SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of November, 2024

PRUDENTIAL PUBLIC LIMITED COMPANY

(Translation

of registrant's name into English)

13/F, One International Finance Centre,

1 Harbour View Street, Central,

Hong Kong, China

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual

reports

under

cover Form 20-F or Form 40-F.

Form

20-F X

Form 40-F

Indicate

by check mark whether the registrant by furnishing the

information

contained

in this Form is also thereby furnishing the information to

the

Commission

pursuant to Rule 12g3-2(b) under the Securities Exchange Act of

1934.

Yes

No X

If

"Yes" is marked, indicate below the file number assigned to the

registrant

in

connection with Rule 12g3-2(b): 82-

NEWS RELEASE

6 November 2024

PRUDENTIAL PLC Q3 BUSINESS PERFORMANCE UPDATE

Q3 YTD new business profit up 11 per cent (9 per cent excluding

economic impacts)

Performance highlights on a constant (and actual) exchange rate

basis for the nine months ended 30 September 2024

●

Q3

year to date new business profit was $2,347

million, up

11 per cent (10 per cent) including economic impacts. Q3 year to

date new business profit excluding economic

impacts was up 9 per cent (7 per cent)

●

Q3

year to date APE sales were up 7 per cent (5 per cent) to $4,638

million. APE

sales for the three months ended 30 September were up 10 per cent

(10 per cent) compared with the same period in the prior year, with

all segments growing in the discrete third

quarter.

Anil Wadhwani, Chief Executive Officer of Prudential,

commented:

"Our new business performance in the third quarter saw our momentum

continue as expected. APE sales for the three months ended 30

September were up 10 per cent compared with the

same period last year. Our multi-channel distribution model has

driven broad based new business profit growth

including, on

a total regional

basis, in Greater

China, ASEAN and Africa. Looking ahead, we remain on track for

growth in new business profit in 2024 of between 9 to 13 per

cent. Through

our transformation programme we continue to drive growth and

quality. In line with our ambition to expand our distribution

strength in our key ASEAN markets, we are delighted to enter a

long-term partnership with Bank

Syariah Indonesia, the biggest Syariah bank

in Indonesia, which gives us access to circa 20 million

customers. We

have also taken full ownership of our Nigeria life

operations."

Business Performance (on a constant exchange rate

basis)

Total APE sales were up 7 per cent in the nine months ended 30

September and up 10 per cent in the discrete third quarter

compared with the

same prior year period. Growth in the third quarter was broad based

across all segments, highlighting the benefits of our multi-channel

distribution model and our diversified geographic

presence. Our agency growth in Q3 was broad based across

our four

multi-market growth regions and

we continue to focus on agent activation and productivity of

agents. Agency

APE sales grew by 11 per cent in the discrete third quarter

compared with the

same period in the prior year. Bancassurance APE sales were up 21

per cent in the nine months ended 30 September, with the discrete

third quarter increasing by 12 per cent when

compared with the

same period in the prior year. This increase in APE sales in the

third quarter was driven by growth from

Hong Kong, China and Thailand, with the

level of growth moderating in

Taiwan. The execution of the first tranche of our $2 billion share

buyback continues with a total of 66 million shares repurchased as

at 31 October 2024 for £437 million ($570

million).

Outlook

Given our performance in the nine months ended 30 September, we

believe we are on track for our expected 2024 new business profit

growth trajectory of 9-13 per cent, assuming economics consistent

with those applied in our FY23 reporting and on a constant foreign

exchange rate basis. This trajectory is consistent with achieving

our 2027 new business profit objective.

APE new business sales (APE sales) and EEV new business profit

(NBP)

|

|

|

|

|

Constant exchange rate

|

|

Actual exchange rate

|

|

|

YTD 30.09.2024 $m

|

|

YTD 30.09.2023 $m

|

Change

%

|

|

YTD 30.09.2023 $m

|

Change

%

|

|

|

APE sales

|

NBP

|

|

APE sales

|

NBP

|

APE sales

|

NBP

|

|

APE sales

|

NBP

|

APE sales

|

NBP

|

|

Total

|

4,638

|

2,347

|

|

4,325

|

2,109

|

7%

|

11%

|

|

4,417

|

2,143

|

5%

|

10%

|

|

Total new business margin (%)

|

|

51%

|

|

|

49%

|

|

|

|

|

49%

|

|

|

|

Total excluding economic impacts

|

4,638

|

2,294

|

|

4,325

|

2,109

|

7%

|

9%

|

|

4,417

|

2,143

|

5%

|

7%

|

|

Total new business margin excluding economic impacts

(%)

|

|

49%

|

|

|

49%

|

|

|

|

|

49%

|

|

|

Market highlights for the nine months ended 30 September

2024

(New business profit commentary below excludes the impacts of

economics and both new business profit and APE sales are on a

constant currency basis. See "Definitions of Performance Metrics"

below for more details.)

