0001819848false00018198482025-02-262025-02-260001819848us-gaap:CommonStockMember2025-02-262025-02-260001819848us-gaap:WarrantMember2025-02-262025-02-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________________________

FORM 8-K

________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 26, 2025

________________________________________________

Joby Aviation, Inc.

(Exact name of registrant as specified in its charter)

________________________________________________

| | | | | | | | | | | | | | |

| Delaware | 001-39524 | 98-1548118 |

(State or other jurisdiction

of incorporation) | (Commission File Number) | (IRS Employer

Identification No.) |

| | | | |

333 Encinal Street | | |

| | |

| Santa Cruz | , | California | | 95060 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (831) 201-6700

(Former name or former address, if changed since last report)

___________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading

Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share | | JOBY | | New York Stock Exchange |

| Warrants to purchase common stock | | JOBY WS | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02 Results of Operations and Financial Condition.

On February 26, 2025, Joby Aviation, Inc. (the “Company”) announced its financial results for the quarter ended December 31, 2024. A copy of the Company’s press release is attached hereto as Exhibit 99.1. The Company also issued a letter to its shareholders, which is attached hereto as Exhibit 99.2.

The information furnished in this Current Report, including Exhibits 99.1 and 99.2, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

Exhibit Number | | Exhibit Description |

| 99.1 | | |

| 99.2 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | | | | |

| | | Joby Aviation, Inc. |

| | | |

| Date: | February 26, 2025 | By: | /s/ Kate DeHoff |

| | Name: | Kate DeHoff |

| | Title: | General Counsel and Corporate Secretary |

Joby Reports Record Certification Progress and Delivery

of Second Aircraft to US Air Force at Edwards Air Force Base

•Joby reports Fourth Quarter and Full Year 2024 results

•Record progress on stage four of FAA certification

•Delivery of second aircraft to U.S. Air Force

•Plans to carry first passengers in late 2025 or early 2026

•More than $1B of additional funding and commitments made in the fourth quarter

Joby delivered a second electric air taxi to Edwards Air Force Base during the quarter, pictured here. Joby Aviation photo

Santa Cruz, CA, February 26, 2025 — Joby Aviation, Inc. (NYSE:JOBY), a company developing electric air taxis for commercial passenger service, today issued its Fourth Quarter and Full Year 2024 Shareholder Letter (https://joby-site.cdn.prismic.io/joby-site/Z75z057c43Q3gO6b_Joby-Aviation_2024-Q4-Shareholder-Letter.pdf) detailing the company’s operational and financial results for the period ending December 31, 2024. The company will host a live audio webcast of its conference call to discuss the results at 2:00 p.m. PT (5:00 p.m. ET) today.

Fourth Quarter 2024 Highlights include:

●Record Certification Progress: We made record progress on the fourth of five stages required to certify our aircraft for commercial passenger use in the US. We expect Type Inspection Authorization (“TIA”) flight testing to begin in the next 12 months.

●Defense Partnerships: We delivered a second aircraft to Edwards Air Force Base as part of our work with the U.S. Department of Defense. We now have five aircraft in our flight test fleet, including a hydrogen-hybrid aircraft.

●First Passenger Operations: We plan to deliver an aircraft to Dubai in the middle of 2025 to complete flight testing ahead of carrying our first passengers in late 2025 or early 2026.

●Strong Balance Sheet: We received more than $1B of additional funding and commitments in the fourth quarter.

●Successful demonstration flights in Korea: We became the first company to fly an electric air taxi as part of Korea’s K-UAM Grand Challenge.

Commenting on Joby’s full year results, JoeBen Bevirt, founder and CEO, said: “The sector-leading progress we made throughout 2024 puts Joby in a great position to capitalize on the opportunities presented by America’s renewed focus on innovation and manufacturing.

“As well as delivering record progress on certification, we scaled our manufacturing, delivered two aircraft to the Department of Defense and flew 561 miles with a hybrid, hydrogen-electric variant of our aircraft, bringing the flight test fleet to a total of five aircraft.

