0000937098False00009370982024-10-252024-10-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 25, 2024

TRINET GROUP, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

| Delaware | 001-36373 | 95-3359658 |

(State or other jurisdiction of

incorporation or organization) | (Commission File Number) | (I.R.S. Employer

Identification No.) |

| One Park Place, Suite 600 | | |

| Dublin, | CA | | 94568 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (510) 352-5000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common stock par value $0.000025 per share | TNET | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.02 Results of Operations and Financial Condition

On October 25, 2024, TriNet Group, Inc. (the “Company”) issued a press release announcing the Company’s financial and operating results for the quarter ended September 30, 2024. A copy of the press release, entitled “TriNet Announces Third Quarter 2024 Results” is furnished as Exhibit 99.1 hereto and incorporated by reference.

The information in this Current Report on Form 8-K and the exhibit attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

| | | | | |

Exhibit

Number | Description |

| 99.1 | Press Release, dated October 25, 2024, entitled “TriNet Announces Third Quarter 2024 Results" |

| 104 | Cover Page Interactive Data File (embedded with the Inline XBRL document) |

INDEX TO EXHIBITS

| | | | | |

Exhibit

Number | Description |

| 99.1 | |

| 104 | Cover Page Interactive Data File (embedded with the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | | TriNet Group, Inc. |

| Date: | October 25, 2024 | By: | /s/ Sidney Majalya |

| | | | Sidney Majalya |

| | | | Senior Vice President, Chief Legal Officer and Secretary |

TriNet Announces Third Quarter 2024 Results

DUBLIN, Calif. — October 25, 2024 — TriNet Group, Inc. (NYSE: TNET), a leading provider of comprehensive human resources solutions for small and medium-size businesses, today announced financial results for the third quarter ended September 30, 2024. The third quarter highlights below include non-GAAP financial measures which are reconciled later in this release.

Third quarter highlights include:

•Total revenues increased 1% to $1.2 billion as compared to the same period last year.

•Flat professional service revenues of $184 million as compared to the same period last year.

•Net income was $45 million, or $0.89 per diluted share, compared to net income of $94 million, or $1.63 per diluted share, in the same period last year.

•Adjusted Net Income was $59 million, or $1.17 per diluted share, compared to Adjusted Net Income of $109 million, or $1.91 per diluted share, in the same period last year.

•Adjusted EBITDA was $109 million, compared to Adjusted EBITDA of $172 million, in the same period last year.

•Average WSEs increased 7% as compared to the same period last year, to approximately 356,000 and includes approximately 20,000 PEO Platform Users.

•Average HRIS Users for the period was approximately 183,000.

•At September 30, 2024, TriNet had unrestricted cash and cash equivalents of $251 million, unrestricted investments of $195 million and total debt of $1.1 billion.

“Small businesses are navigating a challenging business climate, hiring very carefully, and dealing with healthcare cost inflation steeper than we have seen in several years.” said Mike Simonds, TriNet’s President and CEO. "TriNet is not immune from these conditions and higher healthcare costs adversely impacted our profitability in the quarter.”

Mr. Simonds continued, “Fortunately, our model allows us to quickly take action and align our pricing with healthcare cost trends. We repriced our largest cohort of healthcare fees on October 1, and we experienced strong customer retention. Following our January 1 renewal, we will have priced for the current elevated cost trends across more than two thirds of our PEO business. Our colleagues are extremely engaged, delivering strong service to our customers and record retention levels in 2024 despite the challenging environment. Nearly eight months into this role, I am excited by the opportunity in front of us to grow our business profitably in an increasingly focused, disciplined, and customer-centric fashion.”

