As filed with the Securities and Exchange Commission

on September 12, 2024

Registration

No. 333-

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

FORM S-8

REGISTRATION STATEMENT

UNDER THE

SECURITIES ACT OF 1933

SAP

SE

(Exact name of registrant as specified in its

charter)

| Federal Republic of Germany |

Not applicable |

| (State or other jurisdiction of |

(IRS Employer |

| incorporation or organization) |

Identification No.) |

Dietmar-Hopp-Allee 16

69190 Walldorf

Federal Republic of Germany

(Address of Principal Executive Offices) (Zip Code)

Ordinary Shares, Without Nominal Value

Represented by American Depositary Shares Evidenced by American Depositary Receipts

to be Issued Outside of a Plan Upon Settlement of Restricted Stock Units Granted

Under the WalkMe Ltd. 2021 Share Incentive Plan

(Full title of the plan)

Wendy Boufford

c/o SAP Labs LLC

3410 Hillview Avenue

Palo Alto, CA 94304

Telephone: 1-650-849-4000

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for

Service)

| Copies to: |

|

Matthew Gemello

Spencer Cohen

Marsha Mogilevich

Orrick, Herrington & Sutcliffe LLP

1000 Marsh Road

Menlo Park, CA 94025-1015

Telephone: (650) 614-7400 |

| |

| Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. |

| |

|

|

| Large accelerated filer x |

|

Accelerated filer ¨ |

| Non-accelerated filer ¨ |

|

Smaller reporting company ¨ |

| |

|

Emerging growth company ¨ |

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 7(a)(2)(B) of the Securities Act. ¨

PART I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

The documents containing the information specified

in this Part I will be sent to or given by SAP SE (the “Registrant”) to each recipient of an award registered under this

Registration Statement on Form S-8 (“Registration Statement”) as specified by Rule 428(b)(1) under the Securities

Act of 1933, as amended (the “Securities Act”). In accordance with the instructions to Part I of Form S-8, such

documents will not be filed with the Securities and Exchange Commission (the “Commission”) either as part of this Registration

Statement or as prospectuses or prospectus supplements pursuant to Rule 424 under the Securities Act. These documents and the documents

incorporated by reference pursuant to Item 3 of Part II of this Registration Statement, taken together, constitute a prospectus that

meets the requirements of Section 10(a) of the Securities Act.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference.

The following documents previously filed with

the Commission by the Registrant are incorporated by reference herein and shall be deemed to be part hereof:

| (b) | All other reports filed or furnished pursuant to Section 13(a) or

15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) since December 31, 2023, including

any reports on Form 6-K, including without limitation the Registrant’s reports on Form 6-K furnished to the Commission

on January 25,

2024, February 12,

2024, February 22,

2024, March 8,

2024, April 24,

2024, June 11,

2024, and July 24,

2024; and |

All documents filed with or furnished to the Commission

by the Registrant pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act, including any Annual Report on Form 20-F,

subsequent to the date hereof and prior to the filing of a post-effective amendment which indicates that all securities offered herein

have been sold or which deregisters all securities then remaining unsold shall be deemed to be incorporated by reference into this Registration

Statement and to be a part hereof from the date such reports are filed or furnished.

Any statement contained herein or in a document

incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes hereof or of the

related prospectus to the extent that a statement contained herein or in any other subsequently filed or furnished document which is also

incorporated or deemed to be incorporated herein modifies or supersedes such statement. Any such statement so modified or superseded shall

not be deemed, except as so modified or superseded, to constitute a part of this Registration Statement.

Item 4. Description of Securities.

Not applicable.

Item 5. Interests of Named Experts and Counsel.

The validity of the Ordinary Shares to be issued

has been passed upon for the Registrant by Gabriel Harnier, General Counsel of SAP SE. Mr. Harnier is a full-time employee of the

Registrant. Mr. Harnier currently beneficially owns less than 0.001% of the Registrant’s outstanding Ordinary Shares.

Item 6. Indemnification of Directors and Officers.

A Societas Europaea with registered seat in Germany

may only indemnify members of its Executive Board or its Supervisory Board in limited circumstances. A Societas Europaea with registered

seat in Germany may purchase directors’ and officers’ insurance. The Registrant maintains liability insurance for members

of its Executive Board and members of its Supervisory Board in connection with their activities on the Registrant’s behalf, including

against liabilities under the Securities Act and the Exchange Act.

Item 7. Exemption from Registration Claimed.

Not applicable.

Item 8. Exhibits.

The following exhibits are filed herewith:

| |

|

|

Incorporated by Reference |

| Exhibit Number |

Exhibit Description |

|

Form |

|

File No. |

|

Exhibit |

|

Filing Date |

|

Filed

Herewith |

| |

|

|

|

|

|

|

| 4.1 |

Articles of Incorporation (Satzung) of SAP SE, effective as of May 15, 2024 (English translation). |

|

|

|

|

|

|

|

|

|

X |

| |

|

|

|

|

|

|

|

|

|

|

|

| 4.2 |

Amended and Restated Deposit Agreement dated as of November 25, 2009, by and among SAP SE, Deutsche Bank Trust Company Americas as Depositary, and all owners and holders from time to time of American Depositary Receipts issued thereunder (including form of American Depositary Receipt). |

|

F-6 POS AM#1 |

|

333-152876 |

|

99(a)(2) |

|

11/25/2009 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| 4.3 |

Amendment No. 1 dated March 18, 2016 to the Amended and Restated Deposit Agreement, by and among SAP SE, Deutsche Bank Trust Company Americas as Depositary, and all owners and holders from time to time of American Depositary Receipts issued thereunder (including the form of American Depositary Receipt). |

|

F-6 POSAM#2 |

|

333-188515 |

|

99(a)(2) |

|

03/18/2016 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| 5.1 |

Opinion of Gabriel Harnier of the Registrant’s Corporate Legal Department. |

|

|

|

|

|

|

|

|

|

X |

| |

|

|

|

|

|

|

| 23.1 |

Consent of Gabriel Harnier of the Registrant’s Corporate Legal Department (included in Exhibit 5.1). |

|

|

|

|

|

|

|

|

|

X |

| |

|

|

|

|

|

|

| 23.2 |

Consent of BDO AG Wirtschaftsprüfungsgesellschaft. |

|

|

|

|

|

|

|

|

|

X |

| |

|

|

|

|

|

|

|

|

|

|

|

| 23.3 |

Consent of KPMG AG Wirtschaftsprüfungsgesellschaft. |

|

|

|

|

|

|

|

|

|

X |

| |

|

|

|

|

|

|

|

|

|

|

|

| 24.1 |

Power of Attorney (included on the signature page of this Registration Statement). |

|

|

|

|

|

|

|

|

|

X |

| |

|

|

|

|

|

|

|

|

|

|

|

| 99.2 |

WalkMe Ltd. 2021 Share Incentive Plan. |

WalkMe Ltd. Form F-1 |

333-256219 |

10.2 |

05/17/2021 |

|

| |

|

|

|

|

|

|

| 99.3 |

Form of Walkme Ltd. Restricted Share Unit Conversion Notice and Agreement. |

|

|

|

|

X |

| |

|

|

|

|

|

|

| 107 |

Filing Fee Table. |

|

|

|

|

X |

Item 9. Undertakings

| (a) | The undersigned Registrant hereby undertakes: |

| (1) | To file, during any period in which offers or sales are being

made, a post-effective amendment to this Registration Statement: |

| (i) | To include any prospectus required by Section 10(a)(3) of

the Securities Act; |

| (ii) | To reflect in the prospectus any facts or events arising after

the effective date of the Registration Statement (or the most recent post-effective amendment thereof) which, individually or in the

aggregate, represent a fundamental change in the information set forth in the Registration Statement; and |

| (iii) | To include any material information with respect to the plan

of distribution not previously disclosed in the Registration Statement or any material change to such information in the Registration

