false

0000094344

STEWART INFORMATION SERVICES CORP

0000094344

2024-10-23

2024-10-23

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE

SECURITIES EXCHANGE ACT OF 1934

DATE OF REPORT (DATE OF EARLIEST

EVENT REPORTED): October 23, 2024

STEWART INFORMATION SERVICES CORPORATION

(EXACT NAME OF REGISTRANT AS SPECIFIED

IN ITS CHARTER)

| Delaware |

|

001-02658 |

|

74-1677330 |

(STATE OR OTHER

JURISDICTION) |

|

(COMMISSION FILE

NO.) |

|

(I.R.S. EMPLOYER

IDENTIFICATION

NO.) |

1360 Post Oak Blvd, Suite 100, Houston, Texas 77056

(Address Of Principal Executive Offices) (Zip

Code)

Registrant’s Telephone Number,

Including Area Code: (713) 625-8100

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, $1 par value |

STC |

New York Stock Exchange (NYSE) |

Indicate by check mark whether the

registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter)

or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth

company ¨

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| ITEM 2.02. |

RESULTS OF OPERATIONS AND FINANCIAL CONDITION. |

A press release issued by

Stewart Information Services Corporation on October 23, 2024, regarding financial results for the three months ended September 30,

2024, is attached hereto as Exhibit 99.1, and is incorporated herein by reference. This information is not deemed to be “filed”

for the purposes of Section 18 of the Securities Exchange Act of 1934 and is not incorporated by reference in any filing under the

Securities Act of 1933, as amended.

| ITEM 9.01. |

FINANCIAL STATEMENTS AND EXHIBITS. |

(d) EXHIBITS

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

STEWART INFORMATION SERVICES CORPORATION (Registrant) |

| |

|

|

| |

By: |

/s/ David C. Hisey |

| |

David C. Hisey, |

| |

Chief Financial Officer and Treasurer |

| |

|

| Date: October 23, 2024 |

|

Exhibit 99.1

NEWS RELEASE

STEWART INFORMATION SERVICES

CORP.

P.O. Box 2029

Houston, Texas 77252-2029

www.stewart.com |

CONTACT

Kathryn Bass / Brian Glaze

Investor Relations

(713) 625-8633

|

Stewart Reports

Third Quarter 2024 Results

| · | Total

revenues of $667.9 million ($663.2 million on an adjusted basis) compared to $601.7 million ($603.7 million on an adjusted basis) in

the prior year quarter |

| · | Net

income of $30.1 million ($33.1 million on an adjusted basis) compared to $14.0 million ($23.9 million on an adjusted basis) in the prior

year quarter |

| · | Diluted

earnings per share of $1.07 ($1.17 on an adjusted basis) compared to prior year diluted EPS of $0.51 ($0.86 on an adjusted basis) |

HOUSTON, October 23, 2024 - Stewart

Information Services Corporation (NYSE: STC) today reported net income attributable to Stewart of $30.1 million ($1.07 per diluted share)

for the third quarter 2024, compared to $14.0 million ($0.51 per diluted share) for the third quarter 2023. On an adjusted basis, third

quarter 2024 net income was $33.1 million ($1.17 per diluted share) compared to $23.9 million ($0.86 per diluted share) in the third

quarter 2023. Pretax income before noncontrolling interests for the third quarter 2024 was $42.8 million ($46.8 million on an adjusted

basis) compared to $27.1 million ($40.0 million on an adjusted basis) for the third quarter 2023.

Third quarter 2024 results included

$4.7 million of pretax net realized and unrealized gains, while third quarter 2023 results included $1.9 million of pretax net realized

and unrealized losses, both of which were primarily driven by net unrealized gains and losses, respectively, from fair value changes

of equity securities investments in the title segment.

“We are proud of our third quarter

results as they reflect continued progress on our journey. Strong topline performance in several lines of business resulted in improved

third quarter results when compared to the same quarter last year, even as residential purchase market conditions remain difficult given

macro-economic impacts,” commented Fred Eppinger, chief executive officer. “We remain focused on investing in ourselves to

better the company and our customers and remain dedicated to prioritizing our pursuit of growth and margin improvement across all lines

of business.”

Selected Financial Information

Summary results of operations are as

follows (dollars in millions, except per share amounts, pretax margin and adjusted pretax margin, and amounts may not add as presented

due to rounding):

| | |

Quarter Ended

September 30, | | |

Nine Months Ended

September 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Total revenues | |

