Securities Act File No. 333-251492

Investment Company Act File No. 811-23157

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-2

(Check Appropriate Box or Boxes)

|

|

REGISTRATION STATEMENT

|

|

|

|

UNDER

THE SECURITIES ACT OF 1933

|

o

|

|

|

Pre-Effective Amendment No.

|

o

|

|

|

Post-Effective Amendment No. 1

|

x

|

|

|

and/or

|

|

|

|

REGISTRATION STATEMENT

|

|

|

|

UNDER

THE INVESTMENT COMPANY ACT OF 1940

|

x

|

|

|

Amendment No. 3

|

x

|

BROOKFIELD REAL ASSETS INCOME FUND INC.

(Exact Name of Registrant as Specified in Charter)

Brookfield Place, 250 Vesey Street

New York, New York 10281-1023

(Address of Principal Executive Offices)

Registrant’s Telephone Number, including Area Code: (212) 417-7049

Brian F. Hurley, Esq.

Brookfield Real Assets Income Fund Inc.

Brookfield Place, 250 Vesey Street

New York, New York 10281-1023

(Name and Address of Agent for Service)

Copies to:

|

Thomas D. Peeney, Esq.

Brookfield Public Securities Group LLC

Brookfield Place

250 Vesey Street

New York, New York 10281-1023

|

|

Michael R. Rosella, Esq.

Vadim Avdeychik, Esq.

Paul Hastings LLP

200 Park Avenue

New York, New York 10166

(212) 318-6800

|

Approximate date of proposed offering: From time to time after the effective date of this Registration Statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, check the following box o

If any securities being registered on this Form will be offered on a delayed or continuous basis in reliance on Rule 415 under the Securities Act of 1933 (“Securities Act”), other than securities offered in connection with a dividend reinvestment plan, check the following box. x

If this Form is a registration statement pursuant to General Instruction A.2 or a post-effective amendment thereto, check the following box x

If this Form is a registration statement pursuant to General Instruction B or a post-effective amendment thereto that will become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box o

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction B to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box o

It is proposed that this filing will become effective (check appropriate box):

o When declared effective pursuant to section 8(c) of the Securities Act.

Check each box that appropriately characterizes the Registrant:

x Registered Closed-End Fund (closed-end company that is registered under the Investment Company Act of 1940 (the “Investment Company Act”)).

o Business Development Company (closed-end company that intends or has elected to be regulated as a business development company under the Investment Company Act.

o Interval Fund (Registered Closed-End Fund or a Business Development Company that makes periodic repurchase offers under Rule 23c-3 under the Investment Company Act).

x A.2 Qualified (qualified to register securities pursuant to General Instruction A.2 of this Form).

o Well-Known Seasoned Issuer (as defined by Rule 405 under the Securities Act).

o Emerging Growth Company (as defined by Rule 12b-2 under the Securities and Exchange Act of 1934).

o If an Emerging Growth Company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

o New Registrant (registered or regulated under the Investment Company Act for less than 12 calendar months preceding this filing).

EXPLANATORY NOTE

This Post-Effective Amendment No. 1 to the Registration Statement on Form N-2 (File Nos. 333-2251492 and 811-23157) of Brookfield Real Assets Income Fund Inc. (the “Registration Statement”) is being filed pursuant to Rule 462(d) under the Securities Act of 1933, as amended (the “Securities Act”), solely for the purpose of filing exhibits to the Registration Statement. Accordingly, this Post-Effective Amendment No. 1 consists only of a facing page, this explanatory note and Part C of the Registration Statement on Form N-2 setting forth the exhibits to the Registration Statement. This Post-Effective Amendment No. 1 does not modify any other part of the Registration Statement. The contents of the Registration Statement are hereby incorporated by reference.

Pursuant to Rule 462(d) under the Securities Act, this Post-Effective Amendment No. 1 shall become effective immediately upon filing with the Securities and Exchange Commission.

Part C

Item 25.

1. Financial Statements

Included in Part A:

Audited financial highlights for the operating performance of Brookfield Real Assets Income Fund Inc. (the “Registrant”).