Statement; |

provided, however, that paragraphs (a)(1)(i) and (a)(1)(ii) do

not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with

or furnished to the Commission by the Registrant pursuant to Section 13 or Section 15(d) of the Exchange Act that are incorporated

by reference in the Registration Statement.

| (2) | That, for the purpose of determining any liability under

the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities

offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof; and |

| (3) | To remove from registration by means of a post-effective

amendment any of the securities being registered which remain unsold at the termination of the offering. |

| (b) | The undersigned Registrant hereby undertakes that, for purposes

of determining any liability under the Securities Act, each filing of the Registrant’s Annual Report pursuant to Section 13(a) or

Section 15(d) of the Exchange Act (and, where applicable, each filing of an employee benefit plan’s Annual Report pursuant

to Section 15(d) of the Exchange Act) that is incorporated by reference in the Registration Statement shall be deemed to be

a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed

to be the initial bona fide offering thereof. |

| (c) | Insofar as indemnification for liabilities arising under

the Securities Act may be permitted to directors, officers and controlling persons of the Registrant pursuant to the foregoing provisions,

or otherwise, the Registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against

public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against

such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director, officer or controlling person

of the Registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person

in connection with the securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been settled

by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public

policy as expressed in the Securities Act and will be governed by the final adjudication of such issue. |

SIGNATURES

Pursuant to the requirements of the Securities

Act of 1933, as amended, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for

filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly

authorized, in the City of Walldorf, Federal Republic of Germany, on September 12, 2024.

| |

SAP SE |

| |

|

| |

/s/ Christian Klein |

| |

Christian Klein |

| |

Chief Executive Officer |

| |

|

| |

/s/ Dominik Asam |

| |

Dominik Asam |

| |

Chief Financial Officer |

POWERS OF ATTORNEY

KNOW ALL PERSONS BY THESE PRESENTS, that each

person whose signature appears below constitutes and appoints Christian Klein and Dominik Asam, and each of them (with full power in each

of them to act alone), his true and lawful attorney-in-fact and agent, with full power of substitution and resubstitution, for him and

in his name, place and stead, in any and all capacities, to sign any and all subsequent registration statements pursuant to Instruction

E of Form S-8 under the Securities Act, and any and all amendments (including post-effective amendments) to this Registration Statement

or any such subsequent registration statement, and to file such subsequent registration statements and such amendments with all exhibits

thereto and other documents in connection therewith with the Commission granting unto said attorneys-in-fact and agents, and each of them,

full power and authority to do and perform each and every act and thing requisite and necessary to be done in and about the premises as

fully to all intents and purposes as he might or could do in person, hereby ratifying and confirming all that said attorneys-in-fact and

agents, or any of them, or their substitutes, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities

Act, this Registration Statement has been signed by the following persons on behalf of the Registrant in the capacities and on the dates

indicated:

| Signature |

|

Title |

|

Date |

| |

|

|

|

|

| /s/ Christian Klein |

|

Chief Executive Officer and Member of the Executive Board |

|

September 12, 2024 |

| Christian Klein |

|

(principal executive officer) |

|

|

| |

|

|

|

|

| /s/ Dominik Asam |

|

Chief Financial Officer and Member of the Executive Board |

|

September 12, 2024 |

| Dominik Asam |

|

(principal financial and accounting officer) |

|

|

| |

|

|

|

|

| /s/ Gina Vargiu-Breuer |

|

Member of the Executive Board |

|

September 12, 2024 |

| Gina Vargiu-Breuer |

|

|

|

|

| |

|

|

|

|

| /s/ Juergen Mueller |

|

Member of the Executive Board |

|

September 12, 2024 |

| Dr. Juergen Mueller |

|

|

|

|

| |

|

|

|

|

| /s/ Muhammad Alam |

|

Member of the Executive Board |

|

September 12, 2024 |

| Muhammad Alam |

|

|

|

|

| |

|

|

|

|

| /s/ Thomas Saueressig |

|

Member of the Executive Board |

|

September 12, 2024 |

| Thomas Saueressig |

|

|

|

|

| |

|

|

|

|

SIGNATURE OF AUTHORIZED REPRESENTATIVE IN THE

UNITED STATES

Pursuant to the Securities

Act of 1933, the undersigned, the duly authorized representative in the United States of SAP SE, has signed this registration statement

or amendment thereto in Palo Alto, California on September 12, 2024.

| |

Authorized U.S. Representative

Wendy Boufford |

| |

|

| |

By: |

/s/ Wendy Boufford |

| |

Name: Wendy Boufford |

| |

Title: Assistant General Counsel |

Exhibit 4.1

ARTICLES OF INCORPORATION

I. General Provisions

Section 1

Corporate Name, Registered Office

and Domicile, and Period of Incorporation

| 1. | The

name of the Company is: SAP SE. |

| 2. | The

Company‘s registered office and domicile is in Walldorf, Germany. |

| 3. | The

Company is incorporated for an indefinite period of time. |

Section 2

Corporate Purpose

| 1. | The

corporate purpose of the Company is direct or indirect activity in the area of development,

production, and marketing of products and the provision of services in the fields of information

technology and telecommunication, and particularly in the following fields: |

| - | developing

and marketing integrated product and service solutions for e-commerce; |

| - | developing

software and cloud solutions and the licensing of their use to others; |

| - | organization

and deployment consulting, as well as user training, for software and cloud solutions; |

| - | selling,

leasing, renting, and arranging the procurement and provision of all other forms of use of

information technology systems and relevant accessories; |

| - | making

capital investments in enterprises active within the scope of the corporate purpose to promote

the opening and advancement of international markets in these fields. |

| 2. | The

Company is authorized to act in all the business areas listed in paragraph 1 and to delegate

such activities to affiliated enterprises within the meaning of Sections 15 ff. of the German

Stock Corporation Act (Aktiengesetz; "AktG"); in particular the Company

is authorized to delegate its business in whole or in parts to such enterprises. The Company

is authorized to establish branch offices in Germany and other countries, to found, acquire,

and invest in other companies of the same or a related kind and to enter into collaboration

and joint venture agreements. The Company is further authorized to invest in enterprises

of all kinds principally for the purpose of placing financial resources. The Company is authorized

to dispose of investments, to consolidate the management of enterprises in which it participates,

to enter into affiliation agreements with such enterprises, or to do no more than manage

its shareholding. |

| 3. | The

Company is authorized to take all actions and measures that are consistent with the corporate

purpose or that directly or indirectly further the corporate purpose. |

Section 3

Official Notices and the Transfer

of Information

| 1. | Unless

otherwise provided by law, the Company‘s official notices shall be made by publication

in the German Federal Gazette (Bundesanzeiger) exclusively. |

| a. | To

the extent that declarations or information are required by law to be made accessible to

the shareholders without a specific form being determined for such purpose, publication on

the Company‘s Internet site shall be sufficient. |

| 2. | Information

may also be transmitted to the Company’s shareholders by means of telecommunication,

insofar as this is legally permissible. |

II. Capital Stock and Shares

Section 4

Capital Stock

| 1. | The

Company has capital stock of €1,228,504,232 and is divided into 1,228,504,232 no-par

value ordinary shares. The capital stock was paid up by way of conversion of SAP AG to a