| 667.9 | | |

| 601.7 | | |

| 1,824.5 | | |

| 1,675.2 | |

| Pretax income before noncontrolling interests | |

| 42.8 | | |

| 27.1 | | |

| 78.9 | | |

| 42.1 | |

| Income tax expense | |

| (9.1 | ) | |

| (9.1 | ) | |

| (18.0 | ) | |

| (9.6 | ) |

| Net income attributable to noncontrolling interests | |

| (3.6 | ) | |

| (3.9 | ) | |

| (10.4 | ) | |

| (10.9 | ) |

| Net income attributable to Stewart | |

| 30.1 | | |

| 14.0 | | |

| 50.6 | | |

| 21.6 | |

| Non-GAAP adjustments, after taxes* | |

| 3.0 | | |

| 9.9 | | |

| 12.3 | | |

| 27.7 | |

| Adjusted net income attributable to Stewart* | |

| 33.1 | | |

| 23.9 | | |

| 62.8 | | |

| 49.4 | |

| Pretax margin | |

| 6.4 | % | |

| 4.5 | % | |

| 4.3 | % | |

| 2.5 | % |

| Adjusted pretax margin* | |

| 7.1 | % | |

| 6.6 | % | |

| 5.3 | % | |

| 4.7 | % |

| Net income per diluted Stewart share | |

| 1.07 | | |

| 0.51 | | |

| 1.80 | | |

| 0.79 | |

| Adjusted net income per diluted Stewart share* | |

| 1.17 | | |

| 0.86 | | |

| 2.24 | | |

| 1.80 | |

* Adjusted net income, adjusted

pretax margin and adjusted net income per diluted share are non-GAAP measures. See Appendix A for explanation and reconciliation of non-GAAP

adjustments.

Title Segment

Summary results of the title segment

are as follows (dollars in millions, except pretax margin and adjusted pretax margin):

| | |

Quarter Ended September 30, | |

| | |

2024 | | |

2023 | | |

% Change | |

| Operating revenues | |

| 553.3 | | |

| 522.1 | | |

| 6 | % |

| Investment income | |

| 13.6 | | |

| 13.4 | | |

| 2 | % |

| Net realized and unrealized gains (losses) | |

| 4.8 | | |

| (1.8 | ) | |

| 361 | % |

| Pretax income | |

| 45.0 | | |

| 35.4 | | |

| 27 | % |

| Non-GAAP adjustments to pretax income* | |

| (1.6 | ) | |

| 6.6 | | |

| | |

| Adjusted pretax income* | |

| 43.4 | | |

| 42.0 | | |

| 3 | % |

| Pretax margin | |

| 7.9 | % | |

| 6.6 | % | |

| | |

| Adjusted pretax margin* | |

| 7.7 | % | |

| 7.8 | % | |

| | |

| | |

| | | |

| | | |

| | |

| *

Adjusted pretax income and adjusted pretax margin are non-GAAP financial

measures. See Appendix A for explanation and reconciliation of non-GAAP adjustments. |

Title segment operating revenues in

the third quarter 2024 increased $31.2 million, or 6 percent, primarily driven by higher revenues from our domestic commercial and agency

title operations, while total segment operating expenses increased $28.4 million, or 6 percent, compared to the third quarter 2023. Agency

retention expenses in the third quarter 2024 increased $15.0 million, or 7 percent, primarily resulting from $16.8 million (6 percent)

higher gross agency revenues compared to the third quarter 2023.

Total title segment employee costs and

other operating expenses increased by $14.6 million, or 6 percent, in the third quarter 2024 compared to the prior year quarter, primarily

due to higher outside search and incentive compensation expenses related to higher commercial revenues. As a percentage of operating

revenues, these expenses were 47.4 percent in both third quarters of 2024 and 2023. Title loss expense in the third quarter 2024 decreased

$1.0 million, or 4 percent, primarily due to an overall favorable claim experience compared to the prior year quarter. As a percentage

of title revenues, title loss expense was 3.8 percent for the third quarter 2024 compared to 4.3 percent in the third quarter 2023.

In addition to the net realized and

unrealized losses and gains presented above, non-GAAP adjustments to the title segment’s pretax income for the third quarters 2024

and 2023 included $3.2 million and $4.8 million, respectively, of total acquisition intangible asset amortization and other expenses

(refer to Appendix A).

Direct title revenues information is

presented below (dollars in millions):

| | |

Quarter Ended September 30, | |

| | |

2024 | | |

2023 | | |

% Change

(Rounded) | |

| Non-commercial: | |

| | | |

| | | |

| | |

| Domestic | |

| 168.2 | | |

| 167.6 | | |

| 0 | % |

| International | |

| 29.0 | | |

| 29.1 | | |

| 0 | % |

| | |

| 197.2 | | |

| 196.7 | | |

| 0 | % |

| Commercial: | |

| | | |

| | | |

| | |

| Domestic | |

| 67.4 | | |

| 51.9 | | |

| 30 | % |

| International | |

| 6.1 | | |

| 7.8 | | |

| (22 | %) |

| | |

| 73.5 | | |

| 59.7 | | |

| 23 | % |

| Total direct title revenues | |

| 270.7 | | |

| 256.4 | | |

| 6 | % |

Total non-commercial domestic revenues

in the third quarter 2024 were comparable to the prior year quarter, primarily due to the higher average fee per file offsetting the

slightly lower total non-commercial domestic transactions in the third quarter 2024. Domestic commercial revenues in the third quarter

2024 increased $15.5 million, or 30 percent, due to a higher average transaction size and a 4 percent improvement in commercial transactions

closed compared to the third quarter 2023. Third quarter 2024 average domestic commercial fee per file was $17,700, which was 25 percent

higher compared to $14,200 from the prior year quarter, while average residential fee per file was $3,000, a 2 percent improvement compared

to the prior year quarter.

