- Q4 consolidated comparable store sales increased 5%, well

above the Company’s plan, and were driven by an increase in

customer transactions

- Q4 pretax profit margin of 11.6%, well above the Company’s

plan

- Q4 diluted earnings per share of $1.23, well above the

Company’s plan

- Full year FY25 consolidated comparable store sales increased

4%, above the Company’s plan, and were entirely driven by an

increase in customer transactions

- FY25 pretax profit margin of 11.5%, well above the Company’s

plan

- FY25 diluted earnings per share of $4.26, well above the

Company’s plan

- Q4 and full year FY25 pretax profit margin benefitted from

lower inventory shrink expense

- Returned $4.1 billion to shareholders in FY25 through share

repurchases and dividends

- Provides Q1 and full year FY26 guidance

The TJX Companies, Inc. (NYSE: TJX), the leading off-price

apparel and home fashions retailer in the U.S. and worldwide, today

announced sales and operating results for the fourth quarter and

fiscal year ended February 1, 2025.

Net sales for the 13-week fourth quarter of Fiscal 2025 were

$16.4 billion, flat versus the 14-week fourth quarter of Fiscal

2024. Fourth quarter Fiscal 2025 consolidated comparable store

sales increased 5%. For the 13-week fourth quarter of Fiscal 2025,

net income was $1.4 billion and diluted earnings per share were

$1.23, up 1% versus $1.22 in the 14-week fourth quarter of Fiscal

2024. Fourth quarter Fiscal 2025 diluted earnings per share

increased 10% versus last year’s adjusted diluted earnings per

share of $1.12, which excluded an estimated benefit of $.10 from

the extra week in the Company’s fourth quarter Fiscal 2024

calendar.

For the 52-week fiscal year ended February 1, 2025, net sales

were $56.4 billion, an increase of 4% versus the 53-week Fiscal

2024 year. Fiscal 2025 consolidated comparable store sales

increased 4%. For the 52-week Fiscal 2025 year, net income was $4.9

billion and diluted earnings per share were $4.26, up 10% versus

$3.86 in the 53-week Fiscal 2024 year. Full year Fiscal 2025

diluted earnings per share increased 13% versus full year Fiscal

2024 adjusted diluted earnings per share of $3.76, which excluded

an estimated benefit of $.10 from the extra week in the Company’s

Fiscal 2024 calendar.

CEO and President

Comments

Ernie Herrman, Chief Executive Officer and President of The TJX

Companies, Inc., stated, “I am very proud of the performance of our

hard-working Associates in 2024. We delivered outstanding top-and

bottom-line results that exceeded our guidance for the year. We

surpassed $56 billion in annual sales, drove a 4% comparable store

sales increase, significantly increased profitability, and opened

our 5,000th store during the year. Further, each of our divisions

saw strong, consistent full year comp store sales growth of 4% or

above. Our fourth quarter sales, profitability, and earnings per

share were all well above our expectations. I am particularly

pleased that our overall comp store sales growth of 5% for the

quarter was due to strong increases in comp sales and customer

transactions at every division. Throughout the year, we offered our

wide range of customers compelling values on good, better, and best

brands and on-point fashions, and an exciting treasure-hunt

shopping experience. As we begin a new year, we are confident that

remaining focused on the off-price fundamentals of our great

company will continue to serve us well, as it has over many

decades, and as always, we will strive to beat our plans. Longer

term, we see many opportunities to successfully grow our business

and deliver value to even more consumers around the world.”

Comparable Store Sales by

Division

The Company’s comparable store sales by division for fourth

quarter and full year Fiscal 2025 and Fiscal 2024 were as

follows:

Fourth Quarter

Comparable Store Sales1

FY2025

FY2024

Marmaxx (U.S.)2

+4%

+5%

HomeGoods (U.S.)3

+5%

+7%

TJX Canada

+10%

+6%

TJX International (Europe &

Australia)

+7%

+3%

TJX

+5%

+5%

Full Year Comparable

Store Sales1

FY2025

FY2024

Marmaxx (U.S.)2

+4%

+6%

HomeGoods (U.S.)3

+4%

+3%

TJX Canada

+5%

+3%

TJX International (Europe &

Australia)

+4%

+3%

TJX

+4%

+5%

1Comparable store sales excludes

e-commerce. 2Includes TJ Maxx, Marshalls, and Sierra stores.

