State Street Reports 24% Drop in Earnings

October 18 2019 - 7:28AM

Dow Jones News

By Robert Barba

State Street Corp. reported a nearly 24% drop in earnings in the

third quarter as revenue fell and expenses increased.

The custodian banking firm posted a net income of $583 million,

or $1.42 a share, in the quarter, compared with $764 million, or

$1.87 a share, a year earlier. On an adjusted basis, the company

reported earnings of $1.51 a share.

Analysts polled by FactSet expected earnings of $1.36 a share

and adjusted earnings of $1.39 a share.

Fee income was $2.26 billion, down 2.5% from a year earlier. Net

interest income totaled $644 million, down 4.2% from a year

earlier.

Total revenue of $2.9 billion was slightly ahead of the $2.86

billion analysts were expecting.

Total assets under custody and/or administration fell 3.2% to

$32.9 billion. Assets under management totaled $2.95 billion, up

5.1%.

Expenses increased 4.3% to $2.18 billion. The company said it

has achieved $275 million in total savings from the cost-cutting

program it launched in January. That program is expected to hit

$400 million in total cost cuts in 2019.

Shares of State Street rose 1.3% in premarket trading.

Write to Robert Barba at Robert.Barba@wsj.com

(END) Dow Jones Newswires

October 18, 2019 08:13 ET (12:13 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

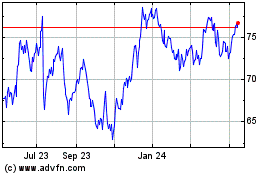

State Street (NYSE:STT)

Historical Stock Chart

From Mar 2024 to Apr 2024

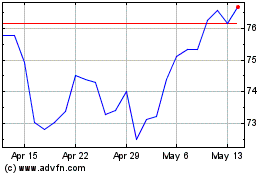

State Street (NYSE:STT)

Historical Stock Chart

From Apr 2023 to Apr 2024