Energy-Drink Upstarts Are Sapping Monster's Strength

April 17 2019 - 6:29AM

Dow Jones News

By Jennifer Maloney

The king of energy drinks is in need of a boost.

Monster Beverage Corp. is losing market share, fighting in court

with an upstart competitor and trying to stop its biggest partner

-- Coca-Cola Co. -- from releasing an energy version of Coke.

Now Keurig Dr Pepper Inc. is jumping in with an energy drink

developed by Lance Collins, the entrepreneur behind successful

brands including Fuze tea, BodyArmor sports drinks and Core bottled

water. His new drink, Adrenaline Shoc, is meant to appeal to

consumers looking for less sugar and more natural ingredients, Mr.

Collins said.

"Traditional energy drinks have ingredients that you can't

pronounce: glucuronolactone, inositol, taurine," he said. "We took

all those things out."

It is a consumer shift that beverage industry analysts say

Monster has struggled to address.

Monster accounted for 41% of energy-drink sales in American

retail stores in the four weeks ended April 7, down from 45% a year

earlier, according to an Evercore ISI analysis of data from IRI, a

market research firm. Meanwhile, a new entrant called Bang has

quickly captured about 9% of the market.

A Monster spokeswoman referred to its previous comments,

criticizing Bang for "false and unsupported" health claims. At an

investor meeting in January, Monster CEO Rodney Sacks said

fitness-oriented energy drinks like Bang will end up expanding the

category, allowing Monster to continue to grow.

Monster is touting a new brand called Reign, which contains

coenzyme Q10, a dietary supplement taken for heart health. "Will we

have competition? Sure, we will. But we've had competition before,"

Mr. Sacks said in January. "Ultimately, we're confident about the

ability of Monster to continue to grow and the ability of Reign to

participate in that space."

The Monster brand has nothing to do health and wellness,

Evercore ISI analyst Robert Ottenstein said. "Monster recognized

that to their credit. They recognized that they couldn't use the

Monster trademark to go after Bang. The question is are they going

to be able to do it? There's a whole new wave of brands with

authenticity in the fitness space."

Other players are crowding into the category: Anheuser-Busch

InBev SA in 2017 bought organic energy-drink startup Hiball Inc.

And Amazon.com Inc. just launched its own energy drink under its

Solimo brand.

Coca-Cola, which owns an 18.5% stake in Monster and distributes

the brand through its bottling network, has developed a drink

called Coca-Cola Energy that is already being introduced in Europe.

Monster says the move is a violation of an agreement the companies

struck in 2015; they are in arbitration.

Bang also has drawn Monster into a fight. In September, Monster

sued Bang's parent company, Vital Pharmaceuticals Inc., alleging

that it doesn't contain creatine, the ingredient it touts

prominently on its cans, and that the company had made false health

claims about its product. Monster also raised concerns about those

health claims with the Food and Drug Administration, according to a

person familiar with the matter. Monster's March launch of Reign

was a parallel attack on Vital, with the new brand's packaging and

flavors closely mirroring Bang's.

Vital has sued Monster alleging trademark infringement and

refutes Monster's charges.

"A meritless and frivolous lawsuit has no chance to prevent the

inevitability of Bang's meteoric rise to the top," Vital said in a

September news release. "Consumers choose Bang because it's more

effective, tastes better, and doesn't contain harmful amounts of

sugar and ingredients like D-glucuronolactone contained in

Monster."

Monster called Vital's trademark suit a bad faith attempt to

slow its Reign launch.

Keurig Dr Pepper has taken a significant minority stake in

Adrenaline Shoc with a path to ownership and will distribute it

nationally. Terms weren't disclosed. The deal comes unusually early

in the brand's development. Typically startup brands build sales on

their own before striking a national distribution agreement. This

one has yet to appear in a single store. Keurig plans to launch it

in June.

With the energy-drink category fragmenting, Keurig Dr Pepper

said it wants to offer consumers a range of options. It already

owns two small traditional energy-drink brands and earlier this

month said that it would distribute Runa Clean Energy, an organic

energy drink with caffeine derived from the Guayusa leaf. Runa is

owned by All Market Inc., which also owns Vita Coco coconut

water.

Adrenaline Shoc has no sugar and contains caffeine derived from

green coffee beans, yerba mate, coffee-bean fruit extract and

guarana.

Write to Jennifer Maloney at jennifer.maloney@wsj.com

(END) Dow Jones Newswires

April 17, 2019 07:14 ET (11:14 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

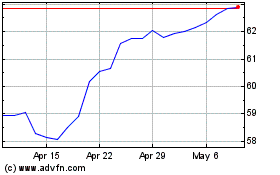

Coca Cola (NYSE:KO)

Historical Stock Chart

From Mar 2024 to Apr 2024

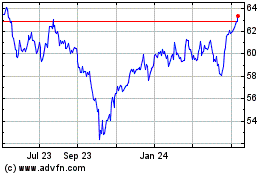

Coca Cola (NYSE:KO)

Historical Stock Chart

From Apr 2023 to Apr 2024