3Includes HomeGoods and Homesense stores.

Net Sales by Division

The Company’s net sales by division for fourth quarter and full

year Fiscal 2025 and Fiscal 2024 were as follows:

Fourth Quarter Net Sales

($ in millions)1

Fourth Quarter FY2025

Reported Sales Growth

Fourth Quarter FY2025

Sales Growth on a Constant Currency Basis2

FY2025 (13-week basis)

FY2024 (14-week basis)

Marmaxx (U.S.)3

$9,971

$10,037

-1%

N.A.

HomeGoods (U.S.)4

$2,851

$2,805

+2%

N.A.

TJX Canada

$1,450

$1,468

-1%

+4%

TJX International (Europe &

Australia)5

$2,078

$2,101

-1%

0%

TJX

$16,350

$16,411

0%

0%

Full Year Net Sales ($ in

millions)1

Full Year FY2025

Reported Sales Growth

Full Year FY2025

Sales Growth on a Constant Currency Basis2

FY2025 (52-week basis)

FY2024 (53-week basis)

Marmaxx (U.S.)3

$34,604

$33,413

+4%

N.A.

HomeGoods (U.S.)4

$9,386

$8,990

+4%

N.A.

TJX Canada

$5,189

$5,046

+3%

+5%

TJX International (Europe &

Australia)5

$7,181

$6,768

+6%

+5%

TJX

$56,360

$54,217

+4%

+4%

1Net sales in TJX Canada and TJX

International include the impact of foreign currency exchange

rates. 2Reflects net sales adjusted for the impact of foreign

currency; see Impact of Foreign Currency Exchange Rates, below.

3Includes TJ Maxx, Marshalls, and Sierra stores as well as their

e-commerce sites. 4Includes HomeGoods and Homesense stores (and

homegoods.com for FY2024 only). 5Includes TK Maxx and Homesense

stores, as well as TK Maxx e-commerce sites in Europe.

Q4 Fiscal 2025 Margins

For the 13-week fourth quarter of Fiscal 2025, the Company’s

pretax profit margin was 11.6%, up 0.4 percentage points versus

last year’s 14-week fourth quarter pretax profit margin of 11.2%.

Fourth quarter pretax profit margin was up 0.7 percentage points

versus last year’s adjusted pretax profit margin of 10.9%, which

excluded an estimated 0.3 percentage point benefit from the extra

week in the Company’s fourth quarter Fiscal 2024 calendar.

The Company’s fourth quarter Fiscal 2025 pretax profit margin

was above the high-end of its plan by 0.7 percentage points,

primarily driven by lower than expected inventory shrink expense as

well as expense leverage on the above-plan sales, partially offset

by higher incentive compensation accruals.

Gross profit margin for the 13-week fourth quarter of Fiscal

2025 was 30.5%, up 0.7 percentage points versus last year’s 14-week

fourth quarter gross profit margin of 29.8%. Fourth quarter gross

profit margin was up 1.0 percentage points versus last year’s

adjusted gross profit margin of 29.5%, which excluded an estimated

0.3 percentage point benefit from the extra week in the Company’s

fourth quarter Fiscal 2024 calendar. This year-over-year increase

was primarily driven by lower inventory shrink expense and strong

markon.

Selling, general and administrative (SG&A) costs as a

percent of sales for the fourth quarter of Fiscal 2025 were 19.2%,

a 0.3 percentage point increase versus last year’s 18.9%. This

year-over-year increase was due to incremental store wage and

payroll costs.

Net interest income for the fourth quarter of Fiscal 2025 was

neutral to pretax profit margin versus the prior year.

Full Year Fiscal 2025

Margins

For the 52-week Fiscal 2025 year, the Company’s pretax profit

margin was 11.5%, up 0.5 percentage points versus last year’s

53-week pretax profit margin of 11.0%. Full year Fiscal 2025 pretax

profit margin was up 0.6 percentage points versus last year’s

adjusted pretax profit margin of 10.9%, which excluded an estimated

0.1 percentage point benefit from the extra week in the Company’s

Fiscal 2024 calendar.

