Malaysia Calls for Goldman to Pay Billions -- WSJ

January 19 2019 - 2:02AM

Dow Jones News

By Yantoultra Ngui

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (January 19, 2019).

PUTRAJAYA, Malaysia -- Malaysia's finance minister waved off an

apology from Goldman Sachs Chief Executive David Solomon for the

role of one its then-bankers in the scandal surrounding state

investment fund 1Malaysia Development Bhd., saying it wasn't

enough.

Lim Guan Eng said Friday that the only apology that would matter

is one that comes with full reimbursement and reparations for the

$6.5 billion the 1MDB fund raised with the investment bank's help.

Prosecutors say much of the money was later siphoned off, with

several hundred million dollars going to the personal accounts of

then-leader Najib Razak.

The former prime minister has pleaded not guilty to multiple

charges of money laundering and other offenses.

"Only when you pay reparation and compensation, then that will

be sufficient," Mr. Lim told reporters, saying an appropriate

figure would be $7.5 billion.

He added that Malaysia would consider dropping charges it filed

against Goldman Sachs if it was compensated for the full amount

raised.

"As we have stated previously, Goldman Sachs was lied to by

certain members of the former Malaysian government and 1MDB," a

spokesman for the investment bank said. "We intend to vigorously

contest the charges brought against us."

Goldman Sachs has been dragged into the scandal at 1MDB because

of its role as underwriter and arranger for three bond sales that

raised $6.5 billion for the fund. Much of the total has gone

missing, sparking a multinational investigation from Switzerland to

the U.S. It also contributed to the defeat of Mr. Najib's

government in elections in May.

U.S. prosecutors charged two former Goldman bankers in November

in relation to the theft of billions of dollars from 1MDB.

Tim Leissner, Goldman's former chairman for Southeast Asia,

pleaded guilty to conspiring to launder money and violating

antibribery laws for his role in the affair. The other former

Goldman banker, Roger Ng, was arrested in Malaysia in November at

the request of U.S. authorities.

He is in custody facing extradition to the U.S. to face criminal

charges relating to the scandal and couldn't be reached for

comment. His lawyer couldn't immediately be reached for

comment.

Malaysia also filed criminal charges against Goldman Sachs last

month for its role in arranging the bond issues.

Mr. Solomon, the chief executive, apologized to the Malaysian

people for Mr. Leissner's involvement in the scandal during a

conference call Wednesday to discuss the bank's fourth-quarter

results.

"At least he accepted that they have to bear and shoulder some

responsibility," Mr. Lim said. "But that apology is

insufficient."

Write to Yantoultra Ngui at yantoultra.ngui@wsj.com

(END) Dow Jones Newswires

January 19, 2019 02:47 ET (07:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

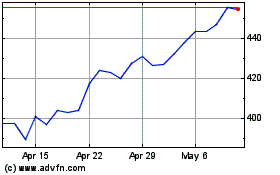

Goldman Sachs (NYSE:GS)

Historical Stock Chart

From Mar 2024 to Apr 2024

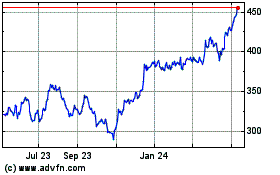

Goldman Sachs (NYSE:GS)

Historical Stock Chart

From Apr 2023 to Apr 2024