Included in Part B:

The following statements of the Registrant are incorporated by reference in Part B of the Registration Statement:

Schedule of Investments at December 31, 2020

Statement of Assets and Liabilities as of December 31, 2020

Statement of Operations for the Year Ended December 31, 2020

Statement of Changes in Net Assets for the Year Ended December 31, 2020

Notes to Financial Statements for the Year Ended December 31, 2020

Report of Independent Registered Public Accounting Firm for the Year Ended December 31, 2020

2. Exhibits

Item 26. Marketing Arrangements

The information contained under the heading “Plan of Distribution” in Part A of this Registration Statement is incorporated herein by reference and any information concerning any underwriters will be contained in the accompanying prospectus supplement, if any. Reference is also made to the Dealer Manager Agreement, Underwriting Agreement, Sales Agreement and/or Distribution Agreement incorporated herein by reference, filed herewith or to be filed by further amendment pursuant to Item 25(2)(h) above.

Item 27. Other Expenses of Issuance and Distribution

The following table sets forth the estimated expenses to be incurred in connection with the offering described in this Registration Statement:

|

Legal Fees

|

|

$

|

250,000

|

|

|

Printing Expenses

|

|

65,000

|

|

|

Marketing Expenses

|

|

25,000

|

|

|

NYSE Listing Fees

|

|

50,500

|

|

|

SEC Registration Fees

|

|

43,640

|

|

|

FINRA Fees

|

|

60,500

|

|

|

Accounting Fees

|

|

17,500

|

|

|

Miscellaneous

|

|

150,000

|

|

|

Total

|

|

$

|

662,140

|

|

Item 28. Persons Controlled by or Under Common Control with Registrant

None.

Item 29. Number of Holders of Securities.

|

Title Class

|

|

Number of Record Shareholders

as of March 31, 2021

|

|

|

Capital stock, at par value ($0.001 par value, 1,000,000,000 shares authorized)

|

|

354

|

|

Item 30. Indemnification

Maryland law permits a Maryland corporation to include in its charter a provision limiting the liability of its directors and officers to the corporation and its stockholders for money damages except for liability resulting from (a) actual receipt of an improper benefit or profit in money, property or services or (b) active and deliberate dishonesty established by a final judgment and material to the cause of action. The Registrant’s charter contains such a provision which eliminates directors’ and officers’ liability to the maximum extent permitted by Maryland law, subject to the requirements of the 1940 Act.

The Registrant’s charter authorizes the Registrant, to the maximum extent permitted by Maryland law and subject to the requirements of the 1940 Act, to obligate the Registrant to indemnify any present or former director or officer or any individual who, while serving as a director or officer of the Registrant and, at the Registrant’s request, serves or has served another corporation, real estate investment trust, partnership, joint venture, limited liability company, trust, employee benefit plan or other enterprise as a director, officer, partner, manager, managing member or trustee from and against any claim or liability to which that individual may become subject or which that individual may incur by reason of his or her service in any such capacity and to pay or reimburse his or her reasonable expenses in advance of final disposition of a proceeding.

The Registrant’s Bylaws obligate the Registrant, to the maximum extent permitted by Maryland law and subject to the requirements of the 1940 Act, to indemnify any present or former director or officer or any individual who, while serving as a director or officer of the Registrant and, at the Registrant’s request, serves or has served another corporation, real estate investment trust, partnership, joint venture, limited liability company, trust, employee benefit plan or other enterprise as a director, officer, partner, manager, managing member or trustee and who is made, or threatened to be made, a party to the proceeding by reason of his or her service in any such capacity and to pay or reimburse his or her reasonable expenses in advance of final disposition of a proceeding. The Registrant’s charter and Bylaws also permit the Registrant to indemnify and advance expenses to any individual who served any predecessor of the Registrant in any of the capacities described above and any employee or agent of the Registrant or a predecessor of the Registrant, if any.