Fourth Quarter and Full-Year 2024 Guidance

In addition to announcing our third quarter 2024 results, we provide our fourth quarter and full-year 2024 guidance. Non-GAAP financial measures are reconciled later in this release. Percentages reflect the increase or (decrease) from the prior year quarter and prior year end.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Q4 2024 | | Full Year 2024 |

| | | | Low | | High | | Low | | High |

| Total Revenues | | | | (1)% | | 2% | | 1% | | 2% |

| Professional Service Revenues | | | | (8)% | | (5)% | | —% | | 1% |

| | | | | | | | | | |

| | | | | | | | | | |

| Insurance Cost Ratio | | | | 96.5% | | 93.5% | | 90.3% | | 89.6% |

| Diluted net income per share of common stock | | | | $(0.19) | | $0.31 | | $3.70 | | $4.20 |

| Adjusted Net Income per share - diluted | | | | $0.06 | | $0.57 | | $4.95 | | $5.45 |

Quarterly Report on Form 10-Q

We anticipate filing our Quarterly Report on Form 10-Q (“Form 10-Q”) for the nine months ended September 30, 2024 with the U.S. Securities and Exchange Commission (SEC) and making it available at http://www.trinet.com today, October 25, 2024. This press release should be read in conjunction with the Form 10-Q and the related Notes to Consolidated Financial Statements and Management's Discussion and Analysis of Financial Condition and Results of Operations contained in the Form 10-Q.

Earnings Conference Call and Audio Webcast

TriNet will host a conference call at 5:30 a.m. PT (8:30 a.m. ET) today to discuss its third quarter results for 2024 and provide fourth quarter and full-year financial guidance for 2024. TriNet encourages participants to pre-register for the conference call. Callers who pre-register will be given a unique PIN to gain immediate access to the call and bypass the live operator. To pre-register, go to: https://dpregister.com/sreg/10193255/fda58bcb7d. For those who would like to join the call but have not pre-registered, they can do so by dialing +1 (412) 317-5426 and requesting the “TriNet Conference Call.” The live webcast of the conference call can be accessed on the Investor Relations section of TriNet’s website at http://investor.trinet.com. Participants can pre-register for the webcast by going to: https://events.q4inc.com/attendee/366545303 A replay of the webcast will be available on this website for approximately one year. A telephonic replay will be available for two weeks following the conference call at +1 (412) 317-0088 conference ID: 1675204.

About TriNet

TriNet provides small and medium-size businesses (SMBs) with full-service industry-specific HR solutions, providing both professional employer organization (PEO) and human resources information system (HRIS) services. TriNet offers access to human capital expertise, benefits, risk mitigation, compliance, payroll, and R&D tax credit services, all enabled by industry-leading technology. TriNet’s suite of products also includes services and software-based solutions to help streamline workflows by connecting HR, benefits, employee engagement, payroll and time & attendance. Rooted in more than 30 years of supporting entrepreneurs and adapting to the ever-changing modern workplace, TriNet empowers SMBs to focus on what matters most - growing their business and enabling their people For more information, please visit TriNet.com or follow us on Facebook, LinkedIn and Instagram.

Use of Non-GAAP Financial Measures

Reconciliations of non-GAAP financial measures to TriNet’s financial results as determined in accordance with GAAP are included at the end of this press release following the accompanying financial data. For a description of these non-GAAP financial measures, including the reasons management uses each measure, please see the section titled “Non-GAAP Financial Measures.”

Forward-Looking Statements

This press release contains, and statements made during the above referenced conference call will contain, statements that are not historical in nature, are predictive in nature, or that depend upon or refer to future events or conditions or otherwise contain forward-looking statements within the meaning of Section 21 of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995, including, among other things, TriNet’s expectations and assumptions regarding: TriNet's financial guidance for the fourth quarter and full-year 2024 and the underlying assumptions, the value to customers and shareholders of TriNet's product offerings, TriNet's financial performance and long-term growth, and the extent, length and growth impact of current economic uncertainty. Forward-looking statements are often identified by the use of words such as, but not limited to, “ability,” “anticipate,” “believe,” “can,” “continue,” “could,” “estimate,” “expect,” "guidance," “impact,” “intend,” “may,” “plan,” "predict," “project,” “seek,” “should,” “strategy,” “target,” “value,” “will,” “would” and similar expressions or variations. Examples of forward-looking statements include, among others, TriNet’s expectations regarding our ability to continue to have our value proposition resonate at required pricing levels; ability to manage our expenses diligently; and our ability to meet our forecasted retention goals. These statements are not guarantees of future performance but are based on management’s expectations as of the date hereof and assumptions that are inherently subject to uncertainties, risks and changes in circumstances that are difficult to predict. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially different from our current expectations and any past or future results, performance or achievements. Investors are cautioned not to place undue reliance upon any forward-looking statements.

