By Sara Castellanos

JPMorgan Chase & Co. sees potential in using quantum

computing as a way to significantly speed up financial

calculations, but it is still years away from deploying the

technology.

Since late 2017, the bank has been collaborating with

researchers at International Business Machines Corp. to experiment

with quantum computing. JPMorgan has seen some minor successes,

including one that proves, in theory, that quantum computing can

radically speed up certain financial models.

But Ning Shen, managing director in quantitative research at

JPMorgan's corporate and investment bank, said the technology will

take several years to mature, in part because the hardware required

is extremely complex and adapting and creating new quantum-based

algorithms will take time.

"You need a lot of knowledge, a lot of understanding before you

really get to any real applications," Mr. Shen said.

Experts say quantum computing can be orders of magnitude more

powerful than traditional computers. By harnessing the properties

of quantum physics, quantum computers have the potential to sort

through a vast number of possibilities in nearly real time to come

up with a probable solution. While traditional computers store

information as either 0s or 1s, quantum computers use quantum bits,

or qubits, which represent and store information as both 0s and 1s

simultaneously.

Timelines regarding when companies will start to see measurable

business value from quantum computing vary from about three years

to a decade, but that's not stopping companies such as JPMorgan

from early experiments.

By 2023, 20% of organizations, including businesses or

governments, are expected to budget for quantum-computing projects,

up from less than 1% in 2018, according to Gartner Inc.

Lori Beer, JPMorgan's global chief information officer, said in

2017 that the bank began experimenting with quantum computing to

understand how it would affect the company and its customers.

"We're optimistic that this is a core capability we need to think

about for the long term, " she said back then.

Mr. Shen now oversees a working group on quantum computing that

includes employees from JPMorgan's corporate and investment bank,

asset and wealth management, and the consumer and community

bank.

His team has been running tests via the cloud on IBM's 20-qubit

machine, suitable for small-scale experiments. Mr. Shen says using

quantum computing to speed up computationally intensive

option-pricing calculations is promising.

A computational algorithm known as Monte Carlo is used to

calculate the theoretical value of an option, or a contract that

gives individuals the right to buy or sell an underlying asset at a

specific price and time.

These types of calculations can be time-consuming for

traditional computers, which can take hours to compute option

prices and risks for a large portfolio of complex trades, Mr. Shen

said.

The team's experiments have proved that, in theory, a scalable,

commercial-grade quantum computer could run similar calculations

using quantum computing-based algorithms in seconds. "It [can] save

us many hours and then we can change the business model

completely," Mr. Shen said.

But first, quantum computers need to overcome problems related

to error mitigation and quality of qubits, tasks that IBM has said

it is working on to commercialize the technology. Qubits are

delicate and easily disrupted by changes in temperature, noise,

frequency and motion, which can derail a calculation.

Another area of opportunity involves using quantum computers to

perform risk-assessment calculations in real time instead of the

hours or days it can take for classical computers, Mr. Shen said.

IBM has said it has developed quantum algorithms that could be used

to significantly speed up risk assessments associated with, for

example, investment portfolios, when commercial-grade quantum

computers are available.

IBM is collaborating with more than 60 companies, national

laboratories and academic institutions to experiment with its

early-stage quantum-computing technology via the cloud.

Big companies are experimenting with the technology now because

they understand the deep correlation between computation and

business value, said Dario Gil, IBM's director of research.

It will likely take years to develop the right quantum

algorithms and applications for this next-generation computing

technology, he said. Companies, though, are already seeing business

impact through early experimentation, Mr. Gil said. "The

commercialization path to quantum, and the implication to the

industry, is going to be a continuum, and it has already started,"

he added.

Write to Sara Castellanos at sara.castellanos@wsj.com

(END) Dow Jones Newswires

June 11, 2019 14:03 ET (18:03 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

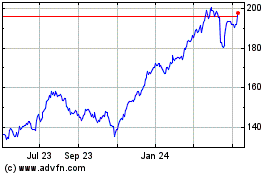

JP Morgan Chase (NYSE:JPM)

Historical Stock Chart

From Mar 2024 to Apr 2024

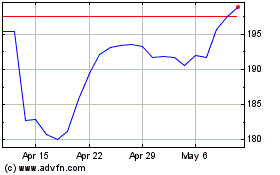

JP Morgan Chase (NYSE:JPM)

Historical Stock Chart

From Apr 2023 to Apr 2024