“The next 12 months mark a critical inflection point, not just for Joby, but for our entire industry, as we look ahead to carrying our first passengers, and I’m proud that Joby continues to lead the way towards this new era of flight.”

Joby ended the fourth quarter of 2024 with $933 million in cash, cash equivalents, and investments in marketable securities. This balance does not include expected Toyota investments totaling $500 million, to be made in two equal tranches of $250 million. All regulatory approvals are now in place for the first tranche of this investment to be made.

Fourth Quarter and Full Year Financial Results Webcast Details:

What: Joby Fourth Quarter and Full Year 2024 Financial Results Webcast

When: Wednesday, February 26, 2025

Time: 2:00 p.m. PT (5:00 p.m. ET)

Webcast: Upcoming Events (https://ir.jobyaviation.com/news-events/ir-calendar) section of the company website (www.jobyaviation.com).

If unable to attend the webcast, to listen by phone, please dial 1-877-407-9719 or 1-201-378-4906. A replay of the webcast will be available on the company website following the event.

About Joby

Joby Aviation, Inc. (NYSE:JOBY) is a California-based transportation company developing an all-electric, vertical take-off and landing air taxi which it intends to operate as part of a fast, quiet, and convenient service in cities around the world. To learn more, visit www.jobyaviation.com.

Forward Looking Statements

This release contains “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, including but not limited to, statements regarding the development and performance of our aircraft, the growth of our manufacturing capabilities, our regulatory outlook, progress and timing, including our plans to begin Type Inspection Authorization flight testing in the next 12 months; our planned operations with the Department of Defense; plans and timing related to certification and operation of our aircraft in the United Arab Emirates, including our plans to deliver our first aircraft to Dubai and begin in-market testing in mid-2025 and plans to carry our first passengers in late 2025 or early 2026; the expected timing of the Toyota investment; our business plan, objectives, goals and market opportunity; and our current expectations relating to our business, financial condition, results of operations, prospects, capital needs and growth of our operations. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as “anticipate”, “estimate”, “expect”, “project”, “plan”, “intend”, “believe”, “may”, “will”, “should”, “can have”, “likely” and other words and terms of similar meaning in connection with any discussion of the timing or nature of future operating or financial performance or other events. All forward looking statements are subject to risks and uncertainties that may cause actual results to differ materially, including: our ability to launch our air taxi service and the growth of the urban air mobility market generally; our ability to produce aircraft that meet our performance expectations in the volumes and on the timelines that we project; complexities related to obtaining certification and operating in foreign markets; the competitive environment in which we operate; our future capital needs; our ability to adequately protect and enforce our intellectual property rights; our ability to effectively respond to evolving regulations and standards relating to our aircraft; our reliance on third-party suppliers and service partners; uncertainties related to our estimates of the size of the market for our service and future revenue opportunities; and other important factors discussed in the section titled “Risk Factors” in our Annual Report on Form 10-K, filed with the Securities and Exchange Commission (the “SEC”) on February 27, 2024, our Quarterly Report on Form 10-Q, filed with the SEC on November 6, 2024, and in future filings and other reports we file with or furnish to

the SEC. Any such forward-looking statements represent management’s estimates and beliefs as of the date of this release. While we may elect to update such forward-looking statements at some point in the future, we disclaim any obligation to do so, even if subsequent events cause our views to change.

