Newmont Dealt Merger Setback -- WSJ

March 23 2019 - 2:02AM

Dow Jones News

Investors concerned about terms of deal, such as chairman's

retirement payment

By Alistair MacDonald and Jacquie McNish

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (March 23, 2019).

One of Newmont Mining Corp.'s largest investors wants terms of

the Denver-based company's merger with Goldcorp Inc. renegotiated,

in a potential setback for a deal that would create the world's

largest gold miner.

Joe Foster, who runs the VanEck International Investors Gold

Fund, said Friday that the company's $10 billion merger with

Goldcorp transfers away significant gains from a recently announced

Nevada joint venture with Barrick Gold Corp.

On Thursday, activist investor Paulson & Co. expressed

similar concerns about the merger in a letter to Newmont, first

reported by The Wall Street Journal.

Also on Friday, a large Canadian investment fund, the British

Columbia Investment Management Corporation, said that it wouldn't

back the deal because of a significant retirement payment being

made to Goldcorp's chairman. As of its latest portfolio report

issued last year, BCI was a shareholder in Newmont and

Goldcorp.

The January deal had been struck before the Nevada joint venture

was agreed, Mr. Foster said. VanEck owns almost 6% of Newmont,

spread across different funds, making it one of the five largest

holders of the company's stock.

"I don't think that Goldcorp shareholders are entitled to the

synergies of the Newmont Barrick JV," Mr. Foster said. "I don't

want to see the deal abandoned, I just want to see it

modified."

To be sure, the two investors don't have a large enough

shareholding to block the deal on their own. Investors that like

the deal may not wish to see it postponed by renegotiation.

Some analysts have also criticized the deal. Newmont is "giving

away too much value" by issuing so many shares to Goldcorp holders

under the all-share merger deal, says Adam Graf, a mining analyst

with B. Riley FBR.

The two companies expect to generate $365 million through more

efficient mine management but "the synergies will largely accrue to

Goldcorp shareholders," he said.

Still, the deal has fans. Chris Mancini, an analyst with Gabelli

Gold Fund, said that the merger makes sense because Newmont will

generate more value for both companies' shareholders by doing "a

better job than Goldcorp managing their mining assets."

The interventions come during a frenetic period for large gold

mergers. Barrick agreed in September to buy Randgold Resources Ltd.

for $6 billion in an all-share merger. Activist investors are also

increasingly intervening in this sector, as they complain of low

returns and overly lavish executive compensation.

A spokeswoman for Goldcorp declined to comment. Newmont also

declined to comment.

Investors in both companies will vote next month on the deal,

which already has had a turbulent history. Last month, Barrick

offered $17.85 billion for Newmont in an all-share deal that would

have broken up the Newmont-Goldcorp merger. Newmont offered instead

to create a joint venture with Barrick in Nevada to squeeze

billions of dollars of cost savings. The two sides agreed to a

joint venture after investors, such as Mr. Foster, said they

preferred it over a full merger.

Now, Paulson and VanEck say the joint venture should be

reflected in the terms of Newmont's deal with Goldcorp.

Paulson estimated Newmont shareholders would lose about 35% of

the planned Nevada gains to Goldcorp shareholders under the current

merger agreement. The hedge fund said in its letter that the 17%

premium Newmont is offering Goldcorp shareholders and its potential

gains from Nevada are "unjustified" given Goldcorp's record of

"poor performance."

Paulson said in its letter that it owns 14.2 million shares,

which would rank it as one of Newmont's largest shareholders. It is

unclear when Paulson acquired its stake.

Investors have also criticized the size of postdeal compensation

for Goldcorp's current chief executive and its chairman, which

could be as much as 11 million Canadian dollars ($8.2 million) and

C$12 million, respectively, according to the group.

BCI said in statement that the payment to Goldcorp Chairman Ian

Telfer was "misaligned with the interests of shareholders who have

experienced a significant destruction" of shareholder value.

A spokeswoman for Goldcorp has referred to a circular sent to

investors at the time of the deal that said Mr. Telfer's payment

was "on the basis of Mr. Telfer's role as founder and strategic

leader of Goldcorp." Goldcorp has declined to comment further on

compensation.

Write to Alistair MacDonald at alistair.macdonald@wsj.com and

Jacquie McNish at Jacquie.McNish@wsj.com

(END) Dow Jones Newswires

March 23, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

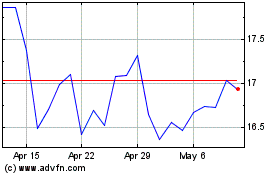

Barrick Gold (NYSE:GOLD)

Historical Stock Chart

From Mar 2024 to Apr 2024

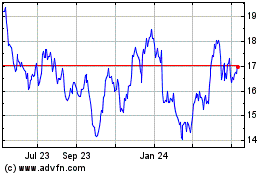

Barrick Gold (NYSE:GOLD)

Historical Stock Chart

From Apr 2023 to Apr 2024