HP Inc. (NYSE: HPQ) today announced the completion of its

acquisition of Poly, a leading global provider of workplace

collaboration solutions.

The deal is expected to accelerate HP’s strategy to create a

more growth-oriented portfolio, further strengthen its industry

opportunity in hybrid work solutions, and position the combined

organization for long-term sustainable growth and value creation.

HP expects the transaction, first announced in March, to be

accretive to revenue, non-GAAP operating profit and non-GAAP EPS in

FY23 post-merger.

“This is a historic day for our business as we mark the union of

two iconic companies that are innovating at the heart of hybrid

work,” said Enrique Lores, President and CEO of HP. “Poly brings

incredibly strong talent, differentiated technology, and a

complementary go-to-market system that we believe will further

strengthen our position in large and growing markets. Together, we

will have vast opportunities to innovate for customers and grow our

business as we continue building a stronger HP.”

The merger of HP and Poly comes as businesses and their

employees are focused on finding better ways to work and

collaborate in the hybrid world. Approximately 75% of office

workers are investing to improve their home setups1. Traditional

office spaces are also being reconfigured to support hybrid work

and collaboration, with a focus on meeting room solutions.

Currently, there are more than 90 million rooms, of which less than

10% have video capability2. As a result, the office meeting room

solutions segment is expected to triple by 2024.

Poly brings industry-leading video conferencing solutions,

cameras, headsets, voice and software to HP, allowing customers to

create meeting equity between those in the room and those who

aren’t. The combined organization will deliver a complete ecosystem

of devices, software, and digital services to create premium

employee experiences, improve workforce productivity, and provide

enterprise customers with better visibility, insights, security,

and manageability across their hybrid IT environments.

“As ideas around the role of the traditional office continue to

shift, there is a critical need for organizations to enable rich

collaboration experiences between in-person and remote workers,”

said Patrick Moorhead, CEO and chief analyst, Moor Insights &

Strategy. “Combining Poly and HP is a win-win for both

organizations. More importantly, uniting these two companies will

provide end-users with the essential hardware, software, and

services required to successfully navigate hybrid work experiences

now and into the future.”

The addition of Poly will help HP to drive innovation and scale

in two of its key growth areas: peripherals and workforce

solutions. Peripherals represent a $110 billion segment opportunity

growing 9% annually, driven by the need for more immersive

experiences2. Workforce solutions represent a $120 billion segment

opportunity that is growing 8% annually, as companies invest in

digital services to set up, manage, and secure more distributed IT

ecosystems 2.

With the transaction completed, Poly CEO Dave Shull will join HP

as President, Workforce Services & Solutions, starting November

1. Shull will lead the newly formed organization focused on driving

a more expansive growth agenda across HP’s commercial services

business. He brings extensive global experience spanning

technology, digital media, operational transformation, and business

development to the role. Shull will join the HP executive

leadership team and report to Lores.

Andy Rhodes will run the combined HP-Poly business as General

Manager, Hybrid Work Solutions & Peripherals. Rhodes, who

joined HP in 2018, has previously led the company’s commercial

Personal Systems business and built the global peripherals

organization. Prior to HP, he held a number of senior executive

roles at Dell. Rhodes will continue to report to HP Personal

Systems President, Alex Cho.

HP completed the deal as an all-cash transaction of $40 per

share, implying a total enterprise value of approximately $3.3

billion, inclusive of Poly’s net debt. The transaction was financed

through a combination of balance sheet cash and new debt.

About HP

HP Inc. is a technology company that believes one thoughtful

idea has the power to change the world. Its product and service

portfolio of personal systems, printers, and 3D printing solutions

helps bring these ideas to life. Visit http://www.hp.com.

Cautionary Statement Regarding Forward-Looking

Statements

This document contains statements, estimates, projections or

guidance that constitute forward-looking statements as defined

under the U.S. federal securities laws based on current

expectations and assumptions that involve risks and uncertainties.

