Gildan Activewear Inc. (GIL: TSX and NYSE) today announced results

for the second quarter ended June 30, 2024. The Company also

reconfirmed its Fiscal 2024 guidance.

"I am proud of the Gildan team's ongoing dedication, delivering

a solid top line performance in the second quarter with strong

adjusted operating margin1 and double-digit adjusted diluted EPS1

growth. Further, I am excited to be back leading the Company as we

continue to focus on our Gildan Sustainable Growth Strategy (GSG)

and celebrate a significant milestone with our Company's 40th

anniversary this year. This is a period of significant opportunity

in our industry, and we believe that Gildan's competitive position

has never been stronger," said Glenn J. Chamandy, Gildan’s

President and CEO. Gildan’s Chairman of the Board, Michael

Kneeland, added "Gildan's new directors bring a wealth of expertise

and fresh perspectives, and the Board is excited about supporting

the Company in this next chapter, working closely with Glenn and

the senior team and all stakeholders. Together, we look forward to

achieving great success."

Q2 2024 Operating Results Net sales were $862

million, up 3% over the prior year, at the higher end of previously

provided guidance of flat to low single-digit growth. Activewear

sales of $737 million, were up 6%, driven by increased activewear

shipments reflecting positive POS trends across all channels and

geographies, as well as favourable mix driven by higher

replenishment of fleece by North American distributors ahead of

peak selling season. Furthermore, strong activewear sales in the

quarter reflected continued market share gains in key growth

categories, including fleece and ring spun products. We also

benefited from a positive market response to our recently

introduced products featuring key innovation, including our soft

cotton technology. Moreover, International sales increased by 7%,

as POS trends rebounded across all regions. In the Hosiery and

underwear category, sales were down 16% versus the prior year,

mainly owing to the phase out of the Under Armour business and to a

lesser extent, to unfavourable mix and continued broader market

weakness in innerwear. Excluding the impact of the Under Armour

phase-out, Hosiery and underwear sales would have been up

mid-single digits year over year.

The Company generated gross profit of $262 million, or 30.4% of

net sales, versus $217 million, or 25.8% of net sales, in the

same period last year representing a 460 basis point improvement

which was primarily driven by lower raw material and manufacturing

input costs.

SG&A expenses of $124 million included significant charges

related to the proxy contest, leadership changes and related

matters, totaling $57 million, as detailed in the non-GAAP

financial measures section of this press release. Excluding these

charges, adjusted SG&A expenses1 were down 15% to $66 million,

or 7.7% of net sales, compared to SG&A expenses of $78 million,

or 9.3% of net sales for the same period last year. The year over

year reduction reflected the significant positive benefit of the

jobs credit introduced by Barbados, which was retroactive to

January 1, 2024 and totaled $17.2 million in the quarter.

The Company generated operating income of $141 million, or 16.4%

of net sales, reflecting the negative impact of the expenses for

the proxy contest, leadership changes and other related matters.

This compares to $183 million, or 21.7% of net sales last year

which included a net insurance gain of $74 million and

restructuring charges of $30 million. Adjusted operating

income1 was $196 million or 22.7% of net sales, in line with

guidance provided and up $57 million or 620 basis points compared

to the prior year.

Net financial expenses of $24 million, were up $4 million over

the prior year due to higher interest rates. The Company's income

tax expense was significantly higher than the prior year, mainly

reflecting the impact of the enactment of Global Minimum Tax (GMT)

in Canada and Barbados, during the second quarter. This impact was

retroactive to January 1, 2024 and the Company's adjusted effective

income tax rate1 for the quarter was 27.2% versus 4.8% last year,

bringing the year to date adjusted tax rate to approximately 18%,

in line with our expectations. Reflecting the positive benefit of a

lower outstanding share base, GAAP diluted EPS were $0.35, down 60%

versus the prior year, while adjusted diluted EPS1 were $0.74

compared to $0.63 last year, up 17% year over year.

Cash flows from operating activities totaled $140 million,

compared to $182 million in the prior year which included the net

positive effect of the $74 million insurance gain. After accounting

for capital expenditures totaling $36 million, the Company

generated approximately $104 million of free cash flow1 (FCF)

compared to $126 million in the prior year, after absorbing a cash

impact of $40 million in the quarter for the proxy contest,

leadership changes and related matters. The Company resumed share

repurchases in the final month of the quarter, repurchasing 3.1

million shares and as such, returned a total of $182 million in

capital to shareholders including dividends during the second

quarter. With the current normal course issuer bid (NCIB) program

now approaching expiry this month, our Board of Directors approved

a new NCIB program to repurchase up to 10% of the Company's public

float over the next twelve months. We ended the second quarter with

net debt1 of $1,238 million and a leverage ratio1 of 1.6 times net

debt to trailing twelve months adjusted EBITDA1.

Year-to-date Operating ResultsNet sales for the

first half ended June 30, 2024 were $1,558 million, up 1%

versus the same period last year. In Activewear, we generated sales

of $1,329 million, up $49 million or 4%, driven by higher

shipments reflecting positive POS trends across North American and

International markets. Activewear sales also benefited from

favourable product mix partly offset by lower net selling prices,

primarily in the first quarter. POS trends for the Activewear

category have continued to show progressive improvement over the

past few quarters. International sales of $123 million were up 4%

versus the same period last year, reflecting demand stabilization

and some recovery in POS trends. In the Hosiery and underwear

category, sales were down 13% versus the prior year mainly

reflecting the phase out of the Under Armour business, less

favourable mix and broader market weakness in the underwear

category. Excluding the impact of the Under Armour phase-out,

Hosiery and underwear sales would have been up low-single digits

year over year.

The Company generated gross profit of $473 million, up $69

million versus the prior year, driven by the increase in sales and

gross margin. Gross margin of 30.4% was up by 420 basis points year

over year mainly a result of lower raw material and manufacturing

input costs, partly offset by slightly lower net selling

prices.

SG&A expenses were $229 million, $69 million above prior

year levels. The increase is mainly attributable to expenses for

the proxy contest, leadership changes and other related matters,

totaling $76.8 million. Excluding these charges, adjusted SG&A

expenses1 were $152 million, or 9.8% of net sales, compared to

10.4% of net sales last year, reflecting the benefit of the jobs

credit introduced by Barbados, which was retroactive to January 1,

2024.

The Company generated operating income of $246 million, or 15.8%

of net sales, reflecting the negative impact of the expenses for

the proxy contest, leadership changes and other related matters.

This compares to operating income of $311 million or 20.1% of net

sales last year which included the benefit of a $77 million net

insurance gain and a $25 million gain from the sale and leaseback

of one of our U.S. distribution facilities, partly offset by

restructuring costs of $33 million. Excluding these items as well

as the expenses for the proxy contest, leadership changes and other

related matters, adjusted operating income1 was $321 million

or 20.6% of net sales, up $80 million or 500 basis points

compared to the prior year.

Net financial expenses of $47 million were up $9 million

over the prior year due to higher interest rates. As detailed

earlier, income tax expenses were significantly higher than the

prior year, due to the enactment of GMT in Canada and Barbados.

Reflecting the benefit of a lower outstanding share base, GAAP

diluted EPS and adjusted diluted EPS1 were $0.81 and $1.33

respectively, compared to GAAP diluted EPS and adjusted diluted

EPS1 of $1.41 and $1.08 respectively, in the prior year.

2024 Outlook The Company's focus remains on

executing the Gildan Sustainable Growth (GSG) strategy initiated in

2022. Substantial progress has been achieved on the three strategic

pillars: capacity-driven growth, innovation and ESG. While we are

encouraged by the positive demand trends for our products in all

our channels in the first half of 2024, the macroeconomic backdrop

remains mixed globally, which is driving a generally cautious

consumer spending outlook. Nonetheless, we are reiterating our

previously provided 2024 guidance, underscoring our confidence in

our continued execution against our GSG strategy.

