Liberty Energy Inc. (NYSE: LBRT) (“Liberty” or the “Company”)

announced today third quarter 2024 financial and operational

results.

Summary Results and Highlights

- Revenue of $1.1 billion, a 2% sequential decrease

- Net income of $74 million, or $0.44 fully diluted earnings per

share (“EPS”)

- Adjusted EBITDA1 of $248 million

- Delivered 22% TTM Adjusted Pre-Tax Return on Capital Employed

(“ROCE”)2

- Distributed $51 million to shareholders through share

repurchases and cash dividends

- Repurchased and retired 1.2% of shares outstanding during the

third quarter, and a cumulative 14.3% of shares outstanding since

reinstatement of the repurchase program in July 2022

- Increased quarterly cash dividend by 14% to $0.08 per share

beginning fourth quarter of 2024

- Liberty’s multi-year fleet technology transition on track to

start 2025 with 90% of fleets primarily powered by natural gas

- A digiPrime fleet completed the highest number of monthly hours

pumped of any crew in Liberty history

- Quarterly record for company pumping efficiency

- Shipped Liberty fleet to Australia, with completions activity

commencing during the fourth quarter

“Liberty delivered a solid quarter with revenue of $1.1 billion

and Adjusted EBITDA1 of $248 million. We again reached new heights

in efficiencies, pumping more hours in a quarter than ever before,

amidst a backdrop of a slowing demand environment. A Liberty

digiPrime fleet set the company record for number of monthly hours

pumped by any crew in company history. I’m proud of our team for

executing at the highest operating levels, generating strong

financial performance and value for our customers,” commented Chris

Wright, Chief Executive Officer.

“Our strategic investments in digiFleets and power generation

are expanding our competitive advantage and market opportunities,

while enabling a robust return of capital program. Since July 2022,

we have distributed $509 million to shareholders through the

retirement of 14% of shares outstanding and quarterly cash

dividends. This week we announced a 14% increase in our quarterly

cash dividend to $0.08 per share. The compounding effect of share

buybacks and dividends is driving higher total shareholder returns

over cycles,” continued Mr. Wright.

“Focused investments have allowed us to develop new markets and

lead technology innovation and operational efficiency in the

industry. Over the past year, Liberty entered partnerships to

develop the new gas-rich Beetaloo Basin in Australia. We have taken

a significant step forward with the arrival of a Liberty fleet in

country,” continued Mr. Wright. “During the third quarter, the

Liberty Advanced Equipment Technologies (LAET) manufacturing and

assembly division delivered its first digiPrime pumps.

Additionally, Liberty Power Innovations’ (LPI) expanded operations

in the DJ Basin are off to a strong start, helping bring our frac

fleet CNG fueling services to critical mass.

“Today, the rising demand for power in commercial and industrial

applications offers compelling opportunities for LPI. We are

excited to leverage the expertise that we have built constructing

and managing power plants for frac fleets to additional

opportunities both inside and outside the oilfield.”

Outlook

Oil markets reflect significant uncertainty across the global

economy, OPEC+ production plans, Chinese economic growth and Middle

East geopolitical dynamics. Global demand for oil will grow by

approximately one million barrels of oil per day this year and is

expected to exceed this next year. While global oil production may

be in surplus in 2025, oil prices are expected to remain relatively

rangebound and supportive of North American activity.

Natural gas prices rose in recent weeks after storage congestion

concerns eased due to producer curtailments and strong domestic

power generation demand, but higher prices may incentivize reversal

of curtailments and prove to be transitory. The commissioning of

LNG export facilities in the U.S. and Canada is expected to

stimulate gas activity in 2025 and support higher sustained natural

gas demand.

Frac markets are navigating the slowing of E&P operators’

2024 development programs in response to the strong first-half 2024

efficiency gains from factors including consolidation, longer

laterals, and concentration in high-graded acreage. Elevated

uncertainty in energy markets has further left operators reluctant

to accelerate completions activity in advance of the new year. We

now expect a low double-digit percentage reduction in Q4 activity,

a bit more than the typical Q4 softening. Completions activity

likely increases in early 2025 to support flattish E&P oil

& gas production targets. Since late 2023, U.S. crude oil

production has been relatively flat and would likely decline if

current completions activity levels persist.

