Kite Realty Group to Present at the Citi 2025 Global Property CEO Conference

February 26 2025 - 3:15PM

Kite Realty Group (NYSE: KRG) announced today that it will present

at the Citi 2025 Global Property CEO Conference on Monday, March 3,

2025. The presentation information is as follows:

Event: Kite Realty Group

Management PresentationWhen: March 3, 2025, at

2:10 p.m. ESTLive Webcast: 2025 Citi Global

Property CEO Conference PresentationInvestor

Presentation: KRG Q4 2024 Investor Update

A replay of the webcast will be available at

kiterealty.com following the completion of the conference.

About Kite Realty Group

Kite Realty Group Trust (NYSE: KRG), a real

estate investment trust (REIT) is a premier owner and operator of

open-air shopping centers and mixed-use assets. The Company’s

primarily grocery-anchored portfolio is located in high-growth Sun

Belt and select strategic gateway markets. The combination of

necessity-based grocery-anchored neighborhood and community

centers, along with vibrant mixed-use assets makes the KRG

portfolio an ideal mix for both retailers and consumers. Publicly

listed since 2004, KRG has nearly 60 years of experience in

developing, constructing and operating real estate. Using

operational, investment, development, and redevelopment expertise,

KRG continuously optimizes its portfolio to maximize value and

return to shareholders. As of December 31, 2024, the Company owned

interests in 179 U.S. open-air shopping centers and mixed-use

assets, comprising approximately 27.7 million square feet of gross

leasable space. For more information, please visit

kiterealty.com.

Connect with

KRG: LinkedIn | X | Instagram | Facebook

Safe Harbor

This release, together with other statements and

information publicly disseminated by us, contains certain

forward-looking statements within the meaning of Section 27A

of the Securities Act of 1933 and Section 21E of the

Securities Exchange Act of 1934. Such statements are based on

assumptions and expectations that may not be realized and are

inherently subject to risks, uncertainties and other factors, many

of which cannot be predicted with accuracy and some of which might

not even be anticipated. Future events and actual results,

performance, transactions or achievements, financial or otherwise,

may differ materially from the results, performance, transactions

or achievements, financial or otherwise, expressed or implied by

the forward-looking statements.

Risks, uncertainties and other factors that

might cause such differences, some of which could be material,

include but are not limited to: economic, business, banking, real

estate and other market conditions, particularly in connection with

low or negative growth in the U.S. economy as well as economic

uncertainty (including a potential economic slowdown or recession,

rising interest rates, inflation, unemployment, or limited growth

in consumer income or spending); financing risks, including the

availability of, and costs associated with, sources of liquidity;

the Company’s ability to refinance, or extend the maturity dates

of, the Company’s indebtedness; the level and volatility of

interest rates; the financial stability of the Company’s tenants;

the competitive environment in which the Company operates,

including potential oversupplies of, or a reduction in demand for,

rental space; acquisition, disposition, development and joint

venture risks; property ownership and management risks, including

the relative illiquidity of real estate investments, and expenses,

vacancies or the inability to rent space on favorable terms or at

all; the Company’s ability to maintain the Company’s status as a

real estate investment trust for U.S. federal income tax purposes;

potential environmental and other liabilities; impairment in the

value of real estate property the Company owns; the attractiveness

of our properties to tenants, the actual and perceived impact of

e-commerce on the value of shopping center assets, and changing

demographics and customer traffic patterns; business continuity

disruptions and a deterioration in our tenants’ ability to operate

in affected areas or delays in the supply of products or services

to us or our tenants from vendors that are needed to operate

efficiently, causing costs to rise sharply and inventory to fall;

risks related to our current geographical concentration of

properties in the states of Texas, Florida, and North Carolina and

the metropolitan statistical areas of New York, Atlanta, Seattle,

Chicago, and Washington, D.C.; civil unrest, acts of violence,

terrorism or war, acts of God, climate change, epidemics,

pandemics, natural disasters and severe weather conditions,

including such events that may result in underinsured or uninsured

losses or other increased costs and expenses; changes in laws and

government regulations including governmental orders affecting the

use of the Company’s properties or the ability of its tenants to

operate, and the costs of complying with such changed laws and

government regulations; possible changes in consumer behavior due

to public health crises and the fear of future pandemics; our

ability to satisfy environmental, social or governance standards

set by various constituencies; insurance costs and coverage,

especially in Florida and Texas coastal areas; risks associated

with cyber attacks and the loss of confidential information and

other business disruptions; risks associated with the use of

artificial intelligence and related tools; other factors affecting

the real estate industry generally; whether our current development

projects and new development opportunities will benefit from our

favorable cost of debt, below-target leverage and higher levels of

free cash flow; and other risks identified in reports the Company

files with the Securities and Exchange Commission or in other

documents that it publicly disseminates, including, in particular,

the section titled “Risk Factors” in the Company’s Annual Report on

Form 10-K for the fiscal year ended December 31, 2024, and in the

Company’s quarterly reports on Form 10-Q. The Company undertakes no

obligation to publicly update or revise these forward-looking

statements, whether as a result of new information, future events

or otherwise.

Contact Information: Kite Realty Group

Trust

Tyler HenshawSVP, Capital Markets & Investor

Relations317.713.7780thenshaw@kiterealty.com

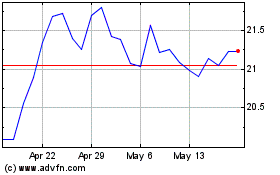

Kite Realty (NYSE:KRG)

Historical Stock Chart

From Jan 2025 to Feb 2025

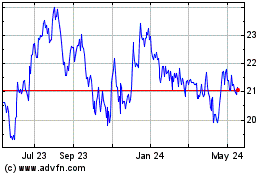

Kite Realty (NYSE:KRG)

Historical Stock Chart

From Feb 2024 to Feb 2025