Consequently, for 2024, we continue to expect the following:

- Revenue growth for the full year to be flat to up low-single

digits

- Adjusted operating margin1 slightly above the high end of our

18% to 20% target range for 2024

- Capex to come in at approximately 5% of net sales

- Adjusted diluted EPS1 in the range of $2.92 to $3.07, up

significantly between 13.5% and 18.5% year over year

- Free cash flow above 2023 levels driven by increased

profitability, lower working capital investments and lower capital

expenditures than in 2023.

The assumptions underpinning our 2024 guidance include the

following:

- The continued improvement in POS trends through the second half

of 2024 as well as growth opportunities in all our channels. Our

revenue guidance also takes into account the expiration of the

Under Armour sock license agreement on March 31, 2024. Excluding

the impact of this agreement, full year revenue growth in 2024

would be in the low to mid-single digit range.

- The continued benefit of the refundable jobs credit recently

introduced by Barbados, where our Sales and Marketing operations

are headquartered. This credit, which became applicable this

quarter, was retroactive to January 1, 2024 and flows through

SG&A.

- We have incorporated the estimated impact of the recently

enacted GMT legislation in Canada and Barbados on our effective tax

rate, retroactive to January 1, 2024. The Company's adjusted

effective income tax1 rate is expected to be approximately 18% for

the full year.

- Given the strength of our balance sheet, our expected strong

free cash flow and the renewed NCIB program, the Company plans to

continue share repurchases in the second half of 2024, with a

revised leverage framework of 1.5x to 2.5x net debt to adjusted

EBITDA1.

- Q3 net sales are expected to be flat to up low single digits

year over year. Adjusted operating margin is expected to come in

above the high end of our 18% to 20% target range for 2024,

including the positive benefit of the refundable jobs credit.

Three-year outlookAssuming no deterioration in

the current macroeconomic environment, Gildan is confident that its

targeted priorities will position the Company to continue to drive

market share gains in key product categories and unlock further

opportunities in targeted markets. Accordingly, as we further

capitalize on the GSG strategy and pursue a disciplined approach to

return capital to shareholders, we believe that the Company is well

positioned to deliver strong value for shareholders as reflected in

the following three-year outlook for the 2025 to 2027 period:

- Net sales growth at a compound annual growth rate in the

mid-single digit range

- Annual adjusted operating margin1 to further improve over the

three-year period as compared to 2024

- Capex as a percentage of sales of about 5% per year, on

average, to support long-term growth and vertical integration

- Continued share repurchases in line with a leverage framework

of 1.5x to 2.5x net debt to adjusted EBITDA1

- Adjusted diluted EPS1 growth at a compound annual growth rate

in the mid-teen range

The 2024 outlook as well as the medium-term targets assume no

meaningful deterioration from current market conditions including

the pricing and inflationary environment, the absence of a

significant shift in labour conditions or the competitive

environment, and no further deterioration in geopolitical

environments. They reflect reasonable industry growth and expected

market share gains. They also assume the continued benefit from

certain refundable jobs credits. In addition, they reflect Gildan’s

expectations as of August 1, 2024 and are subject to significant

risks and business uncertainties, including those factors described

under “Forward-Looking Statements” in this press release and the

annual MD&A for the year ended December 31, 2023.

ESGOn June 18, 2024, Gildan published its 20th

ESG report, marking a significant milestone in the Company’s long

history of public ESG disclosures. The 2023 report highlights

Gildan’s continued progress against key targets, two years into the

implementation of our Next Generation ESG strategy and 2030

targets. In addition, the Company has recently been recognized as

one of the Best 50 Corporate Citizens in Canada by Corporate

Knights, for the third consecutive year, and is the only company in

the Textiles & Clothing Manufacturing peer group to have

received this recognition. Furthermore, Gildan has also recently

been included in the inaugural edition of TIME’s World's Most

Sustainable Companies and is one of only 12 Canadian companies

featured on this global list.

Declaration of Quarterly DividendThe Board of

Directors has declared a cash dividend of $0.205 per share, payable

on September 16, 2024 to shareholders of record as of August 22,

2024. This dividend is an “eligible dividend” for the purposes of

the Income Tax Act (Canada) and any other applicable provincial

legislation pertaining to eligible dividends.

Renewal of Normal Course Issuer Bid

(NCIB)Gildan received approval from the Toronto Stock

Exchange (TSX) to renew its NCIB commencing on August 9, 2024, to

purchase for cancellation up to 16,106,155 common shares,

representing approximately 10% of Gildan’s “public float” (as such

term is defined in the TSX Company Manual) as of July 26, 2024. As

of July 26, 2024, Gildan had 162,610,386 common shares issued and

outstanding, and a public float of 161,061,552 common shares.

Gildan is authorized to make purchases under the NCIB until

August 8, 2025, in accordance with the requirements of the TSX.

Purchases will be made by means of open market transactions on both

the TSX and the New York Stock Exchange (NYSE), or alternative U.S.

or Canadian trading systems, if eligible, or by such other means as

may be permitted by securities regulatory authorities, including

pre-arranged crosses, exempt offers, private agreements under an

issuer bid exemption order issued by securities regulatory

authorities and block purchases of common shares. The average daily

trading volume of common shares on the TSX (ADTV) for the six-month

period ended June 30, 2024, was 320,839. Consequently, and in

accordance with the requirements of the TSX, Gildan may purchase,

in addition to purchases made on other exchanges including the

NYSE, up to a maximum of 80,209 common shares daily through the

facilities of the TSX, which represents 25% of the ADTV for the

most recently completed six calendar months.

The price to be paid by Gildan for any common shares will be the

market price at the time of the acquisition, plus brokerage fees,

and purchases made under an issuer bid exemption order will be at a

discount to the prevailing market price in accordance with the

terms of the order. The actual number of common shares purchased

under the NCIB and the timing of such purchases will be at Gildan's

discretion and shall be subject to the limitations set out in the

TSX Company Manual.

Under its current NCIB that commenced on August 9, 2023, and

will end on August 8, 2024, Gildan is authorized to repurchase for

cancellation up to 17,124,249 common shares, representing

approximately 10% of Gildan’s public float as of July 31, 2023. Of

this amount, Gildan purchased a total of 14,640,845 common shares

at a weighted average price of $34.49 as of July 26, 2024. Common

shares were purchased through the facilities of the TSX and the

NYSE, and through alternative Canadian trading systems.

Gildan will enter into an automatic securities purchase plan

(ASPP) with a designated broker in relation to the NCIB shortly

after the date hereof and before the commencement date of the NCIB.

The ASPP will allow for the purchase of common shares under the

NCIB, subject to certain trading parameters, at times when Gildan

ordinarily would not be permitted to purchase its common shares due

to applicable regulatory restrictions or self-imposed trading

black-out periods. Outside of the predetermined black-out periods,

common shares may be purchased under the NCIB based on the

discretion of the Company’s management, in compliance with TSX

rules and applicable securities laws.

Gildan’s management and the Board of Directors believe the

repurchase of common shares represents an appropriate use of

Gildan’s financial resources and that share repurchases under the

NCIB will not preclude Gildan from continuing to pursue organic

growth and complementary acquisitions.

Disclosure of Outstanding Share DataAs at

July 26, 2024, there were 162,610,386 common shares issued and

outstanding along with 438,703 stock options and 50,304 dilutive

restricted share units (Treasury RSUs) outstanding. Each stock

option entitles the holder to purchase one common share at the end

of the vesting period at a predetermined exercise price. Each

Treasury RSU entitles the holder to receive one common share from

treasury at the end of the vesting period, without any monetary

consideration being paid to the Company.

Conference Call InformationGildan Activewear

will hold a conference call to discuss the Company's second quarter

2024 results today at 8:30 AM ET. The conference call can be

accessed by dialing (800) 715-9871 (Canada & U.S.) or (646)

307-1963 (international) and entering passcode 5492469#. A replay

will be available for 7 days starting at 12:30 PM EST by dialing

(800) 770-2030 (Canada & U.S.) or (609) 800-9909

(international) and entering the same passcode. A live audio

webcast of the conference call, as well as the replay, will be

available at the following link Gildan Q2 2024 audio

webcast.