Contact Details

Investors:

investors@jobyaviation.com

Media:

press@jobyaviation.com

Shareholder Letter Q4 2024 JO B Y A V IA T IO N FE B R U A RY 2 6, 2 02 5 JO B YA V IA T IO N .C O M

Record certification progress Successful demonstration flights in Korea Targeting first passenger operations in late 2025 or early 2026 Five aircraft in flight test fleet, second delivered to Edwards Air Force Base First vertiport in Dubai network under construction $933 million in cash and short-term investments plus additional $500M commitment from Toyota The second tranche of the Toyota investment is subject to closing conditions described in the Company's Current Report on Form 8-K filed with the Securities and Exchange Commission on October 2, 2024, and is not guaranteed. Joby AviationQ4 2024 Shareholder Letter February 26, 2025 2 Highlights

Record Certification Progress WE SAW THE MOST SIGNIFICANT PROGRESS on the fourth stage of the type certification process to date, with a 12 percentage point increase on the Joby side and a 10 point increase on the FAA side, bringing us to more than 50% complete on the Joby side. We marked a key milestone with the successful completion of our first FAA ‘for-credit’ test on a major aerostructure and we completed our first Type Inspection Authorization (“TIA”) testing with the FAA, using our flight simulation lab and conforming flight deck to perform human factors testing with FAA pilots. Completion of our first TIA testing is an acknowledgment by the FAA of the maturity of our certification program. We also welcomed FAA pilots and engineers assigned to our certification program to Marina where they flew in our simulator some of the exact test cards we intend to use for flight TIA. Afterwards, the FAA pilots observed as Joby pilots flew those same test cards in the aircraft as part of our ongoing inhabited flight test campaign. We expect to continue expanding engagements like these as we prepare for flight TIA, which we plan to begin in the next 12 months. Percentage completion may fluctuate mildly through the course of certification as documents are edited and resubmitted. Data as of February 25, 2025. It is typical for a small portion of the Means of Compliance to remain open in order to address minor design changes and improvements that may occur later in the process. We therefore consider the second stage essentially complete. STAGE 1 Certification Basis STAGE 2 Means of Compliance STAGE 3 Certification Plans STAGE 4 Testing & Analysis STAGE 5 Show & Verify JOBY 100% 97% 53% 3% FAA 100% 97% 31% 1% DATA AS OF FEBRUARY 25, 2025 100% 100% Joby AviationQ4 2024 Shareholder Letter February 26, 2025 3

WE REACHED OUR TARGET of achieving the capacity to build parts equivalent to one aircraft per month. A majority of these parts are destined for testing as part of the certification process. We also rolled out and flew our fourth production prototype, bringing the total number of aircraft in our flight test fleet to five. Having access to a fleet of this size is unparalleled in our industry and allows us to rigorously test the performance of our aircraft while perfecting our production processes. Over 95% of the composite components produced on our manufacturing lines are now fully conforming and the expansion of our Marina facility remains on track. The new facility will more than double our footprint in Marina, supporting expanded manufacturing and flight training. We remain on track to deliver the first parts from our Ohio facility in mid-2025. Manufacturing Progress Joby AviationQ4 2024 Shareholder Letter February 26, 2025 4

WE CONTINUE TO BE THE ONLY COMPANY in our sector to have delivered an electric air taxi on-base to our DoD partners. In January 2025, a second Joby aircraft was delivered to Edwards Air Force Base to expand ongoing flight testing with our U.S. Air Force partners. We also became the first company to complete a training program covering the maintenance of our aircraft, having previously trained four U.S. Air Force pilots to fly it. In 2024, we also became the first company to demonstrate a hybrid hydrogen-electric aircraft to our DoD partners, completing multiple flights exceeding 500 miles including vertical take-offs and landings. Leveraging our vertical integration, this program demonstrated our ability to rapidly deliver versions of our core aircraft with different powertrains in order to meet varying performance requirements for our government partners. Defense Partnerships Joby AviationQ4 2024 Shareholder Letter February 26, 2025 5

