Notice of Exempt Solicitation. Definitive Material. (px14a6g)

March 31 2022 - 11:16AM

Edgar (US Regulatory)

NOTICE OF EXEMPT SOLICITATION (VOLUNTARY

SUBMISSION)

NAME OF REGISTRANT: Johnson & Johnson

NAME OF PERSON RELYING ON EXEMPTION: Shareholder

Association for Research & Education (SHARE)

ADDRESS OF PERSON RELYING ON EXEMPTION: Suite

510, 1155 Robson St., Vancouver, BC, Canada, V6E 1B5

Written materials are submitted pursuant

to Rule 14a-6(g)(1) promulgated under the Securities Exchange Act of 1934:

RE: Support FOR: Item #12 – “Shareholder Proposal

- Third Party Review and Report on Lobbying Activities Alignment with Position on Universal Health Coverage”

Annual Meeting: April 28, 2022

Contact: Anthony Schein, Director of Shareholder Advocacy,

SHARE, aschein@share.ca

March 31, 2022

To Johnson & Johnson Stockholders:

SHARE is urging stockholders to vote FOR Item #12 at the Johnson & Johnson

stockholder meeting on April 28, 2022.

The proposal calls for Johnson & Johnson’s board to publish a report to

shareholders disclosing whether the company’s lobbying activities and that of its trade associations align with the company’s

Position on Universal Health Coverage, and in particular its provision supporting “broad and timely access to our medicines at sustainable

prices that aim to be locally affordable.” It asks the Board of Directors to report on how it addresses the risks presented by any

misaligned lobbying and the company’s plans, if any, to mitigate these risks. As you review the proposal, we would like to draw

your attention to the following:

Rationale for a YES Vote

| · | By asking the Company’s board of directors to report on how it addresses the risks

presented by any misaligned lobbying and the company’s plans, if any, to mitigate these risks, the Proposal specifically addresses

the key roles and responsibilities attributed to the Board and recognized best practices of good governance. |

| · | The public policy issues of drug pricing reform, broad and timely access to medicines at

sustainable prices, intellectual property rights as they relate to COVID-19 vaccine access globally, and advocating for the privatization

of Medicare and Medicaid – all raised in the supporting statement of this Proposal – all represent significant regulatory

and reputational risks for the company if not properly overseen and managed. |

| share.ca |

| · | The proposal raises instances where it appears that the advocacy by a trade association

to which the company belongs is contrary to the Company’s own stated and disclosed objectives. For shareholders, the positive statements

about universal health access and pricing which the Company has disclosed publicly are an important element in addressing a mounting material

risk of regulatory and legislative action on these very policy issues, but they are of little value if the Company’s lobbying activity

and that of its trade associations undermine and contradict those same statements. |

| · | The proposal leaves the Board with full discretion to commission the study, assess the

risks, determine its own mitigation strategy, none of which inserts shareholders into the ordinary business of the corporation. |

The company’s response

Johnson & Johnson, in its proxy circular, says that its “global political

engagement strategic imperatives are detailed on our website and align with our vision”, that it “engages in responsible lobbying

and is deliberate in how it engages with trade associations, including through dissent, to advance [Universal Health Coverage].”

It notes that it provides disclosure of payments to some third-party associations

and political contributions.

| · | This proposal, however, is not asking for disclosure of payments but rather a review

of whether lobbying activity carried out on the company’s behalf is consistent with the company’s own disclosures to investors.

|

It notes that the company “rank[ed] as one of the top three companies advancing

access to medicines in low- and middle-income countries around the world” in the 2021 Access to Medicines Index.

| · | The company spends a considerable amount of time enumerating activities in low-income countries,

none of which is being questioned in this proposal. This proposal is not asking shareholders to vote on the company’s general

activities to support universal health coverage, but rather asking the company’s board to evaluate whether policy activity by

entities it supports is consistent with the company’s own disclosed policies, and to mitigate risks, if any, of misalignment, as

it sees fit. |

With regard to third parties like trade associations or “think tanks whose

purpose is to develop policy position papers or model legislation”, the company says it “may not align with or support every

public position each of these broad-based groups takes.” The company says that “the Board of Directors and the Company have

robust governance and oversight practices for Johnson & Johnson’s political engagement programs” and that the Board reviews

