ICE 1Q Net Up as Market Volatility Boosts Exchange Revenue

May 05 2022 - 7:30AM

Dow Jones News

By Rob Curran

Intercontinental Exchange Inc. posted an increase in

first-quarter earnings as energy- and stock-market volatility

boosted revenue at its exchanges, offsetting a slowdown in

mortgage-related operations, which it has recently expanded.

The exchange operator and mortgage-data provider Thursday posted

net income attributable to the company of $657 million, or $1.16 a

share, up from $646 million, or $1.14 a share, a year earlier.

Excluding certain items, the owner of the New York Stock

Exchange and other major exchanges logged adjusted earnings of

$1.43 a share.

Revenue rose 1.2% to $2.46 billion from $2.43 billion, it

said.

Exchange revenue rose 11% to $1.08 billion, with marked strength

in energy-commodities trading revenue, which represented more than

one third of that total and grew by 14%. Oil and natural-gas

futures skyrocketed during the quarter.

Fixed-income and data-services revenue rose 9% to $509 million.

Mortgage-technology revenue slid 13% to $307 million, the company

said.

Intercontinental Exchange on Wednesday said it agreed to buy

mortgage-data company Black Knight Inc. in a cash-and-stock deal

valued at $13.1 billion, expanding its mortgage operations.

Write to Rob Curran at rob.curran@wsj.com

(END) Dow Jones Newswires

May 05, 2022 08:15 ET (12:15 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

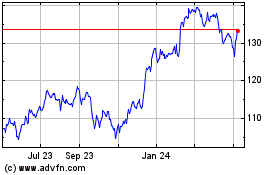

Intercontinental Exchange (NYSE:ICE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Intercontinental Exchange (NYSE:ICE)

Historical Stock Chart

From Apr 2023 to Apr 2024