If the risks or uncertainties ever materialize or the assumptions

prove incorrect, the results may differ materially from those

expressed or implied by such forward-looking statements and

assumptions. All statements other than statements of historical

fact are statements that could be deemed forward-looking

statements, including, but not limited to, statements regarding the

transaction between HP and Poly, including any statements regarding

the expected benefits of the transaction (including anticipated

accretion to earnings and free cash flow and anticipated EBITDA),

the impact of the transaction on HP’s business, the synergies from

the transaction, future opportunities, and any other statements

regarding HP’s future expectations, beliefs, plans, objectives,

results of operations, financial condition and cash flows, or

future events or performance. Words or phrases such as “future,”

“anticipates,” “believes,” “estimates,” “expects,” “intends,”

“plans,” “targets,” “advances,” “commits,” “drives,” “aims,”

“forecasts,” “approaches,” “seeks,” “schedules,” “predicts,”

“projects,” “will,” “would,” “could,” “should,” “can,” “may,”

“outlook,” “guidance,” “goals,” “objectives,” “strategies,”

“opportunities,” “potential,” and similar terms or expressions are

intended to identify such forward-looking statements. These

statements are not guarantees of future performance and are subject

to certain risks, uncertainties and other factors, many of which

are beyond the companies’ control and are difficult to predict.

Therefore, actual outcomes and results may differ materially from

what is expressed or forecasted in such forward-looking statements.

The reader should not place undue reliance on these forward-looking

statements, which speak only as of the date thereof. Unless legally

required, HP undertakes no obligation to update publicly any

forward-looking statements, whether as a result of new information,

future events or otherwise. Among the important factors that could

cause actual results to differ materially from those in the

forward-looking statements include the effects of disruption to

HP’s or Poly’s respective businesses; the effect of this

communication on HP’s stock price and Poly’s ability to retain key

personnel and maintain relationships with its customers, suppliers

and others with whom it does business; the effects of industry,

market, economic, political or regulatory conditions outside of

HP’s control; HP’s ability to achieve the synergies and benefits

from the transaction, including its integration of the businesses

and technologies; the risk that the integration of HP’s and Poly’s

operations will be materially delayed or will be more costly or

difficult than expected; the nature, cost and outcome of any

litigation and other legal proceedings; the risk that cost savings,

any revenue synergies and other anticipated benefits of the

transaction may not be realized or may take longer than anticipated

to be realized, including as a result of the impact of, or problems

arising from, the integration of the two companies; and unknown

liabilities. Other important factors that could cause actual

results to differ materially from those in the forward-looking

statements are described in HP’s filings with the SEC, including

its Annual Report on Form 10-K for the fiscal year ended October

31, 2021, as well as in Poly’s filings with the SEC, including its

Annual Report on Form 10-K for the fiscal year ended April 2, 2022.

Other unpredictable or unknown factors not discussed in this

document could also have material adverse effects on

forward-looking statements.

| HP

Inc. Media RelationsMediaRelations@hp.com |

HP

Inc. Investor RelationsInvestorRelations@hp.com |

| |

|

|

www.hp.com/go/newsroom |

1 HP Proprietary survey

2 Frost & Sullivan, State of the Global Video Conferencing

Devices Market

| ©Copyright

2022 HP Development Company, L.P. The information contained herein

is subject to change without notice. The only warranties for HP

products and services are set forth in the express warranty

statements accompanying such products and services. Nothing herein

should be construed as constituting an additional warranty. HP

shall not be liable for technical or editorial errors or omissions

contained herein. |

|

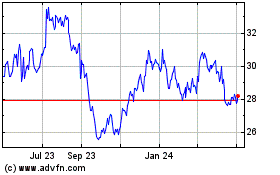

HP (NYSE:HPQ)

Historical Stock Chart

From Mar 2024 to Apr 2024

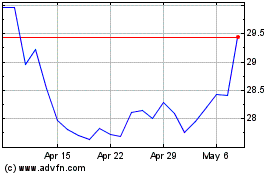

HP (NYSE:HPQ)

Historical Stock Chart

From Apr 2023 to Apr 2024