- Proceeding with Fluor’s Phase 2 Front-End Engineering and

Design (FEED Phase 2) study for the RoPower Doicești small modular

reactor (SMR) power plant

- Robust business development activity including advancements

with prospective data center/artificial intelligence (AI)

customers

- Supply chain partner Doosan Enerbility making progress

producing the first NuScale Power Modules™

NuScale Power Corporation (NYSE: SMR), the industry-leading

provider of proprietary and innovative advanced small modular

reactor nuclear technology, today announced results for the third

quarter ended September 30, 2024.

“As energy demand grows, the world’s largest technology

companies are urgently seeking sources of secure, clean, reliable

nuclear power, and NuScale is uniquely positioned to serve their

needs for uninterrupted energy,” said John Hopkins, President and

Chief Executive Officer of NuScale Power. “NuScale’s SMR technology

is ready for near-term deployment to support the growth of AI and

other power-intensive technologies. We are the sole SMR technology

approved by the U.S. Nuclear Regulatory Commission, have modules

currently in production with supply chain partner Doosan

Enerbility, and are seeing interest like never before.”

Hopkins continued, “We signed a contract with Fluor to proceed

with RoPower’s FEED Phase 2 study for the Doicești SMR power plant

in Romania, which will be the first of its kind in Europe.”

Financial Update

During the third quarter of 2024:

- NuScale ended the third quarter with cash, cash equivalents and

short-term investments of $161.7 million ($5.1 million of which is

restricted), and no debt. At the end of the second quarter of 2024,

the Company had cash and equivalents of $136.0 million ($5.1

million of which was restricted), and no debt.

- NuScale reported $0.5 million in revenue and a net loss of

$45.5 million. In the prior year period, the Company reported

revenue of $7.0 million and a net loss of $58.3 million.

- Net loss in the quarter included a non-cash expense of $7.2

million related to the fair value of warrants outstanding, while in

the same period in the prior year, the Company reported non-cash

income of $11.1 million related to the fair value of our

warrants.

- Operating expense was $41.2 million compared to $93.9 million

in the year-earlier period. The year-over-year reduction in

operating expense of $52.7 million reflects the Company’s actions

to reduce costs and operate more efficiently.

- NuScale reported an operating loss of $41.0 million, compared

to an operating loss of $92.9 million in the year-earlier

period.

Conference Call:

NuScale will host a conference call today at 5:00 p.m. ET. A

live webcast of the presentation will be available by dialing (888)

550-5460 with conference ID 4347254 or by visiting the Events

& Presentations page.

A replay of the webcast will be available for 30 days.

About NuScale Power

Founded in 2007, NuScale Power Corporation (NYSE: SMR) is the

industry-leading provider of proprietary and innovative advanced

small modular reactor (SMR) nuclear technology, with a mission to

help power the global energy transition by delivering safe,

scalable, and reliable carbon-free energy. The company’s

groundbreaking SMR technology is powered by the NuScale Power

Module™, a small, safe, pressurized water reactor that can each

generate 77 megawatts of electricity (MWe) or 250 megawatts thermal

(gross), and can be scaled to meet customer needs through an array

of flexible configurations up to 924 MWe (12 modules) of

output.

As the first and only SMR to have its design certified by the

U.S. Nuclear Regulatory Commission, NuScale is well-positioned to

serve diverse customers across the world by supplying nuclear

energy for electrical generation, data centers, district heating,

desalination, commercial-scale hydrogen production, and other

process heat applications.

To learn more, visit NuScale Power’s website or follow us

on LinkedIn, Facebook, Instagram, X and

YouTube.

Forward Looking Statements

This release may contain forward-looking statements (including

without limitation statements to the effect that the Company or its

management "will," "believes," "expects," “anticipates,” "plans" or

other similar expressions). These forward-looking statements

include statements relating to strategic and operational plans,

capital deployment, future growth, new awards, backlog, earnings

and the outlook for the company’s business.