CONSTRUCTION HAS BEGUN on the first vertiport in our planned network. Situated at Dubai International Airport, the vertiport is being built by Joby partners Dubai Road and Transport Authority and Skyports. Three additional vertiports are planned for Palm Jumeirah, Dubai Downtown, and Dubai Marina. We signed a strategic partnership with Jetex, a global leader in executive aviation, that will focus on using Joby aircraft to connect Jetex locations across the Middle East. Jetex VIP terminals include flagship locations at Al Maktoum International Airport in Dubai and Al Bateen Executive Airport in Abu Dhabi, providing seamless access to key financial, tourist, and entertainment destinations within the UAE. In the U.S., we received a Part 141 certificate from the FAA for our flight academy as well as FAA acceptance for our air operations voluntary Safety Management System, as established under Part 5. With the Part 141 certificate, Joby Aviation Academy can deliver streamlined pilot training to efficiently and economically develop a pipeline of qualified pilots in advance of commercial air taxi operations. By the middle of this year, we plan to deliver our first aircraft to Dubai and begin in-market testing. We intend to carry our first passengers in the Emirate in late 2025 or early 2026. Preparing for Commercial Operations Joby AviationQ4 2024 Shareholder Letter February 26, 2025 6 Render of planned vertiport at Dubai International Airport.

Demonstration Flights in Korea WE BECAME THE FIRST COMPANY to fly an electric air taxi in Korea’s K-UAM Grand Challenge, launched in 2023 by Korea’s Ministry of Land, Infrastructure and Transport to support the commercialization of air taxis in the Korean market. Over the course of a week, we completed a range of missions demonstrating various flight profiles and conditions, including fully wing-borne flight. Joby participated in the Grand Challenge as part of the “K-UAM Dream Team,” a consortium that includes SK Telecom, Hanwha Systems, TMAP and Korea Airports Corporation, which operates the vast majority of airports in Korea. Joby AviationQ4 2024 Shareholder Letter February 26, 2025 7

We were featured in Delta’s Centennial celebration at the Sphere in Las Vegas. Our aircraft served as a backdrop for the LA Area Chamber of Commerce’s Inaugural Reception at USC. Ongoing flight testing in Marina, CA. Image from Microsoft Flight Simulator 2024 that won Screenshot of the Week, taken by Instagram user @ericrensel. FAA pilots and engineers assigned to our certification program observed Joby pilots flying test cards we intend to perform for TIA flight testing. We received our Part 141 certificate from the FAA, enabling Joby Aviation Academy to deliver streamlined pilot training. Joby AviationQ4 2024 Shareholder Letter February 26, 2025 8

Fourth Quarter 2024 Financial Summary IN THE FOURTH QUARTER OF 2024, our financial results reflected our ongoing investments to advance the certification progress of our electric aircraft and to prepare for commercialization of a fast, quiet and convenient service in cities around the world. Net loss for the fourth quarter of 2024 was $246.3 million, comprising a net operating loss of $149.9 million and other loss of $96.4 million. Net operating loss primarily reflected costs and expenses to support the certification and manufacturing of our aircraft. Operating expenses included non-cash stock- based compensation of $21.7 million, and depreciation and amortization of $9.5 million. Other loss was primarily comprised of non-cash loss on revaluation of warrants and earnout shares of $106.7 million, partially offset by interest and other income of $9.8 million. Compared with the fourth quarter of 2023, net loss for the fourth quarter of 2024 increased by $131.2 million primarily due to increases in the non- cash loss on revaluation of warrants and earnout shares of $106.9 million. The remaining increase is due to an increase in operating expenses and a decrease in interest and other income. The increase in operating expenses reflected growth in our organization to support certification, manufacturing, and go-to-market activities, and increased purchases of prototype parts for manufacturing, testing and certification. Sequentially, compared to the net loss for the third quarter of 2024, net loss increased by $102.4 million, primarily due to an increase in the non-cash loss on revaluation of warrants and earnout shares, partially offset by lower operating expenses. The operating expenses for the fourth quarter of 2024 totaled $149.9 million and reflected costs to support certification and manufacturing of our aircraft. Operating expenses included stock based compensation of $21.7 million and depreciation and amortization of $9.5 million. Adjusted EBITDA in the fourth quarter of 2024 was a loss of $118.7 million, primarily reflecting employee related costs associated with the development, certification and manufacturing of the aircraft. The adjusted EBITDA loss was $22.5 million higher than in the fourth quarter of 2023 and $1.7 million lower than in the prior quarter. Adjusted EBITDA is a non-GAAP metric that excludes the loss from the revaluation of our derivative liabilities, stock-based compensation expense, depreciation and amortization, interest income and expense, and other non-operating costs. Please see the section titled “Non-GAAP Financial Measures” for a reconciliation of Net Loss to Adjusted EBITDA. We ended the fourth quarter of 2024 with $932.9 million in cash, cash equivalents, and investments in marketable securities. This includes $221.9 million and $128.8 million of net proceeds received during the fourth quarter of 2024 from an underwritten public offering and an at-the- market public offering, respectively. As expected, use of cash, cash equivalents and short-term investments during 2024, excluding the net proceeds from public offerings, was $450.1 million, at the lower end of our guidance of $440 to $470 million dollars. 2025 OUTLOOK As we prepare for important milestones ahead, including certification of our aircraft by regulatory authorities and initial passenger operations, our focus in 2025 will be on further advancing certification and testing of our aircraft, completion of our Marina, CA facility expansion, beginning aircraft component production at our Dayton, OH facility, aircraft testing in Dubai, and continued collaboration with partners such as Toyota, Delta, and Uber. We estimate that our use of cash, cash equivalents and short-term investments during 2025 will range between $500–$540 million. Joby AviationQ4 2024 Shareholder Letter February 26, 2025 9