This release should be read in conjunction with Gildan’s

Management’s Discussion and Analysis and its unaudited condensed

interim consolidated financial statements as at and for the three

and six months ended June 30, 2024, which will be filed by Gildan

with the Canadian securities regulatory authorities and with the

U.S. Securities and Exchange Commission and which will be available

on Gildan’s corporate website.

Certain minor rounding variances may exist between the condensed

consolidated financial statements and the table summaries contained

in this press release.

Supplemental Financial Data

CONSOLIDATED FINANCIAL DATA (UNAUDITED)

|

(in $ millions, except per share amounts or otherwise

indicated) |

Q2 2024 |

Q2 2023 |

Variation (%) |

YTD 2024 |

YTD 2023 |

Variation (%) |

|

Net sales |

862.2 |

840.4 |

2.6 % |

1,558.0 |

1,543.3 |

1.0 % |

| Gross profit |

262.0 |

216.6 |

21.0 % |

473.1 |

404.3 |

17.0 % |

| Adjusted gross profit(1) |

262.0 |

216.8 |

20.8 % |

473.1 |

401.2 |

17.9 % |

| SG&A expenses |

123.6 |

78.1 |

58.3 % |

228.9 |

159.9 |

43.2 % |

| Adjusted SG&A

expenses(1) |

66.4 |

78.1 |

(15.0)% |

152.1 |

159.9 |

(4.9)% |

| Gain on sale and

leaseback |

— |

— |

n.m. |

— |

(25.0) |

n.m. |

| Net insurance gains |

— |

(74.2) |

n.m. |

— |

(74.2) |

n.m. |

| Restructuring and

acquisition-related (recovery) costs |

(2.9) |

30.0 |

n.m. |

(2.1) |

32.8 |

n.m. |

| Operating income |

141.2 |

182.7 |

(22.7)% |

246.3 |

310.7 |

(20.7)% |

| Adjusted operating

income(1) |

195.5 |

138.7 |

41.0 % |

321.0 |

241.2 |

33.1 % |

| Adjusted EBITDA(1) |

232.3 |

170.3 |

36.4 % |

389.4 |

300.7 |

29.5 % |

| Financial expenses |

24.3 |

20.7 |

17.4 % |

47.0 |

37.7 |

24.7 % |

| Income tax expense |

58.5 |

6.7 |

n.m. |

62.2 |

20.1 |

n.m. |

| Adjusted income tax

expense(1) |

46.5 |

5.7 |

n.m. |

50.2 |

9.6 |

n.m. |

| Net earnings |

58.4 |

155.3 |

(62.4)% |

137.1 |

252.9 |

(45.8)% |

| Adjusted net earnings(1) |

124.7 |

112.3 |

11.0 % |

223.8 |

193.9 |

15.4 % |

|

Basic EPS |

0.35 |

0.87 |

(59.8)% |

0.81 |

1.42 |

(43.0)% |

| Diluted EPS |

0.35 |

0.87 |

(59.8)% |

0.81 |

1.41 |

(42.6)% |

| Adjusted diluted EPS(1) |

0.74 |

0.63 |

17.5 % |

1.33 |

1.08 |

23.1 % |

|

Gross margin(2) |

30.4 % |

25.8 % |

4.6 pp |

30.4 % |

26.2 % |

4.2 pp |

| Adjusted gross margin(1) |

30.4 % |

25.8 % |

4.6 pp |

30.4 % |

26.0 % |

4.4 pp |

| SG&A expenses as a

percentage of net sales(3) |

14.3 % |

9.3 % |

5.0 pp |

14.7 % |

10.4 % |

4.3 pp |

| Adjusted SG&A expenses as

a percentage of net sales(1) |

7.7 % |

9.3 % |

(1.6) pp |

9.8 % |

10.4 % |

(0.6) pp |

| Operating margin(4) |

16.4 % |

21.7 % |

(5.3) pp |

15.8 % |

20.1 % |

(4.3) pp |

| Adjusted operating

margin(1) |

22.7 % |

16.5 % |

6.2 pp |

20.6 % |

15.6 % |

5.0 pp |

|

Cash flows from (used in) operating activities |

140.1 |

181.8 |

(22.9)% |

112.7 |

2.4 |

n.m. |

| Capital expenditures |

(36.2) |

(56.0) |

(35.4)% |

(80.2) |

(129.9) |

(38.2)% |

| Free

cash flow(1) |

103.9 |

126.0 |

(17.5)% |

32.6 |

(76.2) |

n.m. |

|

As at(in $ millions, or otherwise indicated) |

Jun 30,2024 |

Dec 31,2023 |

| Inventories |

1,110.4 |

1,089.4 |

| Trade accounts receivable |

599.0 |

412.5 |

| Net debt(1) |

1,238.3 |

993.4 |

| Net debt leverage

ratio(1) |

1.6 |

1.5 |

(1) This is a non-GAAP financial measure or ratio. Please refer

to "Non-GAAP Financial Measures" in this press release.(2) Gross

margin is defined as gross profit divided by net sales. (3)

SG&A expenses as a percentage of net sales is defined as

SG&A expenses divided by net sales.(4) Operating margin is

defined as operating income divided by net sales.n.m. = not

meaningful

DISAGGREGATION OF REVENUE

Net sales by major product group were as follows:

|

(in $ millions, or otherwise indicated) |

Q2 2024 |

Q2 2023 |

Variation (%) |

YTD 2024 |

YTD 2023 |

Variation (%) |

| Activewear |

736.6 |

691.7 |

6.5 % |

1,328.7 |

1,279.6 |

3.8 % |

| Hosiery and

underwear |

125.6 |

148.7 |

(15.5)% |

229.3 |

263.7 |

(13.0)% |

|

|

862.2 |

840.4 |

2.6 % |

1,558.0 |

1,543.3 |

1.0 % |

Net sales were derived from customers located in the following

geographic areas:

|

(in $ millions, or otherwise indicated) |

Q2 2024 |

Q2 2023 |

Variation (%) |

YTD 2024 |

YTD 2023 |

Variation (%) |

| United States |

763.8 |

745.9 |

2.4 % |

1,381.8 |

1,371.0 |

0.8 % |

| Canada |

27.5 |

28.1 |

(2.1)% |

52.8 |

53.8 |

(1.9)% |

| International |

70.9 |

66.4 |

6.8 % |

123.4 |

118.5 |

4.1 % |

|

|

862.2 |

840.4 |

2.6 % |

1,558.0 |

1,543.3 |

1.0 % |

INCOME TAX EXPENSE AND IMPACT OF GLOBAL MINIMUM TAX

(GMT)

|

(in $ millions) |

Q2 2024 |

Q2 2023 |

YTD 2024 |

YTD 2023 |

| Income tax expense: |

|

|

|

|

|

Tax expense excluding impact of GMT and other items below |

7.5 |

5.7 |

11.2 |

9.6 |

|

Q1 2024 retroactive impact of GMT |

15.5 |

— |

15.5 |

— |

|

Q2 2024 impact of GMT |

23.5 |

— |

23.5 |

— |

|

Income tax expense relating to restructuring charges and other

adjustments |

0.5 |

1.0 |

0.5 |

10.5 |

|

Tax rate changes resulting in the revaluation of deferred income

tax assets and liabilities |

11.5 |

— |

11.5 |

— |

| Total income tax

expense |

58.5 |

6.7 |

62.2 |

20.1 |

|

Adjustments for: |

|

|

|

|

|

Income tax expense relating to restructuring charges and other

adjustments |

(0.5) |

(1.0) |

(0.5) |

(10.5) |

|

Tax rate changes resulting in the revaluation of deferred income

tax assets and liabilities |

(11.5) |

— |

(11.5) |

— |

|

Adjusted income tax expense(3) |

46.5 |

5.7 |

50.2 |

9.6 |

| Earnings before income taxes |

116.9 |

162.0 |

199.3 |

273.0 |

| Adjustments(1)(4) |

54.3 |

(44.0) |

74.7 |

(69.5) |

|

Adjusted earnings before income taxes(3) |

171.2 |

118.0 |

274.0 |

203.5 |

| Average effective income tax rate(2) |

50.1 % |

4.1 % |

31.2 % |

7.4 % |

| Adjusted effective

income tax rate(3) |

27.2 % |

4.8 % |

18.3 % |

4.7 % |

(1) Adjustments are detailed in section entitled "Certain

adjustments to non-GAAP measures" in this press release. (2)

