Statement of Changes in Beneficial Ownership (4)

August 12 2022 - 3:25PM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

|

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

BROWN GREGORY Q |

2. Issuer Name and Ticker or Trading Symbol

Motorola Solutions, Inc.

[

MSI

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

__X__ Director _____ 10% Owner

__X__ Officer (give title below) _____ Other (specify below)

Chairman and CEO |

|

(Last)

(First)

(Middle)

MOTOROLA SOLUTIONS, INC., 500 WEST MONROE ST. |

3. Date of Earliest Transaction

(MM/DD/YYYY)

8/10/2022 |

|

(Street)

CHICAGO, IL 60661

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

| Motorola Solutions, Inc. - Common Stock | 8/10/2022 | | M(1) | | 100000 | A | $68.50 | 170307.7016 (2) | D | |

| Motorola Solutions, Inc. - Common Stock | 8/10/2022 | | S(1) | | 20420 | D | $254.2708 (3) | 149887.7016 (2) | D | |

| Motorola Solutions, Inc. - Common Stock | 8/10/2022 | | S(1) | | 67393 | D | $253.5239 (4) | 82494.7016 (2) | D | |

| Motorola Solutions, Inc. - Common Stock | 8/10/2022 | | S(1) | | 7887 | D | $252.5326 (5) | 74607.7016 (2) | D | |

| Motorola Solutions, Inc. - Common Stock | 8/10/2022 | | S(1) | | 3585 | D | $251.4307 (6) | 71022.7016 (2) | D | |

| Motorola Solutions, Inc. - Common Stock | 8/10/2022 | | S(1) | | 715 | D | $250.4221 (7) | 70307.7016 (2) | D | |

| Motorola Solutions, Inc. - Common Stock | 8/11/2022 | | M(1) | | 100000 | A | $68.50 | 170307.7016 (2) | D | |

| Motorola Solutions, Inc. - Common Stock | 8/11/2022 | | S(1) | | 24988 | D | $253.6883 (8) | 145319.7016 (2) | D | |

| Motorola Solutions, Inc. - Common Stock | 8/11/2022 | | S(1) | | 49592 | D | $252.9345 (9) | 95727.7016 (2) | D | |

| Motorola Solutions, Inc. - Common Stock | 8/11/2022 | | S(1) | | 25420 | D | $252.2846 (10) | 70307.7016 (2) | D | |

| Motorola Solutions, Inc. - Common Stock | | | | | | | | 2220 | I | Held by wife |

| Motorola Solutions, Inc. - Common Stock | | | | | | | | 81000 (11) | I | By Trust |

| Motorola Solutions, Inc. - Common Stock | | | | | | | | 78780 (12) | I | By Trust |

| Motorola Solutions, Inc. - Common Stock | | | | | | | | 37547 (13) | I | By Trust |

| Motorola Solutions, Inc. - Common Stock | | | | | | | | 35348 (14) | I | By Trust |

| Motorola Solutions, Inc. - Common Stock | | | | | | | | 18523 | I | 2020-7 Grantor Retained Annuity Trust, reporting person is the Trustee |

| Motorola Solutions, Inc. - Common Stock | | | | | | | | 53607 | I | 2021 Grantor Retained Annuity Trust, reporting person is the Trustee |

| Motorola Solutions Inc. - Common Stock | | | | | | | | 101609 | I | 2022-1 Grantor Retained Annuity Trust |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Performance Contingent Stock Option - Right to Buy | $68.50 | 8/10/2022 | | M (1) | | | 100000 | (15) | 8/25/2022 | Motorola Solutions, Inc. - Common Stock | 100000 | $0 | 269229 | D | |

| Performance Contingent Stock Option - Right to Buy | $68.50 | 8/11/2022 | | M (1) | | | 100000 | (15) | 8/25/2022 | Motorola Solutions, Inc. - Common Stock | 100000 | $0 | 169229 | D | |

| Explanation of Responses: |

| (1) | The exercise and sale of options reported in this Form 4 were effected pursuant to a 10b5-1 trading plan adopted by the reporting person on December 14, 2021. |

| (2) | Includes shares acquired under the Motorola Solutions Employee Stock Purchase Plan and through the reinvestment of dividends. |