Real Estate Solutions Segment

Summary results of the real estate solutions

segment are as follows (dollars in millions, except pretax margin and adjusted pretax margin):

| | |

Quarter Ended September 30, | |

| | |

2024 | | |

2023 | | |

% Change | |

| Operating revenues | |

| 96.3 | | |

| 68.2 | | |

| 41 | % |

| Pretax income | |

| 7.4 | | |

| 2.6 | | |

| 181 | % |

| Non-GAAP adjustments to pretax income* | |

| 5.5 | | |

| 6.3 | | |

| | |

| Adjusted pretax income* | |

| 12.9 | | |

| 8.9 | | |

| 45 | % |

| Pretax margin | |

| 7.7 | % | |

| 3.8 | % | |

| | |

| Adjusted pretax margin* | |

| 13.4 | % | |

| 13.0 | % | |

| | |

| | |

| | | |

| | | |

| | |

| *

Adjusted pretax income and adjusted pretax margin are non-GAAP financial measures. See Appendix A for an explanation and reconciliation

of non-GAAP adjustments. |

Segment operating revenues in the third

quarter 2024 increased $28.2 million, or 41 percent, compared to the prior year quarter, primarily due to improved revenues from our

credit information and valuation services. On a combined basis, segment employee costs and other operating expenses in the third quarter

2024 increased $24.2 million, or 41 percent, in line with the higher operating revenues. Non-GAAP adjustments to pretax income shown

in the schedule above were related to acquisition intangible asset amortization expenses.

Corporate and Other Segment

The segment’s results were primarily

driven by net expenses attributable to corporate operations, which decreased to $9.5 million in the third quarter 2024, compared to $10.8

million in the third quarter 2023, primarily due to a prior acquisition-related settlement expense in the third quarter 2023.

Expenses

Consolidated employee costs in the third

quarter 2024 increased $12.4 million, or 7 percent, compared to the prior year quarter, primarily driven by increased incentive compensation

on higher title and real estate solutions revenues. As a percentage of total operating revenues, employee costs improved to 29.8 percent

in the third quarter 2024 compared to 30.7 percent in the third quarter 2023.

Consolidated other operating expenses

in the third quarter 2024 increased $25.2 million, or 19 percent, primarily driven by higher service expenses and outside search fees

related to higher revenues from real estate solutions and commercial title operations, respectively, compared to the third quarter 2023.

As a percentage of total operating revenues, total other operating expenses for the third quarter 2024 increased to 24.0 percent compared

to 22.1 percent in the prior year quarter, primarily due to increased real estate solutions service expenses.

Other

Net cash provided by operations in the

third quarter 2024 was $76.1 million compared to $59.5 million in the third quarter 2023, primarily driven by increased consolidated

net income in the third quarter 2024.

Third quarter Earnings Call

Stewart will hold a conference call

to discuss the third quarter 2024 earnings at 8:30 a.m. Eastern Time on Thursday, October 24, 2024. To participate, dial (800) 343-5172

(USA) or (203) 518-9856 (International) - access code STCQ324. Additionally, participants can listen to the conference call through Stewart’s

Investor Relations website at https://investors.stewart.com/news-and-events/events/default.aspx.

The conference call replay will be available from 11:00 a.m. Eastern Time on October 24, 2024 until midnight on October 31, 2024 by dialing

(800) 839-5634 (USA) or (402) 220-2560 (International).

About Stewart

Stewart (NYSE-STC) is a global real

estate services company, offering products and services through our direct operations, network of Stewart Trusted Providers™ and

family of companies. From residential and commercial title insurance and closing and settlement services to specialized offerings for

the mortgage and real estate industries, we offer the comprehensive service, deep expertise and solutions our customers need for any

real estate transaction. At Stewart, we are dedicated to becoming the premier title services company and we are committed to doing so

by partnering with our customers to create mutual success. Learn more at stewart.com.

Cautionary statement regarding forward-looking

statements. Certain statements in this earnings release are “forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995, as amended. Such forward-looking statements relate to future, not past, events and often address

our expected future business and financial performance. These statements often contain words such as “may,” “expect,”

“anticipate,” “intend,” “plan,” “believe,” “seek,” “will,” “foresee”

or other similar words. Forward-looking statements by their nature are subject to various risks and uncertainties that could cause our

actual results to be materially different than those expressed in the forward-looking statements. These risks and uncertainties include,

among other things, the volatility of economic conditions; adverse changes in the level of real estate activity; changes in mortgage

interest rates, existing and new home sales, and availability of mortgage financing; our ability to respond to and implement technology

changes, including the completion of the implementation of our enterprise systems; the impact of unanticipated title losses or the need

to strengthen our policy loss reserves; any effect of title losses on our cash flows and financial condition; the ability to attract

and retain highly productive sales associates; the impact of vetting our agency operations for quality and profitability; independent

agency remittance rates; changes to the participants in the secondary mortgage market and the rate of refinancing that affects the demand

for title insurance products; regulatory non-compliance, fraud or defalcations by our title insurance agencies or employees; our ability

to timely and cost-effectively respond to significant industry changes and introduce new products and services; the outcome of pending

