Pebblebrook Hotel Trust (NYSE: PEB):

Q3 FINANCIAL

HIGHLIGHTS

- Net income: $45.1 million

- Same-Property Total RevPAR Growth: Increased 2.7% vs. Q3

2023, with urban properties improving 2.7% and resort properties

growing 2.5%

- Same-Property Hotel EBITDA: $110.8 million, down $1.1

million, or 1.0%, vs. Q3 2023

- Adjusted EBITDAre: $112.2 million, down $3.8 million, or

3.3%, vs. Q3 2023

- Adjusted FFO per diluted share: $0.59, decreasing 3.3%

from Q3 2023

- Unexpected Insurance Proceeds: Adjusted EBITDAre and FFO

include $7.1 million from business interruption insurance proceeds,

which were not included in the Company’s prior outlook

HOTEL OPERATING TRENDS

- Increased Urban and Resort Occupancies in Q3: Urban

Same-Property Occupancy rose 3.7%, driven by strong performance in

Chicago, San Diego, Boston and Portland. Resort Same-Property

Occupancy saw a robust 5.9% increase, bolstered by higher weekday

business group demand and improving weekend leisure travel.

- Reduced Q3 Performance from Hurricanes Debby and Helene:

Same-Property Total Revenues and Hotel EBITDA decreased by $1.2

million, and Adjusted EBITDA by $1.5 million, resulting in a

30-basis-point reduction in Same-Property Total RevPAR growth and a

25-basis-point decrease in Same-Property RevPAR growth.

PORTFOLIO UPDATES &

BALANCE SHEET

- Hyatt Centric Delfina Santa Monica Rebrand: Following

the rebrand on September 18, 2024, a $16 million property refresh

commenced in November 2024 to enhance the guest experience.

- $400 Million Senior Notes Issuance: On October 3, 2024,

$400 million of 6.375%, 5-year senior unsecured notes were issued

with $353.3 million of the net proceeds used to pay down existing

term loans.

- Extended $787 Million of Debt Maturities and Improved

Liquidity: On November 1, 2024, the Company extended $787

million of its term loans and credit facilities. Pebblebrook now

has no significant debt maturities until December 2026.

2024

OUTLOOK

- Net loss: ($19.4) to ($15.4) million

- Same-Property RevPAR Growth Rate: +1.25% to +1.65%

(midpoint down 30 bps)

- Adjusted EBITDAre: $346.0 to $350.0 million (midpoint

decreased $7.5 million)

- Adjusted FFO per diluted share: $1.57 to $1.60 (midpoint

decreased $0.04)

- Hurricane Impact on Outlook: The updated 2024 Outlook

incorporates an anticipated 30 basis point negative impact to

Same-Property RevPAR growth, an $11.5 million reduction in Adjusted

EBITDAre and a ($0.10) impact to Adjusted FFO per diluted share,

driven by operational disruptions and cancellations from Hurricane

Milton and other recent named storms. A substantial portion of

these losses are expected to be mitigated through business

interruption insurance proceeds.

Note: See tables later in this press

release for a description of Same-Property information and

reconciliations from net income (loss) to non-GAAP financial

measures used in the table above and elsewhere in this press

release.

"Third-quarter demand was in line with our outlook, despite the

challenges posed by Hurricanes Debby and Helene disrupting all our

resorts in the southeast. This solid performance underscores the

continuing recovery of business group, business transient, and

leisure demand across our urban and resort locations. Our resorts

demonstrated exceptional resilience, achieving strong gains in both

occupancy and market share, largely as a result of our recent

strategic redevelopment investments.

‘In the third quarter, we remained intensely focused on

achieving sustainable cost reductions and operational efficiencies

across our portfolio, collaborating closely with our operators to

implement new technologies and best practices. As a result, our

Same-Property Total Expenses increased by just 4.3%, while costs

per occupied room remained flat year-over-year, and declined when

excluding fixed expenses. We are very pleased with the significant

positive impact these efforts have had on our bottom-line

performance.”

-Jon E. Bortz, Chairman and Chief Executive Officer of

Pebblebrook Hotel Trust

Third Quarter and Year-to-Date Highlights

Third Quarter

Nine Months Ended

September 30,

Same-Property and Corporate

Highlights

2024

2023

Var

2024

2023

Var

($ in millions except RevPAR and

per share data)

Net income (loss)(1)

$45.1

($56.5)

NM

$49.9

($32.3)

NM

Same-Property RevPAR(2)

$240

$235

2.2%

$219

$215

1.8%

Same-Property Room Revenues(2)

$259.6

$253.8

2.3%

$695.2

$679.7

2.3%

Same-Property Total Revenues(2)

$393.7

$383.0

2.8%

$1,061.6

$1,034.4

2.6%

Same-Property Total Expenses(2)

$282.9

$271.1

4.3%

$773.7

$753.7

2.7%

Same-Property Hotel EBITDA(2)

$110.8

$111.9

(1.0%)

$287.8

$280.8

2.5%

Adjusted EBITDAre(2)

$112.2

$116.1

(3.3%)

$296.5

$293.1

1.2%

Adjusted FFO(2)

$71.7

$74.1

(3.3%)

$180.4

$172.2

4.8%

Adjusted FFO per diluted share(2)

$0.59

$0.61

(3.3%)

$1.49

$1.39

7.2%

2024 Monthly Results

Same-Property Portfolio

Highlights(3)

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

($ in millions except ADR and

RevPAR)

Occupancy

51

%

63

%

70

%

73

%

76

%

81

%

80

%

79

%

77

%

ADR

$

295

$

294

$

307

$

303

$

310

$

302

$

313

$

292

$

314

RevPAR

$

151

$

184

$

215

$

220

$

236

$

244

$

249

$

230

$

242

Total Revenues

$

84.8

$

94.9

$

115.4

$

115.4

$

129.8

$

127.5

$

135.8

$

126.4

$

131.4

Total Revenues vs. ’23

6

%

3

%

0

%

(1

%)

7

%

2

%

2

%

6

%

1

%

Hotel EBITDA

$

8.1

$

19.1

$

32.5

$

31.0

$

47.3

$

38.9

$

40.4

$

32.6

$

37.8

NM = Not Meaningful

(1)

The Company recorded a $27.0 million

deferred tax benefit in the third quarter of 2024 for the release

of income tax valuation allowance.