Actual results may differ materially as a result of a number of

factors, including, among other things, the Company’s liquidity and

ability to raise capital; the Company's failure to receive new

contract awards; cost overruns, project delays or other problems

arising from project execution activities, including the failure to

meet cost and schedule estimates; intense competition in the

industries in which we operate; failure of our partners to perform

their obligations; cyber-security breaches; foreign economic and

political uncertainties; client cancellations of, or scope

adjustments to, existing contracts; failure to maintain safe

worksites and international security risks; risks or uncertainties

associated with events outside of our control, including weather

conditions, pandemics (including COVID-19), public health crises,

political crises or other catastrophic events; the use of estimates

and assumptions in preparing our financial statements; client

delays or defaults in making payments; the failure of our

suppliers, subcontractors and other third parties to adequately

perform services under our contracts; uncertainties, restrictions

and regulations impacting our government contracts; the inability

to hire and retain qualified personnel; the potential impact of

certain tax matters; possible information technology interruptions;

the Company's ability to secure appropriate insurance; liabilities

associated with the performance of nuclear services; foreign

currency risks; the loss of one or a few clients that account for a

significant portion of the Company's revenues; damage to our

reputation; failure to adequately protect intellectual property

rights; asset impairments; climate change and related environmental

issues; increasing scrutiny with respect to sustainability

practices; the availability of credit and restrictions imposed by

credit facilities for our clients, suppliers, subcontractors or

other partners; failure to obtain favorable results in existing or

future litigation and regulatory proceedings, dispute resolution

proceedings or claims, including claims for additional costs;

failure by us or our employees, agents or partners to comply with

laws; new or changing legal requirements, including those relating

to environmental, health and safety matters; failure to

successfully implement our strategic and operational initiatives

and restrictions on possible transactions imposed by our charter

documents and Delaware law. Caution must be exercised in relying on

these and other forward-looking statements. Due to known and

unknown risks, the Company’s results may differ materially from its

expectations and projections.

Additional information concerning these and other factors can be

found in the Company's public periodic filings with the Securities

and Exchange Commission, including the general economic conditions

and other risks, uncertainties and factors set forth in the section

entitled “Cautionary Note Regarding Forward-Looking Statements and

Summary of Risk Factors” in the Company’s annual report on Form

10-K for the period ended December 31, 2023 and under similar

headings in subsequent filings with the U.S. Securities and

Exchange Commission. The referenced SEC filings are available

either publicly or upon request from NuScale's Investor Relations

Department at ir@nuscalepower.com. The Company disclaims any intent

or obligation other than as required by law to update its

forward-looking statements in light of new information or future

events.

UNAUDITED

NuScale Power

Corporation

Condensed Consolidated Balance

Sheet

(in thousands, except share and per share

amounts)

September 30, 2024

December 31, 2023

ASSETS

(Unaudited)

Current Assets

Cash and cash equivalents

$

111,628

$

120,265

Short-term investments

45,000

—

Restricted cash

5,100

5,100

Prepaid expenses

10,914

19,054

Accounts and other receivables, net

7,912

10,127

Total current assets

180,554

154,546

Property, plant and equipment, net

2,756

4,116

In-process research and development

16,900

16,900

Intangible assets, net

749

882

Goodwill

8,255

8,255

Long-lead material work in process

41,609

36,361

Other assets

2,461

3,798

Total Assets

$

253,284

$

224,858

LIABILITIES AND EQUITY

Current Liabilities

Accounts payable and accrued expenses

$

17,897

$

44,925

Accrued compensation

7,749

8,546

Long-lead material liability

33,064

32,323

Customer deposit

20,000

—

Other accrued liabilities

1,848

1,664

Total current liabilities

80,558

87,458

Warrant liabilities

58,681

5,722

Noncurrent accounts payable and accrued

expenses

23,604

—

Other noncurrent liabilities

238

1,442

Deferred revenue

78

898

Total Liabilities

163,159

95,520

Stockholders’ Equity

Class A common stock, par value $0.0001

per share, 332,000,000 shares authorized, 97,893,884 and 76,895,166

shares outstanding as of September 30, 2024 and December 31, 2023,

respectively

10

8

Class B common stock, par value $0.0001

per share, 179,000,000 shares authorized, 154,266,400 and

154,477,032 shares outstanding as of September 30, 2024 and

December 31, 2023, respectively

15

15

Additional paid-in capital

462,146

333,888

Accumulated deficit

(302,102

)

(240,454

)

Total Stockholders’ Equity Excluding

Noncontrolling Interests

160,069

93,457

Noncontrolling interests

(69,944

)

35,881

Total Stockholders' Equity

90,125

129,338

Total Liabilities and Stockholders'