litigation; our ability to manage risks associated with potential cybersecurity or other privacy or data security breaches; the impact

of changes in governmental and insurance regulations, including any future reductions in the pricing of title insurance products and

services; our dependence on our operating subsidiaries as a source of cash flow; our ability to access the equity and debt financing

markets when and if needed; our ability to grow our international operations; seasonality and weather; and our ability to respond to

the actions of our competitors. These risks and uncertainties, as well as others, are discussed in more detail in our documents filed

with the Securities and Exchange Commission, including our Annual Report on Form 10-K for the year ended December 31, 2023, and if applicable,

as supplemented by any risk factors contained in our Quarterly Reports on Form 10-Q, and our Current Reports on Form 8-K filed subsequently.

All forward-looking statements included in this earnings release are expressly qualified in their entirety by such cautionary statements.

We expressly disclaim any obligation to update, amend or clarify any forward-looking statements contained in this earnings release to

reflect events or circumstances that may arise after the date hereof, except as may be required by applicable law.

STEWART INFORMATION SERVICES CORPORATION

CONDENSED STATEMENTS OF INCOME

(In thousands of dollars, except

per share amounts and except where noted)

| | |

Quarter Ended

September 30, | | |

Nine Months Ended

September 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Revenues: | |

| | | |

| | | |

| | | |

| | |

| Title revenues: | |

| | | |

| | | |

| | | |

| | |

| Direct operations | |

| 270,706 | | |

| 256,377 | | |

| 736,774 | | |

| 722,242 | |

| Agency operations | |

| 282,549 | | |

| 265,700 | | |

| 764,081 | | |

| 723,476 | |

| Real estate solutions | |

| 96,346 | | |

| 68,190 | | |

| 271,561 | | |

| 202,169 | |

| Total operating revenues | |

| 649,601 | | |

| 590,267 | | |

| 1,772,416 | | |

| 1,647,887 | |

| Investment income | |

| 13,626 | | |

| 13,393 | | |

| 40,833 | | |

| 32,114 | |

| Net realized and unrealized gains (losses) | |

| 4,714 | | |

| (1,946 | ) | |

| 11,238 | | |

| (4,829 | ) |

| | |

| 667,941 | | |

| 601,714 | | |

| 1,824,487 | | |

| 1,675,172 | |

| Expenses: | |

| | | |

| | | |

| | | |

| | |

| Amounts retained by agencies | |

| 233,980 | | |

| 218,983 | | |

| 634,083 | | |

| 596,498 | |

| Employee costs | |

| 193,862 | | |

| 181,493 | | |

| 545,987 | | |

| 534,710 | |

| Other operating expenses | |

| 155,646 | | |

| 130,455 | | |

| 444,890 | | |

| 380,530 | |

| Title losses and related claims | |

| 21,282 | | |

| 22,251 | | |

| 59,754 | | |

| 59,727 | |

| Depreciation and amortization | |

| 15,480 | | |

| 16,414 | | |

| 46,062 | | |

| 46,848 | |

| Interest | |

| 4,899 | | |

| 5,054 | | |

| 14,768 | | |

| 14,777 | |

| | |

| 625,149 | | |

| 574,650 | | |

| 1,745,544 | | |

| 1,633,090 | |

| Income before taxes and noncontrolling interests | |

| 42,792 | | |

| 27,064 | | |

| 78,943 | | |

| 42,082 | |

| Income tax expense | |

| (9,123 | ) | |

| (9,134 | ) | |

| (17,999 | ) | |

| (9,588 | ) |

| Net income | |

| 33,669 | | |

| 17,930 | | |

| 60,944 | | |

| 32,494 | |

| Less net income attributable to noncontrolling interests | |

| 3,573 | | |

| 3,931 | | |

| 10,375 | | |

| 10,870 | |

| Net income attributable to Stewart | |

| 30,096 | | |

| 13,999 | | |

| 50,569 | | |

| 21,624 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net earnings per diluted share attributable to Stewart | |