Maryland law requires a corporation (unless its charter provides otherwise, which is not the case for the Registrant’s charter) to indemnify a director or officer who has been successful, on the merits or otherwise, in the defense of any proceeding to which he or she is made, or threatened to be made, a party by reason of his or her service in that capacity. Maryland law permits a corporation to indemnify its present and former directors and officers, among others, against judgments, penalties, fines, settlements and reasonable expenses actually incurred by them in connection with any proceeding to which they may be made, or threatened to be made, a party by reason of their service in those or other capacities unless it is established that (a) the act or omission of the director or officer was material to the matter giving rise to the proceeding and (1) was committed in bad faith or (2) was the result of active and deliberate dishonesty, (b) the director or officer actually received an improper personal benefit in money, property or services or (c) in the case of any criminal proceeding, the director or officer had reasonable cause to believe the act or omission was unlawful. However, under Maryland law, a Maryland corporation may not indemnify for an adverse judgment in a suit by or in the right of the corporation or for a judgment of liability on the basis that a personal benefit was improperly received, unless in either case a court orders indemnification, and then only for expenses. In addition, Maryland law permits a corporation to pay or reimburse reasonable expenses to a director or officer in advance of final disposition of a proceeding upon the corporation’s receipt of (a) a written affirmation by the director or officer of his or her good faith belief that he or she has met the standard of conduct necessary for indemnification by the corporation and (b) a written undertaking by him or her or on his or her behalf to repay the amount paid or reimbursed by the corporation if it is ultimately determined that the standard of conduct was not met.

In accordance with the 1940 Act, we will not indemnify any person for any liability to which such person would be subject by reason of such person’s willful misconduct, bad faith, gross negligence or reckless disregard of the duties involved in the conduct of his or her office.

Insofar as indemnification for liability arising under the Securities Act of 1993, as amended (the “Securities Act”) may be permitted to directors, officers and controlling persons of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion of the Securities and Exchange Commission (the “SEC”) such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director, officer or controlling person of the Registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Act and will be governed by the final adjudication of such issue.

Item 31. Business and Other Connections of Investment Adviser

Brookfield Public Securities Group LLC (“PSG”), a Delaware limited liability company and a registered investment adviser under the Investment Advisers Act of 1940, as amended, serves as investment adviser to the Registrant. PSG’s offices are located at Brookfield Place, 250 Vesey Street, New York, New York 10281-1023. Information as to the officers and directors of PSG is included in its current Form ADV (File No. 801-34605) filed with the Securities and Exchange Commission.

Item 32. Location of Accounts and Records

All accounts, books and other documents required to be maintained by Section 31(a) of the 1940 Act relating to the Registrant are maintained at the following offices:

1. Brookfield Public Securities Group LLC

Brookfield Place

250 Vesey Street

New York, New York 10281-1023

2. U.S. Bancorp Fund Services, LLC

615 East Michigan Street

Milwaukee, Wisconsin 53202

3. U.S. Bancorp Fund Services, LLC

1201 South Alma School Road, Suite 3000

Mesa, Arizona 85210

4. U.S. Bank National Association

1555 North River Center Drive, Suite 302

Milwaukee, Wisconsin 53212

5. American Stock Transfer & Trust Company

6201 15th Avenue

Brooklyn, New York 11219

Item 33. Management Services

Not applicable.

Item 34. Undertakings

1. Not applicable.

2. Not applicable.

3. Registrant undertakes:

(a) to file, during any period in which offers or sales are being made, a post-effective amendment to this Registration Statement:

(1) to include any prospectus required by Section 10(a)(3) of the Securities Act;

(2) to reflect in the prospectus any facts or events after the effective date of the Registration Statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the Registration Statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the SEC pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement; and

(3) to include any material information with respect to the plan of distribution not previously disclosed in the Registration Statement or any material change to such information in the Registration Statement.

Provided, however, that paragraphs a(1), a(2), and a(3) of this section do not apply to the extent the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the Registrant pursuant to Section 13 or Section 15(d) of the Exchange Act that are incorporated by reference into the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

(b) that, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of those securities at that time shall be deemed to be the initial bona fide offering thereof;

(c) to remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering; and

(d) that, for the purpose of determining liability under the Securities Act to any purchaser:

(1) if the Registrant is relying on Rule 430B:

(A) Each prospectus filed by the Registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and

(B) Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (x), or (xi) for the purpose of providing the information required by Section 10(a) of the Securities Act shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date; or

(2) if the Registrant is relying on Rule 430C: each prospectus filed pursuant to Rule 424(b) under the Securities Act as part of a registration statement relating to an offering, other than registration statements relying on Rule 430B or other than prospectuses filed in reliance on Rule 430A, shall be deemed to be part of and included in the registration statement as of the date it is first used after effectiveness. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such first use, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such date of first use.