Frac industry dynamics are poised to improve in 2025 from

today’s levels. E&Ps brought wells to production faster this

year, in part due to completion efficiencies and increased frac

intensity with higher pump rates. Efficiencies were aided by a mix

shift towards larger producers benefiting from consolidation and

partnership with top tier frac service providers. Industry-wide

frac efficiency is at its highest levels, but we expect the rate of

improvement will slow going forward. Higher intensity fracs require

more horsepower. Softer activity has been a catalyst for attrition,

equipment cannibalization, and idling of fleets. Together, these

imply that the supply and demand balance of frac fleets is tighter

than headline fleet counts suggest.

Large, well-capitalized E&Ps are enjoying attractive

economics across a wide range of oil prices. To maintain efficiency

gains and further support the increasing complexity of E&P

needs, investment is necessary in leading edge service

technologies. Soft year end frac activity levels are pressuring

prices in the near term to levels that are inconsistent with the

anticipated market demand and supply of horsepower in 2025. It is

important that service prices support investment, especially given

aging equipment, industry underinvestment in next generation

technologies, and growing fleet sizes.

“Few service providers are positioned to manage the growing

complexities of completion demands with quality services and next

generation technologies. We are significantly advantaged with our

deep customer relationships, leading edge digiTechnologies

offering, and the integrated services that enable strong

efficiencies for our customers and returns for our shareholders,”

commented Mr. Wright.

“We remain disciplined in investing and asset deployment as we

seek to drive superior long-term financial results. Over the last

two years we have maintained a roughly flat deployed fleet count.

However, amidst near term reductions in customer activity and

market pressures, we are planning to temporarily and modestly

reduce our deployed fleet count while continuing to support our

long-term partners.

“Looking ahead, we expect to deliver healthy free cash flow

generation in 2025. Our investment cadence within frac slows

following an accelerated technology transition push in the last few

years. Our strategic investment is expected to shift in support of

our growing opportunities for power generation services. We are

well-positioned to deliver on our dual priorities of strategic

investment and return of capital to shareholders, creating value

over the long-term,” continued Mr. Wright.

Share Repurchase Program

During the quarter ended September 30, 2024, Liberty repurchased

and retired 1,939,072 shares of Class A common stock at an average

of $20.27 per share, representing 1.2% of shares outstanding, for

approximately $39 million. Liberty has cumulatively repurchased and

retired 14.3% of shares outstanding at program commencement on July

25, 2022. Total remaining authorization for future common share

repurchases is approximately $323 million.

The shares may be repurchased from time to time in open market

transactions, through block trades, in privately negotiated

transactions, through derivative transactions or by other means in

accordance with federal securities laws. The timing, as well as the

number and value of shares repurchased under the program, will be

determined by the Company at its discretion and will depend on a

variety of factors, including management’s assessment of the

intrinsic value of the Company’s common stock, the market price of

the Company’s common stock, general market and economic conditions,

available liquidity, compliance with the Company’s debt and other

agreements, applicable legal requirements, and other

considerations. The exact number of shares to be repurchased by the

Company is not guaranteed, and the program may be suspended,

modified, or discontinued at any time without prior notice. The

Company expects to fund the repurchases by using cash on hand,

borrowings under its revolving credit facility and expected free

cash flow to be generated through the authorization period.

Cash Dividend

During the quarter ended September 30, 2024, the Company paid a

quarterly cash dividend of $0.07 per share of Class A common stock,

or approximately $11 million in aggregate to shareholders.

On October 15, 2024, the Board declared a cash dividend of $0.08

per share of Class A common stock, to be paid on December 20, 2024

to holders of record as of December 6, 2024.

Future declarations of quarterly cash dividends are subject to

approval by the Board of Directors and to the Board’s continuing

determination that the declarations of dividends are in the best

interests of Liberty and its stockholders. Future dividends may be

adjusted at the Board’s discretion based on market conditions and

capital availability.

Third Quarter Results

For the third quarter of 2024, revenue was $1.1 billion,

compared to $1.2 billion in each of the third quarter of 2023 and

the second quarter of 2024.

Net income (after taxes) totaled $74 million for the third

quarter of 2024 compared to $149 million in the third quarter of

2023 and $108 million in the second quarter of 2024.

Adjusted Net Income3 (after taxes) totaled $76 million for the

third quarter of 2024 compared to $149 million in the third quarter

of 2023 and $103 million in the second quarter of 2024.