| 1.07 | | |

| 0.51 | | |

| 1.80 | | |

| 0.79 | |

| Diluted average shares outstanding (000) | |

| 28,200 | | |

| 27,650 | | |

| 28,069 | | |

| 27,445 | |

| | |

| | | |

| | | |

| | | |

| | |

| Selected financial information: | |

| | | |

| | | |

| | | |

| | |

| Net cash provided by operations | |

| 76,121 | | |

| 59,533 | | |

| 67,656 | | |

| 43,578 | |

| Other comprehensive income (loss) | |

| 18,259 | | |

| (13,295 | ) | |

| 10,911 | | |

| (7,278 | ) |

| Third Quarter Domestic Order

Counts: | |

| |

| | |

| | |

| |

| Opened Orders

2024: | |

July | | |

August | | |

Sept | | |

Total | | |

Closed Orders

2024: | |

July | | |

August | | |

Sept | | |

Total | |

| Commercial | |

| 1,111 | | |

| 1,273 | | |

| 1,281 | | |

| 3,665 | | |

Commercial | |

| 1,140 | | |

| 1,318 | | |

| 1,336 | | |

| 3,794 | |

| Purchase | |

| 17,796 | | |

| 16,403 | | |

| 15,259 | | |

| 49,458 | | |

Purchase | |

| 12,382 | | |

| 12,217 | | |

| 10,991 | | |

| 35,590 | |

| Refinancing | |

| 6,017 | | |

| 7,077 | | |

| 7,826 | | |

| 20,920 | | |

Refinancing | |

| 3,617 | | |

| 4,016 | | |

| 4,133 | | |

| 11,766 | |

| Other | |

| 3,621 | | |

| 3,129 | | |

| 6,671 | | |

| 13,421 | | |

Other | |

| 4,304 | | |

| 2,142 | | |

| 1,779 | | |

| 8,225 | |

| Total | |

| 28,545 | | |

| 27,882 | | |

| 31,037 | | |

| 87,464 | | |

Total | |

| 21,443 | | |

| 19,693 | | |

| 18,239 | | |

| 59,375 | |

| Opened

Orders 2023: | |

July | | |

August | | |

Sept | | |

Total | | |

Closed

Orders 2023: | |

July | | |

August | | |

Sept | | |

Total | |

| Commercial | |

| 913 | | |

| 1,208 | | |

| 1,199 | | |

| 3,320 | | |

Commercial | |

| 1,036 | | |

| 1,320 | | |

| 1,305 | | |

| 3,661 | |

| Purchase | |

| 17,446 | | |

| 19,674 | | |

| 16,386 | | |

| 53,506 | | |

Purchase | |

| 13,006 | | |

| 14,200 | | |

| 12,697 | | |

| 39,903 | |

| Refinancing | |

| 5,077 | | |

| 5,807 | | |

| 5,148 | | |

| 16,032 | | |

Refinancing | |

| 3,367 | | |

| 3,778 | | |

| 3,252 | | |

| 10,397 | |

| Other | |

| 2,976 | | |

| 3,161 | | |

| 2,493 | | |

| 8,630 | | |

Other | |

| 2,891 | | |

| 1,187 | | |

| 2,269 | | |

| 6,347 | |

| Total | |

| 26,191 | | |

| 29,850 | | |

| 25,226 | | |

| 81,267 | | |

Total | |

| 20,300 | | |

| 20,485 | | |

| 19,523 | | |

| 60,308 | |

STEWART INFORMATION SERVICES CORPORATION

CONDENSED BALANCE SHEETS

(In thousands of dollars)

| | |

September 30,

2024

(Unaudited) | | |

December 31,

2023 | |

| Assets: | |

| | | |

| | |

| Cash and cash equivalents | |

| 183,772 | | |

| 233,365 | |

| Short-term investments | |

| 44,911 | | |

| 39,023 | |

| Investments in debt and equity securities, at fair value | |

| 688,661 | | |

| 679,936 | |

| Receivables – premiums from agencies | |

| 40,730 | | |

| 38,676 | |

| Receivables – other | |

| 120,457 | | |

| 93,811 | |

| Allowance for uncollectible amounts | |

| (8,851 | ) | |

| (7,583 | ) |

| Property and equipment, net | |

| 90,036 | | |

| 82,335 | |

| Operating lease assets, net | |

| 105,510 | | |

| 115,879 | |

| Title plants | |

| 76,028 | | |

| 73,359 | |

| Goodwill | |

| 1,080,681 | | |

| 1,072,129 | |

| Intangible assets, net of amortization | |

| 175,166 | | |

| 193,196 | |

| Deferred tax assets | |

| 3,749 | | |

| 3,776 | |

| Other assets | |

| 128,720 | | |

| 84,959 | |

| | |

| 2,729,570 | | |

| 2,702,861 | |

| Liabilities: | |

| | | |

| | |

| Notes payable | |

| 445,704 | | |

| 445,290 | |

| Accounts payable and accrued liabilities | |

| 196,670 | | |

| 190,054 | |

| Operating lease liabilities | |

| 122,788 | | |

| 135,654 | |

| Estimated title losses | |

| 517,592 | | |

| 528,269 | |

| Deferred tax liabilities | |

| 32,481 | | |

| 25,045 | |

| | |

| 1,315,235 | | |

| 1,324,312 | |

| Stockholders’ equity: | |

| | | |

| | |

| Common Stock and additional paid-in capital | |

| 353,172 | | |

| 338,451 | |

| Retained earnings | |

| 1,080,879 | | |

| 1,070,841 | |

| Accumulated other comprehensive loss | |

| (24,304 | ) | |

| (35,215 | ) |

| Treasury stock | |

| (2,666 | ) | |

| (2,666 | ) |

| Stockholders’ equity attributable to Stewart | |

| 1,407,081 | | |

| 1,371,411 | |

| Noncontrolling interests | |

| 7,254 | | |

| 7,138 | |

| Total stockholders’ equity | |

| 1,414,335 | | |

| 1,378,549 | |

| | |

| 2,729,570 | | |

| 2,702,861 | |

| Number of shares outstanding (000) | |

| 27,714 | | |

| 27,370 | |

| Book value per share | |

| 50.77 | | |

| 50.11 | |

STEWART INFORMATION SERVICES CORPORATION

SEGMENT INFORMATION

(In thousands of dollars)

