HSBC Asset Management Appoints Pete Scott to Lead Venture Debt Offering

November 25 2024 - 7:00AM

Business Wire

- Pete Scott appointed Head of Innovation Credit to develop

venture debt proposition

- HSBC AM taps into HSBC Innovation Banking’s origination

platform in venture debt to launch new strategy

HSBC Asset Management (HSBC AM) has appointed Pete Scott as Head

of Innovation Credit as the business extends its alternatives

credit capabilities through the development of its venture debt

strategy.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20241125883255/en/

HSBC Asset Management (HSBC AM) appointed

Pete Scott as Head of Innovation Credit. (Photo: Business Wire)

The new capability is being developed in partnership with HSBC

Innovation Banking, which has become one of the most active

providers of venture debt across the markets it serves. The asset

selection will be managed by HSBC AM, working in partnership with

HSBC Innovation Banking in a similar arrangement to previous direct

lending strategies by HSBC AM.

HSBC AM’s venture debt strategy will invest in a portfolio of

senior secured loans to growth and late-stage VC-backed tech and

life science companies; leveraging HSBC Innovation Banking’s

presence in the UK, US and Europe, as well as other innovation hubs

that the bank serves.

Pete Scott has been appointed to the newly created role of Head

of Innovation Credit to lead the strategy. Bringing over 30 years’

experience in the industry, Pete will be based in San Francisco and

is responsible for building HSBC AM’s venture debt team and

bringing a product to market designed to scale up fast-growing

businesses that are venture capital backed.

Scott McClurg, Head of Private Credit at HSBC AM, said: “We are

delighted to welcome Pete to the team as we extend our alternatives

credit product suite with the launch of our new venture debt

strategy.

“His experience working with start-ups across the US, and

globally, will prove invaluable as we provide our clients access to

the expanding venture debt market and another stream of

proprietorial HSBC originated credit transactions.”

David Sabow, HSBC U.S. Head of Innovation Banking, added: “We

have been elated with the market reception and growth of HSBC

Innovation Banking. Establishing this venture debt capability with

Asset Management expands the breadth of flexible solutions we have

to meet the financing needs of our innovation clients

globally.”

The venture debt strategy will form part of HSBC AM’s ambition

to grow its alternatives capabilities, which include private

markets, private credit, hedge funds, real assets, venture capital

and flexible capital solutions. With a team of 340 dedicated

alternatives staff including over 130 investment professionals,

HSBC Alternatives has combined assets under management and advice

of USD76.1bn as of 30 September 2024.

HSBC Asset Management

HSBC Asset Management should be referred to either in full or as

HSBC AM to avoid confusion with any other financial services

firms.

HSBC Asset Management, the investment management business of the

HSBC Group, invests on behalf of HSBC’s worldwide customer base of

retail and private clients, intermediaries, corporates and

institutions through both segregated accounts and pooled funds.

HSBC Asset Management connects HSBC’s clients with investment

opportunities around the world through an international network of

offices in 22 countries and territories, delivering global

capabilities with local market insight. As at 30 September 2024,

HSBC Asset Management managed assets totalling US$765bn on behalf

of its clients.

For more information see

http://www.global.assetmanagement.hsbc.com/

HSBC Asset Management is the brand name for the asset management

businesses of HSBC Holdings plc.

The HSBC Group

HSBC Holdings plc HSBC Holdings plc, the parent company

of HSBC, is headquartered in London. HSBC serves customers

worldwide from offices in 60 countries and territories. With assets

of US$3,099bn at 30 September 2024, HSBC is one of the world’s

largest banking and financial services organisations.

HSBC Bank USA, National Association (HSBC Bank USA, N.A.)

serves customers through Wealth and Personal Banking, Commercial

Banking, Private Banking, Global Banking, and Markets and

Securities Services. HSBC Innovation Banking is a business division

with services provided in the United States by HSBC Bank USA, N.A.

Deposit products are offered by HSBC Bank USA, N.A., Member FDIC.

It operates Wealth Centers in: California; Washington, D.C.;

Florida; New Jersey; New York; Virginia; and Washington. HSBC Bank

USA, N.A. is the principal subsidiary of HSBC USA Inc., a

wholly-owned subsidiary of HSBC North America Holdings Inc.

For more information, visit: HSBC in the USA

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241125883255/en/

Media enquiries: Rebecca Lyons –

rebecca.lyons@hsbc.com

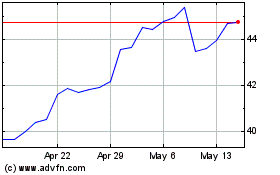

HSBC (NYSE:HSBC)

Historical Stock Chart

From Oct 2024 to Nov 2024

HSBC (NYSE:HSBC)

Historical Stock Chart

From Nov 2023 to Nov 2024