Sprott Physical Copper Trust Files Preliminary Prospectus for Proposed Initial Public Offering

May 13 2024 - 3:17PM

Sprott Asset Management LP (“

Sprott Asset

Management”), on behalf of Sprott Physical Copper Trust

(the “

Trust”), announced that on May 13, 2024 a

preliminary prospectus for the Trust was filed and receipted by the

securities regulatory authorities of all the Canadian provinces and

territories for an initial public offering (the

“

Offering”) of transferable units (the

“

Units”) at a price of US$10.00 per Unit. The

number of Units to be sold has not yet been determined.

The Trust is a closed-end trust established to

invest and hold substantially all of its assets in physical copper

metal (“Copper”). The net proceeds of the Offering

will be used to purchase Copper.

The Trust’s investment objectives are to provide

a secure, convenient and exchange-traded investment alternative for

investors interested in holding Copper without the inconvenience

that is typical of a direct investment in Copper. The Trust does

not anticipate making regular cash distributions to holders of the

Units.

Canaccord Genuity Corp., BMO Nesbitt Burns Inc.

and Cantor Fitzgerald Canada Corporation are acting as joint

bookrunners for the Offering. RBC Dominion Securities Inc. and TD

Securities Inc. are also acting as underwriters for the

Offering.

WMC Energy B.V. is acting as technical advisor

to Sprott Asset Management and will arrange all procurement and

handling of Copper.

About Sprott Asset Management and the

Trust

Sprott Asset Management, a subsidiary of Sprott

Inc. (NYSE/TSX: SII), is the investment manager to the Trust.

Sprott Asset Management’s head office is located at Royal Bank

Plaza, South Tower, Suite 2600, 200 Bay Street, Toronto, Ontario,

Canada M5J 2J1.

Contact:Glen Williams Managing

PartnerInvestor and Institutional Client Relations and Head of

Corporate CommunicationsDirect:

416-943-4394gwilliams@sprott.com

A preliminary prospectus containing

important information relating to these securities has been filed

with securities commissions or similar authorities in each of the

provinces and territories of Canada. The prospectus is still

subject to completion or amendment. Copies of the preliminary

prospectus may be obtained from any one of the underwriters noted

above. There will not be any sale or any acceptance of an offer to

buy the securities until a receipt for the final prospectus has

been issued.

The Units have not been and will not be

registered under the United States Securities Act of 1933, as

amended (the “U.S. Securities Act”), or the securities laws of any

state of the United States, and may not be offered or sold,

directly or indirectly, in the United States (as defined in

Regulation S under the U.S. Securities Act) unless registered under

the U.S. Securities Act and applicable securities laws of any state

of the United States or in reliance on an exemption from such

registration requirements. This news release does not constitute an

offer to sell, or a solicitation of an offer to buy any of the

Trust’s securities referred to herein in the United

States.

This is not an offer to sell these securities

and not a solicitation of an offer to buy these securities in any

state where the offer or sale is not permitted and should be

accompanied by the preliminary prospectus. Investors should

carefully consider the Trust’s investment objectives, risks,

charges and expenses before investing. The preliminary prospectus,

which contains this and other information about the Trust, should

be read carefully before investing.

You could lose some or all of your investment.

For a summary of the risks of an investment in the Trust, please

see the “RISK FACTORS” section of the preliminary

prospectus. Consult your financial advisor before investing.

This material may contain certain statements

which constitute “forward-looking information”. Forward-looking

information includes, among other things, projections, estimates,

and information about possible or future results related to the

Trust, market, or regulatory developments. The views expressed

herein are not guarantees of future performance or economic results

and involve certain risks, uncertainties, and assumptions that

could cause actual outcomes and results to differ materially from

the views expressed herein. The views expressed herein are subject

to change at any time based upon economic, market, or other

conditions and the Trust undertakes no obligation to update the

views expressed herein.

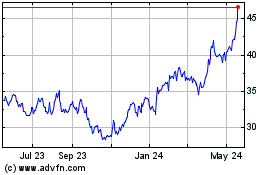

Sprott (NYSE:SII)

Historical Stock Chart

From Oct 2024 to Nov 2024

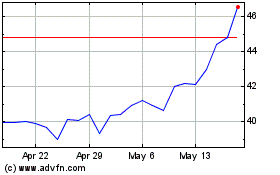

Sprott (NYSE:SII)

Historical Stock Chart

From Nov 2023 to Nov 2024