(e) that for the purpose of determining liability of the Registrant under the Securities Act to any purchaser in the initial distribution of securities:

The undersigned Registrant undertakes that in a primary offering of securities of the undersigned Registrant pursuant to this Registration Statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned Registrant will be a seller to the purchaser and will be considered to offer or sell such securities to the purchaser:

(1) any preliminary prospectus or prospectus of the undersigned Registrant relating to the offering required to be filed pursuant to Rule 424 under the Securities Act;

(2) free writing prospectus relating to the offering prepared by or on behalf of the undersigned Registrant or used or referred to by the undersigned Registrants;

(3) the portion of any other free writing prospectus or advertisement pursuant to Rule 482 under the Securities Act relating to the offering containing material information about the undersigned Registrant or its securities provided by or on behalf of the undersigned Registrant; and

(4) any other communication that is an offer in the offering made by the undersigned Registrant to the purchaser.

4. Registrant undertakes:

(a) that, for the purpose of determining any liability under the Securities Act the information omitted from the form of prospectus filed as part of the Registration Statement in reliance upon Rule 430A and contained in a form of prospectus filed by the Registrant under Rule 424(b)(1) under the Securities Act will be deemed to be a part of the Registration Statement as of the time it was declared effective.

(b) that, for the purpose of determining any liability under the Securities Act, each post-effective amendment that contains a form of prospectus will be deemed to be a new Registration Statement relating to the securities offered therein, and the offering of the securities at that time will be deemed to be the initial bona fide offering thereof.

5. The undersigned Registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of the Registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934 that is incorporated by reference into the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

6. Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion of the SEC such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director, officer or controlling person of the Registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

7. Registrant undertakes to send by first class mail or other means designed to ensure equally prompt delivery, within two business days of receipt of a written or oral request, any prospectus or Statement of Additional Information constituting Part B of this Registration Statement.

Signatures

Pursuant to the requirements of the Securities Act of 1933, as amended, and the Investment Company Act of 1940, as amended, the Registrant has duly caused this Registration Statement on Form N-2 to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of New York, and State of New York, on the 26th day of April, 2021.

|

|

BROOKFIELD REAL ASSETS INCOME FUND INC.

|

|

|

|

|

|

By:

|

/s/ BRIAN F. HURLEY

|

|

|

|

Brian F. Hurley

|

|

|

|

President

|

Pursuant to the requirements of the Securities Act of 1933, as amended, this Registration Statement has been signed by the following persons in the capacities and on the dates indicated.

|

Signature

|

|

Capacity

|

|

Date

|

|

|

|

|

|

|

|

/s/ BRIAN F. HURLEY

|

|

President (Principal Executive Officer)

|

|

April 26, 2021

|

|

Brian F. Hurley

|

|

|

|

|

|

|

|

|

|

|

|

/s/ CASEY P. TUSHAUS

|

|

Treasurer (Principal Financial and Accounting Officer)

|

|

April 26, 2021

|

|

Casey P. Tushaus

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Director

|

|

April 26, 2021

|

|

Louis P. Salvatore

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Director

|

|

April 26, 2021

|

|

Heather S. Goldman

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Director

|

|

April 26, 2021

|

|

Stuart A. McFarland

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Director

|

|

April 26, 2021

|

|

Edward A. Kuczmarski

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Director

|

|

April 26, 2021

|

|

David Levi

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Director

|

|

April 26, 2021

|

|

William H. Wright II

|

|

|

|

|

|

|

|

|

|

|

|

/s/ BRIAN F. HURLEY

|

|

Attorney-in-Fact

|

|

April 26, 2021

|

|

Brian F. Hurley

|

|

|

|

|

* Pursuant to Powers of Attorney

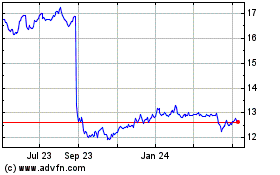

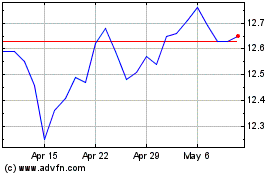

Brookfield Real Assets I... (NYSE:RA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Brookfield Real Assets I... (NYSE:RA)

Historical Stock Chart

From Apr 2023 to Apr 2024