European Company (SE). |

| 2. | The

shares are no-par value shares. They are in bearer form. |

| 3. | Subject

to the consent of the Supervisory Board, the Executive Board shall determine the form of

the share certificates, dividend coupons, and renewal coupons, as well as bonds and interest

coupons. The Company may combine single shares into share certificates representing a majority

of shares (multiple-share certificates). Shareholders are not entitled to share certificates. |

| 4. | When

new shares are issued, the commencement of dividend entitlement in respect of these new shares

may be determined in derogation of Section 60 (2) AktG. |

| 5. | The

Executive Board is authorized, subject to the consent of the Supervisory Board, to increase

the capital stock, on one or more occasions on or before May 19, 2025, by an aggregate

amount of up to €250 million against contributions in cash by issuing new no-par value

bearer shares (Authorized Capital I). The new shares are to be offered to the shareholders

for subscription, with an indirect subscription right within the meaning of Section 186

(5) sentence 1 AktG being sufficient in this context. The Executive Board is authorized,

however, subject to the consent of the Supervisory Board, to exclude fractional shares from

the shareholders' subscription rights. |

The Executive Board may

only exercise the authorization to exclude subscription rights to such an extent that the proportionate amount of the newly issued

shares does not exceed a total of 10% of the share capital. The decisive factor for the calculation of the 10% limit is the share

capital that exists at the time the resolution on this authorization is passed. If the share capital is lower at the time the

authorization is exercised, this value is decisive. As to the 10% limit, it shall be taken into account if, during the term of this

authorization until it is exercised, other authorizations to issue shares in the Company, or to issue rights that entitle or oblige

to subscribe to shares in the Company, are exercised and the subscription right is excluded.

The Executive Board is further

authorized, subject to the consent of the Supervisory Board, to determine the further details of the implementation of capital increases

from Authorized Capital I. The Supervisory Board is authorized to amend the wording of the Articles of Incorporation after the full or

partial implementation of the capital stock increase from Authorized Capital I or after the expiration of the authorization period to

reflect the volume of the capital increase from Authorized Capital I.

| 6. | The

Executive Board is authorized, subject to the consent of the Supervisory Board, to increase

the capital stock, on one or more occasions on or before May 19, 2025, by an aggregate

amount of up to €250 million against contributions in cash or in kind by issuing new

no-par value bearer shares (Authorized Capital II). An indirect subscription right within

the meaning of Section 186 (5) sentence 1 AktG may also ensure compliance with

the statutory shareholders’ subscription right. The Executive Board is authorized,

subject to the consent of the Supervisory Board, to exclude the shareholders' statutory subscription

rights in the following circumstances: |

| - | in

respect of fractional shares; |

| - | insofar

as required to grant subscription rights to new shares to holders and/or beneficiaries of

conversion and/or option rights or obligors under conversion and/or option obligations under

bonds issued by the Company or a group company in the same volume as they would be entitled

to if they exercised their conversion and/or option rights or fulfilled their conversion

and/or option obligations; |

| - | in

the case of capital increases against contributions in cash, if, in accordance with Section 186

(3) sentence 4 AktG, the issue price of the new shares does not fall significantly short

of the stock exchange price of the same class and type of shares already traded on the stock

exchange at the time of the final determination of the issue price and the proportionate

amount of the newly issued shares does not exceed a total of 10% of the share capital. The

decisive factor for the calculation of the 10% limit is the share capital that exists at

the time the resolution on this authorization is passed. If the share capital is lower at

the time the authorization is exercised, this value is decisive. As to the 10% limit, it

shall be taken into account if, during the term of this authorization until it is exercised,

other authorizations to issue or to sell shares in the Company, or to issue rights that entitle

or |

| | oblige to subscribe to shares in the Company, are exercised and the subscription right is excluded

pursuant to or in accordance with Section 186 (3) sentence 4 AktG; |

| - | in

the case of capital increases against contributions in kind for granting shares in connection

with mergers with other enterprises or acquisitions of enterprises or parts thereof or interests

therein or of other contributable assets; |

| - | to

implement a scrip dividend by which shareholders are given the option of contributing their

dividend entitlements to the Company (either in whole or in part) as a contribution in kind

against the issue of new shares from Authorized Capital II. |

The Executive Board may only

exercise the above-described authorization to exclude subscription rights to such an extent that the proportionate amount of the newly

issued shares does not exceed a total of 10% of the share capital. The decisive factor for the calculation of the 10% limit is the share

capital that exists at the time the resolution on this authorization is passed. If the share capital is lower at the time the authorization

is exercised, this value is decisive. As to the 10% limit, it shall be taken into account if, during the term of this authorization until

it is exercised, other authorizations to issue shares in the Company, or to issue rights that entitle or oblige to subscribe to shares

in the Company, are exercised and the subscription right is excluded.

The Executive Board is further

authorized, subject to the consent of the Supervisory Board, to determine the further details of the implementation of capital increases

from Authorized Capital II. The Supervisory Board is authorized to amend the wording of the Articles of Incorporation after the full

or partial implementation of the capital stock increase from Authorized Capital II or after the expiration of the authorization period

to reflect the volume of the capital increase from Authorized Capital II.

| 7. | The

capital stock shall be subject to a further contingent increase by up to €100 million

by issuing up to 100 million no-par value bearer shares (Contingent Capital I). The contingent

capital increase shall be implemented only to the extent that the holders or creditors of

convertible bonds or warrants under warrant-linked bonds issued or guaranteed by SAP SE or

any of its direct or indirect majority holdings on or before May 11, 2026 by virtue

of the authorization resolved by the annual General Meeting of Shareholders of May 12,

2021 exercise their conversion or option rights or fulfill their conversion or option obligations

and no other methods for servicing these rights are used. The new shares shall in each case

be issued at the conversion or option price to be determined in accordance with the above

authorization resolution. The new shares shall participate in the profits as from the beginning of the fiscal year in which they are

created as a result of the exercise of conversion or option rights or upon the fulfillment of the conversion or option obligation. The

Executive Board shall be authorized to determine the further details of the implementation of the contingent capital increase. |

III. Constitution and Management

of the Company

Section 5

Governing

Bodies

The Company's governing bodies are:

| a) | the

Executive Board (the management organ), |

| b) | the

Supervisory Board (the supervisory organ), |

| c) | the

General Meeting of Shareholders. |

The Executive Board

Section 6

Composition of the Executive Board

| 1. | The

Executive Board shall consist of at least two persons. The Supervisory Board may determine

a higher number of Executive Board members. The appointment of deputy members of the Executive

Board is permissible. The latter have the same rights as the full members of the Executive