Gross profit margin for the 52-week Fiscal 2025 year was 30.6%,

up 0.6 percentage points versus last year’s 53-week gross profit

margin of 30.0%. Full year Fiscal 2025 gross profit margin was up

0.7 percentage points versus last year’s adjusted gross profit

margin of 29.9%, which excluded an estimated 0.1 percentage point

benefit from the extra week in the Company’s Fiscal 2024 calendar.

Lower inventory shrink expense resulted in a 0.2 percentage point

benefit to full year Fiscal 2025 gross profit margin.

Selling, general and administrative (SG&A) costs as a

percent of sales for full year Fiscal 2025 were 19.4%, a 0.1

percentage point increase versus last year’s 19.3%.

Net interest income for full year Fiscal 2025 was neutral to

pretax profit margin versus the prior year.

Inventory

Total inventories as of February 1, 2025 were $6.4 billion,

compared to $6.0 billion at the end of Fiscal 2024. Consolidated

inventories on a per-store basis as of February 1, 2025, including

distribution centers, but excluding inventory in transit, the

Company’s e-commerce sites, and Sierra stores, were up 1% on both a

reported and constant currency basis versus last year. The constant

currency basis reflects inventory adjusted for the impact of

foreign currency exchange rates, if any, as described below. The

Company enters the new fiscal year in an excellent inventory

position and is set up well to take advantage of the outstanding

availability in the marketplace and flow fresh assortments to its

stores and online this spring.

Cash and Shareholder

Distributions

For the fourth quarter of Fiscal 2025, the Company generated

$2.7 billion of operating cash flow. For the full year Fiscal 2025,

the Company generated $6.1 billion of operating cash flow and ended

the year with $5.3 billion of cash.

During the fourth quarter of Fiscal 2025, the Company returned a

total of $1.3 billion to shareholders. The Company repurchased 6.9

million shares of TJX stock for a total of $853 million and paid

$421 million in shareholder dividends during the quarter.

In Fiscal 2025, the Company returned a total of $4.1 billion to

shareholders which includes repurchasing a total of $2.5 billion of

TJX stock, retiring 22.3 million shares, and paying $1.6 billion in

shareholder dividends.

With continued strong cash flow, the Company announced today

that it intends to increase the regular quarterly dividend on its

common stock expected to be declared in March 2025 and payable in

June 2025 to $.425 per share, subject to the approval of the

Company’s Board of Directors. This would represent a 13% increase

over the most recent per share dividend.

The Company is also announcing today its plan to repurchase

approximately $2.0 to $2.5 billion of TJX stock during the fiscal

year ending January 31, 2026. With $1.1 billion remaining at Fiscal

2025 year end under the Company’s existing stock repurchase

program, the Company’s Board of Directors approved a new stock

repurchase program that authorizes the repurchase of up to an

additional $2.5 billion of TJX common stock from time to time. The

new authorization represents approximately 1.8% of the Company’s

outstanding shares at current prices. The new stock repurchase

program marks the 25th program approved by the Board since 1997.

Under the Company’s repurchase programs, share repurchases may be

made from time to time in market or private transactions and may

include derivative transactions. The repurchase program announced

today has no time limit and may be suspended or discontinued at any

time. The Company may adjust the amount purchased under this

program up or down depending on various factors. The Company

remains committed to returning cash to its shareholders while

continuing to invest in the business to support the near- and

long-term growth of TJX.

Full Year and First Quarter Fiscal 2026

Outlook

For the full year Fiscal 2026, the Company is planning

consolidated comparable store sales to be up 2% to 3%. The Company

is planning full year Fiscal 2026 pretax profit margin to be in the

range of 11.3% to 11.4%, down 0.1 to 0.2 percentage points versus

the prior year’s 11.5%. The Company is planning full year Fiscal

2026 diluted earnings per share to be in the range of $4.34 to

$4.43, which would represent a 2% to 4% increase over the prior

year’s $4.26. The Company’s full year Fiscal 2026 outlook reflects

an assumption that unfavorable foreign currency exchange rates and

transactional foreign exchange would have an approximately 0.2

percentage point negative impact to pretax profit margin and an

approximately 3% negative impact to earnings per share growth.