Consolidated Statement o O erations JOBY AVIATION, INC. AND SUBSIDIARIES Unaudited (In thousands, except share and per share data) Three months ended December 31, Year ended December 31, 2024 2023 2024 2023 evenue: Flight services $ 55 $ 1,032 $ 136 $ 1,032 perating expenses: Flight services 22 200 67 200 esearch and development 122,385 102,123 477,156 367,049 Selling, general and administrative 27,523 26,951 119,667 105,877 Total operating expenses 149,930 129,274 596,890 473,126 Loss from operations (149,875) (128,242) (596,754) (472,094) Interest and other income, net 9,784 12,867 42,822 45,561 Gain (Loss) from change in fair value of warrants and earnout shares (106,656) 293 (53,973) (86,378) Total other income (loss), net (96,872) 13,160 (11,151) (40,817) Loss before income taxes (246,747) (115,082) (607,905) (512,911) Income tax expense (benefit) (470) 21 129 139 Net loss $ (246,277) $ (115,103) $ (608,034) $ (513,050) Net loss per share, basic and diluted $ (0.34) $ (0.17) $ (0.87) $ (0.79) Weighted-average common stock outstanding, basic and diluted 732,783,965 676,155,677 699,794,747 647,907,598 Q4 2024 Shareholder Letter February 26, 2025 Joby Aviation FS-1 l f p ions I TI N, INC. AND SUBSIDIARIES dited (in thousands, except share and per share dat ) Joby AviationQ4 2024 Shareholder Letter February 26, 2025 10

Consolidated Balance Sheets JOBY AVIATION, INC. AND SUBSIDIARIES Unaudited (in thousands) Consolidated alance Sheets JOBY AVIATION, INC. AND SUBSIDIARIES Unaudited (In thousands) December 31, 2024 December 31, 2023 Assets urrent assets: ash and cash equivalents $ 199,627 $ 204,017 Short-term investments 733,224 828,233 Total cash, cash equivalents and short-term investments 932,851 1,032,250 ther receivables 16,044 4,659 Prepaid expenses and other current assets 20,710 18,842 Total current assets 969,605 1,055,751 Property and equipment, net 120,954 103,430 perating lease right-of-use assets 28,689 28,286 estricted cash 762 762 Intangible assets 8,127 6,585 Goodwill 14,322 14,011 ther non-current assets 61,006 60,610 Total assets $ 1,203,465 $ 1,269,435 iabilities and stoc holders e uit urrent liabilities: Accounts payable $ 4,261 $ 3,006 perating lease liabilities, current portion 5,031 4,312 Accrued and other current liabilities 38,842 37,818 Total current liabilities 48,134 45,136 perating lease liabilities, net of current portion 26,178 26,349 Warrant liability 95,410 62,936 Earnout shares liability 117,416 95,969 ther non-current liabilities 3,964 4,683 Total liabilities 291,102 235,073 ommitments and contingencies Stockholders equity: Preferred stock ommon stock 78 70 Additional paid-in capital 2,768,605 2,282,475 Accumulated deficit (1,855,737) (1,247,703) Accumulated other comprehensive loss (583) (480) Total stockholders equity 912,363 1,034,362 Total liabilities and stockholders equity $ 1,203,465 $ 1,269,435 Q4 2024 Shareholder Letter February 26, 2025 Joby Aviation FS-2 Joby AviationQ4 2024 Shareholder Letter February 26, 2025 11

