UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________________________________

FORM 11-K

_________________________________________________________

(Mark One)

ý

ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2018

or

o

TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________ to __________

___________________________________________________________________

Commission file number: 001-10898

___________________________________________________________________

A. Full title of the plan and the address of the plan, if different from that of the issuer named below:

___________________________________________________________________

The Travelers 401(k) Savings Plan

385 Washington Street

St. Paul, MN 55102

___________________________________________________________________

B.

Name of issuer of the securities held pursuant to the plan and the address of its principal executive office:

___________________________________________________________________

The Travelers Companies, Inc.

485 Lexington Avenue

New York, NY 10017

___________________________________________________________________

REQUIRED INFORMATION

The Travelers 401(k) Savings Plan (the Plan) is subject to the provisions of the Employee Retirement Income Security Act of 1974, as amended (ERISA), and for purposes of satisfying the requirements of Form 11-K has included for filing herewith the Plan financial statements and schedule prepared in accordance with the financial reporting requirements of ERISA.

|

|

|

|

|

|

|

|

|

|

Page

|

|

Financial Statements and Schedule

|

|

|

|

|

|

|

|

|

|

Report of Independent Registered Public Accounting Firm

|

|

|

|

|

|

|

|

|

|

Financial Statements:

|

|

|

|

|

Statement of Net Assets Available for Benefits as of December 31, 2018 and 2017

|

|

|

|

|

|

|

|

|

|

Statement of Changes in Net Assets Available for Benefits for the Years Ended December 31, 2018 and 2017

|

|

|

|

|

|

|

|

|

|

Notes to Financial Statements

|

|

|

|

|

|

|

|

|

|

Supplemental Schedule*:

|

|

|

|

|

|

|

|

|

|

Schedule H, Line 4i — Schedule of Assets (Held at End of Year) as of December 31, 2018

|

|

|

|

|

|

|

|

|

|

Signature

|

|

|

|

|

|

|

|

|

|

Exhibit

|

|

18

|

|

* Other schedules required by Form 5500, which are not applicable, have not been included.

Report of Independent Registered Public Accounting Firm

To the Plan Participants and The Plan Administrative Committee of

The Travelers 401(k) Savings Plan:

Opinion on the Financial Statements

We have audited the accompanying statements of net assets available for benefits of The Travelers 401(k) Savings Plan (the Plan) as of December 31, 2018 and 2017, and the related statements of changes in net assets available for benefits for the years then ended, and the related notes (collectively referred to as the financial statements). In our opinion, the financial statements present fairly, in all material respects, the net assets available for benefits of the Plan as of December 31, 2018 and 2017, and the changes in net assets available for benefits for the years then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on the Plan's financial statements based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Plan in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audit included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audit also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audit provides a reasonable basis for our opinion.

Accompanying Supplemental Information

The supplemental information in the accompanying Schedule H, Line 4i - Schedule of Assets (Held at End of Year) as of December 31, 2018 has been subjected to audit procedures performed in conjunction with the audit of the Plan’s financial statements. The supplemental information is the responsibility of the Plan’s management. Our audit procedures included determining whether the supplemental information reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental information. In forming our opinion on the supplemental information, we evaluated whether the supplemental information, including its form and content, is presented in conformity with the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the supplemental information is fairly stated, in all material respects, in relation to the financial statements as a whole.

/s/ KPMG LLP

We have served as the Plan's auditor since 1968.

Minneapolis, Minnesota

June 17, 2019

THE TRAVELERS 401(K) SAVINGS PLAN

STATEMENT OF NET ASSETS AVAILABLE FOR BENEFITS

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

At December 31,

|

|

2018

|

|

2017

|

|

|

|

|

|

|

|

Assets

|

|

|

|

|

|

|

|

Investments:

|

|

|

|

|

|

|

|

At fair value:

|

|

|

|

|

|

|

|

Mutual funds

|

|

$

|

3,159,390

|

|

|

$

|

3,333,511

|

|

|

Collective/common trust funds

|

|

1,606,051

|

|

|

1,801,974

|

|

|

Common stock

|

|

341,720

|

|

|

422,179

|

|

|

Fidelity BrokerageLink investments

|

|

153,252

|

|

|

155,576

|

|

|

Short-term investments

|

|

39,915

|

|

|

18,260

|

|

|

Total investments, at fair value

|

|

5,300,328

|

|

|

5,731,500

|

|

|

|

|

|

|

|

|

At contract value:

|

|

|

|

|

|

|

|

Fully benefit-responsive investment contracts

|

|

636,935

|

|

|

600,679

|

|

|

Total investments

|

|

5,937,263

|

|

|

6,332,179

|

|

|

|

|

|

|

|

|

Receivables:

|

|

|

|

|

|

|

|

Employer contributions

|

|

111,787

|

|

|

111,250

|

|

|

Notes receivable from participants

|

|

95,658

|

|

|

94,952

|

|

|

Other receivables

|

|

2,471

|

|

|

2,486

|

|

|

Total receivables

|

|

209,916

|

|

|

208,688

|

|

|

|

|

|

|

|

|

Cash

|

|

4

|

|

|

39

|

|

|

|

|

|

|

|

|

Total assets

|

|

6,147,183

|

|

|

6,540,906

|

|

|

|

|

|

|

|

|

Liabilities

|

|

|

|

|

|

|

|

Accrued expenses

|

|

504

|

|

|

502

|

|

|

Other payables

|

|

5,066

|

|

|

3,773

|

|

|

Total liabilities

|

|

5,570

|

|

|

4,275

|

|

|

|

|

|

|

|

|

Net assets available for benefits

|

|

$

|

6,141,613

|

|

|

$

|

6,536,631

|

|

See accompanying notes to financial statements.