Important factors that could cause actual results to differ materially from those expressed or implied by these forward-looking statements include: our ability to manage unexpected changes in workers’ compensation and health insurance claims and costs by WSEs; our ability to mitigate the unique business risks we face as a co-employer; the effects of volatility in the financial and economic environment on the businesses that make up our client base; loss of clients for reasons beyond our control and the short-term contracts we typically use with our clients; the impact of regional or industry-specific economic and health factors on our operations; the impact of failures or limitations in the business systems and centers we rely upon; the impact of discontinuing our discretionary credits on our business and client loyalty and retention; changes in our insurance coverage or our relationships with key insurance carriers; our ability to improve our services and technology to satisfy client and regulatory expectations; our ability to effectively integrate businesses we have acquired or may acquire in the future; our ability to effectively manage and improve our operational effectiveness and resiliency; our ability to attract and retain qualified personnel; the effects of increased competition and our ability to compete effectively; the impact on our business of cyber-attacks, breaches, disclosures and other data-related incidents; our ability to protect against and remediate cyber-attacks, breaches, disclosures and other data-related incidents, whether intentional or inadvertent and whether attributable to us or our service providers; our ability to comply with evolving data privacy and security laws; our ability to manage changes in, uncertainty regarding, or adverse application of the complex laws and regulations that govern our business; changing laws and regulations governing health insurance and employee benefits; our ability to be recognized as an employer of worksite employees and for our benefits plans to satisfy all requirements under federal and state regulations; changes in the laws and regulations that govern what it means to be an employer, employee or independent contractor; the impact of new and changing laws regarding remote work; our ability to comply with the licensing requirements that govern our solutions; the outcome of existing and future legal and tax proceedings; fluctuation in our results of operations and stock price due to factors outside of our control; our ability to comply with the restrictions of our credit facility and meet our debt obligations; and the impact of concentrated ownership in our stock by Atairos and other large stockholders; and our ability to manage risks associated with our international operations. Any of these factors could cause our actual results to differ materially from our anticipated results.

Further information on risks that could affect TriNet’s results is included in our filings with the SEC, including under the headings “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and elsewhere in our most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q, which are available on our investor relations website at http://investor.trinet.com and on the SEC website at www.sec.gov. Copies of these filings are also available by contacting TriNet Corporation's Investor Relations Department at (510) 875-7201. Except as required by law, neither we nor any other person assumes responsibility for the accuracy and completeness of the forward-looking statements in this press release, and any forward-looking statements in this press release speak only as of the date of this press release. In addition, we do not assume any obligation, and do not intend, to update any of our forward-looking statements, except as required by law.

| | | | | |

| Contacts: | |

| Investors: | Media: |

| Alex Bauer | Renee Brotherton |

| TriNet | TriNet |

| Alex.Bauer@TriNet.com | Renee.Brotherton@TriNet.com |

| (510) 875-7201 | (925) 965-8441 |

Key Financial and Operating Metrics

We regularly review certain key financial and operating metrics to evaluate growth trends, measure our performance and make strategic decisions. These key financial and operating metrics may change over time. Our key financial and operating metrics for the periods presented were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| (in millions, except per share and Operating Metrics data) | 2024 | | 2023 | | % Change | | 2024 | | 2023 | | % Change |

| Income Statement Data: | | | | | | | | | | | | | |

| Total revenues | $ | 1,237 | | | $ | 1,222 | | | 1 | | % | | $ | 3,727 | | | $ | 3,677 | | | 1 | | % |

| Operating income | 58 | | | 116 | | | (50) | | | | 261 | | | 382 | | | (32) | | |

| Net income | 45 | | | 94 | | | (52) | | | | 196 | | | 308 | | | (36) | | |

| Diluted net income per share of common stock | 0.89 | | | 1.63 | | | (45) | | | | 3.87 | | | 5.20 | | | (26) | | |