(2)

See tables later in this press release for

a description of Same-Property information and reconciliations from

net income (loss) to non-GAAP financial measures, including

Earnings Before Interest, Taxes, Depreciation and Amortization

(“EBITDA”), EBITDA for Real Estate (“EBITDAre”), Adjusted EBITDAre,

Funds from Operations (“FFO”), FFO per diluted share, Adjusted FFO

and Adjusted FFO per diluted share.

(3)

Includes information for all the hotels

the Company owned as of September 30, 2024, except for the

following:

- LaPlaya Beach Resort & Club is excluded from Jan – Sep

- Newport Harbor Island Resort is excluded from Jan – Jun

“Same Property Total RevPAR rose by 2.7%, driven by higher

occupancy rates and continued robust out-of-room spending across

our urban properties and resorts,” noted Mr. Bortz. “Our

year-over-year growth has been strongly supported by the group

segment, with group revenues up over 11% in Q3 and nearly 7%

year-to-date. We expect continued occupancy growth, propelled by

sustained demand from both business and leisure travelers, despite

concerns about the macroeconomic environment and presidential

election.”

Update on Impact from Named Storms

On September 26, 2024, Hurricane Helene impacted the Company’s

189-room LaPlaya Beach Resort & Club (“LaPlaya”), resulting in

the closure of the Beach House building—which contains 79

guestrooms—due to ground-floor water infiltration. The adjacent

pool complex was also adversely affected and closed. Subsequently,

on October 9, 2024, Hurricane Milton further impacted the resort,

leading to a temporary closure of the entire resort.

Demonstrating Pebblebrook’s commitment to resilience and rapid

recovery, LaPlaya’s Gulf Tower (70 rooms) and Bay Tower (40 rooms)

reopened on November 1, 2024, along with BALEEN Naples and the

members-only Beach Club restaurant. The Company currently

anticipates that the pool complex will reopen later this year, and

the Beach House will partially reopen in the coming months and be

largely operational by the end of Q1 2025, all subject to local

governmental approvals. The Company currently expects repair costs

to be immaterial and believes that property, flood, and business

interruption insurance—net of deductibles—will substantially

mitigate the financial impact.

The Company’s previous outlook projected LaPlaya to generate $24

million in Hotel EBITDA for 2024. Following the impact of

Hurricanes Helene and Milton, this anticipated contribution has

been revised to $18.7 million for 2024, with fourth quarter

expectations reduced to $0.9 million. This reflects a decrease of

$5.3 million compared to the prior outlook, although the total

estimated disruption for LaPlaya from recent hurricanes is

approximately $7.8 million based on updated performance

expectations since the prior outlook. It is important to note that

LaPlaya is excluded from Same-Property results for both 2024 and

2023, so these adjustments do not affect Same-Property Hotel

Revenue and EBITDA metrics. However, the estimated impact does

affect the Company’s Adjusted EBITDAre, Adjusted FFO and Adjusted

FFO per diluted share.

Pebblebrook’s other resorts in southern Florida and southern

Georgia remain fully operational and sustained no material property

damage from the recent named storms. However, these properties,

along with LaPlaya, experienced considerable cancellations and

reduced booking volumes both before and after the storms, affecting

operating performance in the third and fourth quarters. The Company

has factored these impacts into the revised 2024 Outlook.

Regarding insurance claims from Hurricane Ian, Pebblebrook

recorded $7.1 million in business interruption (“BI”) insurance

proceeds in Q3 2024, of which $2.7 million had been expected and

included in the Company’s Outlook for the fourth quarter. The

Company’s prior Outlook did not anticipate any BI insurance

proceeds for the third quarter. Year-to-date, Pebblebrook has

recorded $18.3 million in BI insurance income from Hurricane Ian,

with no additional BI insurance income from Hurricane Ian expected

in Q4 2024.

Conversion of Hyatt Centric Delfina Santa Monica

The Company completed a reflag of the 315-room Hyatt Centric

Delfina Santa Monica on September 18, 2024. This exciting

conversion includes an approximate $16.0 million property refresh,

which commenced in November 2024 and is expected to be completed in

the first quarter of 2025. Hyatt is providing key money, offsetting

a majority of the capital for the property refresh. The property’s

performance in September was meaningfully affected by the

disruption caused by the brand change, and this impact has

continued into the fourth quarter as the customer base transitions

to the new brand. This negative trend is expected to reverse as the

property refresh is completed in the first quarter and as Hyatt and

the property team ramp up sales and marketing efforts.

Capital Investments and Strategic Property

Redevelopments

During the third quarter, the Company completed $14.0 million of

capital investments throughout its portfolio, excluding capital

expenditures related to the repair and rebuilding of LaPlaya. This

includes capital related to the reflagging and refresh of Hyatt

Centric Delfina Santa Monica.

The Company has substantially completed its last major property

redevelopments, with the exception of the potential redevelopment

and conversion of Paradise Point Resort to a Margaritaville Island

Resort. With the completion of these significant investments,

virtually all of the Company's properties have undergone recent

major redevelopments or renovations. This marks a transition to a

period of significantly reduced capital investments planned for the

next few years. The Company expects it will invest a total of $90

to $95 million in the portfolio in 2024, net of key money.

Since 2018, the Company has reinvested approximately $523

million in transforming its hotels and resorts, with over $284

million directed towards return on investment (“ROI”)-generating

investments, as part of the Company’s broader strategic

redevelopment program. These investments have predominantly

involved major overhauls and strategic repositionings, elevating

the Company's properties to superior standards, by adding and

enhancing amenities and other profit-generating facilities,

including remerchandising existing indoor and outdoor facilities.

These ROI-focused projects are anticipated to yield substantial

returns and significant future organic growth, aligning with the

outcomes of past redevelopment and repositioning initiatives

completed by the Company.

Common Share Repurchases

In the third quarter of 2024, the Company repurchased 808,986

common shares at an average price of $12.35 per share. On a

cumulative basis since October 2022, the Company has repurchased

over 12 million common shares, or approximately 9% of the Company’s

outstanding common shares, at an average price of $14.40 per share,

representing a roughly 50% discount to the midpoint of the

Company’s most recently published Net Asset Value (“NAV”) per

share.