THE TRAVELERS 401(K) SAVINGS PLAN

STATEMENT OF CHANGES IN NET ASSETS AVAILABLE FOR BENEFITS

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

For the year ended December 31,

|

|

2018

|

|

2017

|

|

|

|

|

|

|

|

Additions to net assets attributed to:

|

|

|

|

|

|

Investment income (loss):

|

|

|

|

|

|

Net appreciation (depreciation) in fair value of investments

|

|

$

|

(546,019

|

)

|

|

$

|

721,985

|

|

|

Mutual fund dividends

|

|

174,816

|

|

|

182,190

|

|

|

Interest

|

|

18,001

|

|

|

15,350

|

|

|

Common stock dividends

|

|

9,893

|

|

|

10,306

|

|

|

Preferred stock dividends

|

|

27

|

|

|

32

|

|

|

Total investment income (loss)

|

|

(343,282

|

)

|

|

929,863

|

|

|

|

|

|

|

|

|

Contributions:

|

|

|

|

|

|

Employee

|

|

240,341

|

|

|

233,658

|

|

|

Employer

|

|

111,787

|

|

|

111,250

|

|

|

Rollover and other

|

|

38,916

|

|

|

36,246

|

|

|

Total contributions

|

|

391,044

|

|

|

381,154

|

|

|

|

|

|

|

|

|

Total additions, net

|

|

47,762

|

|

|

1,311,017

|

|

|

|

|

|

|

|

|

Deductions from net assets attributed to:

|

|

|

|

|

|

Paid to participants in cash

|

|

427,672

|

|

|

347,756

|

|

|

Common stock distributed at fair value

|

|

9,810

|

|

|

6,477

|

|

|

Administrative expenses

|

|

5,298

|

|

|

4,947

|

|

|

Total deductions

|

|

442,780

|

|

|

359,180

|

|

|

|

|

|

|

|

|

Net increase (decrease)

|

|

(395,018

|

)

|

|

951,837

|

|

|

|

|

|

|

|

|

Net assets available for benefits:

|

|

|

|

|

|

Beginning of year

|

|

6,536,631

|

|

|

5,584,794

|

|

|

End of year

|

|

$

|

6,141,613

|

|

|

$

|

6,536,631

|

|

See accompanying notes to financial statements.

THE TRAVELERS 401(K) SAVINGS PLAN

NOTES TO FINANCIAL STATEMENTS

1.

DESCRIPTION OF THE PLAN

The following brief description of The Travelers 401(k) Savings Plan (the Plan) is provided for general information purposes. Participants should refer to the Plan document and the summary plan description for a more complete description of the Plan’s provisions.

General

The Plan is a defined contribution 401(k) plan, which provides retirement and other benefits to eligible employees of participating companies. The Travelers Companies, Inc. (TRV) and participating affiliated employers (collectively, the Company) currently participate in the Plan. TRV has appointed the Administrative Committee as the delegated authority for administrative matters involving the Plan and the Benefit Plans Investment Committee as the delegated authority for management and control of the assets of the Plan (including the designation of investment funds). Fidelity Management Trust Company (FMTC) is the trustee for the trust maintained in connection with the Plan. The Plan is subject to the provisions of the Employee Retirement Income Security Act of 1974, as amended (ERISA).

Participation

All U.S. employees of participating companies, as defined by the Plan, are eligible to participate immediately upon employment, subject to limited exclusions.

Employee Contributions

Eligible employees who elect to participate in the Plan may contribute up to 75% of their eligible compensation (as defined by the Plan) into the Plan subject to the statutory limitation of $18,500. A participant who is, or will be, age 50 or older by the end of the year could make additional catch-up contributions of up to $6,000. Employee contributions can be made pre-tax, after-tax through the Roth 401(k) or a combination of both up to the applicable limit. Newly hired eligible employees are automatically enrolled at a 5% pre-tax contribution rate if they do not affirmatively make an election (i) not to participate; (ii) to participate at a different rate; or (iii) to contribute on an after-tax Roth 401(k) basis. Temporary status employees are eligible to participate in the Plan; however, they will not be automatically enrolled.

The Plan allows for rollover contributions to be made to the Plan by eligible participants. These rollover contributions are eligible distributions from employer plans or individual retirement accounts (excluding Roth IRAs) either by a direct rollover to the Plan or by a distribution followed by a contribution within sixty days of receipt.

Employer Contributions

The Company matches 100% of the Plan participant’s contributions up to the first 5% of annual eligible pay, subject to a maximum annual match amount of $6,500. The Company matching contribution is made once a year and is invested according to the participant’s current investment election for new contributions going into the Plan. Employer contributions totaling $111,432,202 for plan year 2018 and $110,848,391 for plan year 2017 were made into the Plan in January 2019 and January 2018, respectively. Except for cases of retirement or termination due to disability or death, the matching contribution was made only for participants employed on the last working day of December.

The Plan also provides a supplemental contribution to certain eligible participants. The supplemental contribution amount for each eligible participant is fixed for each year the participant remains actively employed with the Company. Supplemental contributions totaling $354,568 for plan year 2018 and $401,135 for plan year 2017 were made to the Plan in January 2019 and January 2018, respectively.

THE TRAVELERS 401(K) SAVINGS PLAN

NOTES TO FINANCIAL STATEMENTS, Continued

1. DESCRIPTION OF THE PLAN, Continued

Participant Accounts

Each participant’s account is credited with the participant’s contributions, employer contributions and allocations of Plan earnings as defined by the Plan. The benefit to which a participant is entitled is the benefit that can be provided from the participant’s vested account.

Participants generally may elect to have their contributions invested in the funds listed in the Plan’s provisions as they choose and may generally also transfer their balances daily among these funds. Limitations apply to investment of participant accounts in TRV stock as well as to direct exchanges from the Stable Value Fund to the Vanguard U.S. Treasury Money Market Fund. The TRV common stock fund is closed to new investments, with the exception of dividends. Participants are permitted to exchange balances out of the TRV common stock fund, but they cannot direct any new contributions to, or make an exchange into, this fund.