In Hong

Kong we

have delivered 8 per cent growth in new business profit for the

first nine months of 2024. This was driven by improved new business

margins following pricing actions undertaken earlier in the year

and our continued focus on the quality of the products we sell.

Total APE sales for the three months to 30 September 2024 were up

12 per cent compared with the same period in the prior year

contributing to sales for the first nine months being only 1 per

cent lower than the prior year, when we outperformed the market.

While overall agency APE sales were down in the first nine months,

agency APE sales in the three months to 30 September 2024 grew by 8

per cent compared with the

same period in the prior year, following

positive momentum in September. APE sales from the bancassurance

channel grew by 33 per

cent during

the third quarter compared with the same period in the prior

year.

Sales to both domestic customers and Chinese Mainland visitors grew

in the three months to 30 September 2024, with APE sales to

domestic customers up 36 per cent on the equivalent prior year

period and APE sales to Chinese Mainland visitors up 1 per cent on

the same basis. We continue to prioritise channels where we have a

stronger control of the customer experience and remain focused on

value generated by new business.

CITIC Prudential Life (CPL),

our Chinese Mainland joint venture, grew significantly in the third

quarter resulting in a 12 per cent increase in new business profit

in the nine months to 30 September 2024. This was driven by

increased new business profit margins as product mix improved as we

continued to move to less capital intensive, higher margin

products. APE sales for the nine months to 30 September 2024 were

(6) per cent lower compared with the same period last year. However

APE sales for the three months ended 30 September grew by 36 per

cent compared with the same period in the prior year as the growth

momentum improved as expected. During this three month period, both

agency and bancassurance channels saw growth compared with the same

period in the prior year.

As previously announced by CPL, each shareholder will be making a

further $176 million cash contribution to increase the capital of

CPL to complement the ongoing actions the business is already

undertaking. This is subject to the relevant regulatory

approvals.

Singapore: New

business profit for the nine months ended 30 September grew by 15

per cent compared with the

prior year, underpinned by a 14 per cent increase in APE sales.

Overall APE sales in the discrete third quarter were up 6 per cent

compared with the same period in the prior year. The discrete third

quarter saw our agency channel perform strongly, with APE sales up

25 per cent compared with the prior year. Bancassurance channel APE

sales declined by (12) per cent in the discrete third quarter

compared with the same period in the prior year as our

bancassurance partners pivoted to our higher margin products. This

margin expansion together with strong top-line performance in

agency supported an increase in new business profit in both

channels in the quarter demonstrating the benefits of our

diversified business model.

Malaysia: New

business profit for the nine months ended 30 September was (6) per

cent lower compared with the

same period in the prior year, with APE sales in the same period up

7 per cent. Margins were lower given the channel mix shift in the

period. Agency sales in the conventional life business declined

year-on-year as we took repricing actions to both protect the value

of the "in force" business and so that new business can be written

more profitably, amid high medical inflation in the country. We led

the health market with our discipline and have introduced

claims-based pricing products

to improve customer affordability. We expect to

see the benefits of

our management actions in both the quality and affordability of

health products over

the course of next year. In

the discrete third quarter, total APE sales increased by 1 per cent

compared with the

same period last year, and APE sales through the bancassurance

channel grew 19 per cent on the same basis, reflecting the combined

strength of our partnerships with UOB and SCB. We anticipate that

sales trends in both agency and bancassurance will normalise during

2025.

Indonesia: New

business profit for the nine months ended 30 September was down (2)

per cent, with APE sales for the same period being (9) per cent

lower, as

the pivot

from linked business to traditional products improved new business

profit margins. APE sales in the three months to 30 September were

29 per cent higher than the same period last year, driven by

continued sales growth in the bancassurance channel and improved

performance in the agency channel. Sales of health and protection

products rose, largely supported by successful product launches

aimed at better "in force" performance of the business. While we

are encouraged by this quarter's growth, we remain focused on our

transformation programme to create the conditions for more

sustainable growth in this strategically important

market.

In our "Growth Markets

and Other"

segment, new business profit for the nine months ended 30 September

increased by 11 per cent compared with the same period last year.