Balance Sheet

On October 3, 2024, Pebblebrook issued $400 million of 6.375%

Senior Notes due October 2029. The proceeds from the sale of these

notes were used to pay down $353.3 million across three term loans:

$43.3 million on the 2024 term loan, $210 million on the 2025 term

loan, and $100 million on the 2027 term loan.

On November 1, 2024, the Company extended $185.2 million of its

remaining $200 million 2025 term loan from October 2025 to January

2029, and extended the maturity of $602 million of its $650 million

senior unsecured revolving credit facility from October 2027 to

October 2029.

Year-to-date, the Company has successfully executed $1.5 billion

in debt financings and extensions.

Following these refinancings, the Company has no meaningful debt

maturities until December 2026, and the weighted-average maturity

of the Company’s debt is approximately 3.2 years. The Company’s

current $2.3 billion of consolidated debt and convertible notes is

well-structured, with an estimated effective weighted-average

interest rate of 4.3%. Approximately 91% of the combined debt and

convertible notes is fixed at an estimated effective

weighted-average interest rate of 4.0%, while the remaining 9% is

floating at an estimated weighted-average interest rate of 6.9%. In

addition, 91% of the Company’s outstanding debt is unsecured.

As of November 1, 2024, the Company had approximately $175.0

million in cash, cash equivalents and restricted cash, plus $636.3

million of undrawn availability on its $650 million senior

unsecured revolving credit facility.

Common and Preferred Dividends

On September 13, 2024, the Company declared a quarterly cash

dividend of $0.01 per share on its common shares and a regular

quarterly cash dividend for the following preferred shares of

beneficial interest:

- $0.39844 per 6.375% Series E Cumulative Redeemable Preferred

Share;

- $0.39375 per 6.3% Series F Cumulative Redeemable Preferred

Share;

- $0.39844 per 6.375% Series G Cumulative Redeemable Preferred

Share; and

- $0.35625 per 5.7% Series H Cumulative Redeemable Preferred

Share.

Update on Curator Hotel & Resort Collection

Curator Hotel & Resort Collection (“Curator”) is a curated

collection of experientially focused small brands and independent

lifestyle hotels and resorts worldwide founded by Pebblebrook and

several industry-leading independent lifestyle hotel operators. As

of September 30, 2024, Curator had 101 member hotels and resorts

and 117 master service agreements with preferred vendor partners.

The master service agreements provide Curator member hotels,

including Pebblebrook hotels, with preferred pricing, enhanced

operating terms, and early access to curated new technologies.

Curator's mission is to support lifestyle hotels and resorts

through its best-in-class operating agreements, services and

technology, while helping properties amplify their independent

brands and what makes them unique.

2024 Outlook

The Company's 2024 Outlook, which does not assume any

acquisitions or dispositions, incorporates planned capital

investments and key assumptions, including an estimated $18.3

million in BI insurance proceeds and $18.7 million of Hotel EBITDA

related to LaPlaya, which is incorporated into Adjusted EBITDAre,

Adjusted FFO and Adjusted FFO per diluted share, but does not

impact Same-Property Hotel EBITDA. The Company’s 2024 Outlook also

takes into account its best estimate of the impact of Hurricane

Milton and other named storms on the operating performance of its

southeast resorts. This forecast assumes stable travel conditions,

unaffected by pandemics, any further major weather events, federal

shutdowns or deteriorating macro-economic factors.

($ in millions, except per share data)

2024

Outlook

As of 11/07/24

Variance to

Prior Outlook

As of 7/24/24

Impact from

Named Storms

Variance from Other

Impact

Low

High

Low

High

Low

High

Low

High

Net income (loss)

($

19.4

)

($

15.4

)

($

6.4

)

($

11.4

)

($

11.5

)

($

11.5

)

$

5.1

$

0.1

Adjusted EBITDAre

$

346.0

$

350.0

($

5.0

)

($

10.0

)

($

11.5

)

($

11.5

)

$

6.5

$

1.5

Adjusted FFO

$

190.0

$

194.0

($

3.5

)

($

8.5

)

($

11.5

)

($

11.5

)

$

8.0

$

3.0

Adjusted FFO per diluted share

$

1.57

$

1.60

($

0.02

)

($

0.07

)

($

0.10

)

($

0.10

)

$

0.08

$

0.03

This 2024 Outlook is based, in part, on the following

estimates and assumptions:

($ in millions)

2024

Outlook

As of 11/07/24

Variance to

Prior Outlook

As of 7/24/24

Impact from

Named Storms

Variance from Other

Impact

Low

High

Low

High

Low

High

Low

High

US Hotel Industry RevPAR vs. ‘23

1.0

%

1.5

%

0.25

%

(0.25

%)

0.25

%

(0.25

%)

Same-Property RevPAR vs. ‘23

1.25

%

1.65

%

0.0

%

(0.6

%)

(0.3

%)

(0.3

%)

0.3

%

(0.3

%)

Same-Property Total Revenues vs. ‘23

2.0

%

2.4

%

(0.4

%)

(1.0

%)

(0.3

%)

(0.3

%)

(0.1

%)

(0.7

%)

Same-Property Total Expenses vs. ‘23

2.75

%

3.0

%

(0.2

%)

(0.4

%)

(0.1

%)

(0.1

%)

(0.1

%)

(0.3

%)

Same-Property Hotel EBITDA

$

346.0

$

350.0

($

4.1

)

($

9.1

)

($

3.7

)

($

3.7

)

($

0.4

)

($

5.4

)

Same-Property Hotel EBITDA vs. ‘23

(0.4

%)

0.8

%

(1.2

%)

(2.6

%)

(1.1

%)

(1.1

%)

(0.1

%)

(1.5

%)

The Company’s Q4 2024 Outlook is as follows:

($ in millions, except per share data)

Q4 2024

Outlook

As of 11/07/24

Variance to

Prior Outlook

As of 7/24/24

Impact from

Named Storms

Variance from Other

Impact

Low

High

Low

High

Low

High

Low

High

Net income (loss)

($

42.3

)

($

38.3

)

($

16.9

)

($

16.9

)

($

10.0

)

($

10.0

)

($

6.9

)

($

6.9

)

Adjusted EBITDAre

$

49.5

$

53.5

($

16.0

)

($

16.0

)