| (3) | $254.2708 is the weighted average sales price. Prices for this transaction ranged from $253.95 to $254.93. The reporting person undertakes to provide upon request by the Commission staff, the issuer or a security holder of the issuer, full information regarding the number of shares sold at each separate price. |

| (4) | $253.5239 is the weighted average sales price. Prices for this transaction ranged from $252.99 to $253.94. The reporting person undertakes to provide upon request by the Commission staff, the issuer or a security holder of the issuer, full information regarding the number of shares sold at each separate price. |

| (5) | $252.5326 is the weighted average sales price. Prices for this transaction ranged from $251.96 to $252.84. The reporting person undertakes to provide upon request by the Commission staff, the issuer or a security holder of the issuer, full information regarding the number of shares sold at each separate price. |

| (6) | $251.4307 is the weighted average sales price. Prices for this transaction ranged from $250.91 to $251.85. The reporting person undertakes to provide upon request by the Commission staff, the issuer or a security holder of the issuer, full information regarding the number of shares sold at each separate price. |

| (7) | $250.4221 is the weighted average sales price. Prices for this transaction ranged from $250.31 to $250.84. The reporting person undertakes to provide upon request by the Commission staff, the issuer or a security holder of the issuer, full information regarding the number of shares sold at each separate price. |

| (8) | $253.6883 is the weighted average sales price. Prices for this transaction ranged from $253.40 to $254.38. The reporting person undertakes to provide upon request by the Commission staff, the issuer or a security holder of the issuer, full information regarding the number of shares sold at each separate price. |

| (9) | $252.9345 is the weighted average sales price. Prices for this transaction ranged from $252.41 to $253.39. The reporting person undertakes to provide upon request by the Commission staff, the issuer or a security holder of the issuer, full information regarding the number of shares sold at each separate price. |

| (10) | $252.2846 is the weighted average sales price. Prices for this transaction ranged from $252.15 to $252.40. The reporting person undertakes to provide upon request by the Commission staff, the issuer or a security holder of the issuer, full information regarding the number of shares sold at each separate price. |

| (11) | These shares are held in an irrevocable trust for the benefit of the reporting person's wife and children. The reporting person's wife is trustee of this trust. |

| (12) | These shares are held in a family trust for the benefit of the reporting person's children. The reporting person's child is trustee of this trust. |

| (13) | These shares are held in a non-exempt gift trust for the benefit of the reporting person's child. The reporting person's wife is trustee of this trust. |

| (14) | These shares are held in a non-exempt gift trust for the benefit of the reporting person's child. The reporting person's wife is trustee of this trust. |

| (15) | These Performance Contingent Stock Options ("PCSOs") vested upon the attainment of each stock price hurdle as follows: 20% vested when the Company closing stock price was $85.00 for ten consecutive trading days (which was met on June 30, 2017); 30% vested when the Company closing stock price was $102.50 for ten consecutive trading days (which was met on February 28, 2018); and 50% vested when the Company closing stock price was $120.00 for ten consecutive trading days (which was met on July 24, 2018). The PCSOs became exercisable on the third anniversary of the date of grant. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

BROWN GREGORY Q

MOTOROLA SOLUTIONS, INC.

500 WEST MONROE ST.

CHICAGO, IL 60661 | X |

| Chairman and CEO |

|

Signatures

|

| Lauren E. Henderson, on behalf of Gregory Q. Brown, Chairman and Chief Executive Officer (Power of Attorney on File) | | 8/12/2022 |

| **Signature of Reporting Person | Date |

| Reminder: Report on a separate line for each class of securities beneficially owned directly or indirectly. |

| * | If the form is filed by more than one reporting person, see Instruction 4(b)(v). |

| ** | Intentional misstatements or omissions of facts constitute Federal Criminal Violations. See 18 U.S.C. 1001 and 15 U.S.C. 78ff(a). |

| Note: | File three copies of this Form, one of which must be manually signed. If space is insufficient, see Instruction 6 for procedure. |

| Persons who respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

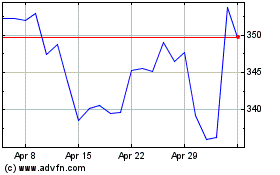

Motorola Solutions (NYSE:MSI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Motorola Solutions (NYSE:MSI)

Historical Stock Chart

From Apr 2023 to Apr 2024