Non-GAAP measures (1): | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Adjusted EBITDA | 109 | | | 172 | | | (37) | | | | 425 | | | 557 | | | (24) | | |

| Adjusted Net income | 59 | | | 109 | | | (46) | | | | 247 | | | 365 | | | (32) | | |

| Operating Metrics: | | | | | | | | | | | | | |

| Insurance Cost Ratio | 90 | % | | 84 | % | | 6 | | % | | 88 | % | | 83 | % | | 5 | | |

Average WSEs (2) | 355,948 | | | 333,286 | | | 7 | | | | 351,856 | | | 329,257 | | | 7 | | % |

Total WSEs at period end (2) | 356,137 | | | 335,741 | | | 6 | | | | 356,137 | | | 335,741 | | | 6 | | |

Average HRIS Users (3) | 183,410 | | | 210,863 | | | (13) | | | | 189,929 | | | 219,058 | | | (13) | | |

| | | | | | | | | | | | | |

(1) Refer to Non-GAAP measures definitions and reconciliations from GAAP measures under the heading "Non-GAAP Financial Measures".

(2) Total WSEs and Average WSEs include incremental WSEs that were charged a platform user access fee and incremental additional service recipients. These were identified as a result of our ongoing effort to ensure that our billing practices best match the expectations of our customers. Please refer to Management Discussion & Analysis in our 2024 10-Q.

| | | | | | | | | | | | | | | | | | | | |

| (in millions) | September 30, 2024 | | December 31, 2023 | | % Change | |

| Balance Sheet Data: | | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| Working capital | 165 | | | 115 | | | 43 | | % |

| Total assets | 3,729 | | | 3,693 | | | 1 | | |

| Debt | 1,068 | | | 1,093 | | | (2) | | |

| | | | | | |

| Total stockholders’ equity | 129 | | | 78 | | | 65 | | |

| | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended September 30, |

| (in millions) | 2024 | | 2023 | | % Change |

| Cash Flow Data: | | | | | | |

| Net cash used in operating activities | $ | (276) | | | $ | (43) | | | 542 | | % |

| Net cash used in investing activities | (25) | | | (57) | | | (56) | | |

| Net cash used in financing activities | (217) | | | (523) | | | (59) | | |

Non-GAAP measure (1): | | | | | | |

| Corporate Operating Cash Flows | $ | 213 | | | $ | 386 | | | (45) | | |

(1) Refer to Non-GAAP measures definitions and reconciliations from GAAP measures under the heading "Non-GAAP Financial Measures".

TRINET GROUP, INC.

CONSOLIDATED STATEMENTS OF INCOME AND COMPREHENSIVE INCOME (Unaudited)

| | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, | |

| (in millions except per share data) | 2024 | 2023 | | 2024 | 2023 | | |

Professional service revenues | $ | 184 | | $ | 185 | | | $ | 584 | | $ | 567 | | | |

Insurance service revenues | 1,053 | | 1,037 | | | 3,143 | | 3,110 | | | |

Total revenues | 1,237 | | 1,222 | | | 3,727 | | 3,677 | | | |

Insurance costs | 949 | | 874 | | | 2,772 | | 2,594 | | | |

Cost of providing services | 74 | | 74 | | | 228 | | 231 | | | |

Sales and marketing | 74 | | 75 | | | 218 | | 214 | | | |

General and administrative | 46 | | 51 | | | 140 | | 154 | | | |

Systems development and programming | 17 | | 15 | | | 52 | | 49 | | | |

Depreciation and amortization of intangible assets | 19 | | 17 | | | 56 | | 53 | | | |

Total costs and operating expenses | 1,179 | | 1,106 | | | 3,466 | | 3,295 | | | |

Operating income | 58 | | 116 | | | 261 | | 382 | | | |

Other income (expense): | | | | | | | |

Interest expense, bank fees and other | (15) | | (10) | | | (47) | | (23) | | | |