Vesting

Participants are 100% vested in their contributions, the supplemental contributions and related earnings. In general, participants are vested in their Company matching contributions and related earnings after three years of service. Participants also become vested in full if they reach age 62 while employed, terminate employment due to a disability, die prior to termination of employment or while in qualified military service, or upon termination of the Plan.

Forfeitures

Forfeitures are transferred to a forfeiture account, which is maintained for the benefit of the Plan as a whole and is not attributable to any given participant. The balance of the forfeiture account may be used to correct errors in the accounts of other participants, restore prior forfeitures, pay Plan administrative expenses or reduce matching contributions to the Plan, as directed by TRV. At December 31, 2018 and 2017, the forfeiture account totaled $2,086,634 and $1,816,347, respectively. Forfeitures used totaled $2,510,510 and $2,527,282 for 2018 and 2017, respectively.

Voting Rights

Each participant is entitled to exercise voting rights attributable to the shares of TRV stock allocated to his or her account and will be notified prior to the time that such rights are to be exercised. FMTC will vote shares for which no directions have been timely received, and shares not credited to any participant’s account, in proportion to the vote cast by participants who have timely voted.

Notes Receivable from Participants

Participants may request to receive a loan from the Plan subject to a minimum of $1,000 and a maximum of the lesser of 50% of the participant’s vested account balance or $50,000 minus the highest outstanding loan balance during the past 12 months. Participants can only have two loans outstanding at any one time. The interest rate established at the inception of a new loan is equal to the prime lending rate as reported by Reuters as of the last business day of the month prior to the month in which the loan originates, plus one percentage point. Generally, loans are repaid by payroll deduction over a maximum period of five years (twenty years if the loan is designated as a primary residence loan). A one-time set-up fee of $35 per loan is charged against the participant’s account. In addition, ongoing quarterly loan maintenance fees of $3.75 per loan are charged against the participant’s account for each calendar quarter in which a balance on such loan is outstanding. At December 31, 2018, there were 11,228 outstanding loans totaling $95,658,179. At December 31, 2017, there were 11,576 outstanding loans totaling $94,951,967.

Distributions and Withdrawals

Participants or beneficiaries may receive distributions from vested accounts under the Plan upon termination of employment, retirement, or death. Distributions are made in the form of a lump-sum payment, or, if the vested account balance is greater than $5,000, participants may elect to have distributions made in full, partial or periodic installments. If a participant’s vested account balance following termination of employment is more than $1,000, but not more than $5,000, and the participant does not provide distribution instructions, the account will automatically be rolled over to a Fidelity IRA.

THE TRAVELERS 401(K) SAVINGS PLAN

NOTES TO FINANCIAL STATEMENTS, Continued

1. DESCRIPTION OF THE PLAN, Continued

Participants are allowed to take in-service withdrawals from vested accounts after age 59½. Prior to that age, withdrawals are allowed from selected accounts in the event of a defined financial hardship to satisfy the financial need. Any hardship withdrawal prior to age 59½ from an account that holds 401(k) contributions is generally limited to the amount of 401(k) contributions made to such account, reduced by prior withdrawals from the account. Withdrawals are also allowed for any reason from accounts funded by rollover contributions, as well as from certain after-tax accounts and predecessor accounts. The after-tax accounts relate to employee after-tax contributions made under prior rules of the legacy plans (these are separate from Roth 401(k) contributions). The predecessor accounts eligible for early withdrawal are accounts that were established in various legacy plans that require separate recordkeeping. Other special withdrawal rights may apply to certain specified accounts or with respect to certain specified participants or upon the occurrence of a qualified disaster.

In-service withdrawals from accounts holding Roth 401(k) contributions are generally allowed under the same circumstances as withdrawals from accounts holding pre-tax 401(k) contributions, but Roth 401(k) contributions are generally withdrawn last. The Plan also provides for an in-plan Roth conversion for amounts eligible for withdrawal (other than for hardship). An in-plan Roth conversion permits the participant to pay income tax on pre-tax amounts and convert them to Roth status.

A withdrawal or distribution can be in the form of cash, in the form of TRV common shares to the extent an account is invested in TRV common shares, or in kind in certain circumstances. Any hardship withdrawal prior to age 59½ is in the form of cash.

Fidelity BrokerageLink Investments Fees

The Fidelity BrokerageLink investment option allows a participant to establish a brokerage account with Fidelity, which provides the opportunity to select from thousands of mutual funds, stocks, bonds, certificates of deposit, U.S. Treasury securities, mortgage-backed securities and other financial instruments. While there are no BrokerageLink annual account fees charged to participants, the investment options available through BrokerageLink have associated fees.

Administrative Expenses

Administrative expenses of the Plan are paid by the participants of the Plan to the extent not paid by the Company and allowable by the Plan.

2. SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

The accompanying Plan financial statements were prepared in conformity with U.S. generally accepted accounting principles (GAAP).

Plan investments, other than short-term money market investments and fully benefit-responsive investment contracts, are stated at fair value (see Note 3). Short-term money market investments are valued at cost plus accrued interest, which approximates their fair value. Fully benefit-responsive investment contracts are valued at contract value, which is the relevant measurement attribute because contract value is the amount participants would receive if they were to initiate permitted transactions under the terms of the Plan. Purchases and sales of all securities are recorded on a trade-date basis.

Notes receivable from participants are valued at their outstanding balances.

Use of Estimates

The preparation of these financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, changes therein, and disclosure of contingent assets and liabilities. Actual results could differ from those estimates and assumptions.

THE TRAVELERS 401(K) SAVINGS PLAN

NOTES TO FINANCIAL STATEMENTS, Continued

2. SIGNIFICANT ACCOUNTING POLICIES, Continued

Risks and Uncertainties

The Plan invests in various investment securities. Investment securities are exposed to various risks, such as interest rate, market, and credit risks. Due to the level of risk associated with certain investment securities, changes in the values of investment securities will occur in the near term that could materially affect participants’ account balances and the amounts reported in the Statements of Net Assets Available for Benefits.

