By Nora Naughton

Fiat Chrysler Automobiles NV is amping up the spotlight on Jeep,

asking dealers to build stand-alone showrooms and rolling out

larger, more expensive models to appeal to more luxury-minded

buyers, including a modern-day Grand Wagoneer.

The company's efforts come as Jeep is facing more competition

than ever in the U.S.'s highly lucrative SUV market and as sales of

its other mass-market brands such as Chrysler and Dodge have

struggled in recent years.

Ford Motor Co. earlier this summer unveiled a new line of Bronco

SUVs that its executives say will take direct aim at Jeep, which

has dominated the off-road-adventure category for decades.

On Thursday, Jeep showed a new version of the Grand Wagoneer, a

long-planned large SUV whose name is a throwback to the simulated

wood-paneled model that became popular in the 1970s. This vehicle,

which is expected to retail for more than $100,000 when fully

loaded, will be one of several big SUVs coming from Jeep in the

next year as Fiat Chrysler aims to move the brand upscale.

As big pickup trucks and SUVs have made a comeback, due in part

to low gasoline prices, brands like Jeep are dusting off historical

nameplates, hoping to play on buyers' sense of nostalgia for once

iconic vehicles.

A Jeep Wagoneer is also in the works, along with a new Grand

Cherokee and another, still-unnamed, large SUV that will have three

rows of seating. Jeep is also pushing to add hybrid, plug-in

options to new and existing models, including the Wrangler, looking

to diversify its lineup further.

"We view this as a time when we cross into a new era," said

Christian Meunier, Jeep's global president.

For Fiat Chrysler, Jeep is among the company's most recognizable

nameplates and a big profit driver in North America. The expansion

of the Jeep brand is critical for Chief Executive Mike Manley, who

is trying to steer the company through a pandemic that is crushing

auto-industry earnings and execute a merger with France's PSA Group

to create one of the world's largest auto makers by sales.

Mr. Manley, who ran Jeep for years before taking the top job,

has tried to move the brand upmarket and expand it globally. He has

pressed to increase sales overseas, particularly in China, and add

smaller Jeeps that can better meet emissions requirements in places

including Europe, where SUVs are rising in popularity.

In the U.S., Fiat Chrysler is constructing a $1.6 billion

factory in Detroit that will build two of the new Jeep models. That

plant is scheduled to open next year.

While Jeep has had success in recent years with its latest

Wrangler, it has struggled with lower-priced models such as the

Renegade and Cherokee, which haven't sold as well and are now

starting to age.

Jeep's sales in the U.S. declined 5% last year to 923,920

vehicles, and the brand's share of the SUV market slipped to 11%, a

percentage point lower than 2018, according to research firm Motor

Intelligence.

Michelle Krebs, an analyst at Cox Automotive, said part of the

challenge ahead for Jeep is that cheaper models have targeted

budget-minded buyers with lower credit scores. That consumer base

is now shrinking in the pandemic-induced recession.

"They've got to get different kinds of customers at the high

end," Ms. Krebs said.

With more buyers flocking to SUVs, particularly as the virus

prompts more Americans to leave cities and avoid air travel, the

bigger Jeeps could be arriving at an optimal time, she added.

Still, they will confront stiff competition. The SUV market has

grown far more crowded over the years as Asian and German car

makers have expanded into bigger offerings.

Ford and General Motors Co. have updated their big

people-haulers in the past few years, hoping to tap this highly

profitable part of the U.S. car business as more buyers move away

from cheaper small cars and sedans.

Fiat Chrysler is hoping to help the brand stand out by

intensifying efforts to build more Jeep-only showrooms.

These showrooms, which aim to separate Jeep from the more

mainstream vehicles offered by Chrysler, Dodge and Ram, have

specialized staff and displays of the latest Jeep accessories and

apparel.

Jeep now has 59 stand-alone showrooms in the U.S. and is

planning a few hundred more in the coming years, mostly in larger

metro areas, a company spokesman said.

Dealers say the larger Jeep models are long overdue, in part

because the lineup now lacks the types of family-oriented vehicles

offered by Ford and GM. That has resulted in customers' abandoning

Jeep when they need to size up, the dealers say.

"The younger buyers love the Wrangler, but what happens as they

get older and have kids?" said Doug Moreland, who recently built a

stand-alone Jeep store in Fort Collins, Colo.

The Grand Wagoneer, which Fiat Chrysler showed as a concept

Thursday, doesn't have the same faux wood paneling made popular by

the older models but instead features a more subtle teak trim in

the roof rails and headlights.

Inside, the new model has multiple multimedia displays,

including one embedded in the dashboard on the passenger side and

others in the second row. The concept shown was a plug-in hybrid,

an option that Jeeps said it is making available on all its future

models.

Jeep will release the Grand Wagoneer and Wagoneer as part a

sub-brand that the company hopes will distinguish these two models

as more premium options, Mr. Meunier said. The Wagoneer, which Fiat

Chrysler has yet to reveal, is expected to start at around $60,000,

he said. The company will start building both models early next

year.

(END) Dow Jones Newswires

September 03, 2020 10:23 ET (14:23 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

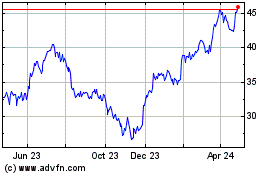

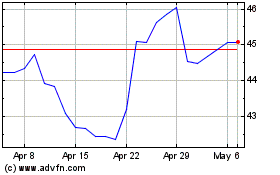

General Motors (NYSE:GM)

Historical Stock Chart

From Mar 2024 to Apr 2024

General Motors (NYSE:GM)

Historical Stock Chart

From Apr 2023 to Apr 2024