Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

February 11 2022 - 10:12AM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C.

20549

FORM 6-K

Report of Foreign

Private Issuer

Pursuant to Rule 13a

-16 or 15d -16 of

the Securities Exchange

Act of 1934

Report on Form 6-K

dated February 11, 2022

(Commission File

No. 1-13202)

Nokia Corporation

Karakaari 7A

FI-02610 Espoo

Finland

(Name and address

of registrant’s principal executive office)

|

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

|

|

|

|

|

|

Form 20-F: x

|

|

Form 40-F: ¨

|

|

|

|

|

|

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

|

|

|

|

Yes: ¨

|

|

No: x

|

|

|

|

|

|

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

|

|

|

|

Yes: ¨

|

|

No: x

|

|

|

|

|

|

Indicate

by check mark whether the registrant by furnishing the information contained in this form is also thereby furnishing the information

to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

|

|

|

|

|

|

Yes: ¨

|

|

No: x

|

Enclosures:

|

|

·

|

Stock

Exchange Release: Nokia launches first phase of share buyback program

|

|

Stock

exchange release

|

|

1 (2)

|

|

|

11 February 2022

|

|

|

Nokia Corporation

Stock Exchange Release

11 February 2022 at 16:00 EET

Nokia launches first phase of share

buyback program

Espoo, Finland – In line with

the announcement on 3 February 2022, the Board of Directors of Nokia Corporation ("Nokia" or the "Company")

has today decided to launch the first phase of the share buyback program.

The main terms of the first phase of

the share buyback program:

|

|

·

|

The

aggregate purchase price of all Nokia shares to be acquired shall not exceed EUR 300 million.

|

|

|

·

|

The

repurchases will start at the earliest on 14 February 2022 and end by 22 December 2022.

|

|

|

·

|

The

purpose of the repurchases is to optimize Nokia's capital structure through the reduction

of capital. The repurchased shares will be cancelled accordingly. The repurchases will be

funded using funds in the reserve for invested unrestricted equity and the repurchases will

reduce total unrestricted equity.

|

|

|

·

|

The

repurchases are based on the authorization granted by Nokia's Annual General Meeting on 8

April 2021. The maximum number of shares that can be repurchased under the first phase

of the program is 275,000,000 shares corresponding to approximately 5 % of the total number

of shares in Nokia.

|

|

|

·

|

The

shares will be acquired through public trading on the regulated market of Nasdaq Helsinki

and select multilateral trading facilities. No repurchases will be made in the United States.

Nokia has appointed a third-party broker as the lead-manager for the first phase of the buyback

program. The lead-manager will make trading decisions independently of and without influence

from Nokia. The repurchases will be carried out in accordance with the so-called safe harbour

rules referred to in Article 5 of the EU Market Abuse Regulation (EU N:o 596/2014).

|

|

|

·

|

The

price payable per share shall be determined in public trading on the relevant trading venue

at the time of the repurchase, in compliance with the price and volume limits applicable

under the safe harbour rules.

|

Nokia may terminate the program prior

to its scheduled end date and will in such case issue a stock exchange release to this effect.

www.nokia.com

|

Stock

exchange release

|

|

2 (2)

|

|

|

11 February 2022

|

|

|

NOKIA CORPORATION

Board of Directors

About Nokia

At Nokia, we create technology that

helps the world act together.

As a trusted partner for critical networks,

we are committed to innovation and technology leadership across mobile, fixed and cloud networks. We create value with intellectual property

and long-term research, led by the award-winning Nokia Bell Labs.

Adhering to the highest standards of

integrity and security, we help build the capabilities needed for a more productive, sustainable and inclusive world.

Inquiries:

Nokia

Investor Relations

Phone: +358 40 803 4080

Email: investor.relations@nokia.com

David Mulholland, Head of Investor Relations

www.nokia.com

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant, Nokia Corporation, has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

Date: February 11, 2022

|

Nokia Corporation

|

|

|

|

|

|

|

By:

|

/s/

Esa Niinimäki

|

|

|

Name:

|

Esa Niinimäki

|

|

|

Title:

|

Deputy Chief Legal Officer, Corporate

|

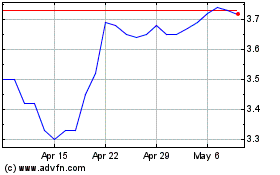

Nokia (NYSE:NOK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Nokia (NYSE:NOK)

Historical Stock Chart

From Apr 2023 to Apr 2024