For the first quarter of Fiscal 2026, the Company is planning

consolidated comparable store sales to be up 2% to 3%. The Company

is planning first quarter Fiscal 2026 pretax profit margin to be in

the range of 10.0% to 10.1%, down 1.0 to 1.1 percentage points

versus the prior year’s 11.1%. The Company is planning first

quarter Fiscal 2026 diluted earnings per share to be in the range

of $.87 to $.89, which would represent a 4% to 6% decrease versus

the prior year’s $.93.

The Company’s first quarter Fiscal 2026 pretax profit margin and

diluted earnings per share outlook is planned lower than the

Company’s outlook for the last nine months of the year primarily

due to a benefit from lower incentive compensation accruals planned

in the last nine months of Fiscal 2026, a lapping of a benefit from

a reserve release in the first quarter of Fiscal 2025, and the

expected timing of certain expenses.

The Company’s first quarter and Fiscal 2026 outlook implies that

in the last nine months of Fiscal 2026, consolidated comparable

store sales would be up 2% to 3%, pretax profit margin would be in

the range of 11.6% to 11.7%, flat to up 0.1 percentage point versus

the prior year, and diluted earnings per share would be in the

range of $3.47 to $3.54, up 4% to 6% versus the prior year.

Stores by Concept

During the fiscal year ended February 1, 2025, the Company

increased its store count by 131 stores overall to a total of 5,085

stores and increased square footage by 2% versus the prior

year.

Store Locations1

FY2025

Gross Square Feet

FY2025 (in millions)

Beginning

End

Beginning

End

In the U.S.:

TJ Maxx

1,319

1,333

35.7

36.0

Marshalls

1,197

1,230

33.7

34.4

HomeGoods

919

943

21.4

22.1

Sierra

95

117

2.0

2.4

Homesense

55

72

1.5

2.0

In Canada:

Winners

302

307

8.2

8.4

HomeSense

158

160

3.7

3.8

Marshalls

106

109

2.8

2.9

In Europe:

TK Maxx

644

655

17.9

18.1

Homesense

79

75

1.5

1.4

In Australia:

TK Maxx

80

84

1.7

1.7

TJX

4,954

5,085

130.1

133.2

1Store counts above include both banners

within a combo or a superstore.

Impact of Foreign Currency Exchange

Rates

Changes in foreign currency exchange rates affect the

translation of sales and earnings of the Company’s international

businesses into U.S. dollars for financial reporting purposes. In

addition, ordinary course, inventory-related hedging instruments

are marked to market at the end of each quarter. Changes in

currency exchange rates can have a material effect on the magnitude

of these translations and adjustments when there is significant

volatility in currency exchange rates. Given the global operations

of the Company, to facilitate comparability, the Company has

provided sales growth and inventory on a constant currency basis,

which assumes a constant exchange rate between periods for

translation based on the rate in effect for the prior period.

The movement in foreign currency exchange rates had a neutral

impact on the Company’s net sales growth in the fourth quarter of

Fiscal 2025 versus the prior year. The overall net impact of

foreign currency exchange rates was neutral on fourth quarter

Fiscal 2025 diluted earnings per share.

The movement in foreign currency exchange rates had a neutral

impact on the Company’s net sales growth in Fiscal 2025 versus the

prior year. The overall net impact of foreign currency exchange

rates had a $.01 positive impact on full year Fiscal 2025 diluted

earnings per share.

A table detailing the impact of foreign currency on TJX’s net

sales, pretax profit margins, as well as those of its international

businesses, can be found in the Investors section of TJX.com.

The foreign currency exchange rate impact to diluted earnings

per share does not include the impact currency exchange rates have

on various transactions, which the Company refers to as

“transactional foreign exchange.”

About The TJX Companies,

Inc.

The TJX Companies, Inc., a Fortune 100 company, is the leading

off-price retailer of apparel and home fashions in the U.S. and

worldwide. Our mission is to deliver great value to customers every

day. We do this by offering a rapidly changing assortment of

quality, fashionable, brand name, and designer merchandise at

prices generally 20% to 60% below full-price retailers’ regular

prices on comparable merchandise. We operate over 5,000 stores

across nine countries, including TJ Maxx, Marshalls, HomeGoods,

Homesense, and Sierra in the U.S.; Winners, HomeSense, and

Marshalls in Canada; TK Maxx and Homesense in Europe, and TK Maxx

in Australia. We also operate e-commerce sites for TJ Maxx,

Marshalls, and Sierra in the U.S. and three sites for TK Maxx in

Europe. Our value mission extends to our corporate responsibility

efforts, which are focused on supporting our Associates, giving

back in the communities we serve, the environment, and operating

responsibly. Additional information about TJX’s press releases,

financial information, and corporate responsibility are available

at TJX.com.