Board regarding the external representation of the Company. |

| 2. | The

appointment of the full members and the deputy members of the Executive Board, the conclusion

of their employment contracts, and the revocation of their appointments are the responsibility

of the Supervisory Board, as are the appointment of a member of the Executive Board as chairperson

of the Executive Board and the appointment of one or more member/s of the Executive Board

as deputy chairperson/s of the Executive Board. |

| 3. | The

full members and the deputy members of the Executive Board will be appointed for a maximum

period of five years. Reappointments are permissible. |

Section 7

Rules of Procedure and Resolutions

of the Executive Board

| 1. | The

Executive Board shall unanimously adopt its own rules of procedure, unless the Supervisory

Board adopts rules of procedure for the Executive Board. |

| 2. | Resolutions

of the Executive Board shall be adopted by a simple majority of votes cast, unless otherwise

mandatorily prescribed by law or the Articles of Incorporation. Should a vote be tied, the

chairperson of the Executive Board, if appointed, shall have the casting vote. |

| 3. | Unless

otherwise mandatorily prescribed by law or the Articles of Incorporation, the Executive Board

is quorate if at least half of its members participate in passing the resolution. |

Section 8

Legal Representation of the Company

The Company shall be legally represented

| a) | by

two members of the Executive Board; |

| b) | by

one member of the Executive Board acting jointly with one holder of full commercial power

of attorney (Prokurist) within the meaning of Sections 48-53 of the German Commercial

Code (Handelsgesetzbuch; "HGB"). |

Section 9

Limitation of the Executive Board's

Authority

The Executive Board owes a duty to the

Company to adhere to the limitations imposed by the Articles of Incorporation or the Supervisory Board regarding the scope of its management

authority or which result from a resolution adopted by the General Meeting of Shareholders pursuant to Section 119 AktG.

The Supervisory Board

Section 10

Composition, Term of Office

| 1. | The

Supervisory Board shall be composed of eighteen members. Nine members will be elected as

shareholders‘ representatives by the General Meeting of Shareholders without being

bound by nominations. Nine members will be appointed as employees‘ representatives

by the SE Works Council in accordance with the agreement on the involvement of employees

(Agreement on Employee Involvement) concluded in accordance with the German Act on the Involvement

of Employees in European Companies (Gesetz über die Beteiligung der Arbeitnehmer

in einer Europäischen Gesellschaft (SE-Beteiligungsgesetz; "SEBG")).

When the Supervisory Board members are elected or appointed (as the case may be), substitute

members may be elected or appointed (as the case may be) at the same time. Reappointments

are permissible. |

| 2. | Unless

a shorter term of office is determined, the members of the Supervisory Board shall be elected

or appointed for a period ending with the close of the annual General Meeting of Shareholders

at which the acts of the Supervisory Board are formally approved for the fourth fiscal year

following commencement of the term of office, not counting the year in which their term of

office commences. In any event, the term of office shall end after six years at the latest. |

| 3. | In

derogation of paragraphs 1 and 2, the following provisions shall apply for the first Supervisory

Board with regard to the employees‘ representatives, as provided in the Agreement on

Employee Involvement: The first employees‘ representatives on the first Supervisory

Board have been appointed under the |

Agreement on Employee Involvement. Their term of office

shall end at the close of the 2015 annual General Meeting of Shareholders. The term of office

of the succeeding employees‘ representatives on the first Supervisory Board of SAP

SE appointed subsequent to this term of office shall end at the same time as the term of

office of the shareholders‘ representatives on the first Supervisory Board. Paragraph

2 shall thereupon also apply to the term of office of the employees‘ representatives

on the Supervisory Board.

| 4. | The

members and substitute members of the Supervisory Board may resign from office by submitting

a written statement addressed to the chairperson of the Supervisory Board or to the Executive

Board observing a period of notice of four weeks. Resignation from office for cause (aus

wichtigem Grund) with immediate effect is permitted. |

| 5. | Unless

a shorter term of office is determined within the limits of paragraph (2), successors for

resigning shareholders’ representatives who are not replaced by substitute members

will be elected for the remaining term of office of the resigning individual. This shall

apply mutatis mutandis to the appointment of any successors for resigning employees'

representatives who are not replaced by substitute members in accordance with the Agreement

on Employee Involvement. |

Section 11

Duties and Responsibilities of the

Supervisory Board

| 1. | The

Supervisory Board shall have all of the duties and rights that are conferred upon it by law,

the Articles of Incorporation, or otherwise. Both the Executive and Supervisory Boards shall

be entitled to call a General Meeting of Shareholders. |

| 2. | The

Supervisory Board shall be authorized to amend the Articles of Incorporation where such amendments

only concern the wording. |

| 3. | The

Supervisory Board shall be entitled at any time to supervise all management activities of

the Executive Board and to this end to inspect and examine all books and records as well

as the assets of the Company. |

| 4. | The

Executive Board shall report to the Supervisory Board continuously at least to the extent

stipulated by law. |

| 5. | The

Supervisory Board may set up committees from among its members and, to the extent permitted

by law, may delegate decision-making powers to them. |

| 6. | The

following transactions are subject to the prior approval of the Supervisory Board: |

| - | adoption

of the group annual plan, which shall comprise at least the budget, the investment plan,

and the liquidity planning; |

| - | investments

in tangible fixed assets or intangible fixed assets which are either not included in the

investment plan for the fiscal year and which, alone or when aggregated with other investments

likewise not included, have an anticipated total volume of more than 10% of the last investment

plan or which are included in the investment plan but whose volume determined in the investment

plan is exceeded to such an extent that the excess amount, together with corresponding amounts

of other investments exceeding the plan of the same fiscal year, if any, amounts to more

than 10% of the total volume of the last investment plan; |

| - | acquisition

and sale of enterprises and interests therein or parts thereof if the (anticipated) acquisition

or sales price in an individual case exceeds 0.6% of the balance sheet total of the last

group balance sheet approved by the Supervisory Board; this shall not apply to any acquisition

or sale within the group; |

| - | incurring

financial liabilities vis-à-vis companies which are not members of the group if either

the volume of the individual financial liability exceeds 1.0% of the balance sheet total

of the last group balance sheet approved by the Supervisory Board or if, as a result of incurring

such liability, the group total of all financial liabilities incurred without the approval

of the Supervisory Board and not yet repaid exceeds 3.0% of the balance sheet total of the

last group balance sheet approved by the Supervisory Board; |

| - | concluding

and amending any agreements which under applicable law or the Articles of Incorporation require

the approval of the General Meeting of Shareholders. |

If permitted by law, the

Supervisory Board may delegate the approval competence for the above-mentioned transactions to a committee generally or in individual

cases. The Supervisory Board may determine additional types of transactions which the Executive Board may only perform with the Supervisory

Board‘s approval.

Section 12

Declarations of Intent of the Supervisory

Board

| 1. | Declarations

of intent of the Supervisory Board and its committees shall be given on behalf of the Supervisory

Board by the chairperson or – should he or she be unable to do so – by the deputy

chairperson. |

| 2. | The

chairperson of the Supervisory Board or his or her deputy shall be the permanent representative

of the Supervisory Board vis-à-vis third parties, especially vis-à-vis courts

and authorities as well as the Executive Board. |

Section 13

Chairperson and Deputy Chairperson

| 1. | Following

a General Meeting of Shareholders at which all members of the Supervisory Board to be elected

by the General Meeting of Shareholders have been newly appointed, a meeting of the Supervisory

Board shall take place, which shall be held without special invitation. At this meeting the

Supervisory Board shall elect a chairperson and one or two deputy chairperson(s) from

among its members for the term of its office. When electing the chairperson of the Supervisory

Board, the oldest member in terms of age of the shareholders‘ representatives on the

Supervisory Board will chair the meeting; Section 14 (6) sentence 3 shall apply

mutatis mutandis. |

| 2. | Only

a shareholders‘ representative may be elected as chairperson of the Supervisory Board. |

| 3. | If

the chairperson is unable to discharge the duties of his or her office, the deputy chairperson

shall do so in his or her place. This provision shall not affect Section 14 (6) sentence

4 and Section 20 (1). |

| 4. | If

the chairperson or a deputy chairperson leaves the Supervisory Board before the end of his

or her term of office, an election shall be held without delay to replace him or her. |

Section 14

Calling of Meetings and Passing of

Resolutions

| 1. | The

Supervisory Board shall adopt its own rules of procedure by a simple majority vote.

