GM Posts Loss but Outlook Brightens -- WSJ

July 30 2020 - 2:02AM

Dow Jones News

By Mike Colias

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (July 30, 2020).

General Motors Co. posted a $758 million second-quarter net loss

mostly due to factory shutdowns in its home U.S. market, although

resilient sales of pricey pickup trucks propelled results beyond

analysts' forecasts.

The company said its U.S. plants are cranking into overdrive to

replenish thinly stocked dealership lots, a sign that its bottom

line could rebound in coming quarters as the company tries to make

up for weeks of lost production this spring from the pandemic. GM

said nearly all its U.S. factories are running at prepandemic

levels.

GM on Wednesday didn't issue a formal 2020 earnings-per-share

forecast, after withdrawing earlier guidance when the pandemic hit.

But finance chief Dhivya Suryadevara said GM could rebound to post

$4 billion to $5 billion in operating profit in the second half of

the year, if U.S. car sales remain resilient and barring any more

Covid-19-related factory disruptions.

GM lost an adjusted 50 cents per share for the April-to-June

period, better than the average analyst estimate of $1.77,

according to FactSet. The pretax profit adjusted for one-time items

was $536 million, compared with a $3 billion profit in the same

period a year earlier.

GM's shares fell more than 2% in midday trading Wednesday.

"The industry has been holding up and recovering well, and

that's especially the case for our full-size truck business," Ms.

Suryadevara told reporters Wednesday.

GM's factory output in North America -- historically the source

of nearly all of its profit -- was frozen for roughly half the

quarter after the company idled plants to comply with

state-mandated quarantines this spring. Still, the company posted a

loss of $101 million in the region, while analysts had expected a

loss of about $1.7 billion, according to FactSet.

Revenue fell 53%, to $16.78 billion, a result of the factory

shutdowns.

GM said it ended the quarter with cash and liquidity of $30.6

billion. Investors remain focused on car companies' ability to

weather potential future waves of Covid-19 outbreaks, according to

a Bank of America research note last week. GM and other major auto

makers burned through billions of dollars in cash this spring after

their plants shut down.

GM and other global auto makers scrambled to hoard cash this

spring as the pandemic spread and operations were suspended for

several weeks, choking off cash flow. GM padded its cash position

by more than $20 billion by drawing down a revolving credit line,

suspending its dividend and issuing unsecured debt.

Car makers reopened most of their U.S. factories in May and in

many cases have ramped up output to near prepandemic levels. Sales

at dealerships also have snapped back more quickly than analysts

predicted when the crisis hit, sparking hope that the industry's

recovery can continue in the second half of the year.

For GM, stronger-than-expected demand for big pickup trucks have

helped avoid sharp losses.

GM executives say they have prioritized output of the company's

big pickup trucks, the Chevrolet Silverado and GMC Sierra, which

saw selling prices rise on average by about $1,500 per vehicle in

the second quarter from the first, to about $47,700, the company

said. The trucks deliver about half of GM's global profit, analysts

estimate.

Many dealers have said they are running low on pickup-truck

models following better-than-expected sales this spring, when GM

offered deep discounts and zero-interest promotions to prevent

sales from cratering during Covid-19 lockdowns.

Analysts expect GM's operating income to rebound in the second

half of the year as the company races to replenish inventory. The

average analyst estimate has GM generating $4 billion in operating

income over the last two quarters of the year, according to

FactSet.

Ms. Suryadevara said GM burned through about $9 billion in cash

during the quarter, mostly from paying suppliers for past

deliveries at a time when its fresh cash flow was frozen because of

the factory shutdowns. She expects GM to generate $7 billion to $9

billion in cash in the second half, assuming sales continue at

about their current pace and there are no further factory

disruptions from the pandemic.

Ms. Suryadevara told reporters GM hopes by year-end to repay a

$16 billion revolving credit line that it drew down this

spring.

China was a second-quarter bright spot for GM, which notched

income of about $200 million there, flat with a year earlier.

Plants gradually reopened after China's Covid-19 outbreak began to

subside in late winter, and vehicle demand has been stronger than

expected.

Write to Mike Colias at Mike.Colias@wsj.com

(END) Dow Jones Newswires

July 30, 2020 02:47 ET (06:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

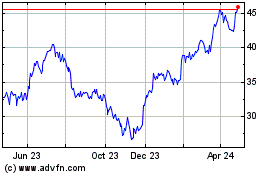

General Motors (NYSE:GM)

Historical Stock Chart

From Mar 2024 to Apr 2024

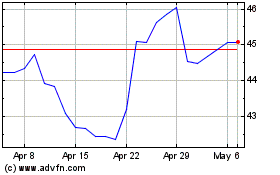

General Motors (NYSE:GM)

Historical Stock Chart

From Apr 2023 to Apr 2024