Johnson & Johnson Raises Full-Year Guidance

April 16 2019 - 6:53AM

Dow Jones News

By Kimberly Chin

Johnson & Johnson raised its full-year financial targets on

Tuesday as it reported sales strength in its pharmaceutical

division, though the company had a weaker showing in its other

segments.

The New Jersey-based company anticipates adjusted earnings this

year to be between $8.53 to $8.63 per share, up from its prior

forecast of $8.50 to $8.65 a share. It expects operational sales to

be between $82 billion and $82.8 billion, up from $81.6 billion to

$82.4 billion as previously targeted.

Sales in its pharmaceuticals division in the U.S. rose 4.1% in

the first quarter to $10.24 billion, driven by sales from its

multiuse treatment Stelara, its blood-disease treatment Imbruvica,

and the multiple myeloma treatment Darzalex. Imbruvica and Darzalex

both received regulatory approvals in the prior quarter.

Meanwhile, sales in its other divisions declined. Revenue from

its consumer segment fell 2.4% to $3.32 billion. Sales in its

medical devices business also fell 4.6%.

Overall sales were flat from a year ago at $20.02 billion though

it was still ahead of analysts polled by Refinitiv's expectations

of $19.61 billion.

Shares rose 1.2% in premarket trading.

J&J's profit fell 14% from the year-ago quarter to $3.75

billion, or $1.39 a share. Analysts expected earnings of $1.67 a

share.

J&J made $2.10 an adjusted share, missing analysts'

estimates by 7 cents.

Write to Kimberly Chin at kimberly.chin@wsj.com

(END) Dow Jones Newswires

April 16, 2019 07:38 ET (11:38 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

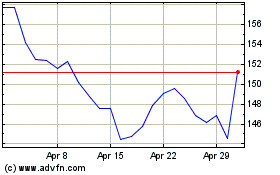

Johnson and Johnson (NYSE:JNJ)

Historical Stock Chart

From Mar 2024 to Apr 2024

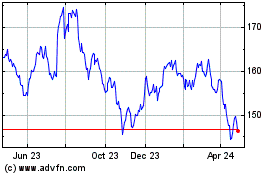

Johnson and Johnson (NYSE:JNJ)

Historical Stock Chart

From Apr 2023 to Apr 2024