($

10.0

)

($

10.0

)

($

6.0

)

($

6.0

)

Adjusted FFO

$

9.6

$

13.6

($

15.6

)

($

15.6

)

($

10.0

)

($

10.0

)

($

5.6

)

($

5.6

)

Adjusted FFO per diluted share

$

0.08

$

0.11

($

0.13

)

($

0.13

)

($

0.08

)

($

0.08

)

($

0.05

)

($

0.05

)

This Q4 2024 Outlook is based, in part, on the following

estimates and assumptions:

($ in millions, except RevPAR)

Q4 2024

Outlook

As of 11/07/24

Variance to

Prior Outlook

As of 7/24/24

Impact from

Named Storms

Variance from Other

Impact

Low

High

Low

High

Low

High

Low

High

Same-Property RevPAR

$188

$192

($3)

($2)

($2)

($2)

($1)

$0

Same-Property RevPAR vs. ‘23

(1.0%)

1.0%

(1.8%)

(1.3%)

(1.0%)

(1.0%)

(0.8%)

(0.3%)

Same-Property Total Revenues vs. ‘23

(0.25%)

1.75%

(2.9%)

(2.3%)

(1.0%)

(1.0%)

(1.9%)

(1.3%)

Same-Property Total Expenses vs. ‘23

3.0%

4.0%

(0.9%)

(0.2%)

(0.2%)

(0.2%)

(0.7%)

0.0%

Same-Property Hotel EBITDA

$58.2

$62.2

($6.9)

($6.9)

($2.5)

($2.5)

($4.4)

($4.4)

Same-Property Hotel EBITDA vs. ‘23

(12.6%)

(6.6%)

(10.4%)

(10.4%)

(3.8%)

(3.8%)

(6.6%)

(6.6%)

Third Quarter 2024 Earnings Call

The Company will conduct its quarterly analyst and investor

conference call on Friday, November 8, 2024, beginning at 10:00 AM

ET. Please dial (877) 407-3982 approximately ten minutes before the

call begins to participate. A live webcast of the conference call

will also be available through the Investor Relations section of

www.pebblebrookhotels.com. To access the webcast, click on

https://investor.pebblebrookhotels.com/news-and-events/webcasts/default.aspx

ten minutes before the conference call. A replay of the conference

call webcast will be archived and available online.

About Pebblebrook Hotel Trust

Pebblebrook Hotel Trust (NYSE: PEB) is a publicly traded real

estate investment trust (“REIT”) and the largest owner of urban and

resort lifestyle hotels and resorts in the United States. The

Company owns 46 hotels and resorts, totaling approximately 12,000

guest rooms across 13 urban and resort markets. For more

information, visit www.pebblebrookhotels.com and follow

@PebblebrookPEB.

This press release contains certain “forward-looking statements”

made pursuant to the safe harbor provisions of the Private

Securities Reform Act of 1995. Forward-looking statements are

generally identifiable by the use of forward-looking terminology

such as “may,” “will,” “should,” “potential,” “intend,” “expect,”

“seek,” “anticipate,” “estimate,” “approximately,” “believe,”

“could,” “project,” “predict,” “forecast,” “continue,” “assume,”

“plan,” references to “outlook” or other similar words or

expressions. Forward-looking statements are based on certain

assumptions and can include future expectations, future plans and

strategies, financial and operating projections and forecasts and

other forward-looking information and estimates. Examples of

forward-looking statements include the following: descriptions of

the Company’s plans or objectives for future capital investment

projects, operations or services; forecasts of the Company’s future

economic performance; forecasts of hotel industry performance;

expectations of business interruption insurance proceeds; and

descriptions of assumptions underlying or relating to any of the

foregoing expectations including assumptions regarding the timing

of their occurrence. These forward-looking statements are subject

to various risks and uncertainties, many of which are beyond the

Company’s control, which could cause actual results to differ

materially from such statements. These risks and uncertainties

include, but are not limited to, the state of the U.S. economy and

the supply of hotel properties, and other factors as are described

in greater detail in the Company’s filings with the SEC, including,

without limitation, the Company’s Annual Report on Form 10-K for

the year ended December 31, 2023. Unless legally required, the

Company disclaims any obligation to update any forward-looking

statements, whether as a result of new information, future events

or otherwise.

For further information about the Company’s business and

financial results, please refer to the "Management’s Discussion and

Analysis of Financial Condition and Results of Operations” and

“Risk Factors” sections of the Company’s filings with the U.S.

Securities and Exchange Commission, including, but not limited to,

its Annual Report on Form 10-K and Quarterly Reports on Form 10-Q,

copies of which may be obtained at the Investor Relations section

of the Company’s website at www.pebblebrookhotels.com.

All information in this press release is as of November 7, 2024.

The Company undertakes no duty to update the statements in this

press release to conform the statements to actual results or

changes in the Company’s expectations.

Consolidated Balance Sheets ($ in thousands, except share

and per-share data) September 30, 2024 December 31,

2023 (Unaudited)

ASSETS Assets: Investment

in hotel properties, net

$

5,400,440

$

5,490,776

Cash and cash equivalents

133,965

183,747

Restricted cash

10,292

9,894

Hotel receivables (net of allowance for doubtful accounts of $428

and $689, respectively)

61,039

43,912

Prepaid expenses and other assets

116,841

96,644

Total assets

$

5,722,577

$

5,824,973

LIABILITIES AND EQUITY

Liabilities: Unsecured revolving credit facilities

$

-

$

-

Unsecured term loans, net of unamortized deferred financing costs

1,263,254

1,375,004

Convertible senior notes, net of unamortized debt premium and

discount and deferred financing costs

747,954

747,262

Senior unsecured notes, net of unamortized deferred financing costs

2,397

2,395

Mortgage loans, net of unamortized debt discount and deferred

financing costs

194,109

195,140

Accounts payable, accrued expenses and other liabilities

243,904

238,644

Lease liabilities - operating leases

320,714

320,617

Deferred revenues

86,878

76,874

Accrued interest

9,612

6,830

Distribution payable

11,857

11,862

Total liabilities

2,880,679

2,974,628

Commitments and contingencies

Shareholders' Equity:

Preferred shares of beneficial interest, $0.01 par value

(liquidation preference $690,000at September 30, 2024 and December

31, 2023), 100,000,000 shares authorized; 27,600,000 shares issued

and outstanding at September 30, 2024 and December 31, 2023

276

276

Common shares of beneficial interest, $0.01 par value, 500,000,000

shares authorized;119,285,394 shares issued and outstanding at

September 30, 2024 and 120,191,349 shares issued and outstanding at

December 31, 2023

1,193

1,202

Additional paid-in capital

4,069,808

4,078,912

Accumulated other comprehensive income (loss)

11,263

24,374

Distributions in excess of retained earnings

(1,330,539

)

(1,341,264

)

Total shareholders' equity

2,752,001

2,763,500

Non-controlling interests

89,897

86,845

Total equity

2,841,898

2,850,345

Total liabilities and equity

$

5,722,577

$

5,824,973

Pebblebrook Hotel Trust Consolidated Statements of

Operations ($ in thousands, except share and per-share

data) (Unaudited) Three months endedSeptember

30, Nine months endedSeptember 30,

2024

2023

2024

2023

Revenues: Room

$

262,755

$

259,397

$

714,633

$

706,705

Food and beverage

95,998

91,661

278,613

261,172

Other operating

45,777

44,741

122,463

117,984

Total revenues

$

404,530

$

395,799

$

1,115,709

$

1,085,861

Expenses: Hotel operating expenses: Room

$

68,721

$

68,065

$

188,747

$

189,179

Food and beverage

71,346

69,091

203,281

196,748

Other direct and indirect

116,953

112,596

328,705

324,164

Total hotel operating expenses

257,020

249,752

720,733

710,091

Depreciation and amortization

57,546

63,272

172,051

179,598

Real estate taxes, personal property taxes, property insurance, and

ground rent

35,274

32,905

92,681

91,380

General and administrative

11,814

11,549

35,937

32,739

Impairment

1,908

71,416

1,908

71,416

Gain on sale of hotel properties

-

-

-

(30,219

)

Business interruption insurance income

(7,059

)

(10,881

)

(18,340

)

(32,985

)

Other operating expenses

963

3,829

4,083

9,876

Total operating expenses

357,466

421,842

1,009,053

1,031,896

Operating income (loss)

47,064

(26,043

)

106,656

53,965

Interest expense

(27,925

)

(31,022

)

(82,285

)

(87,996

)

Other

793

1,403

1,336

2,538

Income (loss) before income taxes

19,932

(55,662

)

25,707

(31,493

)

Income tax (expense) benefit

25,213

(822

)

24,157

(853

)

Net income (loss)

45,145

(56,484

)

49,864

(32,346

)

Net income (loss) attributable to non-controlling interests

1,488

658

3,621

2,999

Net income (loss) attributable to the Company

43,657

(57,142

)

46,243

(35,345

)

Distributions to preferred shareholders

(10,631

)

(10,988

)

(31,894

)

(32,963

)

Net income (loss) attributable to common shareholders

$

33,026

$

(68,130

)

$

14,349

$

(68,308

)

Net income (loss) per share available to common

shareholders, basic

$

0.27

$

(0.57

)

$

0.12

$

(0.56

)

Net income (loss) per share available to common shareholders,

diluted

$

0.24

$

(0.57

)

$

0.12

$

(0.56

)

Weighted-average number of common shares, basic

119,640,463

120,057,744

119,938,931

122,394,293

Weighted-average number of common shares, diluted

149,351,866

120,057,744

120,367,351

122,394,293

Considerations Regarding Non-GAAP Financial Measures

This press release includes certain non-GAAP financial measures.

These measures are not in accordance with, or an alternative to,

measures prepared in accordance with GAAP and may be different from

similarly titled non-GAAP financial measures used by other

companies. In addition, these non-GAAP financial measures are not

based on any comprehensive set of accounting rules or principles.

Non-GAAP financial measures have limitations in that they do not

reflect all of the amounts associated with the Company’s results of

operations determined in accordance with GAAP.

Funds from Operations (“FFO”) - FFO represents net income

(computed in accordance with GAAP), excluding gains or losses from

sales of properties, plus real estate-related depreciation and

amortization and after adjustments for unconsolidated partnerships.

The Company considers FFO a useful measure of performance for an

equity REIT because it facilitates an understanding of the

Company's operating performance without giving effect to real

estate depreciation and amortization, which assume that the value

of real estate assets diminishes predictably over time. Since real

estate values have historically risen or fallen with market

conditions, the Company believes that FFO provides a meaningful

indication of its performance. The Company also considers FFO an

appropriate performance measure given its wide use by investors and

analysts. The Company computes FFO in accordance with standards

established by the Board of Governors of Nareit in its March 1995

White Paper (as amended in November 1999 and April 2002), which may

differ from the methodology for calculating FFO utilized by other

equity REITs and, accordingly, may not be comparable to that of

other REITs. Further, FFO does not represent amounts available for

management’s discretionary use because of needed capital

replacement or expansion, debt service obligations or other

commitments and uncertainties, nor is it indicative of funds

available to fund the Company’s cash needs, including its ability

to make distributions. The Company presents FFO per diluted share

based on the outstanding dilutive common shares plus the

outstanding Operating Partnership units for the periods

presented.

Earnings before Interest, Taxes, and Depreciation and

Amortization ("EBITDA") - The Company believes that EBITDA provides

investors a useful financial measure to evaluate its operating

performance, excluding the impact of our capital structure

(primarily interest expense) and our asset base (primarily

depreciation and amortization).

EBITDA for Real Estate ("EBITDAre") - The Company believes that

EBITDAre provides investors a useful financial measure to evaluate

its operating performance, and the Company presents EBITDAre in

accordance with Nareit guidelines, as defined in its September 2017

white paper "Earnings Before Interest, Taxes, Depreciation and

Amortization for Real Estate." EBITDAre adjusts EBITDA for the

following items, which may occur in any period: (1) gains or losses

on the disposition of depreciated property, including gains or

losses on change of control; (2) impairment write-downs of

depreciated property and of investments in unconsolidated

affiliates caused by a decrease in value of depreciated property in

the affiliate; and (3) adjustments to reflect the entity's share of

EBITDAre of unconsolidated affiliates.