The following provisions apply to the calling of meetings, quorums, and resolutions. Supplementary

provisions may be stipulated in the rules of procedure. |

| 2. | The

chairperson shall call the Supervisory Board meetings in writing or text form, by letter,

e-mail or facsimile message allowing a notice period of 14 days before the day of the meeting.

The day on which the message calling the meeting is sent and the day of the meeting do not

count toward the notice period. In urgent cases, the chairperson may shorten the notice period

and also call the meeting orally or by telephone, or any other appropriate means of electronic

transmission. |

| 3. | The

meetings of the Supervisory Board and its committees shall as a rule be held with the

members attending in person. The Supervisory Board may provide in its rules of procedure

that the meetings of the Supervisory Board and its committees may also be held by video conference

or that individual members of the Supervisory Board may attend the meeting by way of video

transmission, subject to the proviso that in such cases, resolutions may also be adopted

by video conference or by way of video transmission, respectively. |

| 4. | The

Supervisory Board may provide in its rules of procedure for the permissibility of the

adoption of resolutions of the Supervisory Board and its committees outside of meetings by

obtaining written or telephone votes or by voting by video conference or any other means

of electronic communication (e.g. by e-mail or facsimile). |

| 5. | The

members of the Executive Board may attend the meetings of the Supervisory Board, unless otherwise

resolved in an individual case by the Supervisory Board or its chairperson. |

| 6. | Unless

otherwise mandatorily prescribed by law or the Articles of Incorporation, the Supervisory

Board is quorate if at least half of its members participate in passing the resolution. The

resolutions of the Supervisory Board shall be adopted by a majority of the votes cast, unless

otherwise mandatorily prescribed by law or the Articles of Incorporation. In the event of

a tie, the vote of the chairperson and, in the event that the chairperson does not participate

in passing the resolution, the vote of the deputy chairperson, provided that he or she is

a shareholders‘ representative, shall be decisive (casting vote). |

Section 15

Duty of Secrecy

| 1. | The

members of the Supervisory Board shall maintain secrecy in respect of any confidential information

and secrets of the Company, notably business and trade secrets, that become known to them

because of their membership of the Supervisory Board. Persons attending meetings of the Supervisory

Board who are not members of the Supervisory Board shall be expressly enjoined to secrecy. |

| 2. | In

the event that a member of the Supervisory Board intends to pass information on to a third

party, he or she shall notify the Supervisory Board and the Executive Board of that intention

in advance, naming the persons he or she wishes to inform. The Supervisory Board and the

Executive Board must be given the opportunity to decide prior to the disclosure of information

whether they consider such disclosure to violate paragraph 1 or not. The decision shall be

delivered by the chairperson of the Supervisory Board and the chairperson or CEO of the Executive

Board. |

| 3. | The

members of the Supervisory Board shall continue to maintain secrecy as set forth in the foregoing

paragraphs after they leave the Supervisory Board. |

Section 16

Remuneration

| 1. | Each

member of the Supervisory Board shall receive an annual basic remuneration of €165,000.

The chairperson of the Supervisory Board shall receive an annual basic remuneration of €275,000

and each deputy chairperson shall receive €220,000. The chairperson of the Supervisory

Board shall receive an annual basic compensation of €600,000, and each deputy chairperson

shall receive €220,000. |

| 2. | For

membership of the audit committee, Supervisory Board members shall, in addition to their

basic remuneration, receive an annual remuneration of €50,000, and for membership of

another Supervisory Board committee €35,000, the chairperson of the audit committee

shall receive an annual remuneration of €95,000, and the chairpersons of the other committees

€50,000. If a deputy chairperson is appointed for a committee, his or her additional

remuneration shall amount to €43,500 per year, and €72,500 per year for the audit

committee. Any additional compensation for the chairmanship, any deputy chairmanship and

membership of a committee pursuant to this paragraph 2 shall only accrue if the respective

committee has met during the fiscal year. The chairperson of the Supervisory Board shall

not receive any additional compensation for chairing, or being a member of, any committees. |

| 3. | If

the Supervisory Board appoints a Lead Independent Director, the Lead Independent Director

shall receive a compensation of €50,000 per year in addition to his or her basic compensation

and in addition to his or her compensation for any memberships in committees. |

| 4. | Any

members of the Supervisory Board having served for less than the entire fiscal year shall

receive one twelfth of their respective compensation for each month of service commenced.

The same shall apply with respect to the increased compensation for the chairperson and the

deputy chairperson(s) pursuant to paragraph 1 sentence 2, to the compensation for the

chairperson, any possible deputy chairperson, and the members of a committee pursuant to

paragraph 2, and to the additional compensation for the Lead Independent Director pursuant

to paragraph 3. |

| 5. | The

remuneration shall be payable after the end of the fiscal year. |

| 6. | The

remuneration shall be subject to the addition of any possible statutory value added tax. |

| 7. | The

members of the Supervisory Board shall be included in a directors' and officers' (D&O)

group liability insurance which provides for adequate cover and is maintained by the Company

in its own interests, to the extent that such insurance is in place. The premiums for the

insurance policy shall be paid by the Company. |

The General Meeting of Shareholders

Section 17

Calling the General Meeting of Shareholders

| 1. | The

General Meeting of Shareholders shall be held at the registered office of the Company, at

a location within a radius of 50 km from the registered office of the Company, or in a city

in the Federal Republic of Germany where a German stock exchange is located. In the event

that it is difficult to hold the General Meeting of Shareholders at these venues, the Executive

Board or the Supervisory Board may call the meeting at a different venue. The invitation

shall state the venue of the General Meeting of Shareholders. |

| 2. | The

Executive Board or the Supervisory Board shall call the General Meeting of Shareholders. |

| 3. | The

General Meeting of Shareholders shall be called by publication of a single announcement in

the German Federal Gazette (Bundesanzeiger), giving the information required by law,

with a notice period of at least thirty days prior to the date of the General Meeting of

Shareholders, which notice period is to be extended by the number of days of the application

period pursuant to Section 18 (2); the day on which the General Meeting of Shareholders

is held and the day on which it is called shall not be included in the calculation of the

relevant period. |

Section 18

Right to Attend the General Meeting

of Shareholders

| 1. | Shareholders

are entitled to attend the General Meeting of Shareholders and to exercise their voting rights

only if they have submitted an application prior to the General Meeting of Shareholders and

furnished proof to the Company of their shareholding. |

| 2. | Application

shall be made in text form in German or English and must be received by the Company at the

address stated for such purpose in the calling notice no later than six days prior to the

date of the General Meeting of Shareholders; the day on which the General Meeting of Shareholders

is held and the day on which it is called shall not be included in the calculation of the

relevant period. The calling notice may provide for a shorter period of time, which is to

be specified as a number of days. |

| 3. | For

proof of shareholding, proof in accordance with Section 67c (3) AktG shall be sufficient.