Fourth Quarter and Full Year Fiscal

2025 Earnings Conference Call

At 11:00 a.m. ET today, Ernie Herrman, Chief Executive Officer

and President of TJX, will hold a conference call to discuss the

Company’s fourth quarter and full year Fiscal 2025 results,

operations, and business trends. A real-time webcast of the call

will be available to the public at TJX.com. A replay of the call

will also be available by dialing (866) 367-5577 (toll free) or

(203) 369-0233 through Tuesday, March 4, 2025, or at TJX.com.

Non-GAAP Financial

Information

The Company reports its financial results in accordance with

generally accepted accounting principles in the U.S. (GAAP).

However, management believes that certain non-GAAP financial

measures may provide users of this financial information additional

meaningful comparisons between current results and results in prior

operating periods and between results in prior periods and

expectations for future periods. Management believes that these

non-GAAP financial measures can provide additional meaningful

reflection of underlying trends of the business because they

provide a comparison of historical information that excludes

certain items that affect overall comparability. Non-GAAP financial

measures used in this press release include sales growth on a

constant currency basis, inventory on a constant currency basis,

adjusted pretax profit margin, adjusted gross profit margin, and

adjusted diluted earnings per share. The Company uses these

non-GAAP financial measures for business planning purposes, to

consider underlying trends of its business, and in measuring its

performance relative to others in the market, and believes

presenting these measures also provides information to investors

and others for understanding and evaluating trends in the Company’s

operating results or measuring performance in the same manner as

the Company’s management. Non-GAAP financial measures should be

considered in addition to, and not as an alternative for, the

Company’s reported results prepared in accordance with GAAP. The

use of these non-GAAP financial measures may differ from similar

measures reported by other companies and may not be comparable to

other similarly titled measures.

Important Information at

Website

Archived versions of the Company’s conference calls are

available in the Investors section of TJX.com after they are no

longer available by telephone, as are reconciliations of non-GAAP

financial measures to GAAP financial measures and other financial

information. The Company routinely posts information that may be

important to investors in the Investors section at TJX.com. The

Company encourages investors to consult that section of its website

regularly.

Forward-looking

Statement

Various statements made in this release are forward-looking, and

are inherently subject to a number of risks and uncertainties. All

statements that address activities, events or developments that we

intend, expect or believe may occur in the future are

forward-looking statements, including, among others, statements

regarding the Company’s anticipated operating and financial

performance, business plans and prospects, dividends and share

repurchases, and first quarter, last nine months, and full year

Fiscal 2026 outlook. These statements are typically accompanied by

the words “aim,” “anticipate,” “aspire,” “believe,” “continue,”

“could,” “should,” “estimate,” “expect,” “forecast,” “goal,”

“hope,” “intend,” “may,” “plan,” “project,” “potential,” “seek,”

“strive,” “target,” “will,” “would,” or similar words, although not

all forward-looking statements contain these identifying words.

Each forward-looking statement contained in this press release is

inherently subject to risks, uncertainties and potentially

inaccurate assumptions that could cause actual results to differ

materially from those expressed or implied by such statement. We

cannot guarantee that the results and other expectations expressed,

anticipated or implied in any forward-looking statement will be

realized. Applicable risks and uncertainties include, among others,

execution of buying strategy and inventory management; customer

trends and preferences; competition; various marketing efforts;

operational and business expansion; management of large size and

scale; merchandise sourcing and transport; international trade and

tariff policies; data security and maintenance and development of

information technology systems; labor costs and workforce

challenges; personnel recruitment, training and retention;