The Plan provides for investment in TRV’s common stock fund; however, no new contributions (including Company match contributions) or investment transfers into the TRV common stock fund are allowed. Dividends paid on shares in participants’ accounts invested in the TRV common stock fund continue to be reinvested in the TRV common stock fund, unless participants elect to receive dividends in cash. At both December 31, 2018 and 2017, approximately 6% of the Plan’s total assets were invested in the common stock of TRV. The underlying value of the TRV common stock is entirely dependent upon the performance of the Company and the market’s evaluation of such performance.

Income Recognition

Interest income is recorded on the accrual basis. Dividends are recorded on the ex-dividend date. Net appreciation (depreciation) in fair value of investments includes gains and losses in investments sold during the year as well as appreciation and depreciation of the investments held at the end of the year.

Payment of Benefits

Benefit payments are recorded when paid.

3.

FAIR VALUE MEASUREMENTS

The Plan’s estimates of fair value for financial assets are based on the framework established in the fair value accounting guidance. The framework is based on the inputs used in valuation, gives the highest priority to quoted prices in active markets and requires that observable inputs be used in the valuations when available. The disclosure of fair value estimates in the fair value accounting guidance hierarchy is based on whether the significant inputs into the valuation are observable. In determining the level of the hierarchy in which the estimate is disclosed, the highest priority is given to unadjusted quoted prices in active markets and the lowest priority to unobservable inputs that reflect the Plan’s significant market assumptions. The level in the fair value hierarchy within which the fair value measurement is reported is based on the lowest level input that is significant to the measurement in its entirety. The three levels of the hierarchy are as follows:

·

Level 1

-

Unadjusted quoted market prices for identical assets in active markets that the Plan has the ability to access.

·

Level 2

-

Quoted prices for similar assets in active markets; quoted prices for identical or similar assets in inactive markets; or valuations based on models where the significant inputs are observable (e.g., interest rates, yield curves, prepayment speeds, default rates, loss severities, etc.) or can be corroborated by observable market data.

·

Level 3

-

Valuations based on models where significant inputs are not observable. The unobservable inputs reflect the Plan’s own assumptions about the inputs that market participants would use.

Valuation of Investments Reported at Fair Value in Financial Statements

The fair value of a financial instrument is the estimated amount at which the instrument could be exchanged in an orderly transaction between knowledgeable, unrelated, willing parties, i.e., not in a forced transaction. The estimated fair value of a financial instrument may differ from the amount that could be realized if the security was sold in an immediate sale, e.g., a forced transaction. Additionally, the valuation of investments is more subjective when markets are less liquid due to the lack of market based inputs, which may increase the potential that the estimated fair value of an investment is not reflective of the price at which an actual transaction would occur.

THE TRAVELERS 401(K) SAVINGS PLAN

NOTES TO FINANCIAL STATEMENTS, Continued

3. FAIR VALUE MEASUREMENTS, Continued

For investments that have quoted market prices in active markets, the Plan uses the unadjusted quoted market prices as fair value and includes these prices in the amounts disclosed in Level 1 of the hierarchy. The Plan receives the quoted market prices from third party, nationally recognized pricing services. When quoted market prices are unavailable, the Plan utilizes these pricing services to determine an estimate of fair value. The fair value estimates provided from these pricing services are included in the amount disclosed in Level 2 of the hierarchy. If quoted market prices and an estimate from a pricing service are unavailable, the Plan produces an estimate of fair value based on internally developed valuation techniques, which, depending on the level of observable market inputs, will render the fair value estimate as Level 2 or Level 3. The Plan bases all of its estimates of fair value for assets on the bid price as it represents what a third-party market participant would be willing to pay in an arm’s length transaction.

Plan investments (excluding fully benefit-responsive investment contracts) are stated at fair value as of December 31, 2018 and 2017, except for short-term investments that are valued at cost plus accrued interest, which approximates their fair value and are included in Level 1.

Mutual funds are valued at their quoted net asset value. The Plan receives prices daily at the close of trading from a nationally recognized pricing service that are based on observable market transactions and includes these estimates in the amount disclosed in Level 1.

The unit interests in the collective/common trust funds are valued at the net asset value per unit as reported by the sponsor of the collective/common trust funds derived from the exchange where the underlying securities are primarily traded and are redeemable daily. The Plan includes the fair value estimates of these securities in Level 2.

Common stocks traded on national securities exchanges are valued at their closing market prices and are included in Level 1.

For the majority of Fidelity BrokerageLink investments, the Plan receives prices from a nationally recognized pricing service that are based on observable market transactions and includes these estimates in the amount disclosed in Level 1 (common stock, mutual funds and government bonds). When current market quotes in active markets are unavailable for certain equities, the Plan receives an estimate of fair value from the external pricing service. The Plan includes the fair value estimate for these equities in Level 2. The corporate bonds are disclosed in Level 2 since significant inputs are market observable. The certificates of deposit are valued at their certificate balances, which approximate fair value and are disclosed in Level 3 due to the significant inputs being unobservable.