Consolidated Statement of Cash Flows JOBY AVIATION, INC. AND SUBSIDIARIES Unaudited (in thousands) Sergei to send li t t t t l JOBY AVIATION, INC. AND SUBSIDIARIES Unaudited (In thousands) Year ended December 31, 2024 2023 Cash flows from operating activities Net loss $ (608,034) $ (513,050) Reconciliation of net loss to net cash used in operating activities: Depreciation and amortization expense 35,572 30,493 Stock-based compensation expense 104,446 93,636 Loss from change in the fair value of warrants and earnout shares 53,973 86,378 Net accretion of investments in marketable debt securities (15,821) (20,202) Changes in operating assets and liabilities Other receivables and prepaid expenses and other current assets (11,803) (573) Other non-current assets (545) 309 Accounts payable and accrued and other current liabilities 6,116 6,442 Non-current liabilities (171) 2,736 Net cash used in operating activities (436,267) (313,831) Cash flows from investing activities Purchases of marketable securities (603,777) (809,978) Proceeds from sales and maturities of marketable securities 715,157 920,879 Purchases of property and equipment (40,617) (30,597) Net cash provided by investing activities 70,763 80,304 Cash flows from financing activities Underwritten public offering gross proceeds 232,300 — Underwritten public offering commission and offering expenses (10,446) — At-the-market public offering gross proceeds 133,019 — At-the-market public offering commission and offering expenses (4,183) — Proceeds from issuance of common stock in private placement, net — 280,110 Proceeds from the issuance of common stock under the Employee Stock Purchase Plan 11,200 6,918 Proce ds from the exercise of stock options and warrants issuance 1,659 2,055 Repayments of tenant improvement loan and obligations under finance lease (2,435) (844) Net cash provided by financing activities 361,114 288,239 Net change in cash, cash equivalents and restricted cash (4,390) 54,712 Cash, cash equivalents and restricted cash, at the beginning of the period 204,779 150,067 Cash, cash equivalents and restricted cash, at the end of the period $ 200,389 $ 204,779 Reconciliation of cash, cash equivalents and restricted cash to balance sheets Cash and cash equivalents $ 199,627 $ 204,017 Restricted cash 762 762 Cash, cash equivalents and restricted cash $ 200,389 $ 204,779 Non-cash investing and financing activities Unpaid property and equipment purchases $ 6,536 $ 1,769 Property and equipment purchased through finance leases $ 2,537 $ 5,221 Right of use assets acquired through operating leases $ 5,115 $ 5,652 Net non-cash assets acquired $ 9,472 $ — Q4 2024 Shareholder Letter February 26, 2025 Joby Aviation FS-1 Joby AviationQ4 2024 Shareholder Letter February 26, 2025 12