Interest income | 15 | | 18 | | | 49 | | 57 | | | |

Income before provision for income taxes | 58 | | 124 | | | 263 | | 416 | | | |

Income taxes | 13 | | 30 | | | 67 | | 108 | | | |

Net income | $ | 45 | | $ | 94 | | | $ | 196 | | $ | 308 | | | |

| Other comprehensive income (loss), net of income taxes | 7 | | (2) | | | 4 | | (3) | | | |

Comprehensive income | $ | 52 | | $ | 92 | | | $ | 200 | | $ | 305 | | | |

| | | | | | | |

Net income per share: | | | | | | | |

Basic | $ | 0.90 | | $ | 1.65 | | | $ | 3.91 | | $ | 5.23 | | | |

Diluted | $ | 0.89 | | $ | 1.63 | | | $ | 3.87 | | $ | 5.20 | | | |

Weighted average shares: | | | | | | | |

Basic | 50 | | 57 | | | 50 | | 59 | | | |

Diluted | 50 | | 58 | | | 51 | | 59 | | | |

TRINET GROUP, INC.

CONSOLIDATED BALANCE SHEETS (Unaudited)

| | | | | | | | | | | | | | |

| | September 30, | | December 31, |

| (in millions, except share and per share data) | | 2024 | | 2023 |

ASSETS | | | | |

Current assets: | | | | |

Cash and cash equivalents | | $ | 251 | | | $ | 287 | |

Investments | | 50 | | | 65 | |

Restricted cash, cash equivalents and investments | | 780 | | | 1,269 | |

Accounts receivable, net | | 15 | | | 18 | |

Unbilled revenue, net | | 511 | | | 447 | |

Prepaid expenses, net | | 64 | | | 67 | |

| Other payroll assets | | 883 | | | 381 | |

Other current assets | | 51 | | | 44 | |

Total current assets | | 2,605 | | | 2,578 | |

Restricted cash, cash equivalents and investments, noncurrent | | 153 | | | 158 | |

Investments, noncurrent | | 145 | | | 143 | |

| Property and equipment, net | | 14 | | | 17 | |

| Operating lease right-of-use asset | | 30 | | | 24 | |

| Goodwill | | 462 | | | 462 | |

| Software and other intangible assets, net | | 179 | | | 172 | |

Other assets | | 141 | | | 139 | |

Total assets | | $ | 3,729 | | | $ | 3,693 | |

Liabilities and stockholders' equity | | | | |

Current liabilities: | | | | |

Accounts payable and other current liabilities | | $ | 82 | | | $ | 87 | |

| Revolving credit agreement borrowings | | 75 | | | 109 | |

| | | | |

| Client deposits and other client liabilities | | 39 | | | 65 | |

Accrued wages | | 566 | | | 515 | |

Accrued health insurance costs, net | | 193 | | | 175 | |

Accrued workers' compensation costs, net | | 44 | | | 50 | |

Payroll tax liabilities and other payroll withholdings | | 1,420 | | | 1,438 | |

Operating lease liabilities | | 15 | | | 14 | |

Insurance premiums and other payables | | 6 | | | 10 | |

Total current liabilities | | 2,440 | | | 2,463 | |

Long-term debt, noncurrent | | 993 | | | 984 | |

Accrued workers' compensation costs, noncurrent, net | | 107 | | | 120 | |

Deferred taxes | | 18 | | | 13 | |

Operating lease liabilities, noncurrent | | 30 | | | 30 | |

| Other non current liabilities | | 12 | | | 5 | |

Total liabilities | | 3,600 | | | 3,615 | |

| | | | |

Stockholders' equity: | | | | |

Preferred stock | | — | | | — | |

Common stock and additional paid-in capital | | 1,037 | | | 976 | |

| Accumulated deficit | | (910) | | | (896) | |

| Accumulated other comprehensive loss | | 2 | | | (2) | |

Total stockholders' equity | | 129 | | | 78 | |

Total liabilities & stockholders' equity | | $ | 3,729 | | | $ | 3,693 | |

TRINET GROUP, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited)