corporate and retail banner reputation; evolving corporate

governance and public disclosure regulations and expectations with

respect to environmental, social and governance matters; expanding

international operations; fluctuations in quarterly operating

results and market expectations; inventory or asset loss; cash

flow; mergers, acquisitions, or business investments and

divestitures, closings or business consolidations; real estate

activities; economic conditions and consumer spending; market

instability; severe weather, serious disruptions or catastrophic

events; disproportionate impact of disruptions during the fiscal

year; commodity availability and pricing; fluctuations in currency

exchange rates; compliance with laws, regulations and orders and

changes in laws, regulations and applicable accounting standards;

outcomes of litigation, legal proceedings and other legal or

regulatory matters; quality, safety and other issues with our

merchandise; tax matters; and other factors set forth under Item 1A

of our most recent Annual Report on Form 10-K, as well as other

information we file with the Securities and Exchange Commission (

“SEC”).

We caution investors, potential investors and others not to

place considerable reliance on the forward-looking statements

contained in this release. You are encouraged to read any further

disclosures we may make in our future reports to the SEC, available

at www.sec.gov, on our website, or otherwise. Our forward-looking

statements in this release speak only as of the date of this

release, and we undertake no obligation to update or revise any of

these statements, unless required by law, even if experience or

future changes make it clear that any projected results expressed

or implied in such statements will not be realized. Our business is

subject to substantial risks and uncertainties, including those

referenced above. Investors, potential investors, and others should

give careful consideration to these risks and uncertainties.

The TJX Companies, Inc. and

Consolidated Subsidiaries

Financial Summary

(Unaudited)

(In Millions Except Per Share

Amounts)

Thirteen Weeks Ended

Fourteen Weeks Ended

Fifty-Two Weeks Ended

Fifty-Three Weeks Ended

February 1, 2025

February 3, 2024

February 1, 2025

February 3, 2024

Net sales

$

16,350

$

16,411

$

56,360

$

54,217

Cost of sales, including buying and

occupancy costs

11,371

11,528

39,112

37,951

Selling, general and administrative

expenses

3,132

3,094

10,946

10,469

Interest (income) expense, net

(42

)

(54

)

(181

)

(170

)

Income before income taxes

1,889

1,843

6,483

5,967

Provision for income taxes

491

440

1,619

1,493

Net income

$

1,398

$

1,403

$

4,864

$

4,474

Diluted earnings per share

$

1.23

$

1.22

$

4.26

$

3.86

Cash dividends declared per share

$

0.375

$

0.3325

$

1.50

$

1.33

Weighted average common shares –

diluted

1,138

1,152

1,142

1,159

The TJX Companies, Inc. and

Consolidated Subsidiaries

Condensed Balance Sheets

(Unaudited)

(In Millions)

February 1, 2025

February 3, 2024

Assets

Current assets:

Cash and cash equivalents

$

5,335

$

5,600

Accounts receivable and other current

assets

1,235

1,099

Merchandise inventories

6,421

5,965

Total current assets

12,991

12,664

Net property at cost

7,346

6,571

Operating lease right of use assets

9,641

9,396

Goodwill

94

95

Other assets

1,677

1,021

Total assets

$

31,749

$

29,747

Liabilities and shareholders'

equity

Current liabilities:

Accounts payable

$

4,257

$

3,862

Accrued expenses and other current

liabilities

5,115

4,969

Current portion of operating lease

liabilities

1,636

1,620

Total current liabilities

11,008

10,451

Other long-term liabilities

1,050

924

Non-current deferred income taxes, net

156

148

Long-term operating lease liabilities

8,276

8,060

Long-term debt

2,866

2,862

Shareholders’ equity

8,393

7,302

Total liabilities and shareholders'

equity

$

31,749

$

29,747

The TJX Companies, Inc. and

Consolidated Subsidiaries

Condensed Statements of Cash

Flows

(Unaudited)

(In Millions)

Fifty-Two Weeks Ended

Fifty-Three Weeks Ended

February 1, 2025

February 3, 2024

Cash flows from operating

activities:

Net income

$

4,864

$

4,474

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization

1,104

964

Deferred income tax provision

(benefit)

28

(7

)

Share-based compensation

183

160

Changes in assets and liabilities:

(Increase) in accounts receivable and

other assets

(57

)

(3

)

(Increase) in merchandise inventories

(539

)

(145

)

(Increase) decrease in income taxes

recoverable

(10

)