The proof shall relate to the beginning of the 22nd day prior to the General Meeting of Shareholders.

Paragraph 2 shall apply mutatis mutandis to the proof. |

| 4. | The

applicability of any other application or proof procedure available under mandatory law shall

remain unaffected. |

| 5. | The

Executive Board is authorized to provide that shareholders may participate in the General

Meeting of Shareholders without being physically present at the venue of the General Meeting

of Shareholders or being represented by a proxy and exercise all or certain of their rights

in full or in part through electronic communication. |

| 6. | The

Executive Board is authorized to provide that shareholders may vote in writing or through

electronic communication (postal voting) without having to attend the General Meeting of

Shareholders. |

Section 19

Voting Rights

| 1. | Each

share carries one vote. |

| 2. | Voting

rights may be exercised by proxy. The proxy authorization must be granted or revoked, and

proof of the proxy authorization must be provided to the Company, in the form prescribed

by law. The calling notice may specify less strict requirements in this context. Such less

strict requirements may be limited to the granting of proxy authorization to the proxies

designated by the Company. |

| 3. | If

no share certificates have been issued, the invitation to the General Meeting of Shareholders

shall stipulate the provisions that have to be fulfilled by the shareholders in order to

prove their voting rights. |

Section 20

Chair of the General Meeting of Shareholders

Participation of Executive Board

Members and Supervisory Board Members, Video Transmission

| 1. | The

chairperson of the Supervisory Board shall preside over the General Meeting of Shareholders.

If he or she is unable to do so, he or she shall determine another member of the Supervisory

Board to discharge this duty. If the chairperson is prevented from presiding over the meeting

and has not determined another member to take his or her place, a member of the Supervisory

Board elected by the shareholders‘ representatives on the Supervisory Board shall preside

over the General Meeting of Shareholders. |

| 2. | The

chairperson shall chair the proceedings and shall determine both the order of the agenda

and the order and form of voting. The chairperson may also impose a reasonable time limit

on the shareholders‘ right to ask questions and to speak; the chairperson may in particular

reasonably determine a timeframe for the meeting, the discussions regarding the individual

items on the agenda as well as for the individual questions and speaking contributions. The

result of a vote may be determined by subtracting the affirmative votes or the negative votes

and the abstentions from the total number of votes to which the voters are entitled. |

| 3. | The

members of the Executive Board and Supervisory Board should take part in the General Meeting

of Shareholders in person. If any member of the Supervisory Board is unable to attend the

General Meeting of Shareholders in person because he or she has good reason to be abroad,

it is possible for him or her to take part via video transmission. |

| 4. | The

Executive Board is authorized to permit full or partial video or audio transmission of the

General Meeting of Shareholders. |

Section 20a

Virtual General Meeting of Shareholders

| 1. | The

Executive Board is authorized to determine that any or all General Meetings of Shareholders

to be held on or before June 30, 2025, may be held as virtual General Meetings of Shareholders

without the physical presence of the shareholders or their proxies at the place of the General

Meeting. |

| 2. | The

members of the Supervisory Board may also participate in a virtual General Meeting of Shareholders

by means of video and audio transmission. This shall not apply to the chairperson of the

General Meeting of Shareholders if he or she is a member of the Supervisory Board. |

Section 21

Resolutions of the General Meeting

of Shareholders

| 1. | The

resolutions of the General Meeting of Shareholders shall be adopted with a majority of valid

votes cast, unless a larger majority is prescribed by law or the Articles of Incorporation. |

| 2. | A

resolution of the General Meeting of Shareholders on an amendment of the Articles of Incorporation

requires a majority of at least three quarters of valid votes cast. For any amendments of

the Articles of Incorporation which require a simple majority for stock corporations established

under German law, however, the simple majority of the valid votes cast shall suffice if at

least half of the subscribed capital is represented or, in the absence of such quorum, the

majority prescribed by law shall suffice. |

Section 22

Record of the General Meeting of

Shareholders

| 1. | The

proceedings at the General Meeting of Shareholders shall be recorded by notarial deed, and

the record shall be signed by the notary public. |

| 2. | The

record shall have full probative value for the shareholders, both with regard to their relationship

inter se and in their relationship to their representatives. |

| 3. | The

proxy documents need not be attached to the record. |

IV.

Annual Financial Statements and Appropriation of Retained Earnings

Section 23

Fiscal Year, Annual Report, Annual

Financial Statements and Group Annual Financial Statements, Formal Approval of the Acts of the Executive and Supervisory Boards, Distribution

of Retained Earnings

| 1. | The

fiscal year shall be the calendar year. The first fiscal year shall be the calendar year

in which SAP SE is registered in the commercial register for the Company. |

| 2. | In

the first three months of each fiscal year, the Executive Board shall prepare the annual

financial statements, the group annual financial statements, the management report, and the

group management report for the previous fiscal year and submit them to the Supervisory Board

and to the auditor. At that time the Executive Board shall submit to the Supervisory Board

the proposal it wishes to make to the Annual General Meeting of Shareholders concerning the

appropriation of retained earnings. These provisions do not affect Sections 298 (3) and

315 (3) HGB. |

| 3. | The

annual financial statements, the group annual financial statements, the management report,

the group management report, the Supervisory Board’s report pursuant to Section 171

(2) AktG, and the Executive Board‘s proposal for the appropriation of the retained

earnings shall be available for the shareholders‘ inspection at the offices of the

Company from the time when the Annual General Meeting of Shareholders is called. The obligations

under the foregoing sentence shall not apply if the specified documents are made available

on the Company’s website for the same period of time. |

| 4. | Each

year, after receiving the Supervisory Board’s report pursuant to Section 171 (2) AktG,

the Annual General Meeting of Shareholders shall resolve within the first six months of the

fiscal year on the formal approval of the acts of the Executive and Supervisory Boards, the

appropriation of the retained earnings, the appointment of the auditor, and in the cases

provided for by law, the adoption of the annual financial statements, and approval of the

group annual financial statements. |

| 5. | When

approving the annual financial statements, the Executive and Supervisory Boards shall be

authorized to transfer to revenue reserves either all or part of the annual net income remaining

after deduction of amounts to be transferred to the legal reserves and of any accumulated

losses carried forward. The Executive and Supervisory Boards may not transfer more than one

half of the annual net income if, after such transfer, the other revenue reserves would exceed

one half of the capital stock. |

| 6. | Instead

of distributing a cash dividend, the General Meeting of Shareholders can resolve to appropriate

retained earnings by way of distribution in kind. |

V. Final Provisions

Section 24

Formation Costs

| 1. | The

Company shall bear all costs connected with its formation and conversion to a stock corporation,

estimated to be DM 250,000.00. |

| 2. | The

Company shall bear all costs connected with the formation of SAP SE by way of the conversion

of SAP AG to a European Company (SE) in the amount of up to €4 million. |

– End of Articles of Incorporation

–

SAP SE

Dietmar-Hopp-Allee 16

69190 Walldorf

Germany

Exhibit 5.1

September 12, 2024

Legal Opinion of General Counsel of SAP SE

Registration Statement on Form S-8 Relating to the Ordinary

Shares, Without Nominal Value, Represented by American Depositary Shares Evidenced by American Depositary Receipts to be Issued Outside

of a Plan Upon Settlement of Restricted Stock Units Granted Under the WalkMe Ltd. 2021 Share Incentive Plan

I am the General Counsel of SAP SE, a European Company (Societas Europaea,

or “SE”). SAP SE is organized in the Federal Republic of Germany under German and European Law (the “Company”).