| | | | | | | | |

| | Nine Months Ended September 30, |

| (in millions) | 2024 | 2023 |

Operating activities | | |

Net income | $ | 196 | | $ | 308 | |

| Adjustments to reconcile net income to net cash used in operating activities: | | |

| Depreciation and amortization of intangible assets | 56 | | 53 | |

| Amortization of deferred costs | 32 | | 31 | |

| Amortization of ROU asset, lease modification, impairment, and abandonment | 4 | | 5 | |

| Deferred income taxes | 3 | | — | |

| Stock based compensation | 53 | | 43 | |

| | |

| | |

| | |

| | |

| | |

| | |

| Other | 3 | | 1 | |

Changes in operating assets and liabilities: | | |

Accounts receivable, net | 2 | | (4) | |

| Unbilled revenue, net | (64) | | (29) | |

| Prepaid expenses, net | 3 | | (4) | |

| Other assets | (44) | | (44) | |

| Other payroll assets | (502) | | (104) | |

| Accounts payable and other liabilities | (13) | | 9 | |

| Client deposits and other client liabilities | (27) | | (33) | |

| Accrued wages | 52 | | 21 | |

| Accrued health insurance costs, net | 18 | | 9 | |

| Accrued workers' compensation costs, net | (19) | | (9) | |

| Payroll taxes payable and other payroll withholdings | (18) | | (283) | |

| Operating lease liabilities | (11) | | (13) | |

| | |

| | |

| Net cash used in operating activities | (276) | | (43) | |

Investing activities | | |

Purchases of marketable securities | (161) | | (226) | |

| Proceeds from sale and maturity of marketable securities | 196 | | 223 | |

| Acquisitions of property and equipment and software | (60) | | (54) | |

| | |

Net cash used in investing activities | (25) | | (57) | |

Financing activities | | |

Repurchase of common stock | (155) | | (1,109) | |

Proceeds from issuance of common stock | 6 | | 9 | |

| Proceeds from revolving credit agreement borrowings | — | | 695 | |

| Revolver repayment | — | | (495) | |

| Proceeds from issuance of 2031 Notes | — | | 400 | |

Awards effectively repurchased for required employee withholding taxes | (18) | | (14) | |

| | |

| | |

| | |

| Payment of long-term financing fees and debt issuance costs | — | | (9) | |

| | |

| Repayment of revolving credit agreement borrowings | (25) | | — | |

| Dividends paid | (25) | | — | |

| Net cash used in financing activities | (217) | | (523) | |

| | |

| Net change in cash and cash equivalents, unrestricted and restricted | (518) | | (623) | |

Cash and cash equivalents, unrestricted and restricted: | | |

Beginning of period | 1,466 | | 1,537 | |

End of period | $ | 948 | | $ | 914 | |

| | |

Supplemental disclosures of cash flow information | | |

Interest paid | $ | 55 | | $ | 21 | |

| Income taxes paid, net | $ | 67 | | $ | 89 | |

Supplemental schedule of noncash investing and financing activities | | |

| Cash dividend declared, but not yet paid | $ | 12 | | $ | — | |

| Payable for purchase of property and equipment | $ | 2 | | $ | 2 | |

| | |

Non-GAAP Financial Measures

In addition to the selected financial measures presented in accordance with U.S. Generally Accepted Accounting Principles (GAAP), we monitor other non-GAAP financial measures that we use to manage our business, to make planning decisions, to allocate resources and to use as performance measures in our executive compensation plan. These key financial measures provide an additional view of our operational performance over the long term and provide information that we use to maintain and grow our business.