| Quarter Ended: | |

September

30, 2024 | | |

September

30, 2023 | |

| | |

Title | | |

Real

Estate

Solutions | | |

Corporate

and Other | | |

Total | | |

Title | | |

Real

Estate

Solutions | | |

Corporate

and Other | | |

Total | |

| Revenues: | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Operating

revenues | |

| 553,255 | | |

| 96,346 | | |

| - | | |

| 649,601 | | |

| 522,077 | | |

| 68,190 | | |

| - | | |

| 590,267 | |

| Investment income | |

| 13,588 | | |

| 38 | | |

| - | | |

| 13,626 | | |

| 13,368 | | |

| 25 | | |

| - | | |

| 13,393 | |

| Net realized

and unrealized gains (losses) | |

| 4,757 | | |

| - | | |

| (43 | ) | |

| 4,714 | | |

| (1,821 | ) | |

| - | | |

| (125 | ) | |

| (1,946 | ) |

| | |

| 571,600 | | |

| 96,384 | | |

| (43 | ) | |

| 667,941 | | |

| 533,624 | | |

| 68,215 | | |

| (125 | ) | |

| 601,714 | |

| Expenses: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Amounts retained

by agencies | |

| 233,980 | | |

| - | | |

| - | | |

| 233,980 | | |

| 218,983 | | |

| - | | |

| - | | |

| 218,983 | |

| Employee costs | |

| 176,225 | | |

| 14,104 | | |

| 3,533 | | |

| 193,862 | | |

| 165,829 | | |

| 12,361 | | |

| 3,303 | | |

| 181,493 | |

| Other operating

expenses | |

| 85,853 | | |

| 68,634 | | |

| 1,159 | | |

| 155,646 | | |

| 81,625 | | |

| 46,217 | | |

| 2,613 | | |

| 130,455 | |

| Title losses

and related claims | |

| 21,282 | | |

| - | | |

| - | | |

| 21,282 | | |

| 22,251 | | |

| - | | |

| - | | |

| 22,251 | |

| Depreciation

and amortization | |

| 8,860 | | |

| 6,264 | | |

| 356 | | |

| 15,480 | | |

| 9,196 | | |

| 6,820 | | |

| 398 | | |

| 16,414 | |

| Interest | |

| 406 | | |

| - | | |

| 4,493 | | |

| 4,899 | | |

| 355 | | |

| 191 | | |

| 4,508 | | |

| 5,054 | |

| | |

| 526,606 | | |

| 89,002 | | |

| 9,541 | | |

| 625,149 | | |

| 498,239 | | |

| 65,589 | | |

| 10,822 | | |

| 574,650 | |

| Income

(loss) before taxes | |

| 44,994 | | |

| 7,382 | | |

| (9,584 | ) | |

| 42,792 | | |

| 35,385 | | |

| 2,626 | | |

| (10,947 | ) | |

| 27,064 | |

| Nine Months Ended: | |

September

30, 2024 | | |

September

30, 2023 | |

| | |

Title | | |

Real

Estate

Solutions | | |

Corporate

and Other | | |

Total | | |

Title | | |

Real

Estate

Solutions | | |

Corporate

and Other | | |

Total | |

| Revenues: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Operating

revenues | |

| 1,500,855 | | |

| 271,561 | | |

| - | | |

| 1,772,416 | | |

| 1,445,718 | | |

| 202,169 | | |

| - | | |

| 1,647,887 | |

| Investment income | |

| 40,746 | | |

| 87 | | |

| - | | |

| 40,833 | | |

| 32,033 | | |

| 81 | | |

| - | | |

| 32,114 | |

| Net

realized and unrealized gains (losses) | |

| 11,387 | | |

| - | | |

| (149 | ) | |

| 11,238 | | |

| (1,658 | ) | |

| - | | |

| (3,171 | ) | |

| (4,829 | ) |

| | |

| 1,552,988 | | |

| 271,648 | | |

| (149 | ) | |

| 1,824,487 | | |

| 1,476,093 | | |

| 202,250 | | |

| (3,171 | ) | |

| 1,675,172 | |

| Expenses: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Amounts retained

by agencies | |

| 634,083 | | |

| - | | |

| - | | |

| 634,083 | | |

| 596,498 | | |

| - | | |

| - | | |

| 596,498 | |

| Employee costs | |

| 495,943 | | |

| 39,904 | | |

| 10,140 | | |

| 545,987 | | |

| 485,690 | | |

| 37,333 | | |

| 11,687 | | |

| 534,710 | |

| Other operating

expenses | |

| 247,371 | | |

| 193,703 | | |

| 3,816 | | |

| 444,890 | | |

| 236,752 | | |

| 138,052 | | |

| 5,726 | | |

| 380,530 | |

| Title losses

and related claims | |

| 59,754 | | |

| - | | |

| - | | |

| 59,754 | | |

| 59,727 | | |

| - | | |

| - | | |

| 59,727 | |

| Depreciation

and amortization | |

| 26,126 | | |

| 18,803 | | |

| 1,133 | | |

| 46,062 | | |

| 26,182 | | |

| 19,401 | | |

| 1,265 | | |

| 46,848 | |

| Interest | |

| 1,165 | | |

| 7 | | |

| 13,596 | | |

| 14,768 | | |

