Intercontinental Exchange Swings to 3Q Loss on Bakkt Investment

November 03 2022 - 7:29AM

Dow Jones News

By Will Feuer

Intercontinental Exchange Inc. swung to a surprise loss in the

third quarter after it took a non-cash charge on its stake in

cryptocurrency platform Bakkt Holdings Inc.

The exchange operator and mortgage-data provider posted a net

loss attributable to the company of $191 million, compared with a

profit of $633 million in the same period a year earlier. On a

per-share basis, the loss came to 34 cents a share, compared with

earnings of $1.12 a share. According to FactSet, analysts were

expecting earnings of 97 cents a share for the quarter.

The company attributed the results to losses at Bakkt, a

cryptocurrency platform that went public about a year ago through a

merger with a special-purpose acquisition company. At the time of

the merger, Intercontinental Exchange held a 68% economic interest

in the company.

Intercontinental Exchange said last week that it would reduce

the carrying value of its stake in Bakkt to about $400 million as

of Sept. 30, down from $1.5 billion on June 30. Shares of Bakkt are

down almost 77% this year.

Stripping out one-time items, adjusted earnings came to $1.31 a

share. Analysts surveyed by FactSet were expecting adjusted

earnings of $1.27 a share.

Revenue rose to $2.39 billion from $2.28 billion. Revenue,

excluding transaction-based expenses, rose to $1.81 billion from

$1.80 billion. Analysts were expecting revenue of $1.80 billion,

according to FactSet.

Write to Will Feuer at Will.Feuer@wsj.com

(END) Dow Jones Newswires

November 03, 2022 08:14 ET (12:14 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

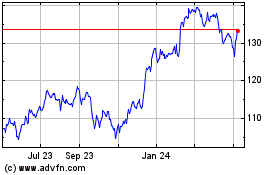

Intercontinental Exchange (NYSE:ICE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Intercontinental Exchange (NYSE:ICE)

Historical Stock Chart

From Apr 2023 to Apr 2024