Shopify: A Beaten-Down Tech Stock With Massive Upside Potential

August 04 2022 - 5:08AM

Finscreener.org

Shopify (NYSE:

SHOP) is a Canada-based e-commerce giant that

provides merchants the tools to start and manage their online

businesses. It is an end-to-end service provider, and once

onboarded, a merchant can do everything from managing products and

inventory, accepting payments, processing orders, filling orders,

and shipping orders.

Over two million merchants use

Shopify’s platform. While Shopify stock thrived amid the ongoing

pandemic, it has lost over 77% in market value since touching

record highs in November 2021.

However, Shopify has an excellent

business model and has also played an essential role in shaping the

long-term prospects of the e-commerce segment. SHOP stock will

likely bounce back once again as inflation loses steam and the

upcoming recession abates.

Shopify is part of a rapidly expanding addressable

market

The pandemic accelerated demand

for the e-commerce sector, but online shopping still has a lot more

potential. According to an

IMARC forecast, the global e-commerce market might

increase at a CAGR of 27.4 % between 2022 and 2027, growing from

$13 trillion in 2021 to a massive $55.6 trillion by 2027 allowing

Shopify to likely to thrive in this market.

In the last few years, Shopify

has played a pivotal role in the evolution of the e-commerce

industry. Numerous manufacturers have benefited from the

companyU+02019s software-as-a-service (SaaS)-based

platform.

Shopify’s platform services

around 1.75 million US merchants in total, which equates to over

10% of online sales in the United States. Therefore, more merchants

will swarm to its portal as new opportunities materialize, and the

company concentrates further on

expanding its fulfillment

ecosystem by providing a two-day

shipping capacity to 90% of the US population.

Shopify’s weak financials in Q2

Shopify’s financial health has

been impacted because of the hindrances it has been facing since

the beginning of this year. Its sales had slowed down largely in Q1

of 2022 to $1.2 billion, an increase of 22% year-over-year.

Comparatively, sales in 2020 rose 86% year-over-year. In Q2,

sales growth decelerated further to 16%.

Alternatively, Shopify’s business

is much bigger now, and its first quarter’s revenue is comparable

with its 2019 revenue levels of $1.6 billion.

Great business strategies

Recently, Shopify has been trying

to reshape its operations to gain traction in international

markets. For instance, the company reached an agreement with the

China-based organization JD.com to make it easy for its merchants

in the USA to sell in China.

Further, it also acquired

Deliverr, a fulfillment technology provider, in order to

help the merchants on its platform to scale up their businesses

through their logistics platform. Notably, this acquisition was

said to more than double the size of ShopifyU+02019s fulfillment

team.

The deal with JD.com will likely

provide the company with merchants who are actively engaged in

exports, while the acquisition of Deliverr would make the logistics

operations much better for the merchants in general.

Shopify is a top business, but

currently, its operations have been badly hurt. The recent changes

made by the company in its operations might pay off, allowing

Shopify to enhance its merchant reach. SHOP stock is currently

trading at $38, and the average target price is $79, which is a

potential upside of over 100%.

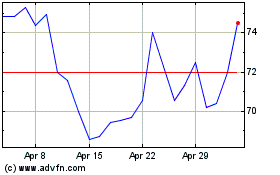

Shopify (NYSE:SHOP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Shopify (NYSE:SHOP)

Historical Stock Chart

From Apr 2023 to Apr 2024