The following tables present the level within the fair value hierarchy at which the Plan’s financial assets are measured on a recurring basis at December 31, 2018 and 2017 (in thousands).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

At December 31, 2018

|

|

Total

|

|

Level 1

|

|

Level 2

|

|

Level 3

|

|

Invested assets

|

|

|

|

|

|

|

|

|

|

Mutual funds

|

|

$

|

3,159,390

|

|

|

$

|

3,159,390

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

Collective/common trust funds

|

|

1,606,051

|

|

|

—

|

|

|

1,606,051

|

|

|

—

|

|

|

Common stock

|

|

341,720

|

|

|

341,720

|

|

|

—

|

|

|

—

|

|

|

Fidelity BrokerageLink investments:

|

|

|

|

|

|

|

|

|

|

Mutual funds

|

|

67,449

|

|

|

67,427

|

|

|

22

|

|

|

—

|

|

|

Common stock

|

|

55,174

|

|

|

55,160

|

|

|

14

|

|

|

—

|

|

|

Interest-bearing cash

|

|

22,416

|

|

|

22,416

|

|

|

—

|

|

|

—

|

|

|

Certificates of deposit

|

|

5,285

|

|

|

—

|

|

|

—

|

|

|

5,285

|

|

|

Corporate bonds

|

|

1,646

|

|

|

—

|

|

|

1,646

|

|

|

—

|

|

|

U.S. government securities

|

|

958

|

|

|

958

|

|

|

—

|

|

|

—

|

|

|

Preferred stock

|

|

323

|

|

|

323

|

|

|

—

|

|

|

—

|

|

|

Other

|

|

1

|

|

|

1

|

|

|

—

|

|

|

—

|

|

|

Short-term investments

|

|

39,915

|

|

|

39,915

|

|

|

—

|

|

|

—

|

|

|

Total

|

|

$

|

5,300,328

|

|

|

$

|

3,687,310

|

|

|

$

|

1,607,733

|

|

|

$

|

5,285

|

|

THE TRAVELERS 401(K) SAVINGS PLAN

NOTES TO FINANCIAL STATEMENTS, Continued

3. FAIR VALUE MEASUREMENTS, Continued

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

At December 31, 2017

|

|

Total

|

|

Level 1

|

|

Level 2

|

|

Level 3

|

|

Invested assets

|

|

|

|

|

|

|

|

|

|

Mutual funds

|

|

$

|

3,333,511

|

|

|

$

|

3,333,511

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

Collective/common trust funds

|

|

1,801,974

|

|

|

—

|

|

|

1,801,974

|

|

|

—

|

|

|

Common stock

|

|

422,179

|

|

|

422,179

|

|

|

—

|

|

|

—

|

|

|

Fidelity BrokerageLink investments:

|

|

|

|

|

|

|

|

|

|

Mutual funds

|

|

73,261

|

|

|

73,256

|

|

|

5

|

|

|

—

|

|

|

Common stock

|

|

59,476

|

|

|

59,374

|

|

|

102

|

|

|

—

|

|

|

Interest-bearing cash

|

|

19,468

|

|

|

19,468

|

|

|

—

|

|

|

—

|

|

|

Certificates of deposit

|

|

1,072

|

|

|

—

|

|

|

—

|

|

|

1,072

|

|

|

Corporate bonds

|

|

1,468

|

|

|

—

|

|

|

1,468

|

|

|

—

|

|

|

U.S. government securities

|

|

361

|

|

|

361

|

|

|

—

|

|

|

—

|

|

|

Preferred stock

|

|

469

|

|

|

469

|

|

|

—

|

|

|

—

|

|

|

Other

|

|

1

|

|

|

1

|

|

|

—

|

|

|

—

|

|

|

Short-term investments

|

|

18,260

|

|

|

18,260

|

|

|

—

|

|

|

—

|

|

|

Total

|

|

$

|

5,731,500

|

|

|

$

|

3,926,879

|

|

|

$

|

1,803,549

|

|

|

$

|

1,072

|

|

The following table presents, for the Level 3 investments in the foregoing tables, the changes in the Level 3 fair value category for the years ended December 31, 2018 and 2017 (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

At and for the year ended December 31,

|

|

2018

|

|

2017

|

|

Balance, beginning of year

|

|

$

|

1,072

|

|

|

$

|

1,187

|

|

|

Net appreciation (depreciation) in fair value of investments

|

|

(16

|

)

|

|

(3

|

)

|

|

Purchases

|

|

5,647

|

|

|

684

|

|

|

Sales

|

|

(1,402

|

)

|

|

(796

|

)

|

|

Transfers

|

|

(16

|

)

|

|

—

|

|

|

Balance, end of year

|

|

$

|

5,285

|

|

|

$

|

1,072

|

|

The Plan had no financial assets that were measured at fair value on a non-recurring basis during the years ended December 31, 2018 and 2017.

4. FULLY BENEFIT-RESPONSIVE INVESTMENT CONTRACTS WITH FINANCIAL INSTITUTIONS

The Plan’s Stable Value Fund (the Fund) is composed primarily of Synthetic Guaranteed Investment Contracts (GICs).

Synthetic GICs.

A Synthetic GIC is an investment contract issued by an insurance company or other financial institution, also known as a wrap contract, backed by a portfolio of bonds or other fixed income securities that are owned by the Fund. The assets underlying the contract are maintained separate from the issuer’s general assets, usually by the Fund’s trustee or a third party custodian. The contracts are obligated to provide an interest rate not less than zero.

The assets underlying the contracts consist of commingled funds sponsored either by Goldman Sachs Asset Management (GSAM) or Prudential Trust Company. The contract value of the Synthetic GICs at December 31, 2018 and 2017 was $636,934,778 and $600,678,879, respectively.

Primary variables impacting future crediting rates of the Synthetic GICs include current yield of the assets within the contract, duration of the assets covered by the contract, and existing difference between the fair value and contract value of the assets within the contract. Synthetic GICs are designed to reset the respective crediting rate, typically on a monthly basis. These contracts provide that realized and unrealized gains and losses on the underlying assets are not reflected immediately in the assets of the Fund, but rather are amortized, over the duration of the underlying assets or other agreed upon period, through adjustments to the

THE TRAVELERS 401(K) SAVINGS PLAN

NOTES TO FINANCIAL STATEMENTS, Continued

|

|

|

|

4.

|

FULLY BENEFIT-RESPONSIVE INVESTMENT CONTRACTS WITH FINANCIAL INSTITUTIONS, Continued

|

future interest crediting rates. The issuer guarantees that all qualified participant withdrawals will occur at contract value, which represents contributions made under the contract, plus credited interest, less withdrawals made under the contract and administrative expenses.