Adjusted EBITDA1 was $248 million in the third quarter of 2024

compared to $319 million in the third quarter of 2023 and $273

million in the second quarter of 2024.

Fully diluted earnings per share of $0.44 for the third quarter

of 2024 compared to $0.85 for the third quarter of 2023 and $0.64

for the second quarter of 2024.

Adjusted Net Income per Diluted Share3 of $0.45 for the third

quarter of 2024 compared to $0.86 for the third quarter of 2023 and

$0.61 for the second quarter of 2024.

Please refer to the tables at the end of this earnings release

for a reconciliation of Adjusted EBITDA, Adjusted Net Income, and

Adjusted Net Income per Diluted Share (each, a non-GAAP financial

measure) to the most directly comparable GAAP financial

measures.

Balance Sheet and Liquidity

As of September 30, 2024, Liberty had cash on hand of $23

million, a decrease from second quarter levels, and total debt of

$123 million, drawn on the secured asset-based revolving credit

facility. Total liquidity, including availability under the credit

facility, was $352 million as of September 30, 2024.

Conference Call

Liberty will host a conference call to discuss the results at

8:00 a.m. Mountain Time (10:00 a.m. Eastern Time) on Thursday,

October 17, 2024. Presenting Liberty’s results will be Chris

Wright, Chief Executive Officer, Ron Gusek, President, and Michael

Stock, Chief Financial Officer.

Individuals wishing to participate in the conference call should

dial (833) 255-2827, or for international callers (412) 902-6704.

Participants should ask to join the Liberty Energy call. A live

webcast will be available at https://investors.libertyenergy.com.

The webcast can be accessed for 90 days following the call. A

telephone replay will be available shortly after the call and can

be accessed by dialing (877) 344-7529, or for international callers

(412) 317-0088. The passcode for the replay is 5442952. The replay

will be available until October 24, 2024.

About Liberty

Liberty is a leading North American energy services firm that

offers one of the most innovative suites of completion services and

technologies to onshore oil and natural gas exploration and

production companies. Liberty was founded in 2011 with a relentless

focus on developing and delivering next generation technology for

the sustainable development of unconventional energy resources in

partnership with our customers. Liberty is headquartered in Denver,

Colorado. For more information about Liberty, please contact

Investor Relations at IR@libertyenergy.com.

1 “Adjusted EBITDA” is not presented in

accordance with generally accepted accounting principles in the

United States (“U.S. GAAP”). Please see the supplemental financial

information in the table under “Reconciliation of Net Income to

EBITDA and Adjusted EBITDA” at the end of this earnings release for

a reconciliation of the non-GAAP financial measure of Adjusted

EBITDA to its most directly comparable GAAP financial measure.

2 Adjusted Pre-Tax Return on Capital

Employed is a non-U.S. GAAP operational measure. Please see the

supplemental financial information in the table under “Calculation

of Adjusted Pre-Tax Return on Capital Employed” at the end of this

earnings release for a calculation of this measure.

3 “Adjusted Net Income” and “Adjusted Net

Income per Diluted Share” are not presented in accordance with U.S.

GAAP. Please see the supplemental financial information in the

table under “Reconciliation of Net Income and Net Income per

Diluted Share to Adjusted Net Income and Adjusted Net Income per

Diluted Share” at the end of this earnings release for a

reconciliation of the non-GAAP financial measures of Adjusted Net

Income and Adjusted Net Income per Diluted Share to the most

directly comparable GAAP financial measures.

Non-GAAP Financial Measures

This earnings release includes unaudited non-GAAP financial and

operational measures, including EBITDA, Adjusted EBITDA, Adjusted

Net Income, Adjusted Net Income per Diluted Share, and Adjusted

Pre-Tax Return on Capital Employed (“ROCE”). We believe that the

presentation of these non-GAAP financial and operational measures

provides useful information about our financial performance and

results of operations. We define Adjusted EBITDA as EBITDA adjusted

to eliminate the effects of items such as non-cash stock-based

compensation, new fleet or new basin start-up costs, fleet lay-down

costs, gain or loss on the disposal of assets, unrealized gain or

loss on investments, net, bad debt reserves, transaction and other

costs, the loss or gain on remeasurement of liability under our tax

receivable agreements, and other non-recurring expenses that

management does not consider in assessing ongoing performance.