The 21 per cent growth in year-to-date APE sales was driven by

Thailand, Taiwan, India and Africa. New business margins declined

given business mix effects. Q3 discrete APE sales grew 6 per

cent, with

good growth delivered

in India, Africa and Thailand while, as

expected, there

was slower growth

in Taiwan, after an exceptionally strong performance in the same

period in the prior year.

Eastspring built

on the strong performance seen in the first half of 2024 with funds

under management or advice (FUM) continuing to grow, reaching

$271.4 billion at the end of September 2024, up from $247.4 billion

at the end of June 2024. We are encouraged by the $4.6 billion

of year

to date net

inflows from third parties (excluding money market funds and funds

managed on behalf of M&G), with continued strong flows into the

retail business partially offset by institutional outflows. Q3

discrete net inflows on the same basis were $1.7 billion. FUM

growth was also supported by net inflows from the Group's insurance

business and positive market and exchange rate

movements.

Q3 YTD Traditional Embedded Value (TEV) new business

profit

To assist the transition to TEV in 2025 we are providing the TEV

new business profit for the nine months ended 30 September 2024,

which was $1,764 million (post central costs and calculated using

average exchange rates for the nine month period).

Notes

Comparisons are to the first nine months of the prior year unless

otherwise stated and year-on-year percentage changes are provided

on a constant exchange rate basis unless otherwise stated. All

results are presented in US dollars.

References to new business profits growth in 2024 of between 9 to

13 per cent are on the basis of assuming economics consistent with

those applied in our FY23 reporting and on a constant foreign

exchange rate basis.

See "Definitions of Performance Metrics" below for explanation of

performance measures used in this announcement.

Contact:

|

Media

|

|

Investors/Analysts

|

|

|

Simon Kutner

|

+44 (0)7581 023260

|

Patrick Bowes

|

+852 2918 5468

|

|

Sonia Tsang

|

+852 5580 7525

|

William Elderkin

|

+44 (0)20 3977 9215

|

|

|

|

Darwin Lam

|

+852 2918 6348

|

About Prudential plc

Prudential plc provides life and health insurance and asset

management in 24 markets across Asia and Africa. Prudential's

mission is to be the most trusted partner and protector for this

generation and generations to come, by providing simple and

accessible financial and health solutions. The business has dual

primary listings on the Stock Exchange of Hong Kong (2378) and the

London Stock Exchange (PRU). It also has a secondary listing on the

Singapore Stock Exchange (K6S) and a listing on the New York Stock

Exchange (PUK) in the form of American Depositary Receipts. It is a

constituent of the Hang Seng Composite Index and is also included

for trading in the Shenzhen-Hong Kong Stock Connect programme and

the Shanghai-Hong Kong Stock Connect programme.

Prudential is not affiliated in any manner with Prudential

Financial, Inc. a company whose principal place of business is in

the United States of America, nor with The Prudential Assurance

Company Limited, a subsidiary of M&G plc, a company

incorporated in the United Kingdom.

https://www.prudentialplc.com/

Metrics presented

This business performance update provides information on the

trading and sales development of the Group in the first nine months

of 2024. This update focusses on annual premium equivalent (APE)

and new business profit (NBP), which are key metrics used by the

Group's management to assess and manage the development and growth

of the business. APE sales are provided as an indicative volume

measure of transactions undertaken in the reporting period that

have the potential to generate profits for shareholders. NBP is

measured in accordance with European Embedded Value (EEV)

Principles and reflects the value of future profit streams which

are not fully captured in shareholders' equity in the year of sale

under IFRS. Under this methodology, discount rates and other

economic assumptions are updated at the end of each reporting

period to reflect current interest rates, introducing a degree of

volatility into the NBP measure. In addition, the entire NBP

amounts within a given reporting period are updated using end of

period discount rates. In particular, the first nine months of 2024

NBP contained in this announcement is based on interest rates as at

30 September 2024. When published, the full year 2024 results will

contain NBP for the full year based on interest rates as at 31

December 2024. Consequently, the NBP values for the first nine

months of 2024 that will be included in the full year 2024 results

may differ to the amounts presented in this announcement. In

addition to the NBP presented as described above, we also present

new business profit excluding economic impacts. This is NBP

calculated using interest rates and other economics at 30 September

2023 to show underlying growth compared with the prior year. It is

based on average exchange rates for the three months ended 30

September 2024 which are also used to determine the constant

exchange rate Q3 2023 amount.