| 1,063 | | |

| 191 | | |

| 13,523 | | |

| 14,777 | |

| | |

| 1,464,442 | | |

| 252,417 | | |

| 28,685 | | |

| 1,745,544 | | |

| 1,405,912 | | |

| 194,977 | | |

| 32,201 | | |

| 1,633,090 | |

| Income

(loss) before taxes | |

| 88,546 | | |

| 19,231 | | |

| (28,834 | ) | |

| 78,943 | | |

| 70,181 | | |

| 7,273 | | |

| (35,372 | ) | |

| 42,082 | |

Appendix A

Non-GAAP Adjustments

Management uses a variety of financial

and operational measurements other than its financial statements prepared in accordance with United States Generally Accepted Accounting

Principles (GAAP) to analyze its performance. These include: (1) adjusted revenues, which are reported revenues adjusted for net realized

and unrealized gains and losses and (2) adjusted pretax income and adjusted net income, which are reported pretax income and reported

net income after earnings from noncontrolling interests, respectively, adjusted for net realized and unrealized gains and losses, acquired

intangible asset amortization, office closure costs, executive severance expenses, and nonrecurring expenses. Adjusted diluted earnings

per share (adjusted diluted EPS) is calculated using adjusted net income divided by the diluted average weighted outstanding shares.

Adjusted pretax margin is calculated using adjusted pretax income divided by adjusted total revenues. Management views these measures

as important performance measures of core profitability for its operations and as key components of its internal financial reporting.

Management believes investors benefit from having access to the same financial measures that management uses.

Below are reconciliations of the non-GAAP

financial measures used by management to the most directly comparable GAAP measures for the quarter and nine months ended September 30,

2024 and 2023 (dollars in millions, except shares, per share amounts and pretax margins, and amounts may not add as presented due to

rounding).

| | |

Quarter Ended

September 30, | | |

Nine Months Ended

September 30, | |

| | |

2024 | | |

2023 | | |

% Chg | | |

2024 | | |

2023 | | |

% Chg | |

| Total revenues | |

| 667.9 | | |

| 601.7 | | |

| 11 | % | |

| 1,824.5 | | |

| 1,675.2 | | |

| 9 | % |

| Non-GAAP revenue adjustments: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net realized and unrealized (gains) losses | |

| (4.7 | ) | |

| 1.9 | | |

| | | |

| (11.2 | ) | |

| 4.8 | | |

| | |

| Adjusted total revenues | |

| 663.2 | | |

| 603.7 | | |

| 10 | % | |

| 1,813.2 | | |

| 1,680.0 | | |

| 8 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Pretax income | |

| 42.8 | | |

| 27.1 | | |

| 58 | % | |

| 78.9 | | |

| 42.1 | | |

| 88 | % |

| Non-GAAP pretax adjustments: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net realized and unrealized (gains) losses | |

| (4.7 | ) | |

| 1.9 | | |

| | | |

| (11.2 | ) | |

| 4.8 | | |

| | |

| Acquired intangible asset amortization | |

| 8.3 | | |

| 9.6 | | |

| | | |

| 25.1 | | |

| 27.3 | | |

| | |

| Office closure costs | |

| 0.3 | | |

| 1.4 | | |

| | | |

| 2.0 | | |

| 1.4 | | |

| | |

| Executive severance expenses | |

| 0.1 | | |

| - | | |

| | | |

| 0.7 | | |

| 1.7 | | |

| | |

| State sales tax assessment expense | |

| - | | |

| - | | |

| | | |

| - | | |

| 1.2 | | |

| | |

| Adjusted pretax income | |

| 46.8 | | |

| 40.0 | | |

| 17 | % | |

| 95.5 | | |

| 78.6 | | |

| 22 | % |

| GAAP pretax margin | |

| 6.4 | % | |

| 4.5 | % | |

| | | |

| 4.3 | % | |

| 2.5 | % | |

| | |

| Adjusted pretax margin | |

| 7.1 | % | |

| 6.6 | % | |

| | | |

| 5.3 | % | |

| 4.7 | % | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net income attributable to Stewart | |

| 30.1 | | |

| 14.0 | | |

| 115 | % | |

| 50.6 | | |

| 21.6 | | |

| 134 | % |

| Non-GAAP pretax adjustments: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net realized and unrealized losses (gains) | |