Our board of directors, management, investors, and lenders use

EBITDA and Adjusted EBITDA to assess our financial performance

because it allows them to compare our operating performance on a

consistent basis across periods by removing the effects of our

capital structure (such as varying levels of interest expense),

asset base (such as depreciation, depletion, and amortization) and

other items that impact the comparability of financial results from

period to period. We present EBITDA and Adjusted EBITDA because we

believe they provide useful information regarding the factors and

trends affecting our business in addition to measures calculated

under U.S. GAAP.

We present Adjusted Net Income and Adjusted Net Income per

Diluted Share because we believe such measures provide useful

information to investors regarding our operating performance by

excluding the after-tax impacts of unusual or one-time benefits or

costs, including items such as unrealized gain or loss on

investments, net, transaction and other costs, and the loss or gain

on remeasurement of liability under our tax receivable agreements,

primarily because management views the excluded items to be outside

of our normal operating results. We define Adjusted Net Income as

net income after eliminating the effects of such excluded items and

Adjusted Net Income per Diluted Share as Adjusted Net Income

divided by the number of weighted average diluted shares

outstanding. Management analyzes net income without the impact of

these items as an indicator of performance to identify underlying

trends in our business.

We define ROCE as the ratio of adjusted pre-tax net income

(adding back income tax and certain adjustments that include tax

receivable agreement impacts, unrealized gain or loss on

investments, net, and transaction and other costs, when applicable)

for the twelve months ended September 30, 2024 to Average Capital

Employed. Average Capital Employed is the simple average of total

capital employed (both debt and equity) as of September 30, 2024

and September 30, 2023. ROCE is presented based on our management’s

belief that these non-GAAP measures are useful information to

investors when evaluating our profitability and the efficiency with

which management has employed capital over time. Our management

uses ROCE for that purpose. ROCE is not a measure of financial

performance under U.S. GAAP and should not be considered an

alternative to net income, as defined by U.S. GAAP.

Non-GAAP financial and operational measures do not have any

standardized meaning and are therefore unlikely to be comparable to

similar measures presented by other companies. The presentation of

non-GAAP financial and operational measures is not intended to be a

substitute for, and should not be considered in isolation from, the

financial measures reported in accordance with U.S. GAAP. See the

tables entitled Reconciliation and Calculation of Non-GAAP

Financial and Operational Measures for a reconciliation or

calculation of the non-GAAP financial or operational measures to

the most directly comparable GAAP measure.

Forward-Looking and Cautionary Statements

The information above includes “forward-looking statements”

within the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. All statements, other than statements of historical facts,

included herein concerning, among other things, statements about

our expected growth from recent acquisitions, expected performance,

future operating results, oil and natural gas demand and prices and

the outlook for the oil and gas industry, future global economic

conditions, the impact of worldwide political, military and armed

conflict, the impact of announcements and changes in oil production

quotas by oil exporting countries, improvements in operating

procedures and technology, our business strategy and the business

strategies of our customers, the deployment of fleets in the

future, planned capital expenditures, future cash flows and

borrowings, pursuit of potential acquisition opportunities, our

financial position, return of capital to stockholders, business

strategy and objectives for future operations, are forward-looking

statements. These forward-looking statements are identified by

their use of terms and phrases such as “may,” “expect,” “estimate,”

“outlook,” “project,” “plan,” “position,” “believe,” “intend,”

“achievable,” “forecast,” “assume,” “anticipate,” “will,”

“continue,” “potential,” “likely,” “should,” “could,” and similar

terms and phrases. However, the absence of these words does not

mean that the statements are not forward-looking. Although we

believe that the expectations reflected in these forward-looking

statements are reasonable, they do involve certain assumptions,

risks and uncertainties. The outlook presented herein is subject to

change by Liberty without notice and Liberty has no obligation to

affirm or update such information, except as required by law. These

forward-looking statements represent our current expectations or

beliefs concerning future events, and it is possible that the

results described in this earnings release will not be achieved.

These forward-looking statements are subject to certain risks,

uncertainties and assumptions identified above or as disclosed from

time to time in Liberty's filings with the Securities and Exchange

Commission. As a result of these factors, many of which are beyond

our control, actual results may differ materially from those

indicated or implied by such forward-looking statements.