In its 2024 Half-Year Financial Report, the Group announced its

intent to convert to Traditional Embedded Value (TEV) from the

first quarter of 2025. This report contains a TEV new business

profit for the nine months to 30 September 2024 which will be the

comparative for Q3 2025 reporting. The approach to the conversion

to TEV was discussed in the Financial Review section of the 2024

Half Year Financial Report. In particular current risk-free rates

were replaced with long-term risk-free rates, with trending from

current rates to long-term rates if appropriate, and the economic

volatility seen in our EEV reporting (discussed above) is

reduced.

The presentation of these key metrics is not intended to be

considered as a substitute for, or superior to, financial

information prepared and presented in accordance with IFRS. Further

information about these metrics including a reconciliation of EEV

shareholders' equity for half year 2024 to the most directly

comparable IFRS measure can be found in the Group's 2024 Half-Year

Financial Report.

Definitions of Performance Metrics

Annual premium equivalent (APE) sales

A measure of new business activity that comprises the aggregate of

annualised regular premiums and one-tenth of single premiums on new

business written during the period for all insurance

products.

Eastspring total funds under management or advice

Total funds under management or advice including external funds

under management, money market funds, funds managed on behalf of

M&G plc and internal funds under management or

advice.

New business profit

Presented on a post-tax basis, on business sold in the period

calculated in accordance with EEV principles.

New business profit excluding economic impacts

New business profit in accordance with EEV principles excluding

economic impacts (and the movements therein) represents the amount

of new business profit for the first nine months of 2024 calculated

using economics (including interest rates) as at 30 September 2023

and average exchange rates for the first nine months of 2024. The

percentage change excluding economics excludes the impact of the

change in interest rates and other economic movements in the period

from that applicable to the new business profit in the first nine

months of 2023, and applies consistent average exchange rates from

the first nine months of 2024.

See the Prudential 2024 Half Year Financial Report for further

information on the metrics above, including reconciliations to IFRS

where appropriate.

Forward-Looking Statements

This announcement contains 'forward-looking statements' with

respect to certain of Prudential's (and its wholly and jointly

owned businesses') plans and its goals and expectations relating to

future financial condition, performance, results, strategy and

objectives. Statements that are not historical facts, including

statements about Prudential's (and its wholly and jointly owned

businesses') beliefs and expectations and including, without

limitation, commitments, ambitions and targets, including those

related to sustainability (including ESG and climate-related)

matters, and statements containing the words 'may', 'will',

'should', 'continue', 'aims', 'estimates', 'projects', 'believes',

'intends', 'expects', 'plans', 'seeks' and 'anticipates', and words

of similar meaning, are forward-looking statements. These

statements are based on plans, estimates and projections as at the

time they are made, and therefore undue reliance should not be

placed on them. By their nature, all forward-looking statements

involve risk and uncertainty.

A number of important factors could cause actual future financial

condition or performance or other indicated results to differ

materially from those indicated in any forward-looking statement.

Such factors include, but are not limited to:

●

current and future market conditions, including

fluctuations in interest rates and exchange rates, inflation

(including resulting interest rate rises), sustained high or low

interest rate environments, the performance of financial and credit

markets generally and the impact of economic uncertainty, slowdown

or contraction (including as a result of the Russia-Ukraine

conflict, conflict in the Middle East, and related or other

geopolitical tensions and conflicts), which may also impact

policyholder behaviour and reduce product

affordability;

●

asset valuation impacts from the

transition to a lower carbon economy;

●

derivative instruments not effectively

mitigating any exposures;

●

global political uncertainties,

including the potential for increased friction in cross-border

trade and the exercise of laws, regulations and executive powers to

restrict trade, financial transactions, capital movements and/or

investment;

●

the policies and actions of regulatory

authorities, including, in particular, the policies and actions of

the Hong Kong Insurance Authority, as Prudential's Group-wide

supervisor, as well as the degree and pace of regulatory changes

and new government initiatives generally;

●

the impact on Prudential of systemic

risk and other group supervision policy standards adopted by the

International Association of Insurance Supervisors, given

Prudential's designation as an Internationally Active Insurance

Group;

●

the physical, social, morbidity/health

and financial impacts of climate change and global health crises,

which may impact Prudential's business, investments, operations and

its duties owed to customers;

●

legal, policy and regulatory

developments in response to climate change and broader

sustainability-related issues, including the development of

regulations and standards and interpretations such as those

relating to sustainability (including ESG and climate-related)

reporting, disclosures and product labelling and their

interpretations (which may conflict and create misrepresentation

risks);

