By Drew FitzGerald and Sarah Krouse

U.S. wireless companies' limited access to some of the nation's

most valuable airwaves threatens to slow down their plans to build

faster 5G networks.

At issue are broad swaths of the radio spectrum in frequencies

that can travel long distances and penetrate buildings. This

"mid-band" is considered ideal for faster, fifth-generation

wireless service.

"Mid-band is in the sweet spot in terms of what's most valuable

to wireless operators," said Walt Piecyk, an analyst at investment

bank BTIG, in part because carriers can deploy those frequencies

atop existing cell towers, rather than blanketing neighborhoods

with hundreds or thousands of new antennas. While U.S. officials

take their time making mid-band airwaves available to carriers, he

said, " a lot of countries are auctioning off that spectrum."

Sprint Corp. and Dish Network Corp. already hold large amounts

of mid-band spectrum not yet put to work serving customers. Other

nearby frequencies remain reserved for satellite communications and

military use in the U.S..

Telecom companies have spent more than $25 billion over the past

three years to snap up wireless-airwave licenses beyond the

mid-band range, targeting both high and low extremes considered

useful for carrying wireless data.

Verizon Communications Inc. and AT&T Inc. have launched 5G

services in a few cities using high-frequency millimeter wave

spectrum that provides ultrafast speeds but can't travel long

distances and is limited in its ability to penetrate hard materials

like walls.

AT&T promises to offer nationwide 5G in the first half of

2020 over spectrum licenses it already controls. Company technology

chief Andre Fuetsch said more mid-band spectrum under FCC

consideration "would help round out our current holdings" and speed

up that 5G expansion.

The Federal Communications Commission unveiled a plan Tuesday to

commercialize licenses in the Educational Broadband Service. The

service was created in the 1960s for use by educational groups for

instructional television, and some licenses are now used for

wireless broadband systems for school districts.

Some of the airwaves, which are above 2.5 gigahertz and often

lumped in with mid-band spectrum, are used by federally recognized

Native American tribes in rural areas of the U.S.

The FCC's plan aims to make available to wireless companies and

other businesses some unused or underused swaths of that spectrum.

Schools that currently use some airwaves can continue to use their

licenses, expand that use or sell them, a senior FCC official said.

Tribal groups also would receive priority access and, after that,

unused airwaves would be auctioned off.

WISPA, a trade body for fixed wireless broadband companies, said

the move would expand broadband coverage, including in rural

areas.

Mariel Triggs, chief executive of Mural Net, an organization

that is building a wireless network to serve the Havasupai tribe in

the Grand Canyon, called the move "a major step forward in the

effort to close the digital divide in rural America, especially for

Indian Country."

Some educational groups oppose commercializing airwaves long

reserved for schools. Taking away educational groups' priority

status would be "disastrous for online learning, 5G deployment and

rural consumers," said Alicja Johnson, a spokeswoman for the

Schools, Health & Libraries Broadband Coalition.

Even with the FCC's efforts, agency officials cautioned the new

rules would take time to implement. New mid-band auctions won't

start until after the commission finishes selling more

millimeter-wave licenses at the end of this year.

Executives of T-Mobile US Inc. and Sprint have seized on delays

in making spectrum available to argue for approval of their more

than $26 billion merger. The companies say joining forces would

save them billions of dollars each year that could be invested in

new equipment that uses Sprint's 2.5 gigahertz licenses.

"Here in the U.S., we have this mid-band dilemma," T-Mobile

technology chief Neville Ray said in an April conference call with

analysts. "We can solve that."

But T-Mobile's plan to cover rural areas using Sprint spectrum

also faces obstacles. A group of state attorneys general sued last

week to block the merger, arguing the arrangement would raise

prices for cellphone service, especially among low-cost plans. The

Justice Department hasn't issued a public decision on the proposed

merger.

Other wireless industry experts cite opportunities above 3.5

gigahertz, where several other countries have marked frequencies

for 5G use. Those frequencies, too, are tied up by competing

interests in the U.S.

The Citizens Band Radio Service is a cluster of radio channels

that offers companies or individuals access to frequencies above

3.5 gigahertz, provided they register their use with an online

system designed to prevent them from interfering with Navy radar

signals.

Nearby on the spectrum, TV broadcasters, cable companies and

other users receive satellite signals on the C-Band. A coalition of

satellite companies called the C-Band Alliance floated a plan last

week to squeeze those satellite customers into a narrower band that

makes room for cellphone companies willing to pay billions of

dollars for desirable spectrum.

That plan, too, would take months to put spectrum on the market

but is still the quickest option available to avoid cutting off

customers who run the gamut from cable-TV providers to Mormon

churches, according to C-Band Alliance vice president Peter

Pitsch.

"We're under contract to a lot of those folks," Mr. Pitsch said.

"We want to keep good faith with them, keep them whole."

Verizon CEO Hans Vestberg met last week with FCC Chairman Ajit

Pai and another agency official to ask the commission to make more

mid-band spectrum available, according to a regulatory filing. The

largest U.S. carrier told regulators that mid-band spectrum would

help achieve broader coverage.

"We're interested in getting as much spectrum in the marketplace

as possible," Craig Silliman, Verizon's general counsel, told

analysts Tuesday.

Write to Drew FitzGerald at andrew.fitzgerald@wsj.com and Sarah

Krouse at sarah.krouse@wsj.com

(END) Dow Jones Newswires

June 20, 2019 10:04 ET (14:04 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

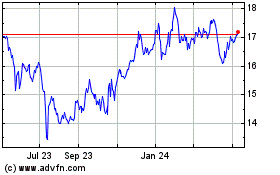

AT&T (NYSE:T)

Historical Stock Chart

From Mar 2024 to Apr 2024

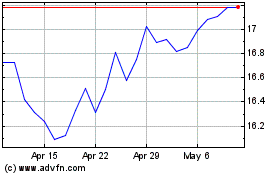

AT&T (NYSE:T)

Historical Stock Chart

From Apr 2023 to Apr 2024