Average effective income tax rate is calculated as income tax

expense divided by earnings before income taxes. (3) Adjusted

income tax expense and adjusted earnings before income tax are

non-GAAP financial measures, and adjusted effective income tax rate

is a non-GAAP ratio calculated as adjusted income tax expense

divided by adjusted earnings before income taxes. Refer to the

section "Non-GAAP financial measures and related ratios" in this

press release. (4) Adjustments for the three and six months ended

June 30, 2024 of $54.3 million and $74.7 million, respectively,

include costs relating to proxy contest and leadership changes and

related matters net of restructuring and acquisition-related

recoveries. Adjustments for the three and six months ended July 2,

2023 of $44.0 million (gain) and $69.5 million (gain),

respectively, include net insurance gains and gain on sale and

leaseback partially offset by restructuring and acquisition-related

costs.

The increase in the income tax expense and

effective tax rate for the six months ended June 30, 2024, compared

to the same period last year, is mainly due to the impact of the

enactment of the Global Minimum Tax Act in Canada and the enactment

of legislation in Barbados introducing certain tax measures in

response to the Global implementation of the Pillar Two global

minimum Tax regime. More specifically, during the second quarter of

fiscal 2024, the Government of Barbados increased the corporate tax

rate applicable to the Company from a sliding scale of 5.5% to 1%

to a flat rate of 9%, effective January 1, 2024. In addition, the

Company also became subject to the OECD’s Pillar Two global minimum

tax regime, effective January 1, 2024, which results in an

additional top-up tax levied on the Company’s subsidiaries in

Barbados under Barbados’ domestic top-up tax legislation. These

events combined to result in an effective tax rate of 15% in

Barbados. For the six months ended June 30, 2024, the Company

recognized a current tax expense of $39.0 million related to the

increase in the Barbados corporate tax rate and the top-up tax on

the Company’s earnings in Barbados. In addition the Company

recorded a deferred income tax charge of $11.5 million (part of the

$12 million in the above table) for the revaluation of deferred tax

assets and liabilities in Barbados as a result of the increase in

the Barbados corporate tax rate to 9%.

As noted in the above table, the retroactive impact of the GMT

for the first quarter of fiscal 2024 has been accounted for in the

Company's second quarter results. The Company's adjusted effective

income tax rate for the six months ended June 30, 2024 was 18.3%,

as noted in the above table, which is in line with the Company's

expected adjusted effective income tax rate for the full year.

Non-GAAP financial measures and related

ratiosThis press release includes references to certain

non-GAAP financial measures, as well as non-GAAP ratios as

described below. These non-GAAP measures do not have any

standardized meanings prescribed by International Financial

Reporting Standards (IFRS) and are therefore unlikely to be

comparable to similar measures presented by other companies.

Accordingly, they should not be considered in isolation or as a

substitute for measures of performance prepared in accordance with

IFRS. The terms and definitions of the non-GAAP measures used in

this press release and a reconciliation of each non-GAAP measure to

the most directly comparable IFRS measure are provided below.

Certain adjustments to non-GAAP measuresAs noted above certain

of our non-GAAP financial measures and ratios exclude the variation

caused by certain adjustments that affect the comparability of the

Company's financial results and could potentially distort the

analysis of trends in its business performance. Adjustments which

impact more than one non-GAAP financial measure and ratio are

explained below:

Restructuring and acquisition-related (recovery)

costsRestructuring and acquisition-related costs are comprised of

costs directly related to significant exit activities, including

the closure of business locations and sale of business locations or

the relocation of business activities, significant changes in

management structure, as well as transaction, exit, and integration

costs incurred pursuant to business acquisitions. Restructuring and

acquisition-related costs is included as an adjustment in arriving

at adjusted operating income, adjusted operating margin, adjusted

net earnings, adjusted earnings before income taxes, adjusted

diluted EPS, and adjusted EBITDA. For the three and six months

ended June 30, 2024, restructuring and acquisition-related

recoveries of $2.9 million and $2.1 million (2023 - $30.0 million

costs and $32.8 million costs), respectively, were recognized.

Refer to subsection 5.5.5 entitled “Restructuring and

acquisition-related (recovery) costs” in our interim MD&A for a

detailed discussion of these costs.

Net insurance gainsDuring fiscal year 2023, the Company

recognized net insurance gains of $74.0 million and $77.3 million

for the three and six months ended July 2, 2023, respectively,

which related to the two hurricanes which impacted the Company’s

operations in Central America in November 2020. Net insurance gains

related to the recognition of insurance recoveries for business

interruption losses and insurance recoveries for damaged equipment

as follows:

- Insurance gains relating to recoveries for business

interruption losses for the three and six months ended July 2, 2023

were $74.2 million and were recorded in insurance gains, and

included as an adjustment in arriving at adjusted operating income,

adjusted operating margin, adjusted earnings before income taxes,

adjusted net earnings, adjusted diluted EPS, and adjusted

EBITDA.

- Net insurance gains and losses relating to recoveries for

damaged equipment for the three and six months ended July 2, 2023,

were $0.2 million (loss) and $3.1 million (gain), respectively,

were recorded in cost of sales and included as an adjustment in

arriving at adjusted gross profit and adjusted gross margin,

adjusted operating income, adjusted operating margin, adjusted

earnings before income taxes, adjusted net earnings, adjusted

diluted EPS, and adjusted EBITDA.

Gain on sale and leasebackDuring the first quarter of 2023, the

Company recognized a gain of $25.0 million ($15.5 million after

reflecting $9.5 million of income tax expense) on the sale and

leaseback of one of our distribution centres located in the U.S.

The impact of this gain was included as an adjustment in arriving

at adjusted operating income, adjusted operating margin, adjusted

earnings before income taxes, adjusted income tax expense, adjusted

net earnings, adjusted diluted EPS, and adjusted EBITDA.

Costs relating to proxy contest and leadership

changes and related mattersOn December 11, 2023, the Company’s then

Board of Directors (the “Previous Board”) terminated the Company’s

President and Chief Executive Officer, Glenn Chamandy. On such

date, the Previous Board appointed Vince Tyra as President and

Chief Executive Officer, and Mr. Tyra took office in the first

quarter of fiscal 2024, effective on January 15, 2024. Following

the termination of Mr. Chamandy, dissenting shareholder Browning

West and others initiated an activist campaign and proxy contest

against the Previous Board, proposing a new slate of Directors and

requesting the reinstatement of Mr. Chamandy as President and Chief

Executive Officer. In the second quarter of 2024, on April 28,

2024, in advance of the May 28, 2024 Annual General Meeting of

Shareholders (“Annual Meeting”), the Previous Board announced a

refreshed Board of Directors (“Refreshed Board”) that resulted in

the immediate replacement of five Directors, with two additional

Directors staying on temporarily but not standing for re-election

at the Annual Meeting. On May 23, 2024, five days prior to the

Annual Meeting, the Refreshed Board and Mr. Tyra resigned, along

with Arun Bajaj, the Company’s Executive Vice-President, Chief

Human Resources Officer (CHRO) and Legal Affairs. The Refreshed

Board appointed Browning West nominees to the Board of Directors

(the “New Board”), effective as of that date. On May 24, 2024, the

New Board reinstated Mr. Chamandy as President and Chief Executive

Officer. On May 28, 2024, the New Board was elected by shareholders

at the Annual Meeting. During this six month timeline, the Company

incurred significant expenses primarily at the direction of the

Previous Board and the Refreshed Board, including: (i) legal,

communication, proxy advisory, financial and other advisory fees

relating to the proxy contest and the termination of Mr. Chamandy;

(ii) legal, financial and other advisory fees with respect to a

review process initiated by the Previous Board following receipt of

a confidential non-binding expression of interest to acquire the

Company; (iii) special senior management retention awards; (iv)

severance and termination benefits relating to outgoing executives;

and (v) incremental director meeting fees and insurance premiums.