Non-GAAP Financial Measures JOBY AVIATION, INC. AND SUBSIDIARIES Unaudited (In thousands) ADJUSTED EBITDA is a non-GAAP measure of operating performance that is included to communicate the financial performance of activities associated with core operations that support the development, manufacturing and commercialization of the Joby aircraft. Adjusted EBITDA is defined as net income (loss) before interest income, interest expense, income tax expense (benefit), depreciation and amortization expense, stock-based compensation expense, income from equity-method investments unrelated to core operations, impact from revaluation of non-operating derivative liabilities, and other income or costs which are not directly related to ongoing core operations. We believe Adjusted EBITDA, when read in conjunction with our GAAP financials, provides investors and management with a useful measure for the evaluation of our operating results and a basis for comparing our core, ongoing operations from period to period. Because Adjusted EBITDA is not a measure of performance or liquidity calculated in accordance with GAAP, it should not be considered more meaningful than or as a substitute for net income (loss) as an indicator of our operating performance. Adjusted EBITDA may not be directly comparable to similarly titled measures provided by other companies due to potential differences in methods of calculation. From time to time, we may modify the nature of the adjustments we make to arrive at Adjusted EBITDA. A reconciliation of Adjusted EBITDA to net income is as follows: Three months ended December 31, Year ended December 31, 2024 2023 2024 2023 Net loss $ (246,277) $ (115,103) $ (608,034) $ (513,050) Income tax expense (benefit) (470) 21 129 139 Loss before income taxes (246,747) (115,082) (607,905) (512,911) Interest and other income, net (9,784) (12,867) (42,822) (45,561) Loss (Gain) from change in the fair value of warrants and earnout shares 106,656 (293) 53,973 86,378 Loss from operations (149,875) (128,242) (596,754) (472,094) Stock-based compensation expense 21,666 23,889 104,446 93,636 Depreciation and amortization expense 9,477 8,141 35,572 30,493 Adjusted EBITDA $ (118,732) $ (96,212) $ (456,736) $ (347,965) Q4 2024 Shareholder Letter February 26, 2025 Joby Aviation FS-4 l e es ADJUSTED EBITDA is a non-GAAP measure of operating performance that is incl ded o communicate the fin cial performance of activities ssociated with core operations that support the development, manufacturing and commercialization of the Joby aircraft. Adjusted EBITDA is defined as net income (loss) before interest inco , interest expense, income tax expense (benefit), depreciation and amortization expense, st ck-based compensation expense, impact from revaluation of non-operating derivative liabilities, and other income or costs which are not directly related to ongoing core operations. We believe Adjusted EBITDA, when read in conjunction with our GAAP financials, provides investors and management with a useful measure for the evaluation of our operating results and a basis for comparing our core, ongoing operations from period t period. Because Adjusted EBITDA is not a measure of performance or liquidity calculated in accordance with GAAP, it should not be considered more meaningful than or as a substitute for net income (loss) as an indicator of our operating performance. Adjusted EBITDA may not be directly comparable to similarly titled measures provided by other companies due to potential differences in methods of calculation. From time to time, we may modify the nature of the adjustments we make to arrive at Adjusted EBITDA. J I I N, INC. AND SUBSIDIARIES naudited (in thousands) Joby AviationQ4 2024 Shareholder Letter February 26, 2025 13 A reconciliation of Net Loss to Adjusted EBITDA is as follows:

Upcoming Events Today’s Webcast Details FOURTH QUARTER 2024 FINANCIAL RESULTS WEBCAST The Company will host a webcast and conference call at 5:00pm ET (2:00pm PT) on February 26, 2025. The webcast will be publicly available in the Financial Results section of the company’s investor website: ir.jobyaviation.com. RAYMOND JAMES 46TH ANNUAL INSTITUTIONAL INVESTORS CONFERENCE CANTOR FITZGERALD GLOBAL TECHNOLOGY CONFERENCE J.P. MORGAN INDUSTRIALS CONFERENCE Joby AviationQ4 2024 Shareholder Letter February 26, 2025 14