Events Limiting Ability to Receive Contract Value.

Certain events limit the ability of the Plan to transact at contract value with the issuer. While the events may differ from contract to contract, the events typically include: (i) amendments to the Plan documents; (ii) changes to the Plan’s prohibition on competing investment options or deletion of equity wash provisions; (iii) complete or partial termination of the Plan or its merger with another plan; (iv) the failure of the Plan or its trust to qualify for exemption from federal income taxes or any required prohibited transaction exemption under ERISA; (v) unless made in accordance with the withdrawal provisions of the Plan, the withdrawal from the wrap contract at the direction of TRV, including withdrawals due to the removal of a specifically identifiable group of employees from coverage under the Plan (such as a group layoff or early retirement incentive program), or the closing or sale of a subsidiary, employing unit or affiliate, the bankruptcy or insolvency of the Company, or the Company’s establishment of another tax qualified defined contribution plan; (vi) the establishment of an employee benefit plan in which Plan participants are eligible to participate; (vii) any change in law, regulation, ruling, administrative or judicial position or accounting requirement, in any case applicable to the Plan or Fund; (viii) the delivery of any communication to Plan participants designed to influence a participant not to invest in the Fund; or, (ix) if it is no longer permissible to account for one or more benefit-responsive agreements held in the Fund on a contract value basis under certain circumstances. At this time, the Company does not believe that the occurrence of any events, such as those described above, which would limit the Plan’s ability to transact at contract value with participants, is probable.

Contract Termination.

Synthetic GIC wrap contracts generally are evergreen contracts that permit termination upon notice at any time, and provide for automatic termination if the contract value or the fair value of the underlying assets equals zero. If the fair value equals zero, the issuer of the wrap contract is obligated to pay the difference between the fair value and the contract value.

If the Fund defaults in its obligations under the contract and the default is not cured within a cure period, the issuer may terminate the contract and the Fund will retain the fair value of the underlying assets as of the date of termination. The Synthetic GICs generally permit the issuer or investment manager to convert the wrapped portfolio to a declining duration strategy, in which case the contract would terminate at a date that corresponds to the duration of the underlying fixed income portfolio on the date of an amortization election (Amortization Election). After the effective date of an Amortization Election, the fixed income portfolio must conform to the guidelines agreed upon by the issuer and the investment manager for the Amortization Election period. Such guidelines are intended to result in the fair value equaling or exceeding the contract value of the wrapped portfolio by such termination date. The Fund may make an Amortization Election if the contract permits the issuer to terminate at fair value, the issuer terminates the contract, and the contract provides for such an Amortization Election.

The Synthetic GICs are placed with financial institutions that have been approved by GSAM Stable Value, LLC’s credit review process. Currently, the Stable Value Fund’s wrap contract issuers have a Standard & Poor’s credit rating of A or equivalent or higher. Additionally, a minimum Standard & Poor’s average credit rating of AA- or equivalent is required at purchase for the issuers of the underlying fixed income investments.

5. PARTY-IN-INTEREST TRANSACTIONS

Transactions resulting in Plan assets being transferred to or used by a related party are prohibited under ERISA unless a specific exemption applies. The following transactions with related parties are specifically exempted from the “prohibited transactions” provisions of ERISA and the Internal Revenue Code:

·

The Plan invests in funds managed by an affiliate of FMTC, a party-in-interest as defined by ERISA as a result of being trustee of the Plan.

·

The Plan also engages in transactions involving the acquisition or disposition of common stock of TRV, a party-in-interest with respect to the Plan. Acquisitions are limited to dividends paid on shares in participant accounts invested in the TRV common stock fund for which the participant has not elected to receive dividends in cash.

THE TRAVELERS 401(K) SAVINGS PLAN

NOTES TO FINANCIAL STATEMENTS

6. PLAN TERMINATION

Although it has not expressed any intent to do so, TRV has the right under the Plan to terminate the Plan subject to the provisions of ERISA. Upon such termination, the Plan administrator may direct the Plan trustee to distribute participant account balances. Upon termination of the Plan, participant account balances would vest in full.

7. TAX STATUS

The Internal Revenue Service has determined and informed the Company by a letter dated August 24, 2017 that the Plan and related trust are designed in accordance with applicable sections of the Internal Revenue Code. The Plan has been amended since receiving the determination letter, and the Company believes that the amended Plan is currently designed and being operated in compliance with the applicable sections of the Internal Revenue Code. Therefore, no provision for income taxes has been included in the Plan’s financial statements. At December 31, 2018 and 2017, the Plan had no uncertain tax positions.

8.

SUBSEQUENT EVENTS

There were no subsequent events requiring adjustment to the financial statements or disclosure through June 17, 2019, the date that the Plan’s financial statements were available to be issued.