In addition, subsequent to the Annual Meeting, the Corporate

Governance and Social Responsibility Committee (the "CGSRC")

recommended to the New Board, and the New Board approved, back-pay

compensation for Mr. Chamandy (who did not receive any severance

payment following his termination on December 11, 2023) relating to

his reinstatement, including the reinstatement of share-based

awards that were canceled by the Previous Board. In light of the

strong shareholder support received for its successful campaign and

the fact that the Refreshed Board resigned in advance of the Annual

Meeting, the CGSRC also recommended to the New Board, and the New

Board approved, the reimbursement of Browning West’s legal and

other advisory expenses relating to the proxy contest, in the

amount of $9.4 million.

The total costs relating to these non-recurring events (“Costs

relating to proxy contest and leadership changes and related

matters”) amounted to $76.8 million for the first six months of

2024, as itemized in the table below and corresponding footnotes.

Such costs are included in selling, general and administrative

expenses. The impact of the below charges are included as

adjustments in arriving at adjusted SG&A expenses, adjusted

SG&A expenses as a percentage of net sales, adjusted operating

income, adjusted operating margin, adjusted earnings before income

taxes, adjusted net earnings, adjusted diluted EPS, and adjusted

EBITDA.

|

(in $ millions) |

Q2 2024 |

Q2 2023 |

YTD 2024 |

YTD 2023 |

| Advisory fees on shareholder matters(1) |

18.0 |

— |

33.3 |

— |

| Severance and other termination benefits(2) |

21.6 |

— |

21.6 |

— |

| Compensation expenses relating to Glenn Chamandy’s termination

and subsequent reinstatement as President and Chief Executive

Officer(3) |

7.8 |

— |

8.9 |

— |

| Incremental costs relating to the previous Board and refreshed

Board(4) |

7.4 |

— |

7.4 |

— |

| Costs relating to assessing external interests in acquiring the

Company(5) |

0.5 |

— |

3.0 |

— |

| Special retention

awards(6) |

1.9 |

— |

2.6 |

— |

|

Costs relating to proxy contest and leadership changes and related

matters |

57.2 |

— |

76.8 |

— |

(1) Relates to advisory, legal and other expenses

for the proxy contest and shareholder matters. Charges incurred

during the three and six months ended June 30, 2024 of $18.0

million and $33.3 million, respectively, include:

- $8.6 million and $24.0 million for the

three and six months ended June 30, 2024 respectively, of advisory,

legal and other fees and expenses related to the proxy contest and

shareholder matters that were incurred at the direction of the

Previous Board and the Refreshed Board;

- $9.4 million of accrued expenses in

the second quarter of 2024 for the reimbursement of advisory, legal

and other fees and expenses incurred by Browning West in relation

to the proxy contest (refer to note 8(c) of the condensed interim

consolidated financial statements for additional information).

(2) Relates to the payout of severance and other

termination benefits to Mr. Tyra and Mr. Bajaj pursuant to existing

severance arrangements approved and made by the Refreshed Board in

the context of the proxy contest, just prior to its conclusion in

May 2024. The cash payouts in the second quarter of 2024 for

severance and termination benefits totaled $24.4 million, of which

$15.3 million was for Mr. Tyra and $9.1 million was for Mr. Bajaj.

The respective charges included in selling, general and

administrative expenses during the second quarter of 2024 totaled

$21.6 million (of which $14.1 million was for Mr. Tyra and

$7.5 million was for Mr. Bajaj), and include $12.3 million for

accelerated vesting of share-based awards as well $9.3 million in

other termination benefits for these executives.

(3) Salary and other accrued benefits relate to

back-pay as part of the reinstatement of Mr. Chamandy by the New

Board, including the reinstatement of share-based awards which had

been canceled by the Previous Board. Net charges incurred during

the second quarter of 2024 of $7.8 million ($8.9 million

year-to-date), include:

- $1.7 million for backpay and accruals

for short-term incentive plan benefits;

- $14.6 million of stock-based

compensation expense for past service costs related to the

reinstatement of Mr. Chamandy’s 2022 and 2023 long-term

incentive program (LTIP) grants (for which a reversal of

compensation expense of approximately $6 million was recorded in

the fourth quarter of fiscal 2023);

- $1.3 million ($2.4 million

year-to-date) of stock-based compensation expense adjustments

relating to Mr. Chamandy’s 2021 LTIP share-based grant which

vested in 2024; and

- The reversal of a $9.8 million accrual

for severance in the second quarter of 2024 (which had been accrued

for in the fourth quarter of 2023), as Mr. Chamandy forfeited any

termination benefit entitlement in connection with the award of

back-pay and reinstatement of canceled share-based awards as noted

above.

(4) During fiscal 2024 the Company incurred $7.4

million of incremental costs relating to the Previous Board and

Refreshed Board. These charges include $4.8 million for a Directors

and Officers run off insurance policy, $0.4 million for special

board meeting fee payments, and $2.2 million for the increase in

value of the deferred share units (DSU) liability.

(5) Relates to advisory, legal and other expenses

with respect to the announced review process initiated by the

Previous Board following receipt of a confidential non-binding

expression of interest to acquire the Company. The Company incurred

$0.5 million and $3.0 million for the three and six months ended

June 30, 2024, respectively, of expenses related to this

matter.

(6) Stock-based compensation relating to special

retention awards of $1.9 million in the second quarter of fiscal

2024 ($2.6 million year-to-date). At the grant date, these special

retention awards had a total fair value of $8.6 million. The

stock-based compensation expense relating to these awards is being

recognized over the respective vesting periods, with most of the

awards originally vesting at the end of 2024. In connection with

the departure of Mr. Bajaj, $2.5 million of these awards were

fully paid out in cash to him during the second quarter of 2024, as

part of the $9.1 million payout in note 2 above.

Adjusted net earnings and adjusted diluted EPSAdjusted net

earnings are calculated as net earnings before restructuring and

acquisition-related costs, impairment (impairment reversal) of

intangible assets, net of write-downs, net insurance gains, gain on

sale and leaseback, costs relating to proxy contest and leadership

changes and related matters, and income tax expense or recovery

relating to these items. Adjusted net earnings also excludes income

taxes related to the re-assessment of the probability of

realization of previously recognized or de-recognized deferred

income tax assets, and income taxes relating to the revaluation of

deferred income tax assets and liabilities as a result of statutory

income tax rate changes in the countries in which we operate.