The presentation of these non-GAAP financial measures is used to enhance the understanding of certain aspects of our financial performance. It is not meant to be considered in isolation from, superior to, or as a substitute for the directly comparable financial measures prepared in accordance with GAAP.

| | | | | | | | |

| Non-GAAP Measure | Definition | How We Use The Measure |

| | |

| | |

| | |

| Adjusted EBITDA | • Net income, excluding the effects of:

- income tax provision,

- interest expense, bank fees and other,

- depreciation,

- amortization of intangible assets,

- stock based compensation expense,

- amortization of cloud computing arrangements, and

- transaction and integration costs. | • Provides period-to-period comparisons on a consistent basis and an understanding as to how our management evaluates the effectiveness of our business strategies by excluding certain non-recurring costs, which include transaction and integration costs, as well as certain non-cash charges such as depreciation and amortization, and stock-based compensation and certain impairment charges recognized based on the estimated fair values. We believe these charges are either not directly resulting from our core operations or not indicative of our ongoing operations.

• Enhances comparisons to the prior period and, accordingly, facilitates the development of future projections and earnings growth prospects.

• Provides a measure, among others, used in the determination of incentive compensation for management.

• We also sometimes refer to Adjusted EBITDA margin, which is the ratio of Adjusted EBITDA to total revenues. |

| Adjusted Net Income | • Net income, excluding the effects of:

- effective income tax rate (1),

- stock based compensation,

- amortization of intangible assets, net,

- non-cash interest expense,

- transaction and integration costs, and

- the income tax effect (at our effective tax rate (1) of these pre-tax adjustments. | • Provides information to our stockholders and board of directors to understand how our management evaluates our business, to monitor and evaluate our operating results, and analyze profitability of our ongoing operations and trends on a consistent basis by excluding certain non-cash charges. |

| Corporate Operating Cash Flows | • Net cash provided by (used in) operating activities, excluding the effects of:

- Assets associated with WSEs and TriNet Trust (accounts receivable, unbilled revenue, prepaid expenses, other payroll assets and other current assets) and

- Liabilities associated with WSEs and TriNet Trust (client deposits and other client liabilities, accrued wages, payroll tax liabilities and other payroll withholdings, accrued health insurance costs, accrued workers' compensation costs, insurance premiums and other payables, and other current liabilities). | • Provides information that our stockholders and management can use to evaluate our cash flows from operations independent of the current assets and liabilities associated with our WSEs and TriNet Trust. • Enhances comparisons to prior periods and, accordingly, used as a liquidity measure to manage liquidity between corporate and WSE and TriNet Trust related activities, and to help determine and plan our cash flow and capital strategies. |

(1) Non-GAAP effective tax rate is 25.6% for the third quarters and full years of 2024 and 2023, which excludes the income tax impact from stock-based compensation, changes in uncertain tax positions, and nonrecurring benefits or expenses from federal legislative changes.

(2) Non-cash interest expense represents amortization and write-off of our debt issuance costs and loss on a terminated derivative.

Reconciliation of GAAP to Non-GAAP Measures

The table below presents a reconciliation of net income to Adjusted EBITDA:

| | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended

September 30, |

| (in millions) | 2024 | 2023 | | 2024 | 2023 |

| Net income | $ | 45 | | $ | 94 | | | $ | 196 | | $ | 308 | |

| Provision for income taxes | 13 | | 30 | | | 67 | | 108 | |

| Stock based compensation | 15 | | 15 | | | 53 | | 43 | |

| Interest expense, bank fees and other | 15 | | 10 | | | 47 | | 23 | |

| Depreciation and amortization of intangible assets | 19 | | 17 | | | 56 | | 53 | |

| Amortization of cloud computing arrangements | 2 | | 3 | | | 6 | | 7 | |

| Transaction and integration costs | — | | 3 | | | — | | 15 | |

| Adjusted EBITDA | $ | 109 | | $ | 172 | | | $ | 425 | | $ | 557 | |

| Adjusted EBITDA Margin | 8.8 | % | 14.1 | % | | 11.4 | % | 15.1 | % |

The table below presents a reconciliation of net income to Adjusted Net Income and Adjusted Net Income per share - diluted:

| | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended

September 30, |

| (in millions, except per share data) | 2024 | 2023 | | 2024 | 2023 |

| Net income | $ | 45 | | $ | 94 | | | $ | 196 | | $ | 308 | |

| Effective income tax rate adjustment | (2) | | (2) | | | — | | 1 | |

| Stock based compensation | 15 | | 15 | | | 53 | | 43 | |

| Amortization of intangible assets | 5 | | 5 | | | 14 | | 16 | |

| Non-cash interest expense | 1 | | — | | | 2 | | 1 | |

| Transaction and integration costs | — | | 3 | | | — | | 15 | |

| Income tax impact of pre-tax adjustments | (5) | | (6) | | | (18) | | (19) | |

| Adjusted Net Income | $ | 59 | | $ | 109 | | | $ | 247 | | $ | 365 | |

| GAAP weighted average shares of common stock - diluted | 50 | | 58 | | | 51 | | 59 | |

| Adjusted Net Income per share - diluted | $ | 1.17 | | $ | 1.91 | | | $ | 4.88 | | $ | 6.16 | |

| | | | | |

| | | | | |

The table below presents a reconciliation of net cash provided by operating activities to Corporate Operating Cash flows:

| | | | | | | | |

| Nine Months Ended

September 30, |

| (in millions) | 2024 | 2023 |

| Net cash used in operating activities | $ | (276) | | $ | (43) | |

| Less: Change in WSE & TriNet Trust related other current assets | (548) | | (134) | |

| Less: Change in WSE & TriNet Trust related current liabilities | 59 | | (295) | |

| Net cash used in operating activities - WSE & TriNet Trust | $ | (489) | | $ | (429) | |

| Net cash provided by operating activities - Corporate | $ | 213 | | $ | 386 | |

Reconciliation of GAAP to Non-GAAP Measures for the fourth quarter and full-year 2024 guidance.

Low and high percentages represent increases (decreases) from the same periods in the previous year.

The table below presents a reconciliation of net income to Adjusted Net Income and Adjusted Net Income per share - diluted:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Q4 2023 | | Q4 2024 Guidance | | FY 2023 | | Year 2024 Guidance |

| (in millions, except per share data) | Actual | | Low | High | | Actual | | Low | High |

| Net income | $67 | | (114)% | (77)% | | $375 | | (50)% | (44)% |

| Effective income tax rate adjustment | (3) | | (73) | (59) | | (2) | | (28) | (3) |

| Stock based compensation | 16 | | (17) | (12) | | 59 | | 11 | 13 |

| Amortization of intangible assets | 5 | | 1 | 1 | | 20 | | (5) | (5) |

| Non-cash interest expense | 1 | | (100) | (100) | | 2 | | (20) | (20) |

| Transaction and integration costs | 2 | | (100) | (100) | | 17 | | (100) | (100) |

| Income tax impact of pre-tax adjustments | (6) | | (24) | (20) | | (25) | | (12) | (11) |

| Adjusted Net Income | $82 | | (96)% | (65)% | | $446 | | (44)% | (38)% |

| GAAP weighted average shares of common stock - diluted | 51 | | | | | 57 | | | |

| Adjusted Net Income per share - diluted | $1.60 | | $0.06 | $0.57 | | $7.81 | | $4.95 | $5.45 |

v3.24.3

Cover Cover

|

Oct. 25, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Oct. 25, 2024

|

| Entity Registrant Name |

TRINET GROUP, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-36373

|

| Entity Tax Identification Number |

95-3359658

|

| Entity Address, Address Line One |

One Park Place, Suite 600

|

| Entity Address, City or Town |

Dublin,

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94568

|

| City Area Code |

510

|

| Local Phone Number |

352-5000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock par value $0.000025 per share

|

| Trading Symbol |

TNET

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a security having no trading symbol.

| Name: |

dei_NoTradingSymbolFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:trueItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

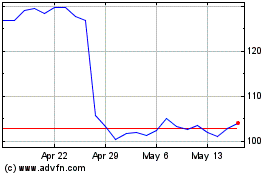

TriNet (NYSE:TNET)

Historical Stock Chart

From Oct 2024 to Nov 2024

TriNet (NYSE:TNET)

Historical Stock Chart

From Nov 2023 to Nov 2024