Pursuant to the Agreement and Plan of Merger, dated as of June 4,

2024, as amended, by and among the Company, WalkMe Ltd., a company organized under the laws of the State of Israel (“WalkMe”),

and Hummingbird Acquisition Corp Ltd., a company organized under the laws of the State of Israel and a wholly owned subsidiary of the

Company (“Merger Sub”), Merger Sub merged with and into WalkMe, with WalkMe surviving the merger and becoming a wholly owned

subsidiary of the Company (the “Merger”). In connection with the Merger, certain outstanding restricted stock units issued

by WalkMe under the WalkMe Ltd. 2021 Share Incentive Plan will be converted into restricted RSUs of post-Merger WalkMe (the “Converted

RSUs”).

This opinion is given in connection with the filing by the

Company on September 12, 2024 with the U.S. Securities and Exchange Commission of a registration statement on Form S-8

(the “Registration Statement”) with respect to up to 280,000 Ordinary Shares of the Company (“Ordinary

Shares”) represented by American Depositary Shares (“ADSs”) and evidenced by American Depositary Receipts

(“ADRs”), each ADS representing one Ordinary Share to be issued outside of a plan upon settlement of the Converted RSUs,

pursuant to the U.S. Securities Act of 1933, as amended (the “Securities Act”), and the rules and regulations

promulgated thereunder (the “Rules”).

In connection therewith, I have examined and am familiar with

originals or copies, certified or otherwise identified to my satisfaction, of (i) the Registration Statement, (ii) the Articles

of Incorporation (Satzung) of the Company (the “Articles”), (iii) a copy of an electronic excerpt with respect

to the Company from the commercial register at the local court (Amtsgericht) in Mannheim, (iv) the resolutions adopted by the Executive

Board of the Company on May 24, 2024 (the “Resolutions”) approving the Merger and related matters, (v) the form

of a letter agreement between the Company and each holder of the Converted RSUs (the “Conversion Agreement”), (vi) Amended

and Restated Deposit Agreement dated as of November 25, 2009, by and among SAP SE, Deutsche Bank Trust Company Americas as Depositary,

and all owners and holders from time to time of American Depositary Receipts issued thereunder, as amended by Amendment No. 1 dated

March 18, 2016 to the Amended and Restated Deposit Agreement, (vii) the WalkMe Ltd. 2021 Share Incentive Plan (the “Plan”),

and (viii) such other documents as I have deemed necessary or appropriate as a basis for the opinions set forth below.

In my examination, I have assumed the genuineness of all signatures,

the legal capacity of all natural persons, the authenticity of all documents submitted to me as originals, the conformity to original

documents of all documents submitted to me as certified or photostatic copies and the authenticity of the originals of such copies. As

to any facts material to the opinion expressed herein which were not independently established or verified, I have relied upon statements

and representations of officers and other representatives of the Company and others.

Based upon and subject to the foregoing qualifications, assumptions

and limitations and the further limitations set forth below, I am of the opinion that the Ordinary Shares to be issued upon settlement

of the Converted RSUs and represented by ADSs as evidenced by ADRs, will be, when issued in accordance with the Articles, the Plan, the

Conversion Agreement, the Resolutions and applicable law, validly issued, fully paid and nonassessable.

The foregoing opinion is limited to the laws of the Federal Republic

of Germany, and I express no opinion as to the laws of any other jurisdiction.

This opinion is delivered to you solely in connection with the Registration

Statement and may not be used, circulated, quoted or otherwise referred to or relied upon for any other purpose or by any other person

or entity without my express prior written permission.

I consent to the filing of this opinion as an exhibit to the Registration

Statement. In giving this consent, I do not admit that I am within the category of persons whose consent is required under Section 7

of the Securities Act or the Rules.

Very truly yours,

| /s/ Gabriel Harnier |

|

| Gabriel Harnier |

|

| General Counsel |

|

| SAP SE |

|

Exhibit 23.2

September 12, 2024

Consent of Independent Registered Public Accounting

Firm

We hereby consent to the incorporation by

reference in this Registration Statement of our reports dated February 21, 2024, relating to the consolidated financial

statements and the effectiveness of internal control over financial reporting of SAP SE (the Company),

appearing in the Company’s Annual Report on Form 20-F for the year ended December 31, 2023.

/s/ BDO AG Wirtschaftsprüfungsgesellschaft

BDO AG Wirtschaftsprüfungsgesellschaft

Hanauer Landstraße 115

60314 Frankfurt am Main

Exhibit 23.3

Consent of Independent Registered Public Accounting

Firm

We consent to the use of our report dated February 22, 2023, except

for retrospective adjustments to present the Qualtrics disposal group as discontinued operations as described in Note D.1 and the changes

resulting from the Updated Cost Allocation Policy described in Note IN.1, with respect to the consolidated financial statements of SAP

SE, incorporated herein by reference.

/s/ KPMG AG Wirtschaftsprüfungsgesellschaft

Mannheim, Germany

September 12, 2024

Exhibit 99.3

WALKME LTD.

FORM OF RESTRICTED SHARE UNIT CONVERSION

NOTICE AND AGREEMENT

Dear RSU Holder:

As you know, on September 12, 2024, SAP SE

(“SAP”) acquired WalkMe Ltd. (“Company”), pursuant to that certain Agreement and Plan of

Merger by and among SAP, the Company and certain other parties dated June 4, 2024 (the “Merger

Agreement”).

Immediately prior to the effective time (the “Effective

Time”) of the transactions contemplated by the Merger Agreement (the “Merger”), you held one or more outstanding

awards of restricted share units (“Company RSUs”) covering ordinary shares of the Company (“Company Shares”)

that were granted to you under the Company’s 2021 Share Incentive Plan (the “Plan”), as evidenced by one or more

restricted share unit agreement(s) by and between you and Company (collectively, and together with any amendment(s) thereto,

the “RSU Agreement(s)”). For the avoidance of doubt, as contemplated by the Merger Agreement, Company RSUs for purposes

hereof does not include any Section 102 Awards (as defined in the Merger Agreement) or Section 3(i) Awards (as defined

in the Merger Agreement).

At the Effective Time, each award of Company RSUs,

to the extent outstanding and unvested as of the Effective Time, was converted by the Company into an award of restricted share units

(“Converted RSUs”) covering ordinary shares of SAP, without nominal value, represented by American Depositary Shares

(“SAP ADSs”), as evidenced by American Depositary Recieipts (“SAP ADRs”). This Restricted Stock

Unit Conversion Notice and Agreement (the “Agreement”) evidences the terms of the conversion of your Company RSUs into

Converted RSUs. Each SAP ADS represents one ordinary share of SAP.

The number of Converted RSUs underlying each

award is shown in your account on the Company’s stock administration platform on which this Agreement was delivered to you.