| (4.7 | ) | |

| 1.9 | | |

| | | |

| (11.2 | ) | |

| 4.8 | | |

| | |

| Acquired intangible asset amortization | |

| 8.3 | | |

| 9.6 | | |

| | | |

| 25.1 | | |

| 27.6 | | |

| | |

| Office closure costs | |

| 0.3 | | |

| 1.4 | | |

| | | |

| 2.0 | | |

| 1.4 | | |

| | |

| Executive severance expenses | |

| 0.1 | | |

| - | | |

| | | |

| 0.7 | | |

| 1.7 | | |

| | |

| State sales tax assessment expense | |

| - | | |

| - | | |

| | | |

| - | | |

| 1.2 | | |

| | |

| Net tax effects of non-GAAP adjustments | |

| (1.0 | ) | |

| (3.1 | ) | |

| | | |

| (4.3 | ) | |

| (8.8 | ) | |

| | |

| Non-GAAP adjustments, after taxes | |

| 3.0 | | |

| 9.9 | | |

| | | |

| 12.3 | | |

| 27.7 | | |

| | |

| Adjusted net income attributable to Stewart | |

| 33.1 | | |

| 23.9 | | |

| 39 | % | |

| 62.8 | | |

| 49.4 | | |

| 27 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Diluted average shares outstanding (000) | |

| 28,200 | | |

| 27,650 | | |

| | | |

| 28,069 | | |

| 27,445 | | |

| | |

| GAAP net income per share | |

| 1.07 | | |

| 0.51 | | |

| | | |

| 1.80 | | |

| 0.79 | | |

| | |

| Adjusted net income per share | |

| 1.17 | | |

| 0.86 | | |

| | | |

| 2.24 | | |

| 1.80 | | |

| | |

| | |

Quarter Ended

September 30, | | |

Nine Months Ended

September 30, | |

| | |

2024 | | |

2023 | | |

% Chg | | |

2024 | | |

2023 | | |

% Chg | |

Title Segment: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total revenues | |

| 571.6 | | |

| 533.6 | | |

| 7 | % | |

| 1,553.0 | | |

| 1,476.1 | | |

| 5 | % |

| Net realized and unrealized (gains) losses | |

| (4.8 | ) | |

| 1.8 | | |

| | | |

| (11.4 | ) | |

| 1.7 | | |

| | |

| Adjusted total revenues | |

| 566.8 | | |

| 535.4 | | |

| 6 | % | |

| 1,541.6 | | |

| 1,477.8 | | |

| 4 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Pretax income | |

| 45.0 | | |

| 35.4 | | |

| 27 | % | |

| 88.5 | | |

| 70.2 | | |

| 26 | % |

| Non-GAAP revenue adjustments: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net realized and unrealized (gains) losses | |

| (4.8 | ) | |

| 1.8 | | |

| | | |

| (11.4 | ) | |

| 1.7 | | |

| | |

| Acquired intangible asset amortization | |

| 2.8 | | |

| 3.4 | | |

| | | |

| 8.5 | | |

| 9.4 | | |

| | |

| Office closure costs | |

| 0.3 | | |

| 1.4 | | |

| | | |

| 2.0 | | |

| 1.4 | | |

| | |

| Severance expenses | |

| 0.1 | | |

| - | | |

| | | |

| 0.7 | | |

| 0.4 | | |

| | |

| Adjusted pretax income | |

| 43.4 | | |

| 42.0 | | |

| 3 | % | |

| 88.3 | | |

| 83.1 | | |

| 6 | % |

| GAAP pretax margin | |

| 7.9 | % | |

| 6.6 | % | |

| | | |

| 5.7 | % | |

| 4.8 | % | |

| | |

| Adjusted pretax margin | |

| 7.7 | % | |

| 7.8 | % | |

| | | |

| 5.7 | % | |

| 5.6 | % | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Real Estate Solutions Segment: | |

| | |

| | |

| | |

| | |

| | |

| |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Total revenues | |

| 96.4 | | |

| 68.2 | | |

| 41 | % | |

| 271.6 | | |

| 202.3 | | |

| 34 | % |

| Pretax income | |

| 7.4 | | |

| 2.6 | | |

| 181 | % | |

| 19.2 | | |

| 7.3 | | |

| 164 | % |

| Non-GAAP revenue adjustments: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Acquired intangible asset amortization | |

| 5.5 | | |

| 6.3 | | |

| | | |

| 16.6 | | |

| 17.9 | | |

| | |

| State sales tax assessment expense | |

| - | | |

| - | | |

| | | |

| - | | |

| 1.2 | | |

| | |

| Adjusted pretax income | |

| 12.9 | | |

| 8.9 | | |

| 45 | % | |

| 35.9 | | |

| 26.4 | | |

| 36 | % |

| GAAP pretax margin | |

| 7.7 | % | |

| 3.8 | % | |

| | | |

| 7.1 | % | |

| 3.6 | % | |

| | |

| Adjusted pretax margin | |

| 13.4 | % | |

| 13.0 | % | |

| | | |

| 13.2 | % | |

| 13.0 | % | |

| | |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

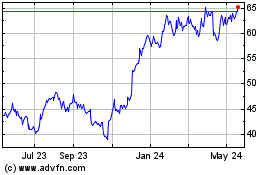

Stewart Information Serv... (NYSE:STC)

Historical Stock Chart

From Oct 2024 to Nov 2024

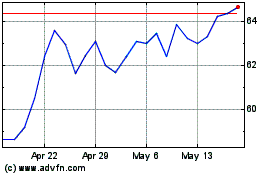

Stewart Information Serv... (NYSE:STC)

Historical Stock Chart

From Nov 2023 to Nov 2024