Any forward-looking statement speaks only as of the date on

which it is made, and, except as required by law, we do not

undertake any obligation to update or revise any forward-looking

statement, whether as a result of new information, future events or

otherwise. New factors emerge from time to time, and it is not

possible for us to predict all such factors. When considering these

forward-looking statements, you should keep in mind the risk

factors and other cautionary statements in “Item 1A. Risk Factors”

included in our most recent Annual Report on Form 10-K, any

subsequent Quarterly Reports on Form 10-Q, and in our other public

filings with the SEC. These and other factors could cause our

actual results to differ materially from those contained in any

forward-looking statements.

Liberty Energy Inc.

Selected Financial

Data

(unaudited)

Three Months Ended

Nine Months Ended

September 30,

June 30,

September 30,

September 30,

2024

2024

2023

2024

2023

Statement of Operations Data:

(amounts in thousands, except

for per share data)

Revenue

$

1,138,578

$

1,159,884

$

1,215,905

$

3,371,587

$

3,672,970

Costs of services, excluding depreciation,

depletion, and amortization shown separately

840,274

835,798

850,247

2,458,752

2,572,119

General and administrative

58,614

57,700

55,040

169,300

166,110

Transaction and other costs

—

—

202

—

1,804

Depreciation, depletion, and

amortization

126,395

123,305

108,997

372,886

303,093

Loss (gain) on disposal of assets

6,017

1,248

(3,808

)

6,105

(6,981

)

Total operating expenses

1,031,300

1,018,051

1,010,678

3,007,043

3,036,145

Operating income

107,278

141,833

205,227

364,544

636,825

Unrealized loss (gain) on investments,

net

2,727

(7,201

)

—

(4,474

)

—

Interest expense, net

8,589

8,063

6,776

23,715

21,142

Net income before taxes

95,962

140,971

198,451

345,303

615,683

Income tax expense

22,158

32,550

49,843

81,186

151,658

Net income

73,804

108,421

148,608

264,117

464,025

Less: Net income attributable to

non-controlling interests

—

—

—

—

91

Net income attributable to Liberty Energy

Inc. stockholders

$

73,804

$

108,421

$

148,608

$

264,117

$

463,934

Net income attributable to Liberty Energy

Inc. stockholders per common share:

Basic

$

0.45

$

0.65

$

0.88

$

1.59

$

2.68

Diluted

$

0.44

$

0.64

$

0.85

$

1.55

$

2.62

Weighted average common shares

outstanding:

Basic

164,741

166,210

169,781

165,755

173,135

Diluted

168,595

169,669

173,984

169,947

177,284

Other Financial and Operational

Data

Capital expenditures (1)

$

162,835

$

134,081

$

161,379

$

438,909

$

442,779

Adjusted EBITDA (2)

$

247,811

$

273,256

$

319,213

$

765,853

$

960,561

_______________

(1)

Net capital expenditures presented above

include investing cash flows from purchase of property and

equipment, excluding acquisitions, net of proceeds from the sales

of assets.

(2)

Adjusted EBITDA is a non-GAAP financial

measure. See the tables entitled “Reconciliation and Calculation of

Non-GAAP Financial and Operational Measures” below.

Liberty Energy Inc.

Condensed Consolidated Balance

Sheets

(unaudited, amounts in

thousands)

September 30,

December 31,

2024

2023

Assets

Current assets:

Cash and cash equivalents

$

23,012

$

36,784

Accounts receivable and unbilled

revenue

594,056

587,470

Inventories

197,563

205,865

Prepaids and other current assets

107,889

124,135

Total current assets

922,520

954,254

Property and equipment, net

1,834,214

1,645,368

Operating and finance lease right-of-use

assets

357,757

274,959

Other assets

158,393

158,976

Total assets

$

3,272,884

$

3,033,557

Liabilities and Equity

Current liabilities:

Accounts payable and accrued

liabilities

$

655,519

$

572,029

Current portion of operating and finance

lease liabilities

93,052

67,395

Total current liabilities

748,571

639,424

Long-term debt

123,000

140,000

Long-term operating and finance lease

liabilities

255,020

197,914

Deferred tax liability

102,287

102,340

Payable pursuant to tax receivable

agreements

75,008

112,471

Total liabilities

1,303,886

1,192,149

Stockholders' equity:

Common Stock

1,634

1,666

Additional paid in capital

996,336

1,093,498

Retained earnings

980,914

752,328

Accumulated other comprehensive loss

(9,886

)

(6,084

)

Total stockholders’ equity

1,968,998

1,841,408

Total liabilities and equity

$

3,272,884

$

3,033,557

Liberty Energy Inc.