“the annual dues to trade associations of $50,000 or more, where a percentage of the annual dues may be directed toward federal

lobbying”

| · | No one would expect a company to agree with every position or activity of every group it

supports. This proposal does not ask it to do so. Instead, it asks the board to know and evaluate what positions or lobbying activities

it is being exposed to when it provides financial support for those third parties, and to determine how best to mitigate any risks to

which it is exposed. Knowing which associations it supports with more than $50,000 annually is not the same as knowing the full range

of activities that association is undertaking – a fundamental requirement of risk mitigation. For example, as the Proposal notes,

the trade association PhRMA raised nearly $527 million in 2020 and spent roughly $506 million, including making multi-million-dollar donations

to numerous other organizations like the American Action Network for use in opposing congressional efforts to address drug pricing. The

American Action Network also sponsored facebook advertising in 2020 supporting claims of electoral fraud.1 PhRMA also sits

on the board of the American Legislative Exchange Council (ALEC) which has been involved in highly controversial lobbying activity including

advocating for the privatization of Medicare and Medicaid and opposition to drug pricing reforms and prescription drug importation. |

_____________________________

1 https://www.fastcompany.com/90567642/facebook-is-still-failing-to-take-down-ads-that-question-the-elections-integrity

| This is not a solicitation of authority to vote your proxy. Please DO NOT send us your proxy card as it will not be accepted | share.ca | 2 |

Regulatory risk in this area is growing

The proposal’s subject is the Board’s oversight of regulatory and reputational

risks in the company’s industry and disclosure to inform shareholders on the effectiveness of this oversight.

The subject of drug pricing reform has been the subject of at least nine congressional

reports since 2019, including a 269-page Congressional Majority Staff report issued earlier this year, which concluded a nearly three-year,

sweeping public investigation of the issue that included five public hearings.

The question of global policy on intellectual property in the context of the COVID

pandemic – raised in this shareholder proposal – is of serious interest to shareholders because of the severe economic impacts

of new variants of COVID which arise when vaccines are in short supply in developing countries – which were clearly evident when

the Omicron variant spread globally late last year.

The Proposal clearly asks the company’s board to review whether its lobbying

activity, and that of its trade associations, is consistent with its own disclosed position on exactly these policy issues.

The Proposal does not ask shareholders to vote on any membership or position taken

on an issue, but rather asks the board to report on its oversight of activity related to positions already defined by the Company itself,

positions earlier disclosed to shareholders and upon which shareholders may rely when considering the company’s exposure to regulatory

and reputational risk.

SHARE urges you to support the proposal. If you have any questions please contact

Anthony Schein at aschein@share.ca

Vote “FOR” on Item #12, “Shareholder

Proposal - Third Party Review and Report on Lobbying Activities Alignment with Position on Universal Health Coverage”

at the annual general meeting on April 28, 2022.

THE FOREGOING INFORMATON MAY BE DISSEMINATED TO SHAREHOLDERS

VIA TELEPHONE, U.S. MAIL, EMAIL, CERTAIN WEBSITES AND CERTAIN SOCIAL MEDIA VENUES, AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE OR

AS A SOLICITATION OF AUTHORITY TO VOTE YOUR PROXY. THE COST OF DISSEMINATING THE FOREGOING INFORMATION TO SHAREHOLDERS IS BEING BORNE

ENTIRELY BY THE FILERS. PROXY CARDS WILL NOT BE ACCEPTED BY ANY FILER. PLEASE DO NOT SEND YOUR PROXY TO ANY FILER. TO VOTE YOUR PROXY,

PLEASE FOLLOW THE INSTRUCTIONS ON YOUR PROXY CARD.

The filer of this document is Shareholder Association for Research & Education

(SHARE), Suite 510 – 1155 Robson Street Vancouver, BC V6E 1B5

| This is not a solicitation of authority to vote your proxy. Please DO NOT send us your proxy card as it will not be accepted | share.ca | 3 |

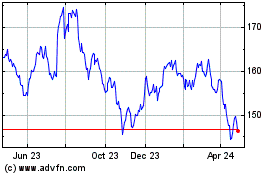

Johnson and Johnson (NYSE:JNJ)

Historical Stock Chart

From Mar 2024 to Apr 2024

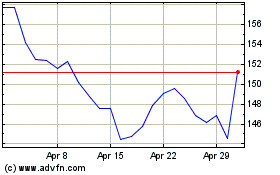

Johnson and Johnson (NYSE:JNJ)

Historical Stock Chart

From Apr 2023 to Apr 2024