Adjusted diluted EPS is calculated as adjusted net earnings divided

by the diluted weighted average number of common shares

outstanding. The Company uses adjusted net earnings and adjusted

diluted EPS to measure its net earnings performance from one period

to the next, and in making decisions regarding the ongoing

operations of its business, without the variation caused by the

impacts of the items described above. The Company excludes these

items because they affect the comparability of its net earnings and

diluted EPS and could potentially distort the analysis of net

earnings trends in its business performance. The Company believes

adjusted net earnings and adjusted diluted EPS are useful to

investors because they help identify underlying trends in our

business that could otherwise be masked by certain expenses,

write-offs, charges, income or recoveries that can vary from period

to period. Excluding these items does not imply they are

non-recurring. These measures do not have any standardized meanings

prescribed by IFRS and are therefore unlikely to be comparable to

similar measures presented by other companies.

|

(in $ millions, except per share amounts) |

Q2 2024 |

Q2 2023 |

YTD 2024 |

YTD 2023 |

| Net earnings |

58.4 |

155.3 |

137.1 |

252.9 |

| Adjustments for: |

|

|

|

|

|

Restructuring and acquisition-related (recovery) costs |

(2.9) |

30.0 |

(2.1) |

32.8 |

|

Net insurance gains |

— |

(74.0) |

— |

(77.3) |

|

Gain on sale and leaseback |

— |

— |

— |

(25.0) |

|

Costs relating to proxy contest and leadership changes and related

matters |

57.2 |

— |

76.8 |

— |

|

Income tax expense relating to restructuring charges and other

items |

0.5 |

1.0 |

0.5 |

10.5 |

|

Income tax recovery related to the revaluation of deferred income

tax assets and liabilities |

11.5 |

— |

11.5 |

— |

|

Adjusted net earnings |

124.7 |

112.3 |

223.8 |

193.9 |

| Basic EPS |

0.35 |

0.87 |

0.81 |

1.42 |

| Diluted EPS |

0.35 |

0.87 |

0.81 |

1.41 |

| Adjusted diluted

EPS(1) |

0.74 |

0.63 |

1.33 |

1.08 |

(1) This is a non-GAAP ratio. It is calculated

as adjusted net earnings divided by the diluted weighted average

number of common shares outstanding.

Adjusted earnings before income taxes, adjusted income tax

expense, and adjusted effective income tax rateAdjusted effective

income tax rate is defined as adjusted income tax expense divided

by adjusted earnings before income taxes. Adjusted earnings before

income taxes excludes restructuring and acquisition-related

(recovery) costs, impairment (impairment reversal) of intangible

assets, net of write-downs, net insurance gains, gain on sale and

leaseback, and costs relating to proxy contest and leadership

changes and related matters. Adjusted income tax expense is defined

as income tax expense excluding tax rate changes resulting in the

revaluation of deferred income tax assets and liabilities, income

taxes relating to the re-assessment of the probability of

realization of previously recognized or de-recognized deferred

income tax assets, and income tax expense relating to restructuring

charges and other adjustments. The Company excludes these

adjustments because they affect the comparability of its effective

income tax rate. The Company believes the adjusted effective income

tax rate provides a clearer understanding of our normalized

effective tax rate and operating performance for the current period

and for purposes of developing its annual financial budgets. The

Company believes that adjusted effective income tax rate is useful

to investors in assessing the Company's future effective income tax

rate as it identifies certain pre-tax expenses and gains and income

tax charges and recoveries which are not expected to recur on a

regular basis (in particular, non-recurring costs such as proxy

contest and leadership changes and related matters incurred in the

Company’s Canadian legal entity which do not result in tax

recoveries, and tax rate changes resulting in the revaluation of

deferred income tax assets and liabilities).

|

(in $ millions) |

Q2 2024 |

Q2 2023 |

YTD 2024 |

YTD 2023 |

| Earnings before income taxes |

116.9 |

162.0 |

199.3 |

273.0 |

| Adjustments for: |

|

|

|

|

|

Restructuring and acquisition-related (recovery) costs |

(2.9) |

30.0 |

(2.1) |

32.8 |

|

Net insurance gains |

— |

(74.0) |

— |

(77.3) |

|

Gain on sale and leaseback |

— |

— |

— |

(25.0) |

|

Costs relating to proxy contest and leadership changes and related

matters |

57.2 |

— |

76.8 |

— |

|

Adjusted earnings before income taxes |

171.2 |

118.0 |

274.0 |

203.5 |

| Income tax expense |

58.5 |

6.7 |

62.2 |

20.1 |

| Adjustments for: |

|

|

|

|

|

Income tax expense relating to restructuring charges and other

adjustments above |

(0.5) |

(1.0) |

(0.5) |

(10.5) |

|

Tax rate changes resulting in the revaluation of deferred income

tax assets and liabilities |

(11.5) |

— |

(11.5) |

— |

|

Adjusted income tax expense |

46.5 |

5.7 |

50.2 |

9.6 |

| Average effective income

tax rate(1) |

50.1 % |

4.1 % |

31.2 % |

7.4 % |

| Adjusted effective

income tax rate(2) |

27.2 % |

4.8 % |

18.3 % |

4.7 % |

(1) Average effective income tax rate is

calculated as income tax expense divided by earnings before income

taxes.(2) This is a non-GAAP ratio. It is calculated as adjusted

income tax expense divided by adjusted earnings before income

taxes.

Adjusted gross profit and adjusted gross marginAdjusted gross

profit is calculated as gross profit excluding the impact of net

insurance gains in fiscal 2023. The Company uses adjusted gross

profit and adjusted gross margin to measure its performance at the

gross margin level from one period to the next, without the

variation caused by the impacts of the item described above. The

Company excludes this item because it affects the comparability of

its financial results and could potentially distort the analysis of

trends in its business performance. Excluding this item does not

imply that it is non-recurring. The Company believes adjusted gross

profit and adjusted gross margin are useful to management and

investors because they help identify underlying trends in our

business in how efficiently the Company uses labor and materials

for manufacturing goods to our customers that could otherwise be

masked by the impact of net insurance gains in prior years. These

measures do not have any standardized meanings prescribed by IFRS

and are therefore unlikely to be comparable to similar measures

presented by other companies.

|

(in $ millions, or otherwise indicated) |

Q2 2024 |

Q2 2023 |

YTD 2024 |

YTD 2023 |

| Gross profit |

262.0 |

216.6 |

473.1 |

404.3 |

| Adjustment for: |

|

|

|

|

|

Net insurance losses (gains) |

— |

0.2 |

— |

(3.1) |

| Adjusted gross

profit |

262.0 |

216.8 |

473.1 |

401.2 |

| Gross margin |

30.4 % |

25.8 % |

30.4 % |

26.2 % |

| Adjusted gross

margin(1) |

30.4 % |

25.8 % |

30.4 % |

26.0 % |

(1) This is a non-GAAP ratio. It is calculated

as adjusted gross profit divided by net sales.

Adjusted SG&A expenses and adjusted SG&A expenses as a

percentage of net salesAdjusted SG&A expenses is calculated as

selling, general and administrative expenses excluding the impact

of costs relating to proxy contest and leadership changes and

related matters. The Company uses adjusted SG&A expenses and

adjusted SG&A expenses as a percentage of net sales to measure

its performance from one period to the next, without the variation

caused by the impact of the items described above. Excluding these

items does not imply they are non-recurring. The Company believes

adjusted SG&A expenses and adjusted SG&A expenses as a

percentage of net sales are useful to investors because they help

identify underlying trends in our business that could otherwise be

masked by certain expenses and write-offs that can vary from period

to period. These measures do not have any standardized meanings

prescribed by IFRS and are therefore unlikely to be comparable to

similar measures presented by other companies.

|

(in $ millions, or otherwise indicated) |

Q2 2024 |

Q2 2023 |

YTD 2024 |

YTD 2023 |

| SG&A expenses |

123.6 |

78.1 |

228.9 |

159.9 |

| Adjustment for: |

|

|

|

|

|

Costs relating to proxy contest and leadership changes and related

matters |

57.2 |

— |

76.8 |

— |

|

Adjusted SG&A expenses |

66.4 |

78.1 |

152.1 |

159.9 |

| SG&A expenses as a

percentage of net sales |

14.3 % |

9.3 % |

14.7 % |

10.4 % |

| Adjusted SG&A

expenses as a percentage of net sales(1) |

7.7 % |

9.3 % |

9.8 % |

10.4 % |

(1) This is a non-GAAP ratio. It is calculated as adjusted

SG&A expenses divided by net sales.