Such number was determined by multiplying 0.0648466377018352 (the “Exchange Ratio”) by the number of unvested Company RSUs

underlying each award immediately prior to the Effective Time and rounding the resulting product down to the next whole number. The

Exchange Ratio was determined in accordance with the terms of the Merger Agreement, and is intended to preserve immediately after

the Effective Time the approximate aggregate fair market value of the underlying securities immediately prior to the conversion.

For any award of Company RSUs that remained subject

to performance-based vesting criteria in respect of a performance period that had not ended as of immediately prior to the Effective Time,

the performance-based vesting criteria in respect of such ongoing performance period was deemed achieved at target (or at such lower level,

if any, required by the terms of the applicable RSU Agreement(s)), and such Company RSUs were converted based on the performance-based

criteria being achieved at such target or lower level. In addition, if any performance-based vesting criteria applicable to awards of

Company RSUs were achieved below target in respect of a performance period that ended prior to the Effective Time, such Company RSUs were

converted based on the performance-based vesting criteria being achieved at such level below target, in each case, notwithstanding anything

to the contrary set forth in the applicable RSU Agreement(s), the Plan or any other agreement or arrangement.

The vesting commencement date of each award of

Converted RSUs remains the same as the related award of Company RSUs as set forth in the RSU Agreements and/or any notice of grant but

with the number of Converted RSUs subject to each vesting installment adjusted to reflect the conversion. The vesting schedule of each

award of Converted RSUs also remains substantially the same as set forth in the applicable RSU Agreement(s) and/or any notice of

grant, except that (i) the vesting dates that are scheduled to occur following the Effective Time will be adjusted to the extent

necessary to align with the February 20, May 20, August 20 or November 20 immediately following the originally scheduled

vesting date and (ii) with respect to any Company RSUs that were subject to performance-based vesting criteria as of immediately

prior to the Effective Time, no performance-based vesting metrics or criteria will apply from and after the Effective Time, other than

(x) forfeiture terms for awards not subject to, or no longer subject to, service-based vesting conditions and (y) any recoupment

provisions.

Upon settlement of the Converted RSUs, any withholding

tax obligations will be satisfied in accordance with the terms of the original RSU Agreement evidencing your pre-conversion Company RSUs.

Please note that any references to “Shares”

or shares of the Company in the RSU Agreement(s) and the Plan shall mean ordinary shares of SAP, without nominal value, represented

by SAP ADSs, as evidenced by SAP ADRs to the extent the context requires to achieve the intent of the conversion described in this Agreement.

Except as described above or as otherwise set

forth in the Merger Agreement, all other provisions of your Converted RSUs remain substantially the same as set forth in the RSU Agreement(s) evidencing

your pre-conversion Company RSUs. The provisions of such RSU Agreement(s), other than those rendered inoperative by the Merger as determined

by the Company in its sole discretion, will govern and control your rights to acquire SAP ADRs with respect to your Converted RSUs, except

as modified by this Agreement. In addition, any legally binding rights you have under any employment agreement, offer letter, plan or

other agreement with the Company or one of its affiliates or subsidiaries that apply to your Company RSUs will continue to apply to your

Converted RSUs to the extent not waived by you in writing prior to the date of this Agreement.

Please note that any explanatory discussion of

the terms of Company RSUs or Converted RSUs in any employment offer letter (whether from SAP, the Company or any of their respective subsidiaries

or affiliates) is explanatory in nature and will not result in duplication of benefits (including vesting) with respect to your Converted

RSUs.

Nothing in this Agreement or the RSU Agreement(s) interferes in any way with your right and the right of the Company or any parent,

subsidiary or affiliate, which rights are expressly reserved, to terminate your employment or service at any time for any reason, subject

to applicable law.

This Agreement is contingent upon the closing

the Merger.

If you do not accept this Agreement prior to the first vesting date of the Converted RSUs that occurs on or after the Effective Time,

your Converted RSU(s) will be automatically accepted on your behalf on such first vesting date.

If you have any questions regarding this Agreement

or your Converted RSUs, please contact [Name] at [Number] or [Email].

WALKME LTD.

ACKNOWLEDGMENT

You acknowledge that clicking on the I Agree

button constitutes acceptance and agreement to be bound by the terms of this Agreement.

ATTACHMENTS

Exhibit A - Form S-8 Prospectus

S-8

S-8

EX-FILING FEES

0001000184

SAP SE

Fees to be Paid

0001000184

2024-09-10

2024-09-10

0001000184

1

2024-09-10

2024-09-10

iso4217:USD

xbrli:pure

xbrli:shares

|

Calculation of Filing Fee Tables

|

|

S-8

|

|

SAP SE

|

|

Table 1: Newly Registered Securities

|

|

|

Security Type

|

Security Class Title

|

Fee Calculation Rule

|

Amount Registered

|

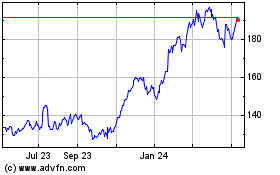

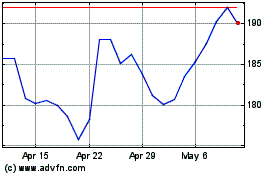

Proposed Maximum Offering Price Per Unit

|

Maximum Aggregate Offering Price

|

Fee Rate

|

Amount of Registration Fee

|

|

1

|

Equity

|

Ordinary Share, without nominal value

|

Other

|

280,000

|

$

212.595

|

$

59,526,600.00

|

0.0001476

|

$

8,786.13

|

|

Total Offering Amounts:

|

|

$

59,526,600.00

|

|

$

8,786.13

|

|

Total Fee Offsets:

|

|

|

|

$

0.00

|

|

Net Fee Due:

|

|

|

|

$

8,786.13

|

|

1

|

Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (the "Securities Act"), the registration statement on Form S-8 shall also cover an indeterminate amount of Ordinary Shares (the "Ordinary Shares") of SAP SE ("Registrant") that become issuable with respect to the securities identified in the above table, by reason of stock splits, stock dividends or similar anti-dilution adjustments of outstanding Ordinary Shares.

The amount registered represents Ordinary Shares represented by American Depositary Shares evidenced by American Depositary Receipts that are expected to be issued outside of any equity incentive plan of Registrant upon settlement of certain restricted stock units granted under the WalkMe Ltd. 2021 Share Incentive Plan pursuant to the terms of that certain Agreement and Plan of Merger, dated as of June 4, 2024 (as amended, the "Merger Agreement"), by and among Registrant, Hummingbird Acquisition Corp Ltd., a company organized under the laws of the State of Israel and a wholly owned subsidiary of Registrant, and WalkMe Ltd., a company organized under the laws of the State of Israel. Each American Depositary Share represents one Ordinary Share.

The proposed maximum offering price per unit is estimated solely for the purpose of calculating the registration fee pursuant to Rules 457(c) of the Securities Act on the basis of $212.595, the average of the high and low prices of one American Depositary Share as reported on the New York Stock Exchange on September 6, 2024.

|

|

|

v3.24.2.u1

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_FeeExhibitTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:feeExhibitTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_SubmissionLineItems |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_SubmissnTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

v3.24.2.u1

Offerings - Offering: 1

|

Sep. 10, 2024

USD ($)

shares

|

| Offering: |

|

| Fee Previously Paid |

false

|

| Other Rule |

true

|

| Security Type |

Equity

|

| Security Class Title |

Ordinary Share, without nominal value

|