The Company also evaluates its performance by reviewing Adjusted

FFO and Adjusted EBITDAre because it believes that adjusting FFO

and EBITDAre to exclude certain recurring and non-recurring items

described below provides useful supplemental information regarding

the Company's ongoing operating performance and that the

presentation of Adjusted FFO and Adjusted EBITDAre, when combined

with the primary GAAP presentation of net income (loss), more

completely describes the Company's operating performance. The

Company adjusts FFO available to common share and unit holders and

EBITDAre for the following items, which may occur in any period,

and refers to these measures as Adjusted FFO and Adjusted

EBITDAre:

- Transaction costs: The Company excludes transaction

costs expensed during the period because it believes that including

these costs in Adjusted FFO and Adjusted EBITDAre does not reflect

the underlying financial performance of the Company and its

hotels.

- Non-cash ground rent: The Company excludes the non-cash

ground rent expense, which is primarily made up of the

straight-line rent impact from a ground lease.

- Management/franchise contract transition costs: The

Company excludes one-time management and/or franchise contract

transition costs expensed during the period because it believes

that including these costs in Adjusted FFO and Adjusted EBITDAre

does not reflect the underlying financial performance of the

Company and its hotels.

- Interest expense adjustment for acquired liabilities:

The Company excludes interest expense adjustment for acquired

liabilities assumed in connection with acquisitions, because it

believes that including these non-cash adjustments in Adjusted FFO

does not reflect the underlying financial performance of the

Company.

- Finance lease adjustment: The Company excludes the

effect of non-cash interest expense from finance leases because it

believes that including these non-cash adjustments in Adjusted FFO

does not reflect the underlying financial performance of the

Company.

- Non-cash amortization of acquired intangibles: The

Company excludes the non-cash amortization of acquired intangibles,

which includes but is not limited to the amortization of favorable

and unfavorable leases or management agreements and above/below

market real estate tax reduction agreements because it believes

that including these non-cash adjustments in Adjusted FFO and

Adjusted EBITDAre does not reflect the underlying financial

performance of the Company.

- Early extinguishment of debt and deferred tax benefit:

The Company excludes these items because the Company believes that

including these adjustments in Adjusted FFO does not reflect the

underlying financial performance of the Company and its hotels.

- Amortization of share-based compensation expense and

hurricane-related costs: The Company excludes these items

because it believes that including these costs in Adjusted FFO and

Adjusted EBITDAre does not reflect the underlying financial

performance of the Company and its hotels.

The Company presents weighted-average number of basic and fully

diluted common shares and units by excluding the dilutive effect of

shares issuable upon conversion of convertible debt.

The Company’s presentation of FFO and Adjusted FFO should not be

considered as alternatives to net income (computed in accordance

with GAAP) as an indicator of the Company’s financial performance

or to cash flow from operating activities (computed in accordance

with GAAP) as an indicator of its liquidity. The Company’s

presentation of EBITDAre and Adjusted EBITDAre should not be

considered as alternatives to net income (computed in accordance

with GAAP) as an indicator of the Company’s financial performance

or to cash flow from operating activities (computed in accordance

with GAAP) as an indicator of its liquidity.

Pebblebrook Hotel Trust Reconciliation of Net Income

(Loss) to FFO and Adjusted FFO ($ in thousands, except share

and per-share data) (Unaudited) Three months

endedSeptember 30, Nine months endedSeptember 30,

2024

2023

2024

2023

Net income (loss)

$

45,145

$

(56,484

)

$

49,864

$

(32,346

)

Adjustments: Real estate depreciation and amortization

57,466

63,186

171,807

179,341

Gain on sale of hotel properties

-

-

-

(30,219

)

Impairment

1,908

71,416

1,908

71,416

FFO

$

104,519

$

78,118

$

223,579

$

188,192

Distribution to preferred shareholders and unit holders

(11,795

)

(12,152

)

(35,386

)

(36,455

)

FFO available to common share and unit holders

$

92,724

$

65,966

$

188,193

$

151,737

Transaction costs

-

273

44

583

Non-cash ground rent

1,868

1,901

5,613

5,712

Management/franchise contract transition costs

28

(1

)

72

210

Interest expense adjustment for acquired liabilities

259

403

890

1,487

Finance lease adjustment

750

740

2,242

2,210

Non-cash amortization of acquired intangibles

(482

)

(482

)

(1,445

)

(5,013

)

Early extinguishment of debt

-

1,004

1,534

1,004

Amortization of share-based compensation expense

3,500

3,321

10,083

9,232

Hurricane-related costs

-

991

183

5,058

Deferred tax provision (benefit)

(26,976

)

-

(26,976

)

-

Adjusted FFO available to common share and unit holders

$

71,671

$

74,116

$

180,433

$

172,220

FFO per common share - basic

$

0.77

$

0.54

$

1.56

$

1.23

FFO per common share - diluted

$

0.77

$

0.54

$

1.55

$

1.23

Adjusted FFO per common share - basic

$

0.59

$

0.61

$

1.49

$

1.40

Adjusted FFO per common share - diluted

$

0.59

$

0.61

$

1.49

$

1.39

Weighted-average number of basic common shares and units

120,651,591

121,066,124

120,950,059

123,402,673

Weighted-average number of fully diluted common shares and units

120,921,819

121,240,662

121,378,479

123,719,181

See “Considerations Regarding Non-GAAP Financial Measures” of this

press release for important considerations regarding the use of

non-GAAP financial measures. Any differences are a result of

rounding.

Pebblebrook Hotel Trust Reconciliation of Net

Income (Loss) to EBITDA, EBITDAre and Adjusted EBITDAre ($

in thousands) (Unaudited) Three months endedSeptember

30, Nine months endedSeptember 30,

2024

2023

2024

2023

Net income (loss)

$

45,145

$

(56,484

)

$

49,864

$

(32,346

)

Adjustments: Interest expense

27,925

31,022

82,285

87,996

Income tax expense (benefit)

(25,213

)

822

(24,157

)

853

Depreciation and amortization

57,546

63,272

172,051

179,598

EBITDA

$

105,403

$

38,632

$

280,043

$

236,101

Gain on sale of hotel properties

-

-

-

(30,219

)

Impairment

1,908

71,416

1,908

71,416

EBITDAre

$

107,311

$

110,048

$

281,951

$

277,298

Transaction costs

-

273

44

583

Non-cash ground rent

1,868

1,901

5,613

5,712

Management/franchise contract transition costs

28

(1

)

72

210

Non-cash amortization of acquired intangibles

(482

)

(482

)

(1,445

)

(5,013

)

Amortization of share-based compensation expense

3,500

3,321

10,083

9,232

Hurricane-related costs

-

991

183

5,058

Adjusted EBITDAre

$

112,225

$

116,051

$

296,501

$

293,080

See “Considerations Regarding Non-GAAP Financial Measures” of this

press release for important considerations regarding the use of

non-GAAP financial measures. Any differences are a result of

rounding.