Adjusted operating income and adjusted operating marginAdjusted

operating income is calculated as operating income before

restructuring and acquisition-related costs, and also excludes

impairment (impairment reversal) of intangible assets, net

insurance gains, gain on sale and leaseback, and costs relating to

proxy contest and leadership changes and related matters.

Management uses adjusted operating income and adjusted operating

margin to measure its performance at the operating income level as

we believe it provides a better indication of our operating

performance and facilitates the comparison across reporting

periods, without the variation caused by the impacts of the items

described above. The Company excludes these items because they

affect the comparability of its financial results and could

potentially distort the analysis of trends in its operating income

and operating margin performance. The Company believes adjusted

operating income and adjusted operating margin are useful to

investors because they help identify underlying trends in our

business in how efficiently the Company generates profit from its

primary operations that could otherwise be masked by the impact of

the items noted above that can vary from period to period.

Excluding these items does not imply they are non-recurring. These

measures do not have any standardized meanings prescribed by IFRS

and are therefore unlikely to be comparable to similar measures

presented by other companies.

|

(in $ millions, or otherwise indicated) |

Q2 2024 |

Q2 2023 |

YTD 2024 |

YTD 2023 |

| Operating income |

141.2 |

182.7 |

246.3 |

310.7 |

| Adjustments for: |

|

|

|

|

|

Restructuring and acquisition-related (recovery) costs |

(2.9) |

30.0 |

(2.1) |

32.8 |

|

Net insurance gains |

— |

(74.0) |

— |

(77.3) |

|

Gain on sale and leaseback |

— |

— |

— |

(25.0) |

|

Costs relating to proxy contest and leadership changes and related

matters |

57.2 |

— |

76.8 |

— |

|

Adjusted operating income |

195.5 |

138.7 |

321.0 |

241.2 |

| Operating margin |

16.4 % |

21.7 % |

15.8 % |

20.1 % |

| Adjusted operating

margin(1) |

22.7 % |

16.5 % |

20.6 % |

15.6 % |

(1) This is a non-GAAP ratio. It is calculated

as adjusted operating income divided by net sales.

Adjusted EBITDAAdjusted EBITDA is calculated as

earnings before financial expenses net, income taxes, and

depreciation and amortization, and excludes the impact of

restructuring and acquisition-related costs. Adjusted EBITDA also

excludes impairment (impairment reversal) of intangible assets, net

insurance gains, the gain on sale and leaseback, and costs relating

to proxy contest and leadership changes and related matters.

Management uses adjusted EBITDA, among other measures, to

facilitate a comparison of the profitability of its business on a

consistent basis from period-to-period and to provide a more

complete understanding of factors and trends affecting our

business. The Company also believes this measure is commonly used

by investors and analysts to assess profitability and the cost

structure of companies within the industry, as well as measure a

company’s ability to service debt and to meet other payment

obligations, or as a common valuation measurement. The Company

excludes depreciation and amortization expenses, which are non-cash

in nature and can vary significantly depending upon accounting

methods or non-operating factors. Excluding these items does not

imply they are non-recurring. This measure does not have any

standardized meanings prescribed by IFRS and is therefore unlikely

to be comparable to similar measures presented by other

companies.

|

(in $ millions) |

Q2 2024 |

Q2 2023 |

YTD 2024 |

YTD 2023 |

| Net earnings |

58.4 |

155.3 |

137.1 |

252.9 |

| Restructuring and acquisition-related (recovery) costs |

(2.9) |

30.0 |

(2.1) |

32.8 |

| Net insurance gains |

— |

(74.0) |

— |

(77.3) |

| Gain on sale and leaseback |

— |

— |

— |

(25.0) |

| Costs relating to proxy contest and leadership changes and

related matters |

57.2 |

— |

76.8 |

— |

| Depreciation and amortization |

36.8 |

31.6 |

68.4 |

59.5 |

| Financial expenses, net |

24.3 |

20.7 |

47.0 |

37.7 |

| Income tax

expense |

58.5 |

6.7 |

62.2 |

20.1 |

|

Adjusted EBITDA |

232.3 |

170.3 |

389.4 |

300.7 |

Free cash flow Free cash flow is defined as cash flow from

operating activities, less cash flow used in investing activities

excluding cash flows relating to business acquisitions. The Company

considers free cash flow to be an important indicator of the

financial strength and liquidity of its business, and it is a key

metric used by management in managing capital as it indicates how

much cash is available after capital expenditures to repay debt, to

pursue business acquisitions, and/or to redistribute to its

shareholders. Management believes that free cash flow also provides

investors with an important perspective on the cash available to us

to service debt, fund acquisitions, and pay dividends. In addition,

free cash flow is commonly used by investors and analysts when

valuing a business and its underlying assets. This measure does not

have any standardized meanings prescribed by IFRS and is therefore

unlikely to be comparable to similar measures presented by other

companies.

|

(in $ millions) |

Q2 2024 |

Q2 2023 |

YTD 2024 |

YTD 2023 |

| Cash flows from (used in)

operating activities |

140.1 |

181.8 |

112.7 |

2.4 |

| Cash flows from (used in) investing activities |

(36.2) |

(55.8) |

(80.1) |

(78.6) |

| Adjustment for: |

|

|

|

|

|

Business acquisitions |

— |

— |

— |

— |

|

Free cash flow |

103.9 |

126.0 |

32.6 |

(76.2) |

Total debt and net debtTotal debt is defined as the

total bank indebtedness, long-term debt (including any current

portion), and lease obligations (including any current portion),

and net debt is calculated as total debt net of cash and cash

equivalents. The Company considers total debt and net debt to be

important indicators for management and investors to assess the

financial position and liquidity of the Company, and measure its

financial leverage. These measures do not have any standardized

meanings prescribed by IFRS and are therefore unlikely to be

comparable to similar measures presented by other companies.

|

(in $ millions) |

Jun 30, 2024 |

Dec 31, 2023 |

| Long-term debt (including

current portion) |

1,219.0 |

985.0 |

| Bank indebtedness |

— |

— |

| Lease obligations

(including current portion) |

109.6 |

98.1 |

| Total debt |

1,328.6 |

1,083.1 |

| Cash and cash

equivalents |

(90.3) |

(89.6) |

|

Net debt |

1,238.3 |

993.4 |

Net debt leverage ratio The net debt leverage ratio is defined

as the ratio of net debt to pro-forma adjusted EBITDA for the

trailing twelve months, all of which are non-GAAP measures. The

pro-forma adjusted EBITDA for the trailing twelve months reflects

business acquisitions made during the period, as if they had

occurred at the beginning of the trailing twelve month period. The

Company has currently set a net debt leverage target ratio of 1.5

to 2.5 times pro-forma adjusted EBITDA for the trailing twelve

months (previously 1.5 to 2.0 times). The net debt leverage ratio

serves to evaluate the Company's financial leverage and is used by

management in its decisions on the Company's capital structure,

including financing strategy. The Company believes that certain

investors and analysts use the net debt leverage ratio to measure

the financial leverage of the Company, including our ability to pay

off our incurred debt. The Company's net debt leverage ratio

differs from the net debt to EBITDA ratio that is a covenant in our

loan and note agreements, and therefore the Company believes it is

a useful additional measure. This measure does not have any

standardized meanings prescribed by IFRS and is therefore unlikely

to be comparable to similar measures presented by other

companies.

|

(in $ millions, or otherwise indicated) |

Jun 30, 2024 |

Dec 31, 2023 |

| Adjusted EBITDA for the

trailing twelve months |

763.1 |

674.5 |

| Adjustment for: |

|

|

|

Business acquisitions |

— |

— |

|

Pro-forma adjusted EBITDA for the trailing twelve months |

763.1 |

674.5 |

| Net debt |

1,238.3 |

993.4 |

| Net debt leverage

ratio(1) |

1.6 |

1.5 |

(1) The Company's total net debt to EBITDA ratio for purposes of

its loan and note agreements was 1.8 at June 30, 2024.