60

Increase in accounts payable

448

64

Increase in accrued expenses and other

liabilities

197

489

(Decrease) in net operating lease

liabilities

(12

)

(18

)

Other, net

(90

)

19

Net cash provided by operating

activities

6,116

6,057

Cash flows from investing

activities:

Property additions

(1,918

)

(1,722

)

Purchase of equity investments

(551

)

—

Purchase of investments

(35

)

(28

)

Sales and maturities of investments

27

33

Net cash (used in) investing

activities

(2,477

)

(1,717

)

Cash flows from financing

activities:

Repayment of debt

—

(500

)

Payments for repurchase of common

stock

(2,513

)

(2,484

)

Proceeds from issuance of common stock

366

285

Cash dividends paid

(1,648

)

(1,484

)

Other

(43

)

(32

)

Net cash (used in) financing

activities

(3,838

)

(4,215

)

Effect of exchange rate changes on

cash

(66

)

(2

)

Net (decrease) increase in cash and cash

equivalents

(265

)

123

Cash and cash equivalents at beginning of

year

5,600

5,477

Cash and cash equivalents at end of

period

$

5,335

$

5,600

The TJX Companies, Inc. and

Consolidated Subsidiaries

Selected Information by Major

Business Segment

(Unaudited)

(In Millions)

Thirteen Weeks Ended

Fourteen Weeks Ended

Fifty-Two Weeks Ended

Fifty-Three Weeks Ended

February 1, 2025

February 3, 2024

February 1, 2025

February 3, 2024

Net sales:

In the United States:

Marmaxx

$

9,971

$

10,037

$

34,604

$

33,413

HomeGoods

2,851

2,805

9,386

8,990

TJX Canada

1,450

1,468

5,189

5,046

TJX International

2,078

2,101

7,181

6,768

Total net sales

$

16,350

$

16,411

$

56,360

$

54,217

Segment profit:

In the United States:

Marmaxx

$

1,400

$

1,351

$

4,895

$

4,597

HomeGoods

342

314

1,021

861

TJX Canada

170

183

703

715

TJX International

151

174

422

332

Total segment profit

2,063

2,022

7,041

6,505

General corporate expense

216

233

739

708

Interest (income) expense, net

(42

)

(54

)

(181

)

(170

)

Income before income taxes

$

1,889

$

1,843

$

6,483

$

5,967

The TJX Companies, Inc. and Consolidated

Subsidiaries Notes to Consolidated Condensed Statements

- During the fourth quarter ended February 1, 2025, the Company

returned $1.3 billion to shareholders. The Company repurchased and

retired 6.9 million shares of its common stock at a cost of $853

million and paid $421 million in shareholder dividends. During the

twelve months ended February 1, 2025, the Company returned $4.1

billion to shareholders. The Company repurchased and retired 22.3

million shares of its common stock at a cost of $2.5 billion and

paid $1.6 billion in shareholder dividends. In February 2025, the

Company announced that the Board of Directors had approved a new

stock repurchase program that authorizes the repurchase of up to an

additional $2.5 billion of TJX common stock from time to time, with

$1.1 billion still remaining as of February 1, 2025 under the

existing stock repurchase program.

- During the fourth quarter ended February 1, 2025, the Company

completed its 35% ownership stake investment in Brands for Less

(“BFL”) for $358 million, which includes a purchase price of $344

million and acquisition costs of $14 million.

- During the third quarter ended November 2, 2024, the Company

completed its investment in the joint venture with Grupo Axo,

S.A.P.I. de C.V. (Axo) for a 49% interest in Multibrand Outlet

Stores, S.A.P.I. de C.V., Axo’s off-price, physical store business

for $193 million, which includes a purchase price of $179 million

and acquisition costs of $14 million.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250225572361/en/

Debra McConnell Global Communications (508) 390-2323

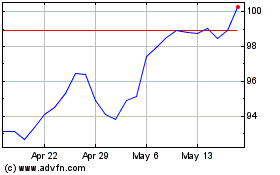

TJX Companies (NYSE:TJX)

Historical Stock Chart

From Jan 2025 to Feb 2025

TJX Companies (NYSE:TJX)

Historical Stock Chart

From Feb 2024 to Feb 2025