Pebblebrook Hotel Trust Reconciliation of Q4

2024 and Full Year 2024 Outlook Net Income (Loss) to FFO and

Adjusted FFO (in millions, except per share data)

(Unaudited) Three months endingDecember 31, 2024

Year endingDecember 31, 2024 Low High

Low High Net income (loss)

$

(42

)

$

(38

)

$

(19

)

$

(15

)

Adjustments: Real estate depreciation and amortization

57

57

229

229

Impairment

-

-

2

2

FFO

$

15

$

19

$

212

$

216

Distribution to preferred shareholders and unit holders

(12

)

(12

)

(47

)

(47

)

FFO available to common share and unit holders

$

3

$

7

$

165

$

169

Non-cash ground rent

2

2

8

8

Amortization of share-based compensation expense

4

4

14

14

Other

1

1

3

3

Adjusted FFO available to common share and unit holders

$

10

$

14

$

190

$

194

FFO per common share - diluted

$

0.02

$

0.06

$

1.36

$

1.40

Adjusted FFO per common share - diluted

$

0.08

$

0.11

$

1.57

$

1.60

Weighted-average number of fully diluted common shares and

units

120.6

120.6

121.1

121.1

Pebblebrook Hotel Trust Reconciliation of Q4 2024 and

Full Year 2024 Outlook Net Income (Loss) to EBITDA, EBITDAre and

Adjusted EBITDAre ($ in millions) (Unaudited)

Three months endingDecember 31, 2024 Year

endingDecember 31, 2024 Low High Low

High Net income (loss)

$

(42

)

$

(38

)

$

(19

)

$

(15

)

Adjustments: Interest expense and income tax expense

29

29

114

114

Depreciation and amortization

57

57

229

229

EBITDA

$

44

$

48

$

324

$

328

Impairment

-

-

2

2

EBITDAre

$

44

$

48

$

326

$

330

Non-cash ground rent

2

2

8

8

Amortization of share-based compensation expense

4

4

14

14

Other

-

-

(2

)

(2

)

Adjusted EBITDAre

$

50

$

54

$

346

$

350

See “Considerations Regarding Non-GAAP Financial Measures” of this

press release for important considerations regarding the use of

non-GAAP financial measures. Any differences are a result of

rounding.

Pebblebrook Hotel Trust Same-Property

Statistical Data (Unaudited) Three months

endedSeptember 30, Nine months endedSeptember 30,

2024

2023

2024

2023

Same-Property Occupancy

78.5

%

75.4

%

72.2

%

69.6

%

2024 vs. 2023 Increase/(Decrease)

4.1

%

3.7

%

Same-Property ADR

$

306.03

$

312.05

$

303.78

$

309.42

2024 vs. 2023 Increase/(Decrease)

(1.9

%)

(1.8

%)

Same-Property RevPAR

$

240.28

$

235.16

$

219.30

$

215.39

2024 vs. 2023 Increase/(Decrease)

2.2

%

1.8

%

Same-Property Total RevPAR

$

364.36

$

354.87

$

334.88

$

327.81

2024 vs. 2023 Increase/(Decrease)

2.7

%

2.2

%

Notes:

For the three months ended September 30,

2024 and 2023, the above table of hotel operating statistics

includes information from all hotels owned as of September 30,

2024, except for the following: • LaPlaya Beach Resort & Club

is excluded due to its closure following Hurricane Ian.

For the nine months ended September 30,

2024 and 2023, the above table of hotel operating statistics

includes information from all hotels owned as of September 30,

2024, except for the following: • LaPlaya Beach Resort & Club

is excluded from Q1, Q2, and Q3 due to its closure following

Hurricane Ian. • Newport Harbor Island Resort is excluded from Q1

and Q2 due to its redevelopment.

These hotel results for the respective

periods may include information reflecting operational performance

prior to the Company's ownership of the hotels. Any differences are

a result of rounding. The information above has not been audited

and is presented only for comparison purposes.

Pebblebrook Hotel Trust Same-Property Statistical Data -

by Market (Unaudited) Three months

endedSeptember 30, Nine months endedSeptember 30,

2024

2024

Same-Property RevPAR variance to 2023: Chicago

18.1

%

6.6

%

Other Resort Markets

7.5

%

5.7

%

San Diego

6.3

%

8.6

%

Boston

5.2

%

5.1

%

Portland

4.7

%

(14.2

%)

Washington DC

(0.9

%)

3.2

%

Los Angeles

(4.6

%)

(2.5

%)

Southern Florida/Georgia

(5.2

%)

(4.6

%)

San Francisco

(9.4

%)

(4.1

%)

Urban

2.7

%

3.1

%

Resorts

0.8

%

(1.4

%)

Notes:

For the three months ended September 30,

2024, the above table of hotel operating statistics includes

information from all hotels owned as of September 30, 2024, except

for the following:

• LaPlaya Beach Resort & Club is

excluded due to its closure following Hurricane Ian.

For the nine months ended September 30,

2024, the above table of hotel operating statistics includes

information from all hotels owned as of September 30, 2024, except

for the following:

• LaPlaya Beach Resort & Club is

excluded from Q1, Q2, and Q3 due to its closure following Hurricane

Ian.

• Newport Harbor Island Resort is excluded

from Q1 and Q2 due to its redevelopment.

"Other Resort Markets" includes:

• Q1 and Q2: Columbia River Gorge, WA and

Santa Cruz, CA

• Q3: Columbia River Gorge, WA, Santa

Cruz, CA, and Newport, RI

These hotel results for the respective

periods may include information reflecting operational performance

prior to the Company's ownership of the hotels. Any differences are

a result of rounding.

The information above has not been audited

and is presented only for comparison purposes.