Forward-Looking Statements THIS SHAREHOLDER LETTER contains “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, including but not limited to, statements regarding the development and performance of our aircraft, the growth of our manufacturing capabilities, our regulatory outlook, progress and timing, and expected manufacturing and flight test capabilities and timing, including plans to begin flight TIA within the next 12 months; our planned operations with the Department of Defense; plans and timing related to certification and operation of our aircraft in the United Arab Emirates, including our plans to deliver our first aircraft to Dubai and begin in-market testing in mid-2025 and plans to carry our first passengers in late 2025 or early 2026; the expected timing of the Toyota investment and plans to establish a manufacturing alliance, including the expect- ed benefits of such alliance; potential routes and vertiport locations for our services; expected expansion of our manufac- turing facilities, including the expected production capacity of our Marina facility and plans to deliver the first parts from our Ohio facility in mid-2025; our business plan, objectives, goals and market opportunity; plans for, and potential benefits of, our strategic partnerships; and our current expectations relating to our business, financial condition, results of operations, pros- pects, capital needs and growth of our operations, including the expected benefits of our vertically-integrated business model and our cash spending outlook for 2025. You can iden- tify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as “anticipate”, “estimate”, “expect”, “project”, “plan”, “intend”, “believe”, “may”, “will”, “should”, “can have”, “likely” and other words and terms of similar meaning in connection with any discussion of the timing or nature of future operating or financial performance or other events. All forward looking statements are subject to risks and uncertainties that may cause actual results to differ materially, including: our ability to launch our air taxi service and the growth of the urban air mobility market generally; our ability to produce aircraft that meet our performance expectations in the volumes and on the timelines that we project; complexities related to obtaining certification and operating in foreign markets, including the need to negotiate additional definitive agreements related to such operations; our ability to satisfy the closing conditions, including the negotiation of certain agreements receipt of required governmental and shareholder approvals, required to receive the additional investment from Toyota on the expect- ed timelines or at all; the competitive environment in which we operate; our future capital needs; our ability to adequately protect and enforce our intellectual property rights; our ability to effectively respond to evolving regulations and standards relating to our aircraft; our reliance on third-party suppliers and service partners; uncertainties related to our estimates of the size of the market for our service and future revenue oppor- tunities; and other important factors discussed in the section titled “Risk Factors” in our Annual Report on Form 10-K, filed with the Securities and Exchange Commission (the “SEC”) on February 27, 2024, our Quarterly Report on Form 10-Q, filed with the SEC on November 6, 2024, and in future filings and other reports we file with or furnish to the SEC. Any such for- ward-looking statements represent management’s estimates and beliefs as of the date of this shareholder letter. While we may elect to update such forward-looking statements at some point in the future, we disclaim any obligation to do so, even if subsequent events cause our views to change. CONTACT DETAILS Investors: investors@jobyaviation.com Media: press@jobyaviation.com Joby AviationQ4 2024 Shareholder Letter February 26, 2025 15

v3.25.0.1

Cover

|

Feb. 26, 2025 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 26, 2025

|

| Entity Registrant Name |

Joby Aviation, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-39524

|

| Entity Tax Identification Number |

98-1548118

|

| Entity Address, Address Line One |

333 Encinal Street

|

| Entity Address, City or Town |

Santa Cruz

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

95060

|

| City Area Code |

831

|

| Local Phone Number |

201-6700

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001819848

|

| Amendment Flag |

false

|

| Common Stock, par value $0.0001 per share |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

JOBY

|

| Security Exchange Name |

NYSE

|

| Warrants to purchase common stock |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Warrants to purchase common stock

|

| Trading Symbol |

JOBY WS

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_WarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

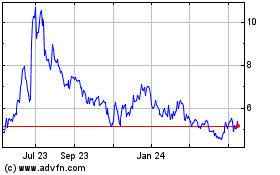

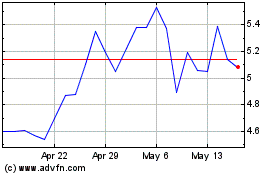

Joby Aviation (NYSE:JOBY)

Historical Stock Chart

From Jan 2025 to Feb 2025

Joby Aviation (NYSE:JOBY)

Historical Stock Chart

From Feb 2024 to Feb 2025