●

the collective ability of governments,

policymakers, the Group, industry and other stakeholders to

implement and adhere to commitments on mitigation of climate change

and broader sustainability-related issues effectively (including

not appropriately considering the interests of all Prudential's

stakeholders or failing to maintain high standards of corporate

governance and responsible business practices);

●

the

impact of competition and fast-paced technological

change;

●

the

effect on Prudential's business and results from mortality and

morbidity trends, lapse rates and policy renewal

rates;

●

the

timing, impact and other uncertainties of future acquisitions or

combinations within relevant industries;

●

the impact of internal transformation

projects and other strategic actions failing to meet their

objectives or adversely impacting the Group's operations or

employees;

●

the availability and effectiveness of

reinsurance for Prudential's businesses;

●

the risk that Prudential's operational

resilience (or that of its suppliers and partners) may prove to be

inadequate, including in relation to operational disruption due to

external events;

●

disruption to the availability,

confidentiality or integrity of Prudential's information

technology, digital systems and data (or those of its suppliers and

partners);

●

the

increased non-financial and financial risks and uncertainties

associated with operating joint ventures with independent partners,

particularly where joint ventures are not controlled by

Prudential;

●

the impact of changes in capital,

solvency standards, accounting standards or relevant regulatory

frameworks, and tax and other legislation and regulations in the

jurisdictions in which Prudential and its affiliates operate;

and

●

the impact of legal and

regulatory actions, investigations and

disputes.

These factors are not exhaustive. Prudential operates in a

continually changing business environment with new risks emerging

from time to time that it may be unable to predict or that it

currently does not expect to have a material adverse effect on its

business. In addition, these and other important factors may, for

example, result in changes to assumptions used for determining

results of operations or re-estimations of reserves for future

policy benefits. Further discussion of these and other important

factors that could cause actual future financial condition or

performance to differ, possibly materially, from those anticipated

in Prudential's forward-looking statements can be found under the

'Risk Factors' heading of Prudential's 2024 Half Year Financial

Report, available on Prudential's website at www.prudentialplc.com.

Any forward-looking statements contained in this announcement speak

only as of the date on which they are made. Prudential expressly

disclaims any obligation to update any of the forward-looking

statements contained in this announcement or any other

forward-looking statements it may make, whether as a result of

future events, new information or otherwise except as required

pursuant to the UK Prospectus Rules, the UK Listing Rules, the UK

Disclosure Guidance and Transparency Rules, the Hong Kong Listing

Rules, the SGX-ST Listing Rules or other applicable laws and

regulations.

Prudential may also make or disclose written and/or oral

forward-looking statements in reports filed with or furnished to

the US Securities and Exchange Commission, the UK Financial Conduct

Authority, the Hong Kong Stock Exchange and other regulatory

authorities, as well as in its annual report and accounts to

shareholders, periodic financial reports to shareholders, proxy

statements, offering circulars, registration statements,

prospectuses, prospectus supplements, press releases and other

written materials and in oral statements made by directors,

officers or employees of Prudential to third parties, including

financial analysts. All such forward-looking statements are

qualified in their entirety by reference to the factors discussed

under the 'Risk Factors' heading of Prudential's 2024 Half Year

Financial Report, available on Prudential's website at

www.prudentialplc.com.

Cautionary Statements

This announcement does not constitute or form part of any offer or

invitation to purchase, acquire, subscribe for, sell, dispose of or

issue, or any solicitation of any offer to purchase, acquire,

subscribe for, sell or dispose of, any securities in any

jurisdiction nor shall it (or any part of it) or the fact of its

distribution, form the basis of, or be relied on in connection

with, any contract therefor.

NOT FOR DISTRIBUTION OR RELEASE, DIRECTLY OR INDIRECTLY, IN OR INTO

THE UNITED STATES OF AMERICA

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

Date: 06 November

2024

|

|

PRUDENTIAL

PUBLIC LIMITED COMPANY

|

|

|

|

|

|

By:

/s/ Ben Bulmer

|

|

|

|

|

|

Ben

Bulmer

|

|

|

Chief

Financial Officer

|

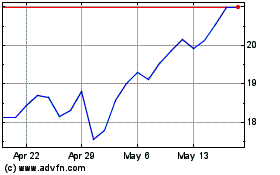

Prudential (NYSE:PUK)

Historical Stock Chart

From Oct 2024 to Nov 2024

Prudential (NYSE:PUK)

Historical Stock Chart

From Nov 2023 to Nov 2024