Pebblebrook Hotel Trust Hotel Operational Data

Schedule of Same-Property Results ($ in thousands)

(Unaudited) Three months endedSeptember 30, Nine

months endedSeptember 30,

2024

2023

2024

2023

Same-Property Revenues: Room

$

259,610

$

253,814

$

695,181

$

679,664

Food and beverage

93,024

89,138

258,407

250,087

Other

41,035

40,071

107,973

104,670

Total hotel revenues

393,669

383,023

1,061,561

1,034,421

Same-Property Expenses: Room

$

67,988

$

66,357

$

185,063

$

180,646

Food and beverage

68,908

66,673

190,442

185,090

Other direct

8,807

8,899

23,978

24,747

General and administrative

30,721

29,574

86,681

84,783

Information and telecommunication systems

5,317

5,172

15,436

15,099

Sales and marketing

28,138

27,137

80,259

77,311

Management fees

11,913

11,257

30,744

29,999

Property operations and maintenance

13,844

13,563

39,407

38,999

Energy and utilities

12,031

11,316

32,423

30,313

Property taxes

17,513

14,933

43,368

43,865

Other fixed expenses

17,671

16,227

45,917

42,812

Total hotel expenses

282,851

271,108

773,718

753,664

Same-Property EBITDA

$

110,818

$

111,915

$

287,843

$

280,757

Same-Property EBITDA Margin

28.2

%

29.2

%

27.1

%

27.1

%

Notes

For the three months ended September 30,

2024 and 2023, the above table of hotel operating statistics

includes information from all hotels owned as of September 30,

2024, except for the following: • LaPlaya Beach Resort & Club

is excluded due to its closure following Hurricane Ian.

For the nine months ended September 30,

2024 and 2023, the above table of hotel operating statistics

includes information from all hotels owned as of September 30,

2024, except for the following: • LaPlaya Beach Resort & Club

is excluded from Q1, Q2, and Q3 due to its closure following

Hurricane Ian. • Newport Harbor Island Resort is excluded from Q1

and Q2 due to its redevelopment.

These hotel results for the respective

periods may include information reflecting operational performance

prior to the Company's ownership of the hotels. Any differences are

a result of rounding.

The information above has not been audited

and is presented only for comparison purposes.

Pebblebrook Hotel Trust Historical Operating Data

($ in millions except ADR and RevPAR data)

(Unaudited) Historical Operating Data:

First Quarter Second Quarter Third Quarter

Fourth Quarter Full Year

2019

2019

2019

2019

2019

Occupancy

74%

86%

86%

77%

81%

ADR

$251

$275

$272

$250

$263

RevPAR

$186

$236

$234

$192

$212

Hotel Revenues

$294.3

$375.5

$372.5

$318.8

$1,361.0

Hotel EBITDA

$74.2

$132.7

$126.5

$84.9

$418.3

Hotel EBITDA Margin

25.2%

35.3%

34.0%

26.6%

30.7%

First Quarter Second Quarter Third Quarter

Fourth Quarter Full Year

2023

2023

2023

2023

2023

Occupancy

59%

73%

75%

64%

68%

ADR

$303

$312

$312

$296

$306

RevPAR

$177

$229

$235

$188

$208

Hotel Revenues

$290.2

$372.1

$383.0

$320.3

$1,365.7

Hotel EBITDA

$59.1

$110.5

$111.9

$67.7

$349.1

Hotel EBITDA Margin

20.4%

29.7%

29.2%

21.1%

25.6%

First Quarter Second Quarter Third Quarter

2024

2024

2024

Occupancy

60%

76%

79%

ADR

$299

$306

$306

RevPAR

$179

$232

$240

Hotel Revenues

$295.1

$380.5

$393.7

Hotel EBITDA

$58.4

$118.9

$110.8

Hotel EBITDA Margin

19.8%

31.2%

28.2%

Notes

These historical hotel operating results

include information for all of the hotels the Company owned as of

September 30, 2024, as if they were owned as of January 1, 2019,

except for LaPlaya Beach Resort & Club which is excluded from

all time periods due to its closure following Hurricane Ian. These

historical operating results include periods prior to the Company's

ownership of the hotels. The information above does not reflect the

Company's corporate general and administrative expense, interest

expense, property acquisition costs, depreciation and amortization,

taxes and other expenses.

These hotel results for the respective

periods may include information reflecting operational performance

prior to the Company's ownership of the hotels. Any differences are

a result of rounding.

The information above has not been audited

and is presented only for comparison purposes.

Pebblebrook Hotel Trust 2024 Same-Property Inclusion

Reference Table Hotels Q1 Q2

Q3 Q4 LaPlaya Beach Resort & Club Newport

Harbor Island Resort X

Notes

A property marked with an "X" in a

specific quarter denotes that the same-property operating results

of that property are included in the Same-Property Statistical Data

and in the Schedule of Same-Property Results.

The Company's estimates and assumptions

for 2024 Same-Property RevPAR, RevPAR Growth, Total Revenue Growth,

Total Expense Growth, Hotel EBITDA and Hotel EBITDA growth include

all of the hotels the Company owned as of September 30, 2024,

except for the following:

• LaPlaya Beach Resort & Club is

excluded from all quarters due to its closure following Hurricane

Ian.

• Newport Harbor Island Resort is excluded

from Q1, Q2 and Q4 due to its redevelopment.

Operating statistics and financial results

may include periods prior to the Company's ownership of the

hotels.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241107939480/en/

Raymond D. Martz, Co-President and Chief

Financial Officer, Pebblebrook Hotel Trust - (240) 507-1330 For

additional information or to receive press releases via email,

please visit www.pebblebrookhotels.com

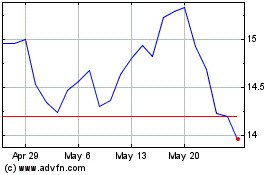

Pebblebrook Hotel (NYSE:PEB)

Historical Stock Chart

From Oct 2024 to Nov 2024

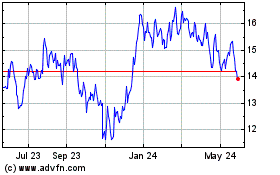

Pebblebrook Hotel (NYSE:PEB)

Historical Stock Chart

From Nov 2023 to Nov 2024