating results and (ii) EBITDA is an appropriate measure of evaluating the company’s operating performance and liquidity that reflects the resources available for strategic opportunities including, among others, investing in the business, strengthening the balance sheet, repurchasing the Company’s securities and making strategic acquisitions. In addition, these benchmarks are widely used in the investment community.

(3)The Company believes Free Cash Flow (before acquisitions) is an important measure because it encompasses both profitability and capital management in evaluating results.

Company Contact

Rob Kukla

Director of Investor Relations

281.994.3763

rob.kukla@f-e-t.com

Forum Energy Technologies Announces $100 Million Bond Issuance

HOUSTON, TEXAS, October 14, 2024 – Forum Energy Technologies, Inc. (NYSE: FET) (“FET”) announced today the commencement of a backstopped private offering of USD $100.0 million aggregate principal amount of 5-year senior secured bonds (the “Offering”). FET intends to use the net proceeds from the Offering, together with cash on hand, to redeem in full all outstanding 9.000% Convertible Senior Secured Notes due 2025 (the “2025 Notes”) and to repay all borrowings outstanding under the seller term loan issued in connection with the acquisition of Variperm Energy Services (the “Seller Term Loan”).

The securities to be offered have not been registered under the Securities Act of 1933, as amended (the “Securities Act”), or any state securities laws, and unless so registered, the securities may not be offered or sold in the United States or to U.S. persons except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act and applicable state securities laws. In the Offering, FET plans to offer and sell the securities in a private placement only to non-U.S. persons outside the United States pursuant to Regulation S under the Securities Act.

This announcement does not constitute a notice of redemption with respect to the 2025 Notes or a notice of repayment with respect to the Seller Term Loan.

This press release shall not constitute an offer to sell, or the solicitation of an offer to buy, any of these securities, nor shall there be any sale of these securities in any state in which such offer, solicitation, or sale would be unlawful. This press release is being issued pursuant to and in accordance with Rule 135c under the Securities Act.

FET (Forum Energy Technologies) is a global manufacturing company, serving the oil, natural gas, industrial and renewable energy industries. With headquarters located in Houston, Texas, FET provides value added solutions aimed at improving the safety, efficiency, and environmental impact of its customers' operations. For more information, please visit www.f-e-t.com.

Cautionary Statement Regarding Forward-Looking Statements

Statements contained in this press release that are not historical facts are forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements include words or phrases such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “likely,” “plan,” “project,” “could,” “may,” “might,” “should,” “will” and similar words and specifically include statements regarding the Offering and the use of proceeds therefrom. The forward-looking statements contained in this press release are subject to numerous risks, uncertainties and assumptions that may cause actual results to vary materially from those indicated. For additional information regarding known material risks, you should also carefully read and consider FET’s most recent annual report on Form 10-K and quarterly reports on Form 10-Q, which are available on the Securities and Exchange Commission’s website at www.sec.gov. Each forward-looking statement speaks only as of the date of the particular statement, and FET undertakes no obligation to update or revise any forward-looking statements, except as required by law.

Company Contact

Rob Kukla

Director of Investor Relations

281.994.3763

rob.kukla@f-e-t.com

v3.24.3

Cover Page

|

Oct. 14, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Oct. 14, 2024

|

| Entity Registrant Name |

FORUM ENERGY TECHNOLOGIES, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-35504

|

| Entity Tax Identification Number |

61-1488595

|

| Entity Address, Address Line One |

10344 Sam Houston Park Drive

|

| Entity Address, Address Line Two |

Suite 300

|

| Entity Address, City or Town |

Houston

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

77064

|

| City Area Code |

281

|

| Local Phone Number |

949-2500

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

FET

|

| Security Exchange Name |

NYSE

|

| Emerging Growth Company |

false

|

| Entity Central Index Key |

0001401257

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

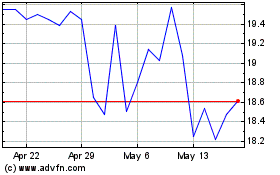

Forum Energy Technologies (NYSE:FET)

Historical Stock Chart

From Oct 2024 to Nov 2024

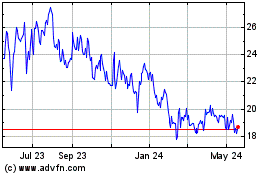

Forum Energy Technologies (NYSE:FET)

Historical Stock Chart

From Nov 2023 to Nov 2024