THE TRAVELERS 401(K) SAVINGS PLAN

SCHEDULE H, Line 4i

—

Schedule of Assets (Held at Year End)

December 31, 2018

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Description of Investment

|

|

|

|

Maturity

|

|

Number of

|

|

Current

|

|

|

Identity of Issue

|

|

Rate

|

|

Date

|

|

Shares/Units

|

|

Value

|

|

|

Mutual Funds:

|

|

|

|

|

|

|

|

|

|

|

American Beacon Large Cap Value Fund — Institutional Class

|

|

|

|

|

|

6,149,723

|

|

|

$

|

142,796,570

|

|

|

|

Fidelity Mid-Cap Index Fund — Institutional Premium Class

|

|

|

|

|

|

8,284,324

|

|

|

154,336,948

|

|

|

|

Fidelity Puritan Fund — Class K

|

|

|

|

|

|

6,457,648

|

|

|

126,505,331

|

|

|

|

Fidelity Small-Cap Growth Fund — Class K6

|

|

|

|

|

|

8,068,630

|

|

|

87,706,005

|

|

|

|

Fidelity Small-Cap Index Fund

|

|

|

|

|

|

6,743,707

|

|

|

116,261,509

|

|

|

|

Janus Henderson Enterprise Fund — Class N

|

|

|

|

|

|

1,897,983

|

|

|

209,689,189

|

|

|

|

JPMorgan Large Cap Growth Fund — Class R6

|

|

|

|

|

|

11,616,420

|

|

|

395,771,419

|

|

|

|

Neuberger Berman Genesis Fund — Class R6

|

|

|

|

|

|

2,610,717

|

|

|

124,792,267

|

|

|

|

PGIM QMA Small-Cap Value Fund — Class R6

|

|

|

|

|

|

2,607,888

|

|

|

38,701,052

|

|

|

|

PIMCO Total Return Fund — Institutional Class

|

|

|

|

|

|

7,324,932

|

|

|

72,736,576

|

|

|

|

Thornburg International Value Fund — Class R6

|

|

|

|

|

|

6,878,468

|

|

|

136,331,228

|

|

|

|

Vanguard Institutional Index Fund — Institutional Plus Class

|

|

|

|

|

|

4,242,954

|

|

|

965,569,115

|

|

|

|

Vanguard Mid-Cap Value Index Fund - Admiral Shares Class

|

|

|

|

|

|

1,296,579

|

|

|

63,960,223

|

|

|

|

Vanguard Total Bond Market Index Fund — Institutional Plus Class

|

|

|

|

|

|

44,115,778

|

|

|

461,009,876

|

|

|

|

Vanguard U.S. Treasury Money Market Fund — Investor Class

|

|

|

|

|

|

63,223,038

|

|

|

63,223,038

|

|

|

|

Total Mutual Funds

|

|

|

|

|

|

|

|

3,159,390,346

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Collective/Common Trust Funds:

|

|

|

|

|

|

|

|

|

|

|

SSgA World ex. U.S. Index Non-Lending Series Fund — Class A

|

|

|

|

|

|

23,234,199

|

|

|

283,015,774

|

|

|

|

SSgA Emerging Markets Index Non-Lending Series Fund — Class A

|

|

|

|

|

|

2,635,375

|

|

|

75,424,427

|

|

|

|

Vanguard Target Retirement Income Trust Select

|

|

|

|

|

|

1,104,832

|

|

|

36,702,532

|

|

|

|

Vanguard Target Retirement 2015 Trust Select

|

|

|

|

|

|

1,737,011

|

|

|

58,467,789

|

|

|

|

Vanguard Target Retirement 2020 Trust Select

|

|

|

|

|

|

4,087,522

|

|

|

139,139,237

|

|

|

|

Vanguard Target Retirement 2025 Trust Select

|

|

|

|

|

|

6,671,806

|

|

|

228,442,632

|

|

|

|

Vanguard Target Retirement 2030 Trust Select

|

|

|

|

|

|

4,321,825

|

|

|

148,454,681

|

|

|

|

Vanguard Target Retirement 2035 Trust Select

|

|

|

|

|

|

4,973,146

|

|

|

171,424,329

|

|

|

|

Vanguard Target Retirement 2040 Trust Select

|

|

|

|

|

|

3,242,013

|

|

|

111,946,722

|

|

|

|

Vanguard Target Retirement 2045 Trust Select

|

|

|

|

|

|

5,135,433

|

|

|

177,429,226

|

|

|

|

Vanguard Target Retirement 2050 Trust Select

|

|

|

|

|

|

3,196,953

|

|

|

110,422,758

|

|

|

|

Vanguard Target Retirement 2055 Trust Select

|

|

|

|

|

|

1,796,456

|

|

|

62,013,657

|

|

|

|

Vanguard Target Retirement 2060 Trust Select

|

|

|

|

|

|

66,704

|

|

|

2,303,954

|

|

|

|

Vanguard Target Retirement 2065 Trust Select

|

|

|

|

|

|

41,567

|

|

|

862,935

|

|

|

|

Total Collective/Common Trust Funds

|

|

|

|

|

|

|

|

1,606,050,653

|

|

(continued)

THE TRAVELERS 401(K) SAVINGS PLAN

SCHEDULE H, Line 4i

—

Schedule of Assets (Held at Year End)

December 31, 2018

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Description of Investment

|

|

|

|

Maturity

|

|

Number of

|

|

Current

|

|

Identity of Issue

|

|

Rate

|

|

Date

|

|

Shares/Units

|

|

Value

|

|

Fully Benefit-Responsive Investments with Financial Institutions:

|

|

|

|

|

|

|

|

|

|

Lincoln Financial Group, BVW0010G

|

|

|

|

|

|

|

|

|

|

2018 Term Fund

|

|

2.38%

|

|

Various

|

|

1,248,095

|

|

|

1,248,095

|

|

|

2019 Term Fund

|

|

2.38%

|

|

Various

|

|

20,391,457

|

|

|

20,391,457

|

|

|

2020 Term Fund

|

|

2.38%

|

|

Various

|

|

19,455,016

|

|

|

19,455,016

|

|

|

2021 Term Fund

|

|

2.38%

|

|

Various

|

|

13,416,509

|

|

|

13,416,509

|

|

|

2022 Term Fund

|

|

2.38%

|

|

Various

|

|

16,775,529

|

|

|

16,775,529

|

|

|

Intermediate Core Fund

|

|

2.38%

|

|

Various

|

|

7,172,608

|

|

|

80,191,579

|

|

|

Total Lincoln Financial Group, BVW0010G

|

|

|

|

|

|

|

|

151,478,185

|

|

|

|

|

|

|

|

|

|

|

|

|

The Prudential Insurance Company of America, GA-63058

|

|

|

|

|

|

|

|

|

|

2018 Term Fund

|

|

2.26%

|

|

Various

|

|

1,517,550

|

|

|

1,517,550

|

|

|

2019 Term Fund

|

|

2.26%

|

|

Various

|

|

22,298,154

|

|

|

22,298,154

|

|

|

2020 Term Fund

|

|

2.26%

|

|

Various

|

|

20,619,759

|

|

|

20,619,759

|

|

|

2021 Term Fund

|

|

2.26%

|

|

Various

|

|

16,180,846

|

|

|

16,180,846

|

|

|

2022 Term Fund

|

|

2.26%

|

|

Various

|

|

19,906,026

|

|

|

19,906,026

|

|

|

Prudential Core Conservative Int. Bond Fund

|

|

2.26%

|

|

Various

|

|

79,468,488

|

|

|

79,468,488

|

|

|

Total Prudential Insurance Company of America, GA-63058

|

|

|

|

|

|

|

|

159,990,823

|

|

|

|

|

|

|

|

|

|

|

|

|

Transamerica Premier Life Insurance Company, MDA00987TR

|

|

|

|

|

|

|

|

|

|

2018 Term Fund

|

|

2.32%

|

|

Various

|

|

1,396,956

|

|

|

1,396,956

|

|

|

2019 Term Fund

|

|

2.32%

|

|

Various

|

|

20,708,306

|

|

|

20,708,306

|

|

|

2020 Term Fund

|

|

2.32%

|

|

Various

|

|

17,169,712

|

|

|

17,169,712

|

|

|

2021 Term Fund

|

|

2.32%

|

|

Various

|

|

17,024,001

|

|

|

17,024,001

|

|

|

2022 Term Fund

|

|

2.32%

|

|

Various

|

|

18,213,501

|

|

|

18,213,501

|

|

|

Dodge & Cox Int G/C - Travelers

|

|

2.32%

|

|

Various

|

|

29,239,635

|

|

|

29,239,635

|

|

|

Intermediate Core Fund

|

|

2.32%

|

|

Various

|

|

4,981,401

|

|

|

55,693,327

|

|

|

Total Transamerica Premier Life Insurance Company, MDA00987TR

|

|

|

|

|

|

|

|

159,445,438

|

|

|

|

|

|

|

|

|

|

|

|

|

Voya Retirement Insurance and Annuity Company, MCA-60441

|

|

|

|

|

|

|

|

|

|

2018 Term Fund

|

|

2.43%

|

|

Various

|

|

855,327

|

|

|

855,327

|

|

|

2019 Term Fund

|

|

2.43%

|

|

Various

|

|

12,595,266

|

|

|

12,595,266

|

|

|

2020 Term Fund

|

|

2.43%

|

|

Various

|

|

12,358,673

|

|

|

12,358,673

|

|

|

2021 Term Fund

|

|

2.43%

|

|

Various

|

|

10,733,828

|

|

|

10,733,828

|

|

|

2022 Term Fund

|

|

2.43%

|

|

Various

|

|

11,845,197

|

|

|

11,845,197

|

|

|

Dodge & Cox Int G/C - Travelers

|

|

2.43%

|

|

Various

|

|

117,632,041

|

|

|

117,632,041

|

|

|

Total Voya Retirement Insurance and Annuity Company, MCA-60441

|

|

|

|

|

|

|

|

166,020,332

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Fully Benefit-Responsive Investments with Financial Institutions

|

|

|

|

|

|

|

|

636,934,778

|

|

(continued)

THE TRAVELERS 401(K) SAVINGS PLAN

SCHEDULE H, Line 4i

—

Schedule of Assets (Held at Year End)

December 31, 2018

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Description of Investment

|

|

|

|

Maturity

|

|

Number of

|

|

Current

|

|

|

Identity of Issue

|

|

Rate

|

|

Date

|

|

Shares/Units

|

|

Value

|

|

|

Common Stock:

|

|

|

|

|

|

|

|

|

|

*

|

The Travelers Companies, Inc.

|

|

|

|

|

|

2,853,613

|

|

|

341,720,157

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*

|

Fidelity BrokerageLink Investments

|

|

|

|

|

|

|

|

153,252,283

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Short-Term Investments:

|

|

|

|

|

|

|

|

|

|

*

|

Fidelity Management Trust Company, Institutional Cash Portfolio, MM Fund Class 1 Shares

|

|

2.19%

|

|

Due on Demand

|

|

|

|

39,915,393

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*

|

Notes receivable from participants (1)

|

|

|

|

|

|

|

|

95,658,179

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

|

|

|

|

|

|

$

|

6,032,921,789

|

|

See accompanying report of independent registered public accounting firm.

* Parties-in-interest as defined by ERISA.

(1) 11,228 loans, interest rates ranging from 4.25% to 10.50%, 5-year maximum term with the exception of home loans, which have a 20-year maximum term.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the trustees (or other persons who administer the employee benefit plan) have duly caused this annual report to be signed on their behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

THE TRAVELERS 401(k) SAVINGS PLAN

|

|

|

|

(The Plan)

|

|

|

|

|

|

Date: June 17, 2019

|

|

By:

|

/s/ Diane D. Bengston

|

|

|

|

Diane D. Bengston

Executive Vice President and Chief Human Resources

Officer and Plan Administrator

Member of the Administrative Committee for

The Travelers 401(k) Savings Plan

|

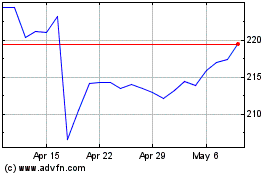

The Travelers Companies (NYSE:TRV)

Historical Stock Chart

From Mar 2024 to Apr 2024

The Travelers Companies (NYSE:TRV)

Historical Stock Chart

From Apr 2023 to Apr 2024