Caution Concerning Forward-Looking

Statements

Certain statements included in this press release constitute

“forward-looking statements” within the meaning of the U.S. Private

Securities Litigation Reform Act of 1995 and Canadian securities

legislation and regulations and are subject to important risks,

uncertainties, and assumptions. This forward-looking information

includes, amongst others, information with respect to our

objectives and the strategies to achieve these objectives, as well

as information with respect to our beliefs, plans, expectations,

anticipations, estimates, and intentions, including, without

limitation, our expectation with regards to net sales, gross

margin, SG&A expenses, restructuring and acquisition-related

costs, operating margin, adjusted operating margin, adjusted

EBITDA, diluted earnings per share, adjusted diluted earnings per

share, income tax rate, free cash flow, return on adjusted average

net assets, net debt to adjusted EBITDA leverage ratios, capital

return and capital investments or expenditures, including our

financial outlook set forth in this press release under the section

“Outlook”. Forward-looking statements generally can be identified

by the use of conditional or forward-looking terminology such as

“may”, “will”, “expect”, “intend”, “estimate”, “project”, “assume”,

“anticipate”, “plan”, “foresee”, “believe”, or “continue”, or the

negatives of these terms or variations of them or similar

terminology. We refer you to the Company’s filings with the

Canadian securities regulatory authorities and the U.S. Securities

and Exchange Commission, as well as the risks described under the

“Financial risk management”, “Critical accounting estimates and

judgments”, and “Risks and uncertainties” sections of our most

recent Management’s Discussion and Analysis for a discussion of the

various factors that may affect the Company’s future results.

Material factors and assumptions that were applied in drawing a

conclusion or making a forecast or projection are also set out

throughout such document and this press release.

Forward-looking information is inherently uncertain and the

results or events predicted in such forward-looking information may

differ materially from actual results or events. Material factors,

which could cause actual results or events to differ materially

from a conclusion, forecast, or projection in such forward-looking

information, include, but are not limited to:

- changes in general economic, financial or geopolitical

conditions globally or in one or more of the markets we serve;

- our ability to implement our growth strategies and plans,

including our ability to bring projected capacity expansion

online;

- the intensity of competitive activity and our ability to

compete effectively;

- our reliance on a small number of significant customers;

- the fact that our customers do not commit to minimum quantity

purchases;

- our ability to anticipate, identify, or react to changes in

consumer preferences and trends;

- our ability to manage production and inventory levels

effectively in relation to changes in customer demand;

- fluctuations and volatility in the prices of raw materials from

current levels and energy related inputs used to manufacture and

transport our products;

- our reliance on key suppliers and our ability to maintain an

uninterrupted supply of raw materials, intermediate materials, and

finished goods;

- the impact of climate, political, social, and economic risks,

natural disasters, epidemics, pandemics and endemics, such as the

COVID-19 pandemic, in the countries in which we operate or sell to,

or from which we source production;

- disruption to manufacturing and distribution activities due to

such factors as operational issues, disruptions in transportation

logistic functions, labour disruptions, political or social

instability, weather-related events, natural disasters, epidemics

and pandemics, such as the COVID-19 pandemic, and other unforeseen

adverse events;

- compliance with applicable trade, competition, taxation,

environmental, health and safety, product liability, employment,

patent and trademark, corporate and securities, licensing and

permits, data privacy, bankruptcy, anti-corruption, and other laws

and regulations in the jurisdictions in which we operate;

- the imposition of trade remedies, or changes to duties and

tariffs, international trade legislation, bilateral and

multilateral trade agreements and trade preference programs that

the Company is currently relying on in conducting its manufacturing

operations or the application of safeguards thereunder;

- elimination of government subsidies and credits that we

currently benefit from, and the non-realization of anticipated new

subsidies and credits;

- factors or circumstances that could increase our effective

income tax rate, including the outcome of any tax audits or changes

to applicable tax laws or treaties;

- changes to and failure to comply with consumer product safety

laws and regulations;

- changes in our relationship with our employees or changes to

domestic and foreign employment laws and regulations;

- our reliance on key management and our ability to attract

and/or retain key personnel;

- negative publicity as a result of actual, alleged, or perceived

violations of human rights, labour and environmental laws or

international labour standards, or unethical labour or other

business practices by the Company or one of its third-party

contractors;

- our ability to protect our intellectual property rights;

- operational problems with our information systems or those of

our service providers as a result of system failures, viruses,

security and cyber security breaches, disasters, and disruptions

due to system upgrades or the integration of systems;

- an actual or perceived breach of data security;

- rapid developments in artificial intelligence;

- our ability to successfully integrate acquisitions and realize

expected benefits and synergies;

- changes in accounting policies and estimates; and

- exposure to risks arising from financial instruments, including

credit risk on trade accounts receivables and other financial

instruments, liquidity risk, foreign currency risk, and interest

rate risk, as well as risks arising from commodity prices.

These factors may cause the Company’s actual performance and

financial results in future periods to differ materially from any

estimates or projections of future performance or results expressed

or implied by such forward-looking statements. Forward-looking

statements do not take into account the effect that transactions or

non-recurring or other special items announced or occurring after

the statements are made may have on the Company’s business. For

example, they do not include the effect of business dispositions,

acquisitions, other business transactions, asset write-downs, asset

impairment losses, or other charges announced or occurring after

forward-looking statements are made. The financial impact of such

transactions and non-recurring and other special items can be

complex and necessarily depends on the facts particular to each of

them.

There can be no assurance that the expectations represented by

our forward-looking statements will prove to be correct. The

purpose of the forward-looking statements is to provide the reader

with a description of management’s expectations regarding the

Company’s future financial performance and may not be appropriate

for other purposes. Furthermore, unless otherwise stated, the

forward-looking statements contained in this press release are made

as of the date hereof, and we do not undertake any obligation to

update publicly or to revise any of the included forward-looking

statements, whether as a result of new information, future events,

or otherwise unless required by applicable legislation or

regulation. The forward-looking statements contained in this press

release, including our updated financial outlook for the 2024

fiscal year under the section "2024 Outlook", are expressly

qualified by this cautionary statement.

About Gildan

Gildan is a leading manufacturer of everyday basic apparel. The

Company’s product offering includes activewear, underwear and

socks, sold to a broad range of customers, including wholesale

distributors, screenprinters or embellishers, as well as to

retailers that sell to consumers through their physical stores

and/or e-commerce platforms and to global lifestyle brand

companies. The Company markets its products in North America,

Europe, Asia Pacific, and Latin America, under a diversified

portfolio of Company-owned brands including Gildan®, American

Apparel®, Comfort Colors®, GOLDTOE® and Peds®.

Gildan owns and operates vertically integrated, large-scale

manufacturing facilities which are primarily located in Central

America, the Caribbean, North America, and Bangladesh. Gildan

operates with a strong commitment to industry-leading labour,

environmental and governance practices throughout its supply chain

in accordance with its comprehensive ESG program embedded in the

Company's long-term business strategy. More information about the

Company and its ESG practices and initiatives can be found at

www.gildancorp.com.

|

Investor inquiries: Jessy Hayem, CFA

Vice-President, Head of Investor Relations (514) 744-8511

jhayem@gildan.com |

Media inquiries:Genevieve GosselinDirector, Global

Communications and Corporate Marketing(514)

343-8814communications@gildan.com |

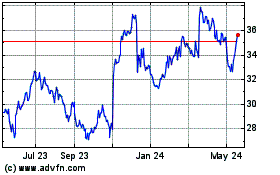

Gildan Activewear (NYSE:GIL)

Historical Stock Chart

From Oct 2024 to Nov 2024

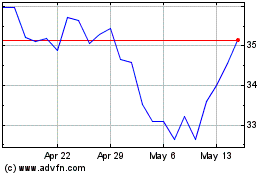

Gildan Activewear (NYSE:GIL)

Historical Stock Chart

From Nov 2023 to Nov 2024