Reconciliation and Calculation

of Non-GAAP Financial and Operational Measures

(unaudited, amounts in thousands,

except per share data)

Reconciliation of Net Income to EBITDA

and Adjusted EBITDA

Three Months Ended

Nine Months Ended

September 30,

June 30,

September 30,

September 30,

2024

2024

2023

2024

2023

Net income

$

73,804

$

108,421

$

148,608

$

264,117

$

464,025

Depreciation, depletion, and

amortization

126,395

123,305

108,997

372,886

303,093

Interest expense, net

8,589

8,063

6,776

23,715

21,142

Income tax expense

22,158

32,550

49,843

81,186

151,658

EBITDA

$

230,946

$

272,339

$

314,224

$

741,904

$

939,918

Stock-based compensation expense

8,121

6,870

8,595

22,318

23,738

Unrealized loss (gain) on investments,

net

2,727

(7,201

)

—

(4,474

)

—

Fleet start-up and lay-down costs

—

—

—

—

2,082

Transaction and other costs

—

—

202

—

1,804

Loss (gain) on disposal of assets

6,017

1,248

(3,808

)

6,105

(6,981

)

Adjusted EBITDA

$

247,811

$

273,256

$

319,213

$

765,853

$

960,561

Reconciliation of Net Income and Net

Income per Diluted Share to Adjusted Net Income and Adjusted Net

Income per Diluted Share

Three Months Ended

Nine Months Ended

September 30,

June 30,

September 30,

September 30,

2024

2024

2023

2024

2023

Net income

$

73,804

$

108,421

$

148,608

$

264,117

$

464,025

Adjustments:

Less: Unrealized loss (gain) on

investments, net

2,727

(7,201

)

—

(4,474

)

—

Add back: Transaction and other costs

—

—

202

—

1,804

Total adjustments, before taxes

2,727

(7,201

)

202

(4,474

)

1,804

Income tax expense (benefit) of

adjustments

656

(1,707

)

53

(1,051

)

444

Adjusted Net Income

$

75,875

$

102,927

$

148,757

$

260,694

$

465,385

Diluted weighted average common shares

outstanding

168,595

169,669

173,984

169,947

177,284

Net income per diluted share

$

0.44

$

0.64

$

0.85

$

1.55

$

2.62

Adjusted Net Income per Diluted Share

$

0.45

$

0.61

$

0.86

$

1.53

$

2.63

Calculation of Adjusted Pre-Tax Return on Capital Employed

Twelve Months Ended

September 30,

2024

2023

Net income

$

356,500

Add back: Income tax expense

108,010

Less: Gain on remeasurement of liability

under tax receivable agreements (1)

(1,817

)

Less: Unrealized gain on investments,

net

(4,474

)

Add back: Transaction and other costs

249

Adjusted Pre-tax net income

$

458,468

Capital Employed

Total debt

$

123,000

$

223,000

Total equity

1,968,998

1,788,562

Total Capital Employed

$

2,091,998

$

2,011,562

Average Capital Employed (2)

$

2,051,780

Adjusted Pre-Tax Return on Capital

Employed (3)

22

%

(1)

Gain on remeasurement of the liability

under tax receivable agreements is calculated using the Company’s

effective tax rates and payments expected to be made under the

agreements and should be excluded in the determination of adjusted

pre-tax return on capital employed.

(2)

Average Capital Employed is the simple

average of Total Capital Employed as of September 30, 2024 and

2023.

(3)

Adjusted Pre-tax Return on Capital

Employed is the ratio of adjusted pre-tax net income for the twelve

months ended September 30, 2024 to Average Capital Employed.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241015141816/en/

Michael Stock Chief Financial Officer

Anjali Voria, CFA Director of Investor Relations

303-515-2851 IR@libertyenergy.com

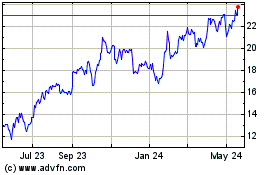

Liberty Energy (NYSE:LBRT)

Historical Stock Chart

From Oct 2024 to Nov 2024

Liberty Energy (NYSE:LBRT)

Historical Stock Chart

From Nov 2023 to Nov 2024