Equity

$

253,284

$

224,858

UNAUDITED

NuScale Power

Corporation

Condensed Consolidated

Statements of Operations

(in thousands, except share and per share

amounts)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Revenue

$

475

$

6,950

$

2,821

$

18,250

Cost of sales

(295

)

(5,940

)

(1,880

)

(15,121

)

Gross Margin

180

1,010

941

3,129

Research and development expenses

12,160

63,725

37,447

118,227

General and administrative expenses

17,021

16,402

53,207

47,420

Other expenses

12,018

13,799

37,157

41,991

Loss From Operations

(41,019

)

(92,916

)

(126,870

)

(204,509

)

Sponsored cost share

660

20,774

6,504

54,984

Change in fair value of warrant

liabilities

(7,191

)

11,076

(52,969

)

17,167

Interest income

2,008

2,738

5,275

8,686

Loss Before Income Taxes

(45,542

)

(58,328

)

(168,060

)

(123,672

)

Foreign income taxes

12

—

12

—

Net Loss

(45,554

)

(58,328

)

(168,072

)

(123,672

)

Net loss attributable to noncontrolling

interests

(28,095

)

(39,206

)

(106,424

)

(84,065

)

Net Loss Attributable to Class A Common

Stockholders

$

(17,459

)

$

(19,122

)

$

(61,648

)

$

(39,607

)

Loss per Share of Class A Common

Stock:

Basic and Diluted

$

(0.18

)

$

(0.26

)

$

(0.70

)

$

(0.55

)

Weighted-Average Shares of Class A

Common Stock Outstanding:

Basic and Diluted

95,197,500

74,836,884

88,137,939

72,235,763

UNAUDITED

NuScale Power

Corporation

Condensed Consolidated

Statements of Cash Flows

Nine Months Ended September

30,

(in thousands)

2024

2023

OPERATING CASH FLOW

Net Loss

$

(168,072

)

$

(123,672

)

Adjustments to reconcile net loss to

operating cash flow:

Depreciation

1,286

1,813

Amortization of intangibles

133

133

Equity-based compensation expense

10,442

12,099

Provision for credit losses

57

—

Impairment of intangible asset

71

—

Gain on insurance proceeds received for

damage to property, plant and equipment

(122

)

—

Change in fair value of warrant

liabilities

52,969

(17,167

)

Net noncash change in right of use assets

and lease liabilities

(274

)

(230

)

Changes in assets and liabilities:

Prepaid expenses and other assets

8,474

(18,377

)

Accounts and other receivables

2,157

(8,991

)

Long-term contract work in process

(5,248

)

(30,765

)

Long-lead material liability

741

34,500

Accounts payable and accrued expenses

(2,044

)

8,830

Nonrefundable customer deposit

20,000

—

Lease liability

(1,202

)

(1,290

)

Deferred revenue

(820

)

32,525

Accrued compensation

(797

)

550

Net Cash Used in Operating

Activities

(82,249

)

(110,042

)

INVESTING CASH FLOW

Sale of short-term investments

—

50,000

Purchase of short-term investments

(45,000

)

—

Insurance proceeds received for damage to

property, plant and equipment

195

—

Purchases of property, plant and

equipment

—

(1,674

)

Net Cash (Used) Provided by Investing

Activities

(44,805

)

48,326

FINANCING CASH FLOW

Proceeds from the issuance of common

stock, net of issuance fees

103,842

7,867

Proceeds from exercise of warrants and

common share options

14,575

6,266

Net Cash Provided by Financing

Activities

118,417

14,133

Net Change in Cash, Cash Equivalents

and Restricted Cash

(8,637

)

(47,583

)

Cash, cash equivalents and restricted

cash:

Beginning of period

125,365

244,217

End of period

$

116,728

$

196,634

Supplemental disclosures of cash flow

information:

Foreign income taxes paid

$

3,212

$

—

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241107954809/en/

Investor Contact Scott Kozak, Director, Investor

Relations, NuScale Power skozak@nuscalepower.com

Media Contact Chuck Goodnight, Vice President, Business

Development, NuScale Power media@nuscalepower.com

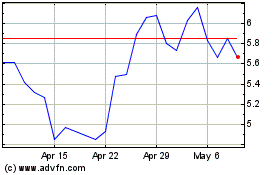

NuScale Power (NYSE:SMR)

Historical Stock Chart

From Oct 2024 to Nov 2024

NuScale Power (NYSE:SMR)

Historical Stock Chart

From Nov 2023 to Nov 2024